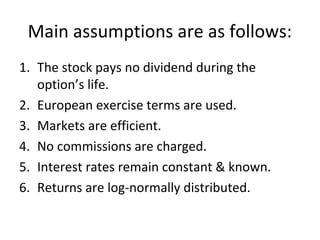

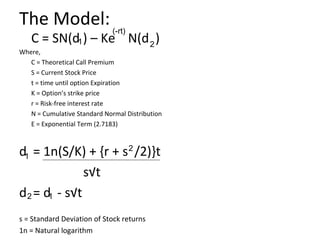

Option pricing is determined by 5 key factors: the asset's cash price, strike price, volatility, time to expiration, and interest rates. The Black-Scholes model uses these factors to price European options, assuming the asset pays no dividends, markets are efficient, and other restricting assumptions. It models the asset's price as following geometric Brownian motion to derive a theoretical option price formula involving the standard normal distribution.