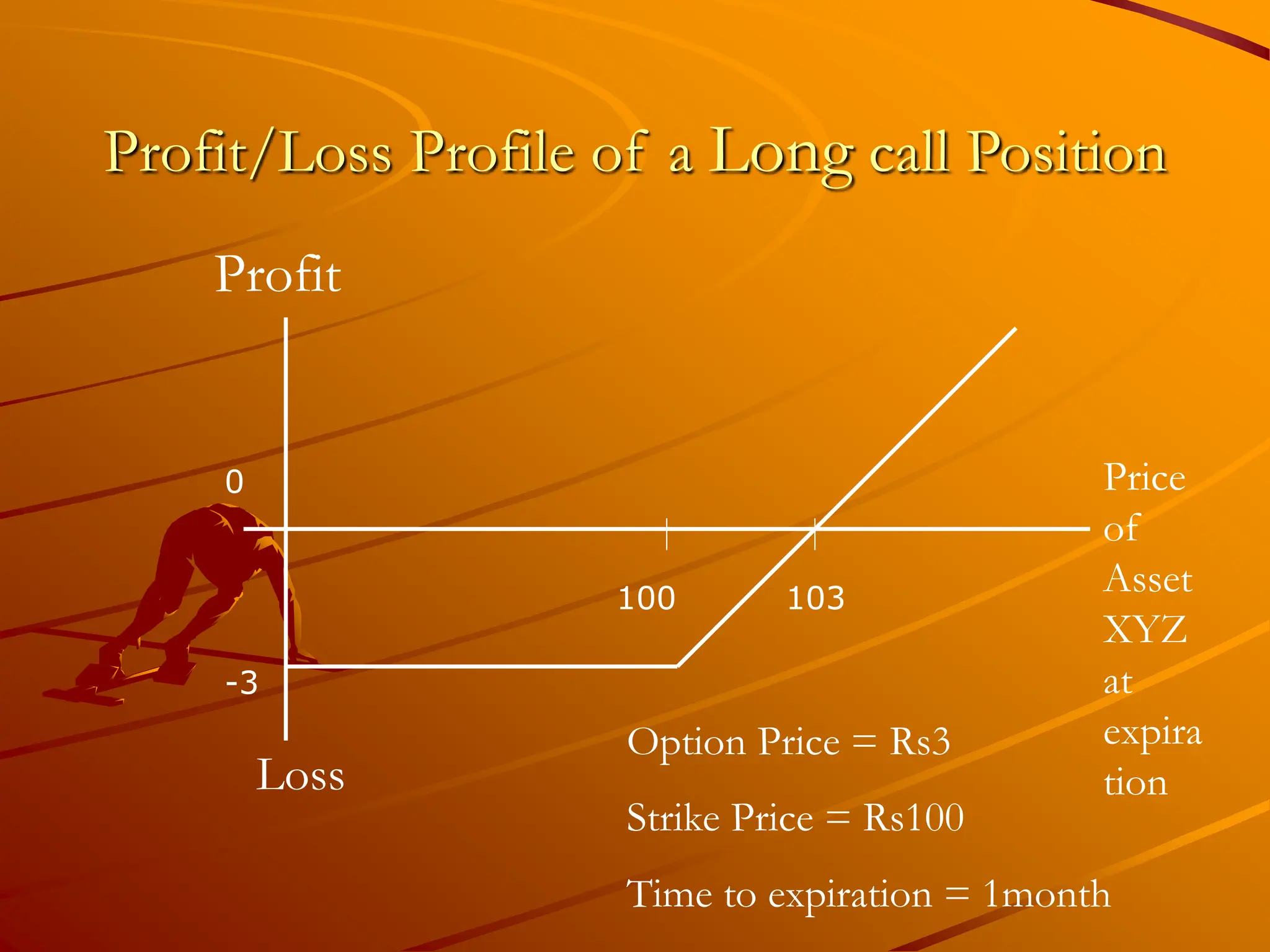

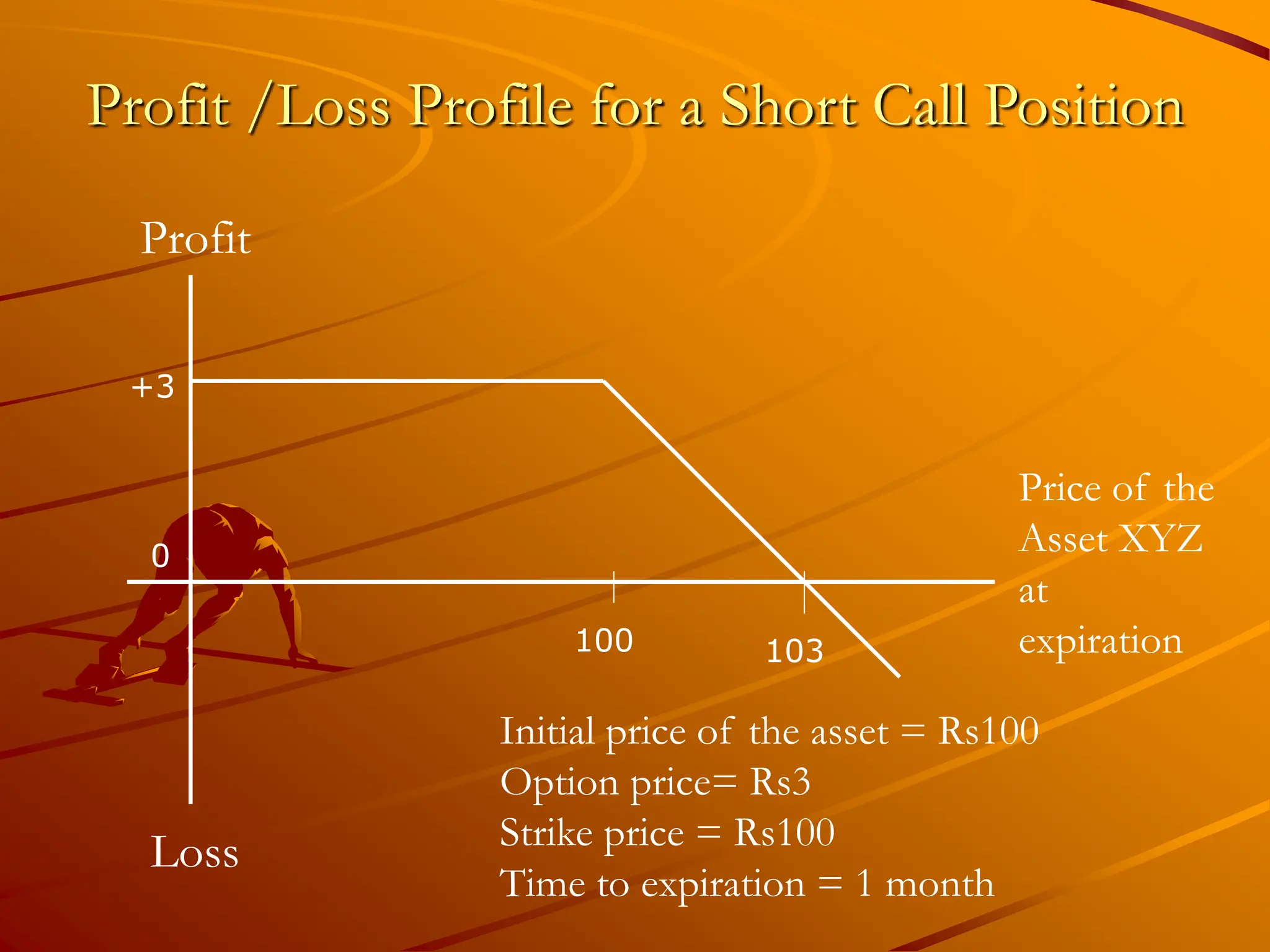

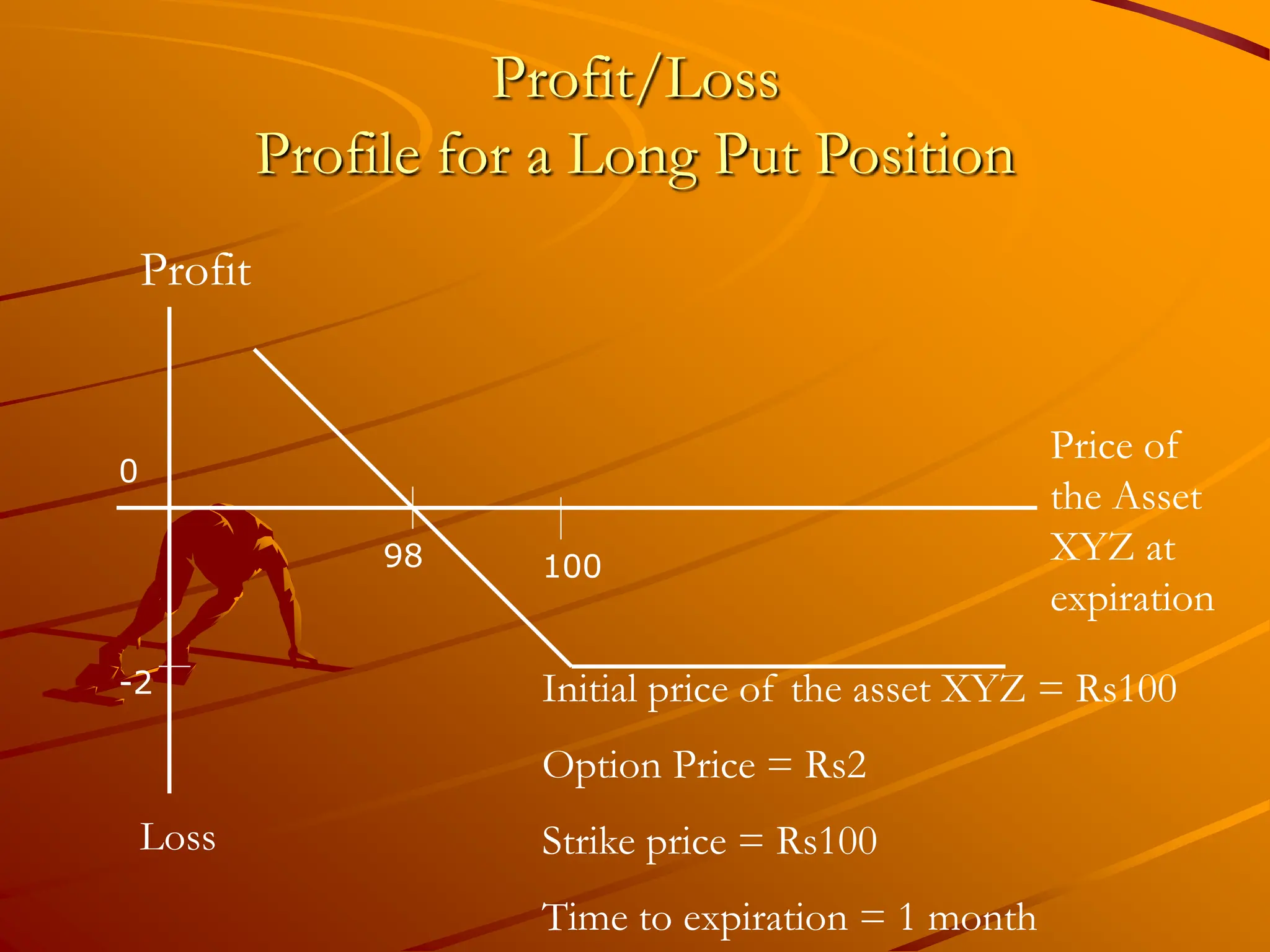

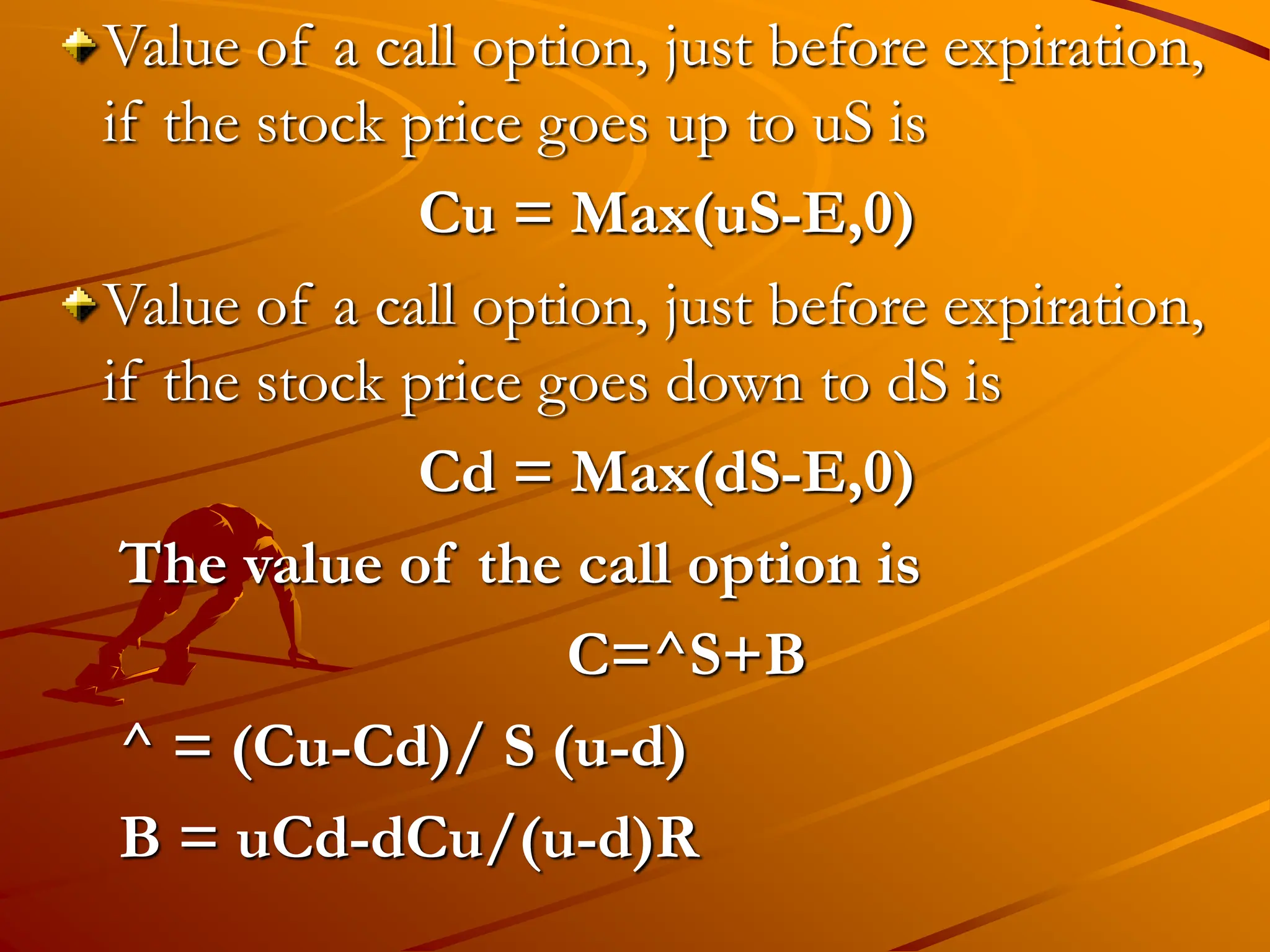

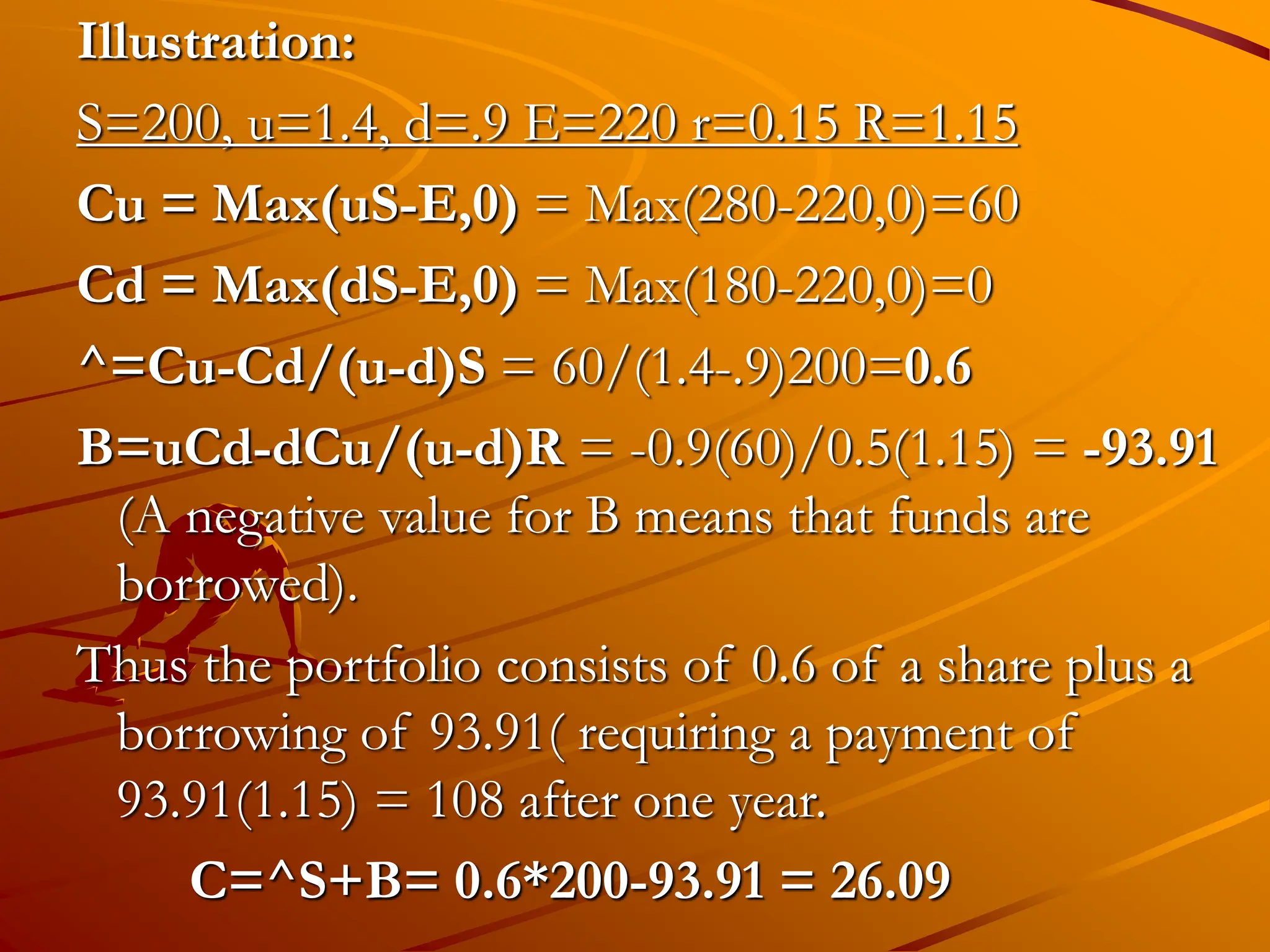

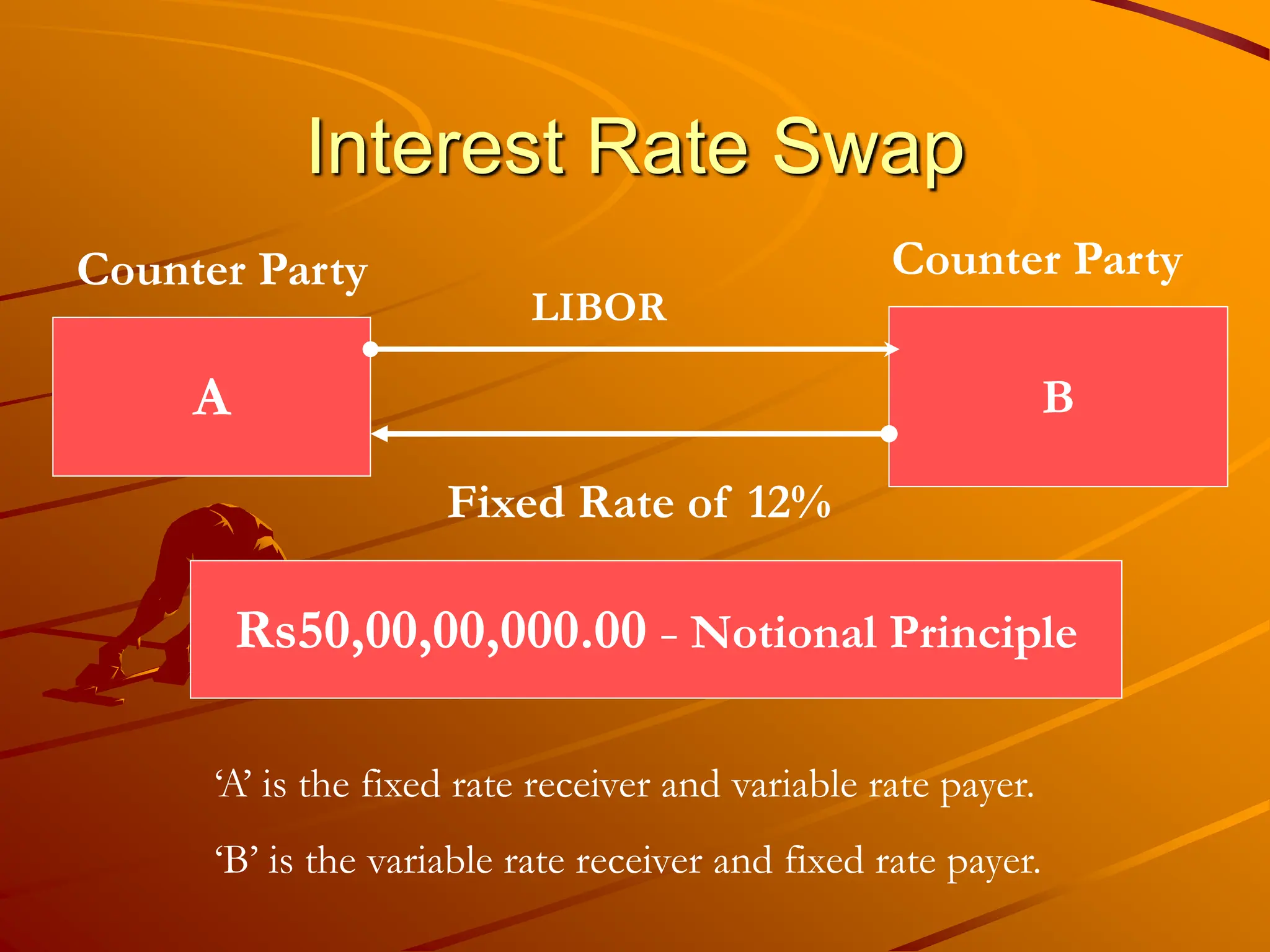

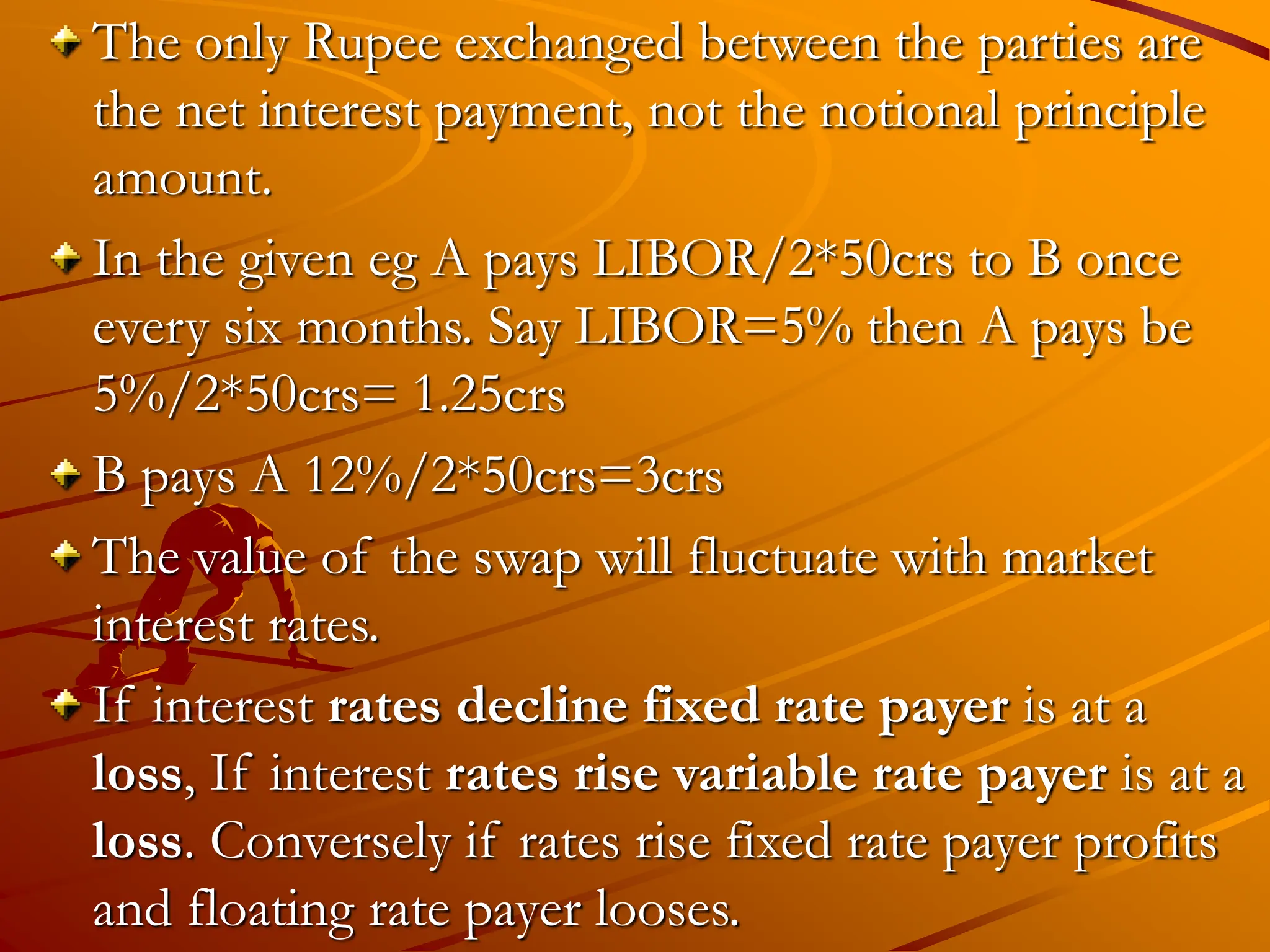

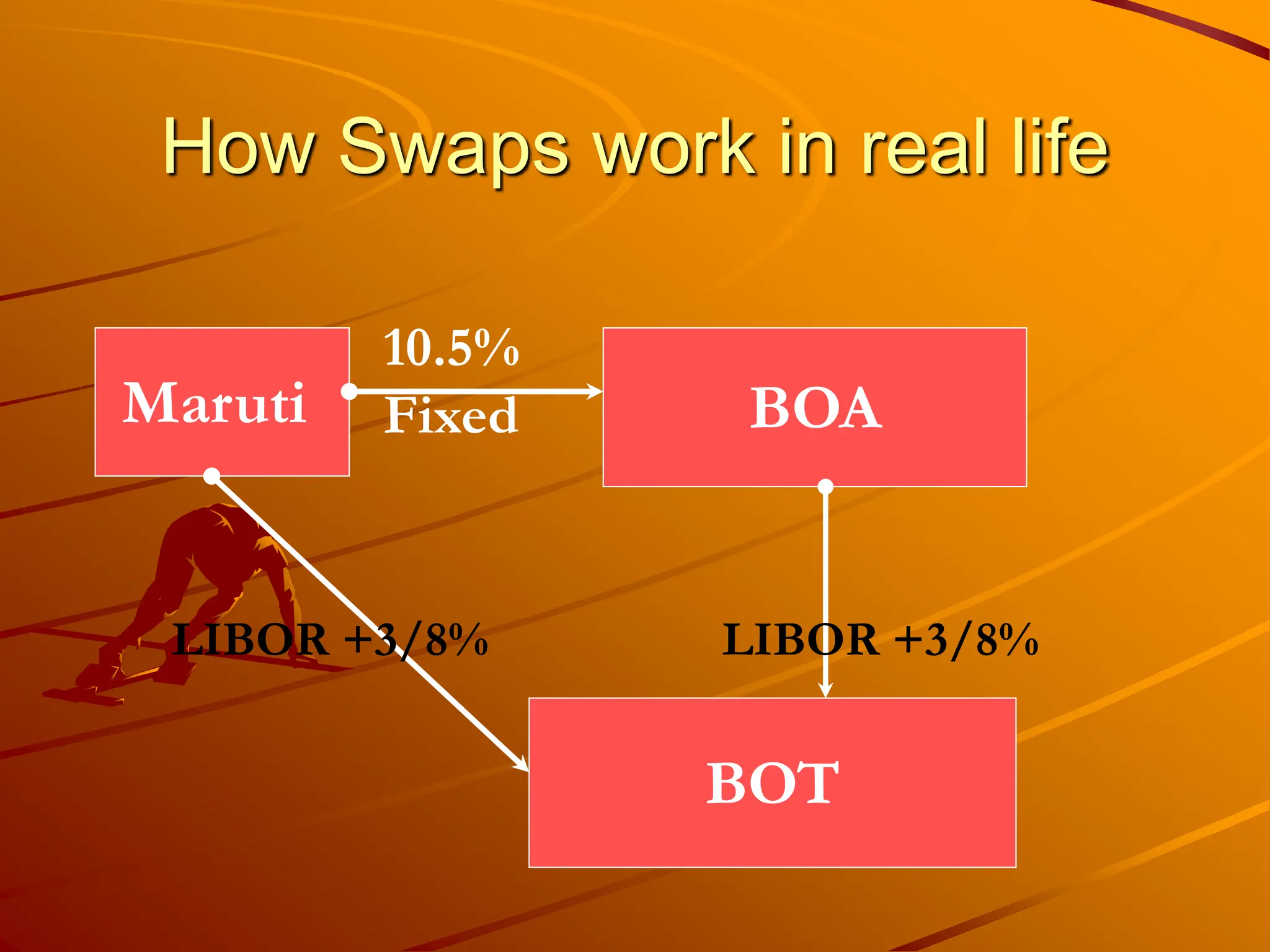

Derivatives are financial contracts whose value is derived from underlying assets and can be used for hedging against price movements to minimize losses or maximize profits. They are divided into financial, commodity, and index derivatives, with common types including forwards, futures, options, and swaps. Each type serves different purposes and involves unique operational mechanisms, such as options providing buyers the right to buy or sell an asset, and swaps allowing for the exchange of cash flows between parties.