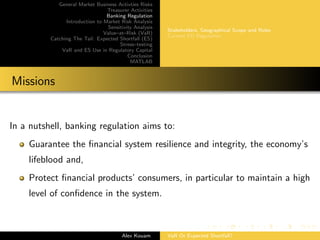

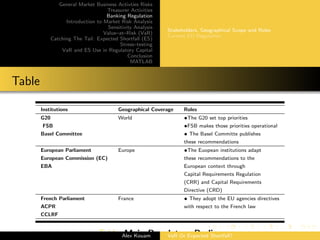

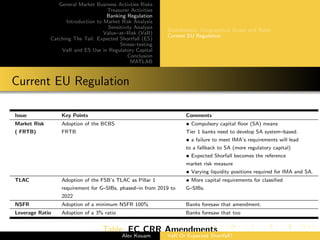

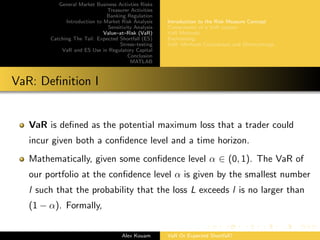

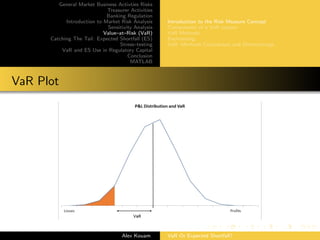

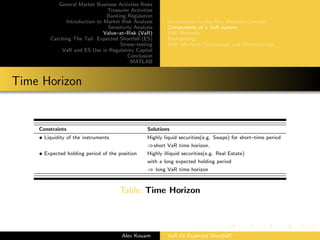

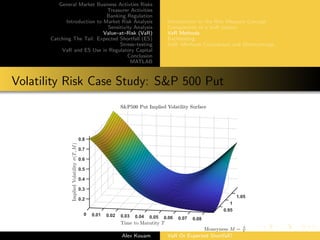

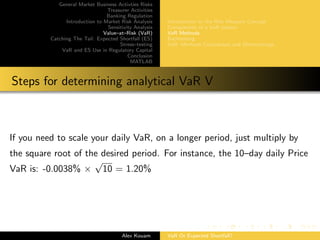

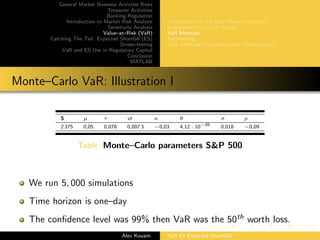

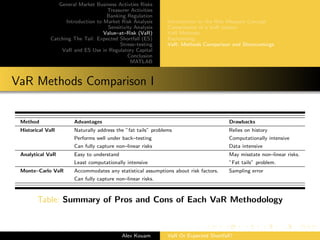

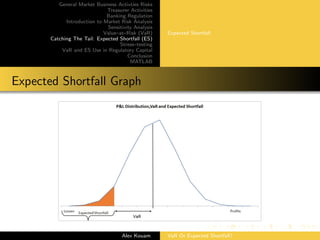

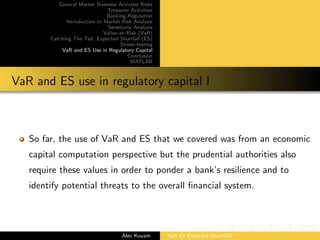

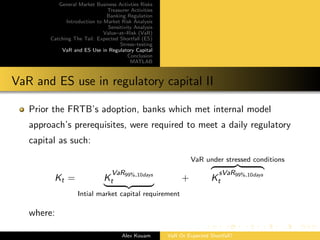

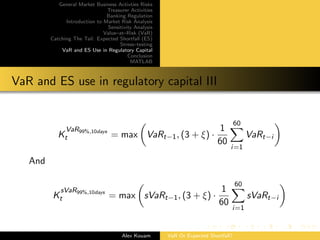

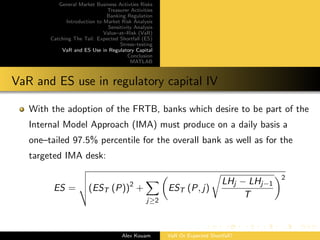

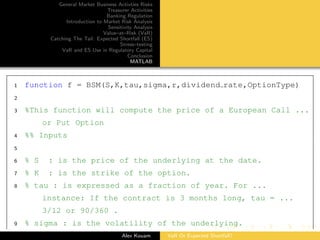

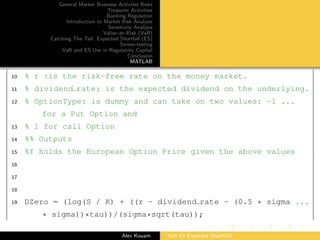

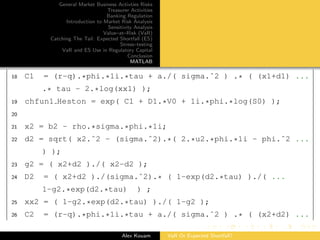

The document discusses the various types of risks in the banking sector, including credit, liquidity, market, and operational risks, highlighting their implications and historical examples. It also details the roles of treasurers, banking regulations, and market risk analysis processes, with specific emphasis on methodologies like Value-at-Risk (VaR) and Expected Shortfall (ES). The document concludes with insights into regulatory capital and risk management practices within financial institutions.

![General Market Business Activties Risks

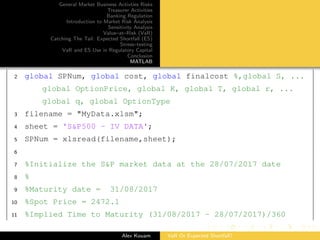

Treasurer Activities

Banking Regulation

Introduction to Market Risk Analysis

Sensitivity Analysis

Value–at–Risk (VaR)

Catching The Tail: Expected Shortfall (ES)

Stress–testing

VaR and ES Use in Regulatory Capital

Conclusion

MATLAB

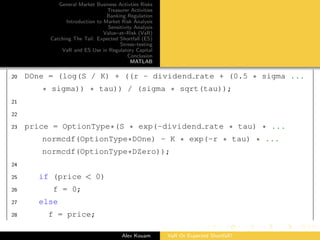

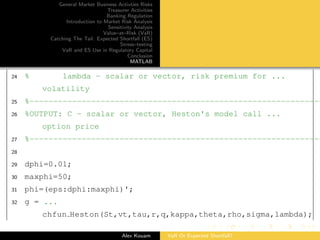

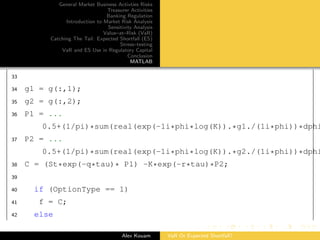

.* tau - 2.*log(xx2) );

27 chfun2 Heston = exp( C2 + D2.*V0 + 1i.*phi.*log(S0) );

28

29 f = [chfun1 Heston, chfun2 Heston];

30 end

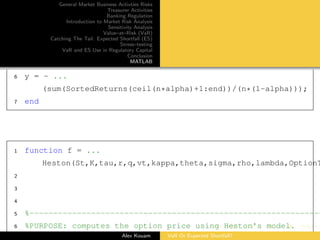

1 function y = ES(returns,alpha)

2 %This function computes the Expected shortfall

3 SortedReturns = sort(returns);

4 n = size (returns,1);

5

Alex Kouam VaR Or Expected Shortfall?](https://image.slidesharecdn.com/var-es-170904051511/85/VaR-Or-Expected-Shortfall-98-320.jpg)

![General Market Business Activties Risks

Treasurer Activities

Banking Regulation

Introduction to Market Risk Analysis

Sensitivity Analysis

Value–at–Risk (VaR)

Catching The Tail: Expected Shortfall (ES)

Stress–testing

VaR and ES Use in Regulatory Capital

Conclusion

MATLAB

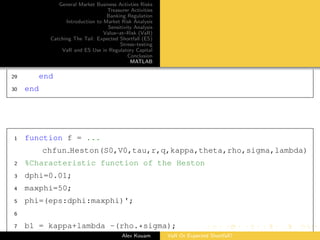

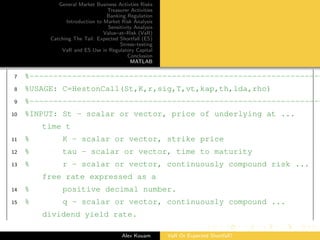

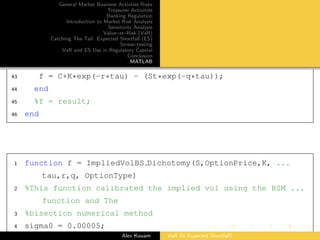

12

13 S = 2472.1;

14 OptionPrice = SPNum(:,3);

15 K = SPNum(:,1);

16 T = SPNum(:,2);

17 r = 0.0099;

18 q = SPNum(:,5);

19 OptionType = -1;

20

21 % Initial parameters and parameter bounds

22 % Bounds [vt,kappa, theta, sigma, rho,lambda]

23 % Last bound include non-negativity constraint and ...

Alex Kouam VaR Or Expected Shortfall?](https://image.slidesharecdn.com/var-es-170904051511/85/VaR-Or-Expected-Shortfall-108-320.jpg)

![General Market Business Activties Risks

Treasurer Activities

Banking Regulation

Introduction to Market Risk Analysis

Sensitivity Analysis

Value–at–Risk (VaR)

Catching The Tail: Expected Shortfall (ES)

Stress–testing

VaR and ES Use in Regulatory Capital

Conclusion

MATLAB

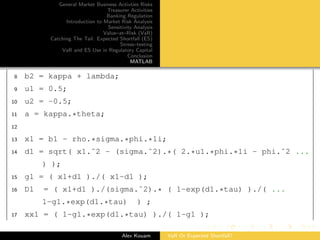

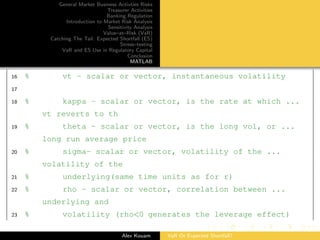

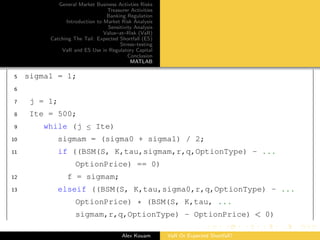

bounds for mean-reversion

24 x0 = [.123, .5,.00001809, .05,-0.086835851,0];

25 lb = [0, 0, 0, 0, -.9, 0];

26 ub = [1, 100, 1, .5, .9, 0];

27

28 % Optimization: calls function costf.m:

29

30 x = lsqnonlin(@costf Heston,x0,lb,ub);

31

32 %Solution

33 Heston sol = [x(1),(x(5)+x(3)ˆ2)/(2*x(2)),x(3), x(4), ...

x(5),x(6)];

Alex Kouam VaR Or Expected Shortfall?](https://image.slidesharecdn.com/var-es-170904051511/85/VaR-Or-Expected-Shortfall-109-320.jpg)