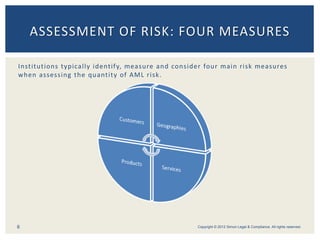

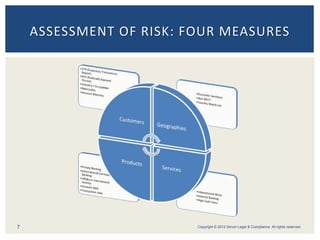

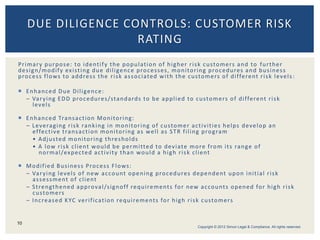

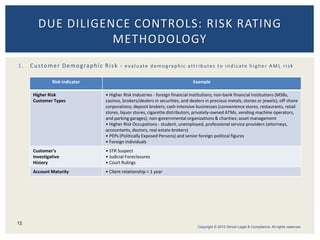

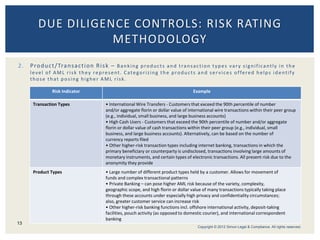

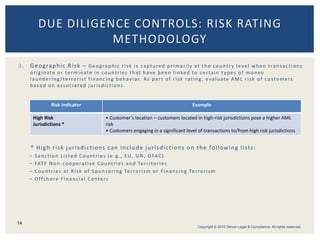

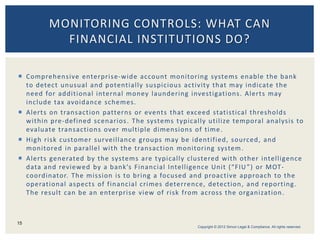

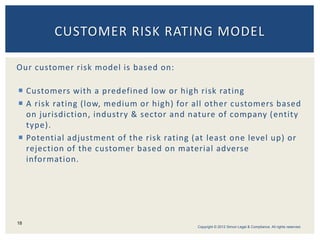

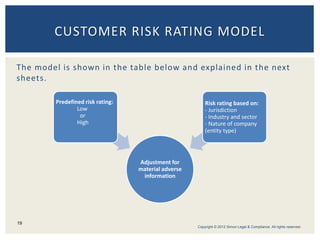

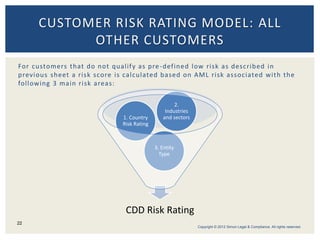

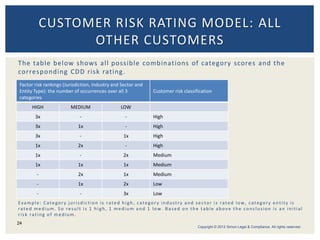

The document outlines a risk-based approach for anti-money laundering (AML) compliance, focusing on the assessment of risk through four key measures and the implementation of due diligence and monitoring controls. It emphasizes the importance of customer risk rating and categorization based on demographic, product/transactional, and geographic risks, as well as the development of effective transaction monitoring programs. The summary also highlights the necessity for financial institutions to adjust risk ratings based on material adverse information and to adopt tailored procedures for various customer risk levels.