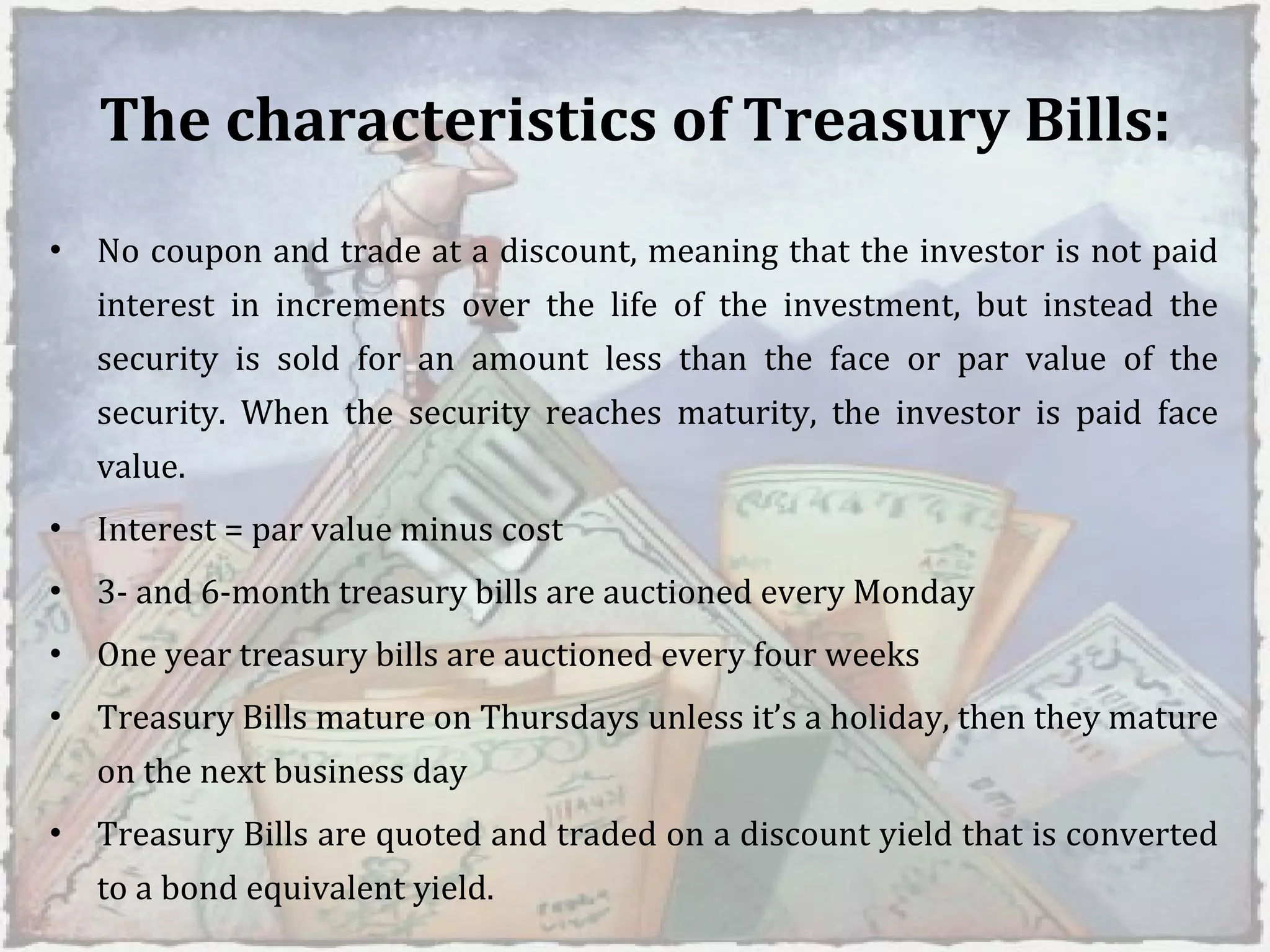

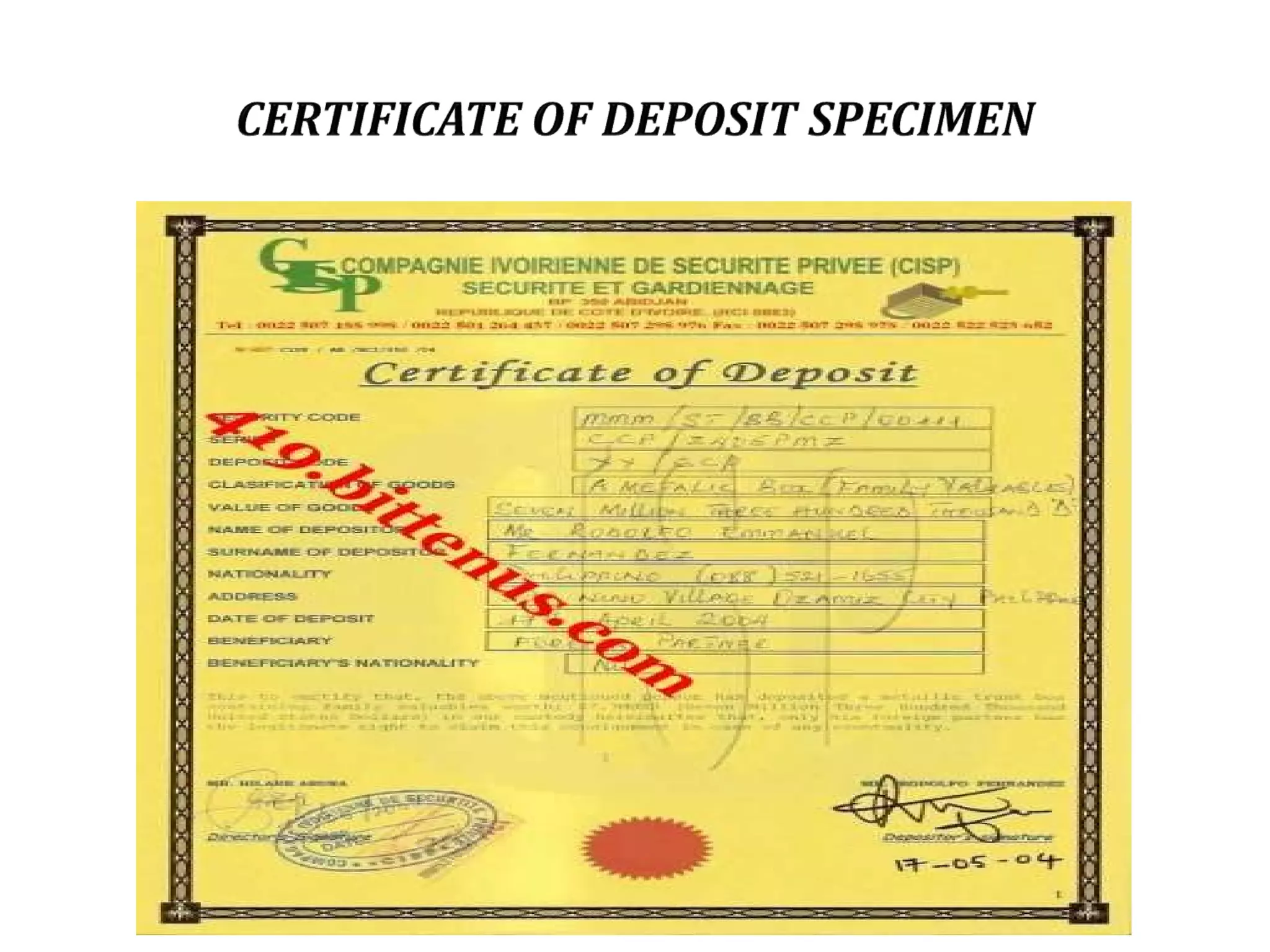

Treasury bills are short-term government securities that mature in one year or less and are considered very safe investments. They are auctioned weekly and pay interest through the difference between the discounted price and face value at maturity. Certificates of deposit are issued by commercial banks for terms between 15 days to 1 year, require a minimum deposit, and interest is calculated daily. Commercial paper is a short-term unsecured loan issued by corporations to meet credit needs, bearing higher risk and return than Treasury bills.