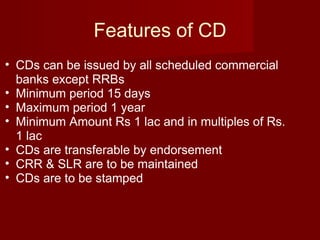

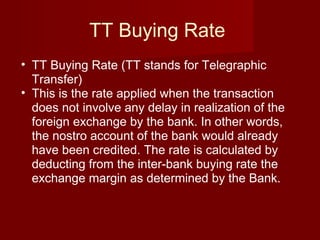

The document provides an overview of modules C and D of the Indian Institute of Banking & Finance's risk management syllabus.

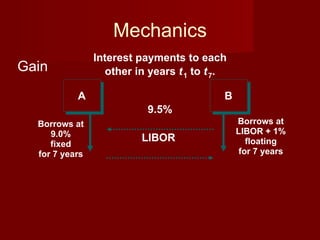

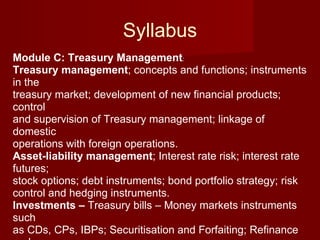

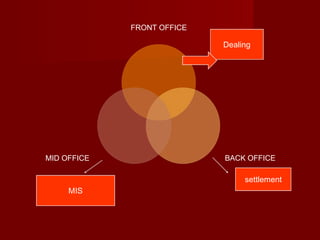

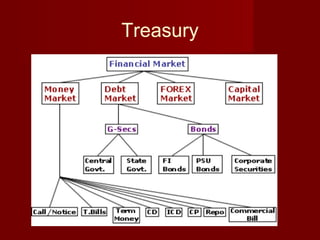

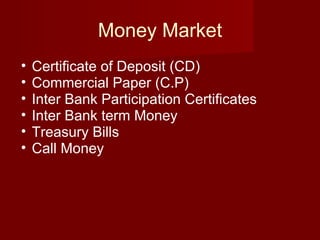

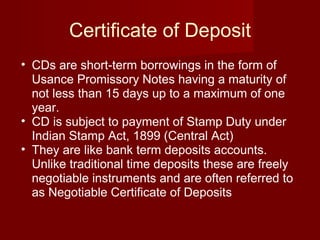

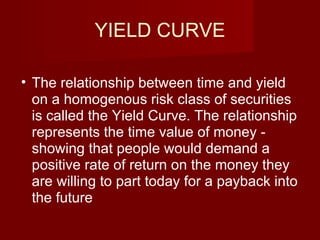

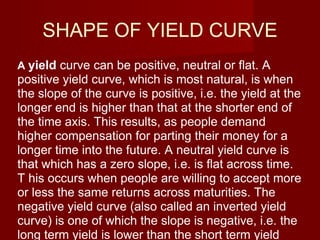

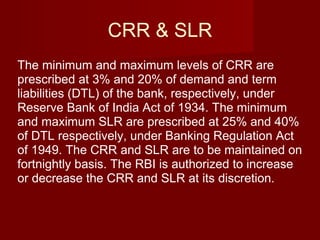

Module C covers treasury management, including treasury functions, products, and risk management. It also discusses asset-liability management and various money market instruments.

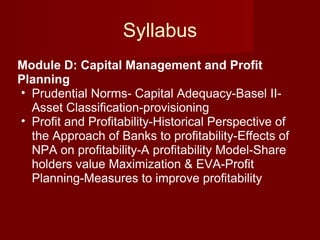

Module D covers capital adequacy, asset classification, profitability analysis, and profit planning for banks. It discusses topics like Basel II, non-performing assets, return on assets, and shareholder value.

![INDIAN INSTITUTE OF BANKING & FINANCE RISK MANAGEMENT MODULE C & D BY M.Ravindran [email_address]](https://image.slidesharecdn.com/11700633-120222030149-phpapp01/85/money-market-instruments-1-320.jpg)

![LIBOR LIBOR stands for the London Interbank Offered Rate and is the rate of interest at which banks borrow funds from other banks, in marketable size, in the London interbank market. LIBOR is the most widely used "benchmark" or reference rate for short term interest rates. It is compiled by the British Bankers Association as a free service and released to the market at about 11.00[London time] each day.](https://image.slidesharecdn.com/11700633-120222030149-phpapp01/85/money-market-instruments-36-320.jpg)

![Problem You would like to import machinery from USA worth USD 100000 to be payable to the overseas supplier on 31st Oct [a] Spot Rate USD = Rs.45.8500/8600 Forward Premium September 0.2950/3000 October 0.5400/5450 November 0.7600/7650 [b] exchange margin 0.125% [c] Last two digits in multiples of nearest 25 paise Calculate the rate to be quoted by the bank ?](https://image.slidesharecdn.com/11700633-120222030149-phpapp01/85/money-market-instruments-48-320.jpg)

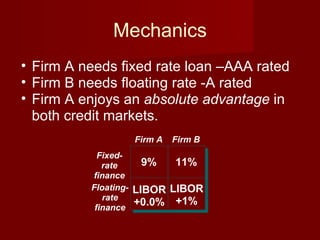

![Mechanics STEP ! Firm A will borrow at Fixed rate 9% Firm B will borrow at floating rate (LIBOR +1)% STEP 2 Firm A will pay Floating rate [LIBOR] to Firm B Firm B will Pay Fixed rate [9.5%] only Gain Net interest cost LIBOR- .5% Net Interest cost 9+[ 1%+0.5%]=10.5%](https://image.slidesharecdn.com/11700633-120222030149-phpapp01/85/money-market-instruments-52-320.jpg)