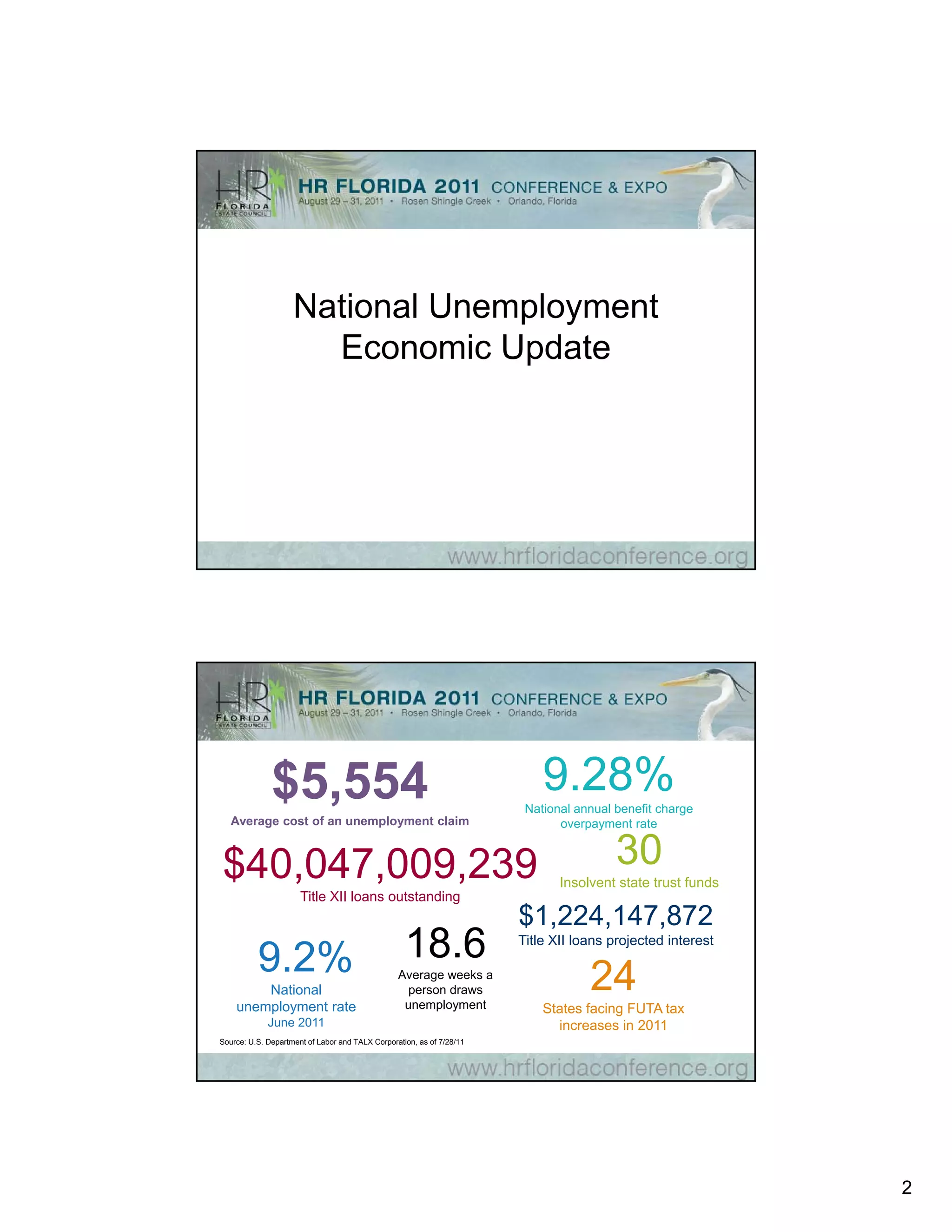

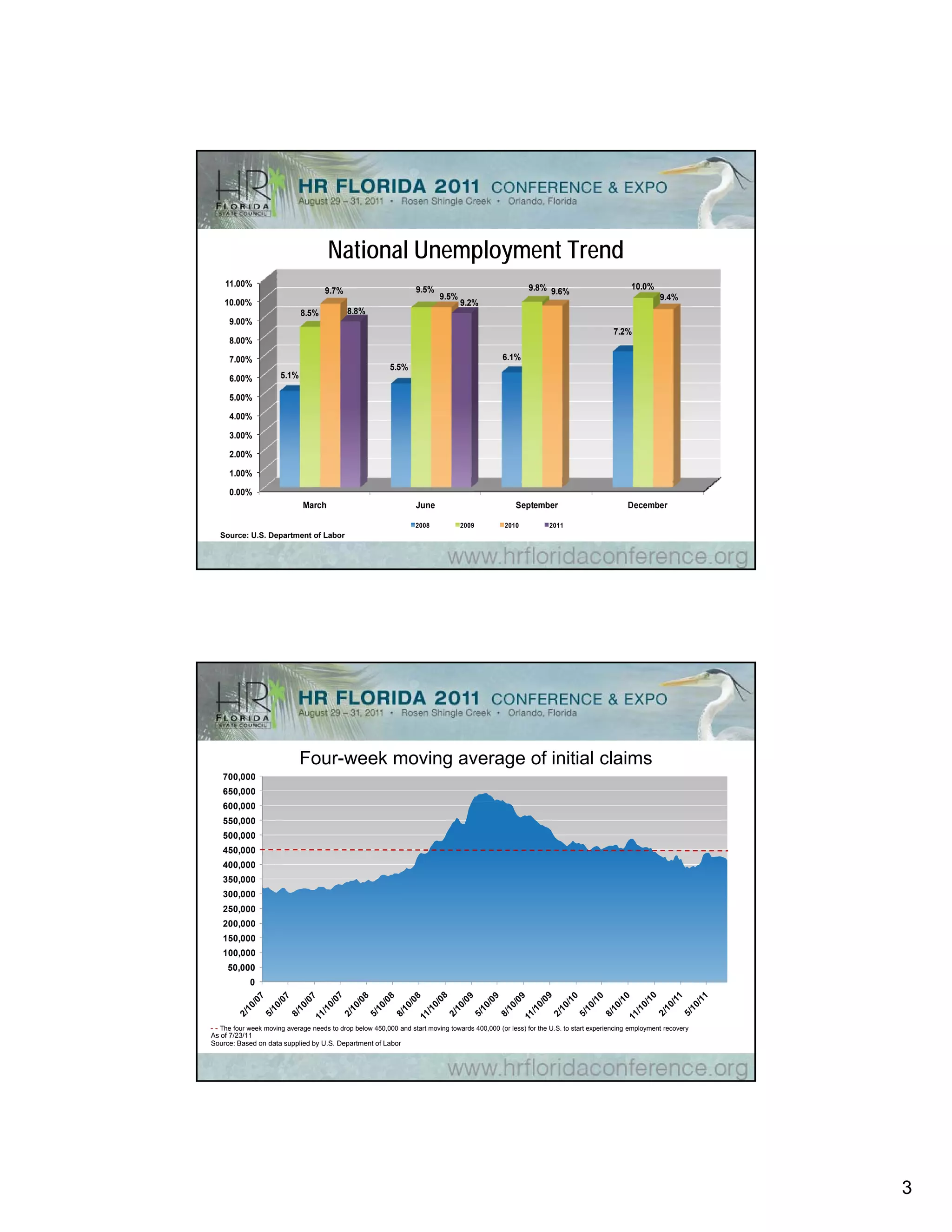

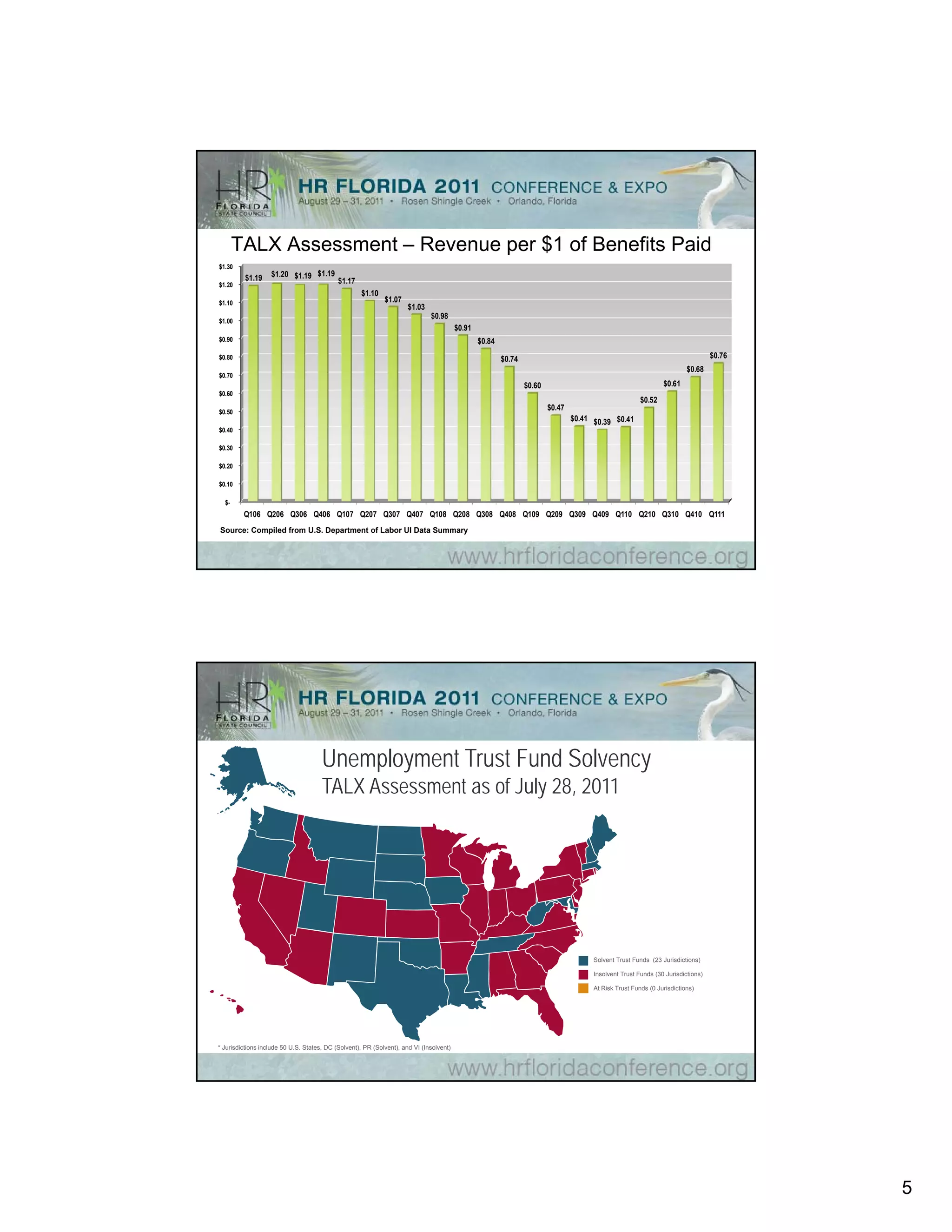

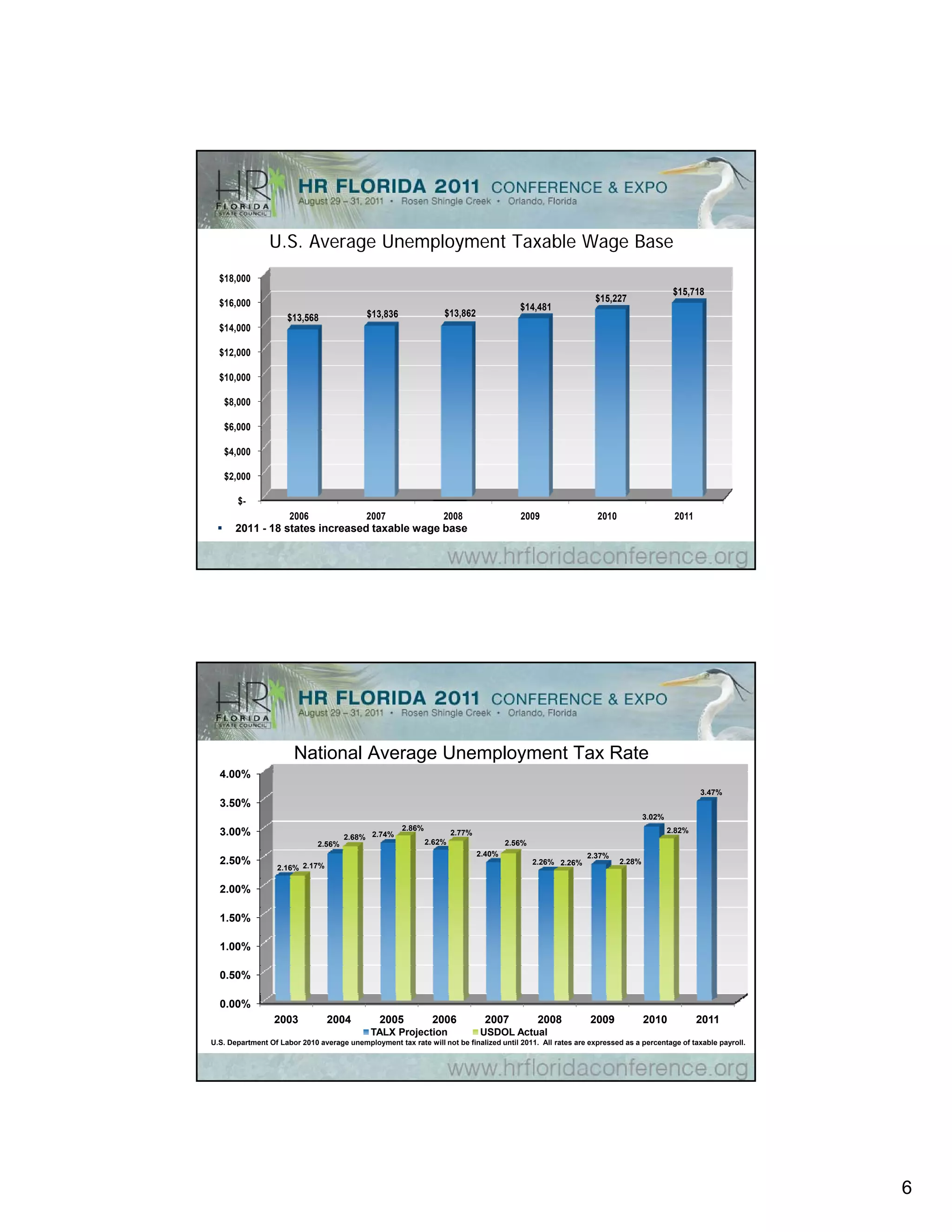

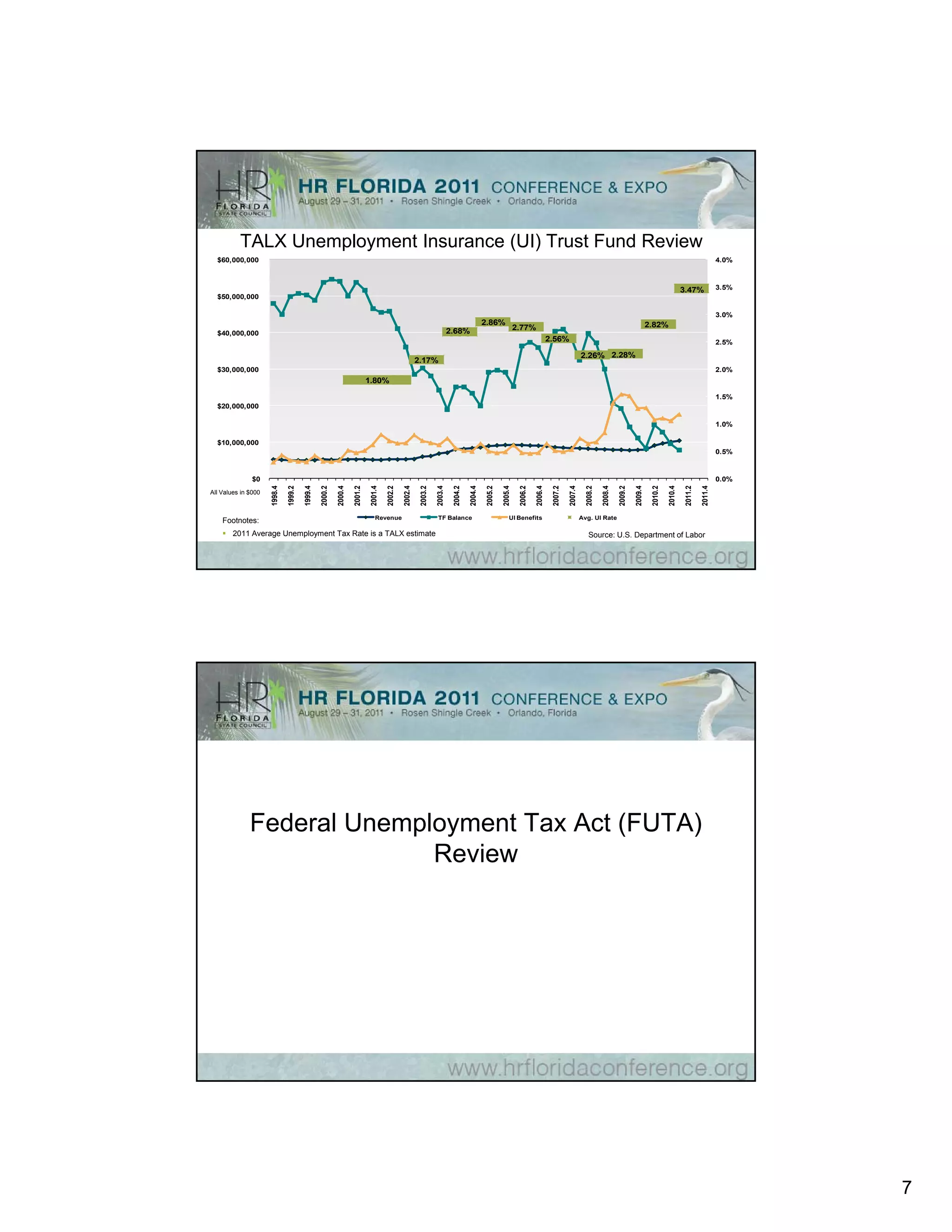

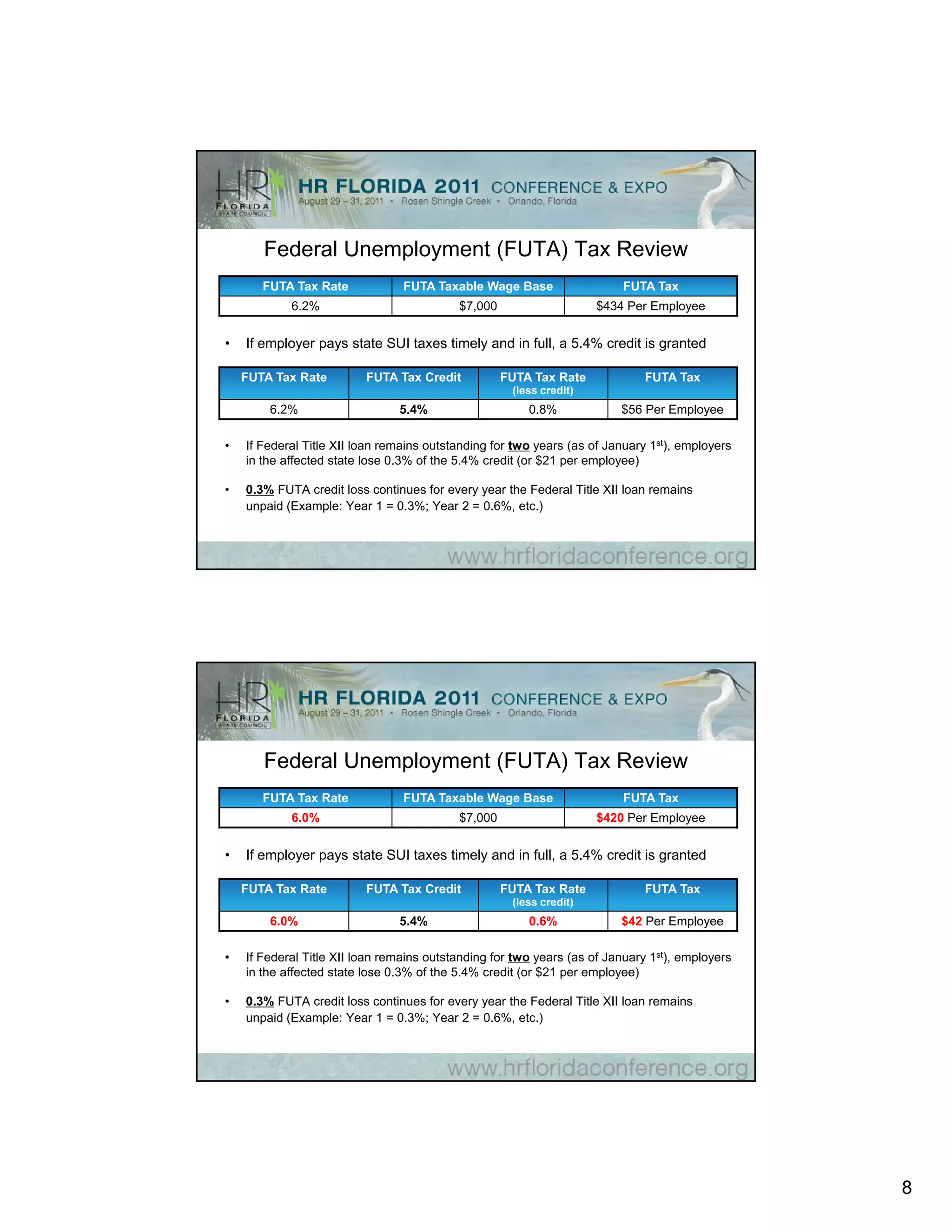

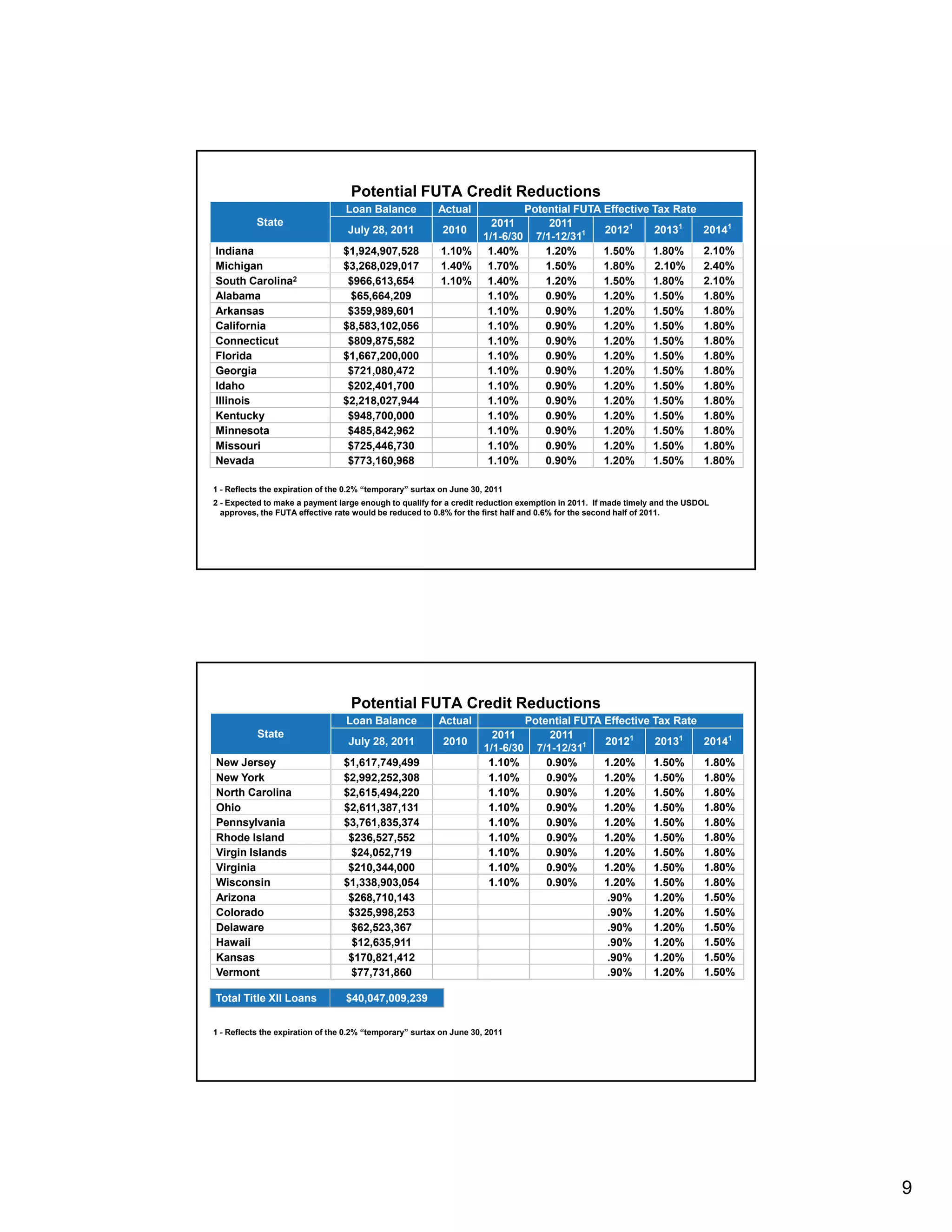

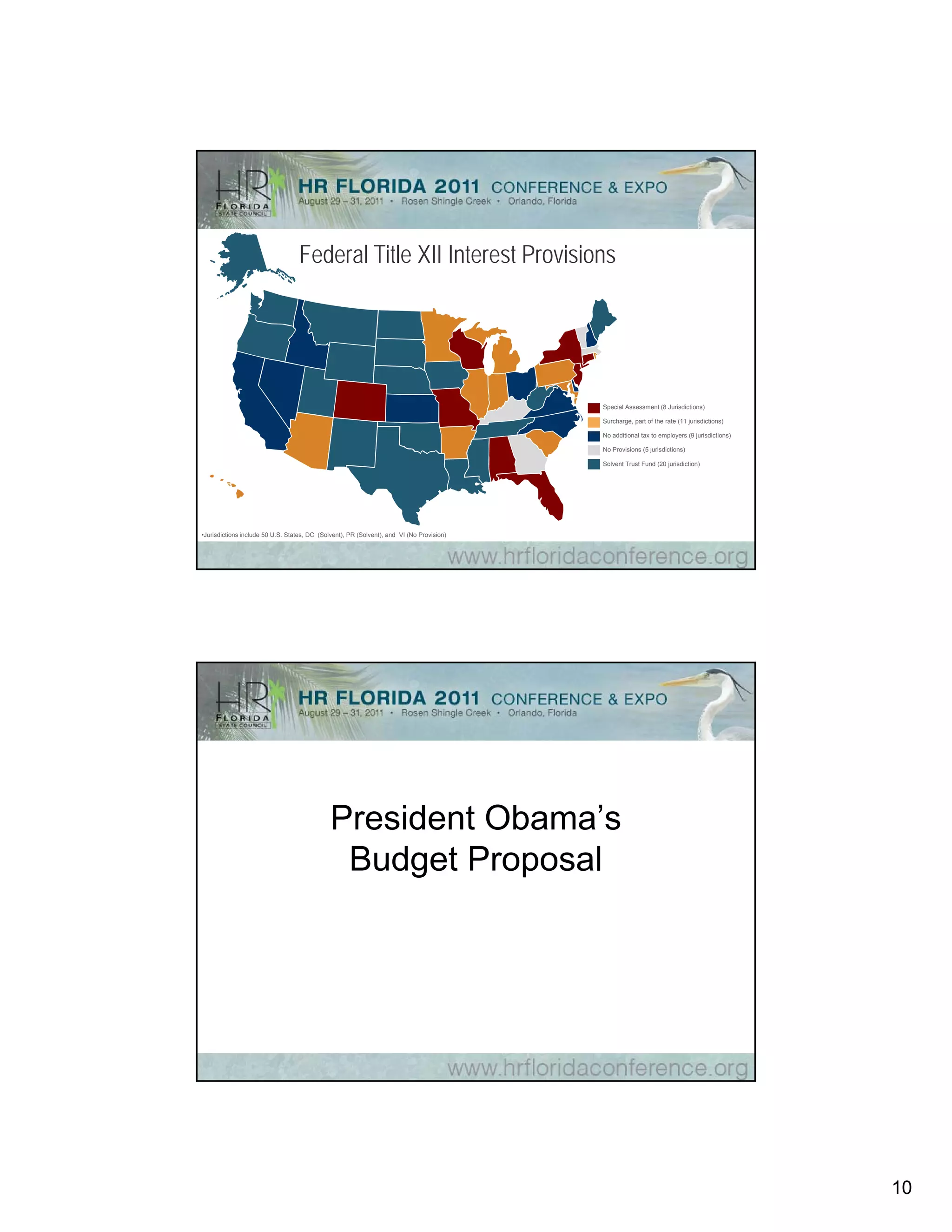

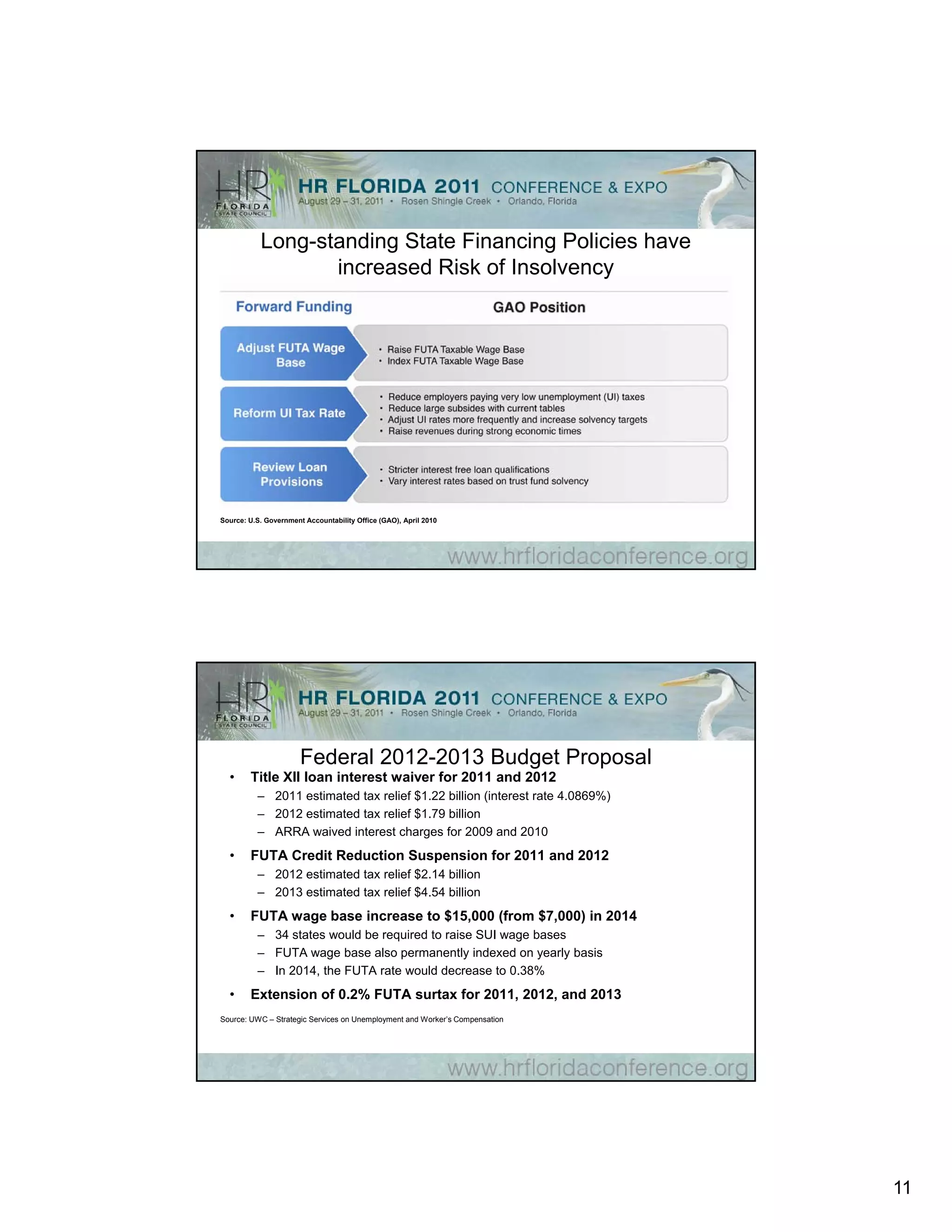

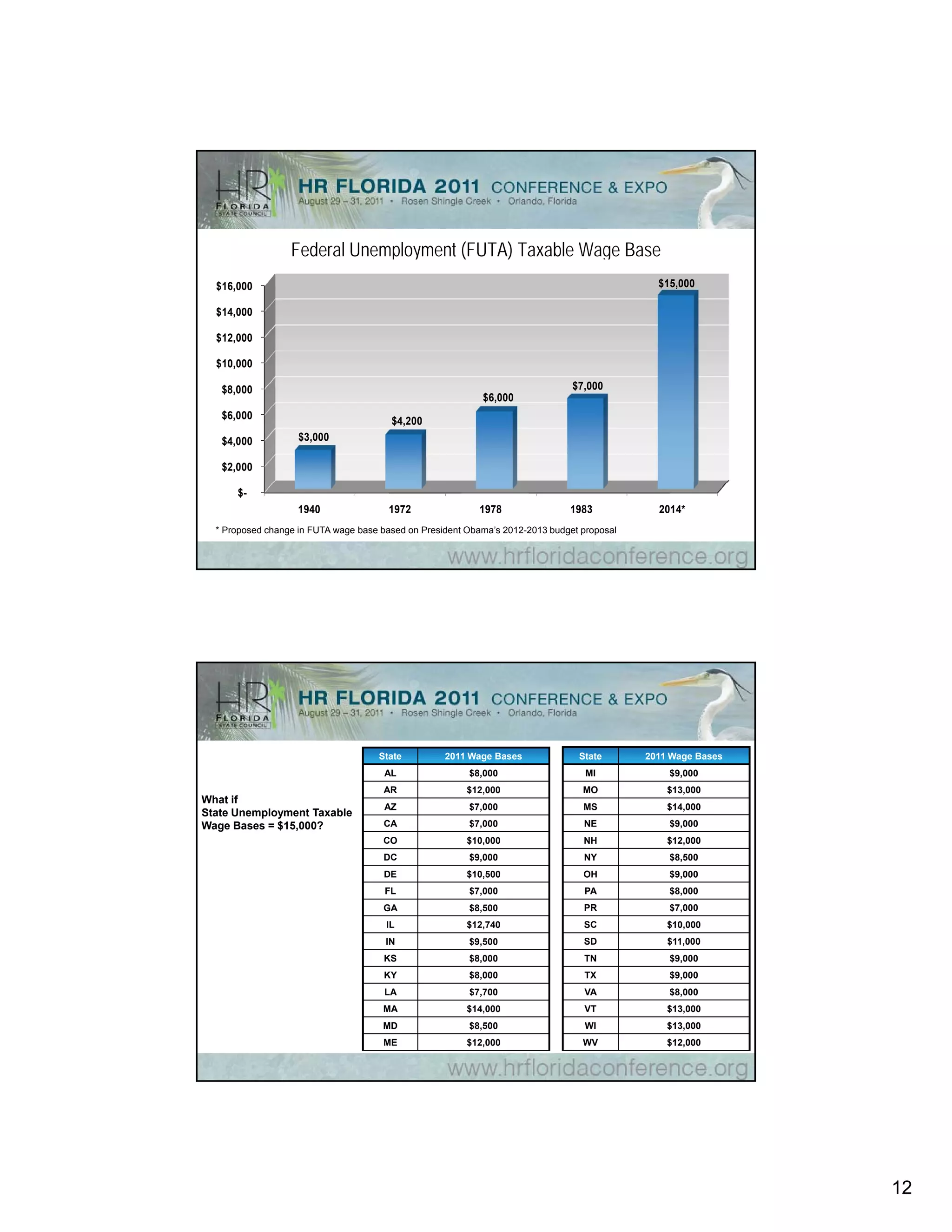

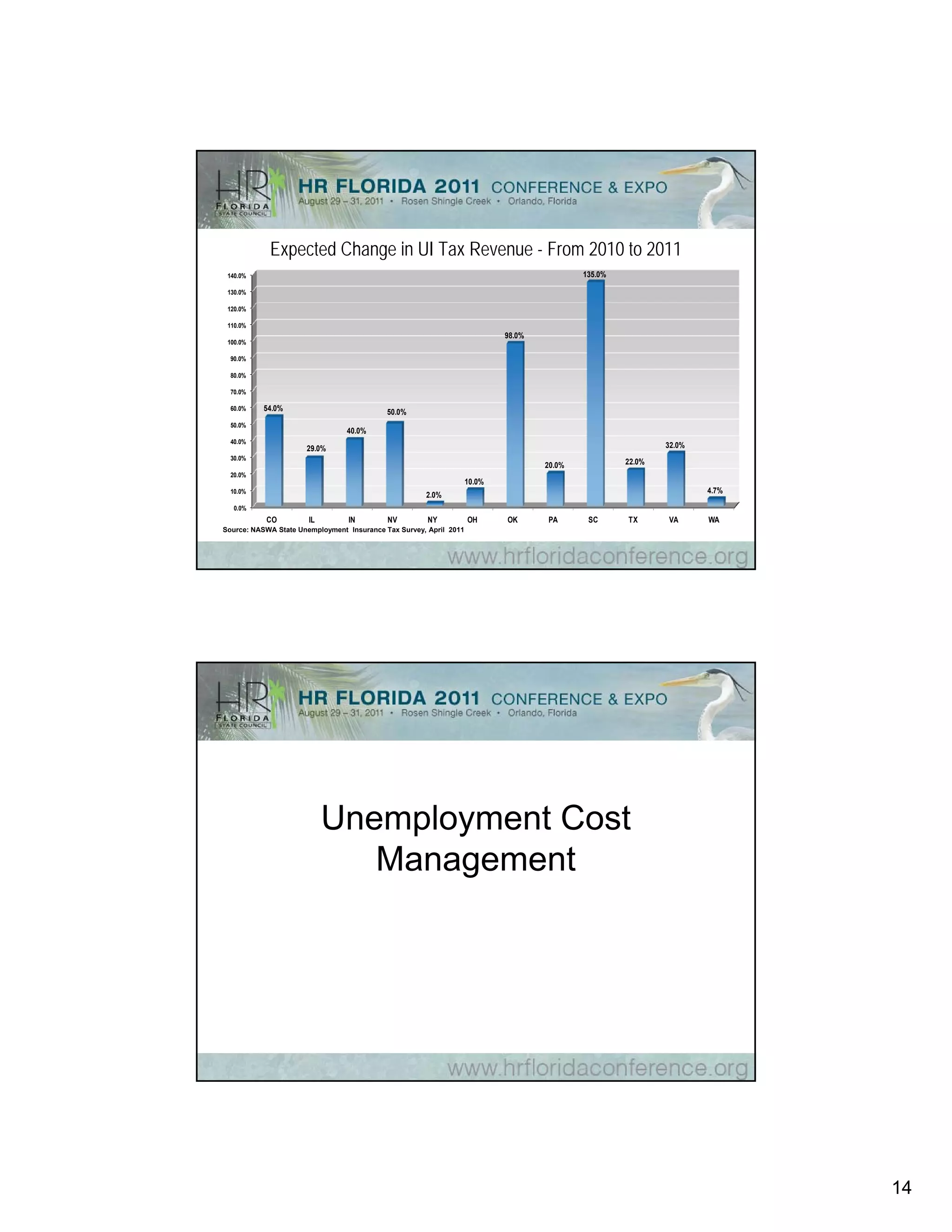

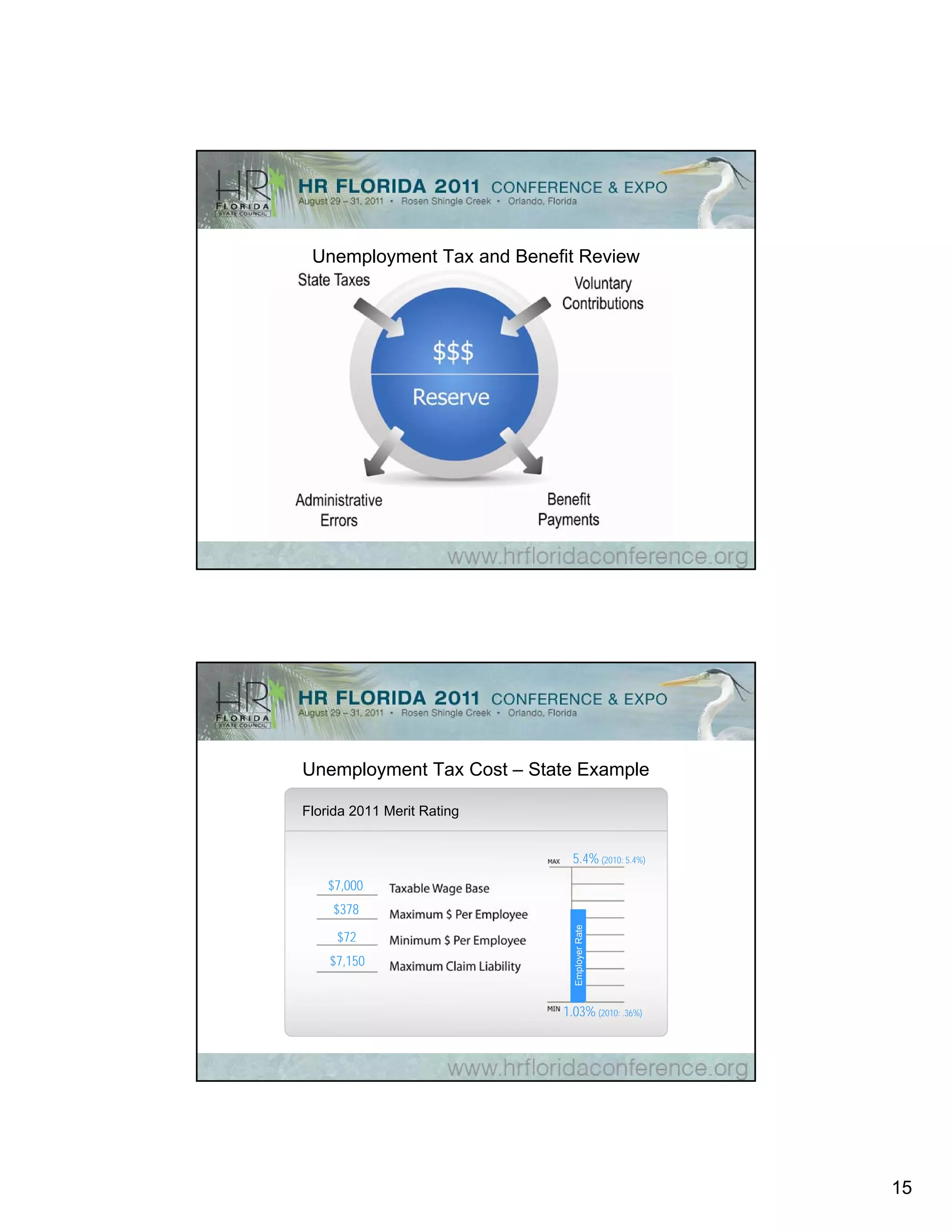

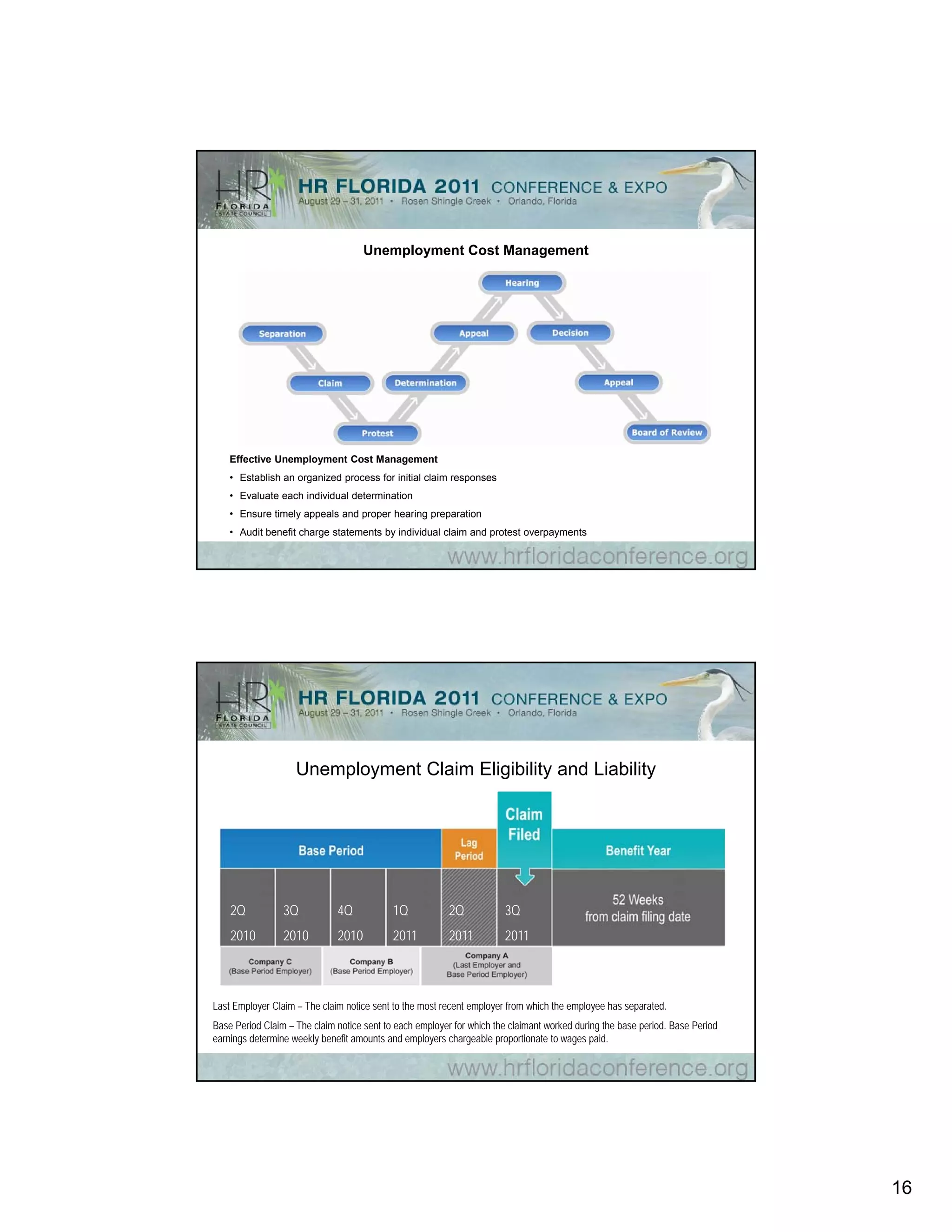

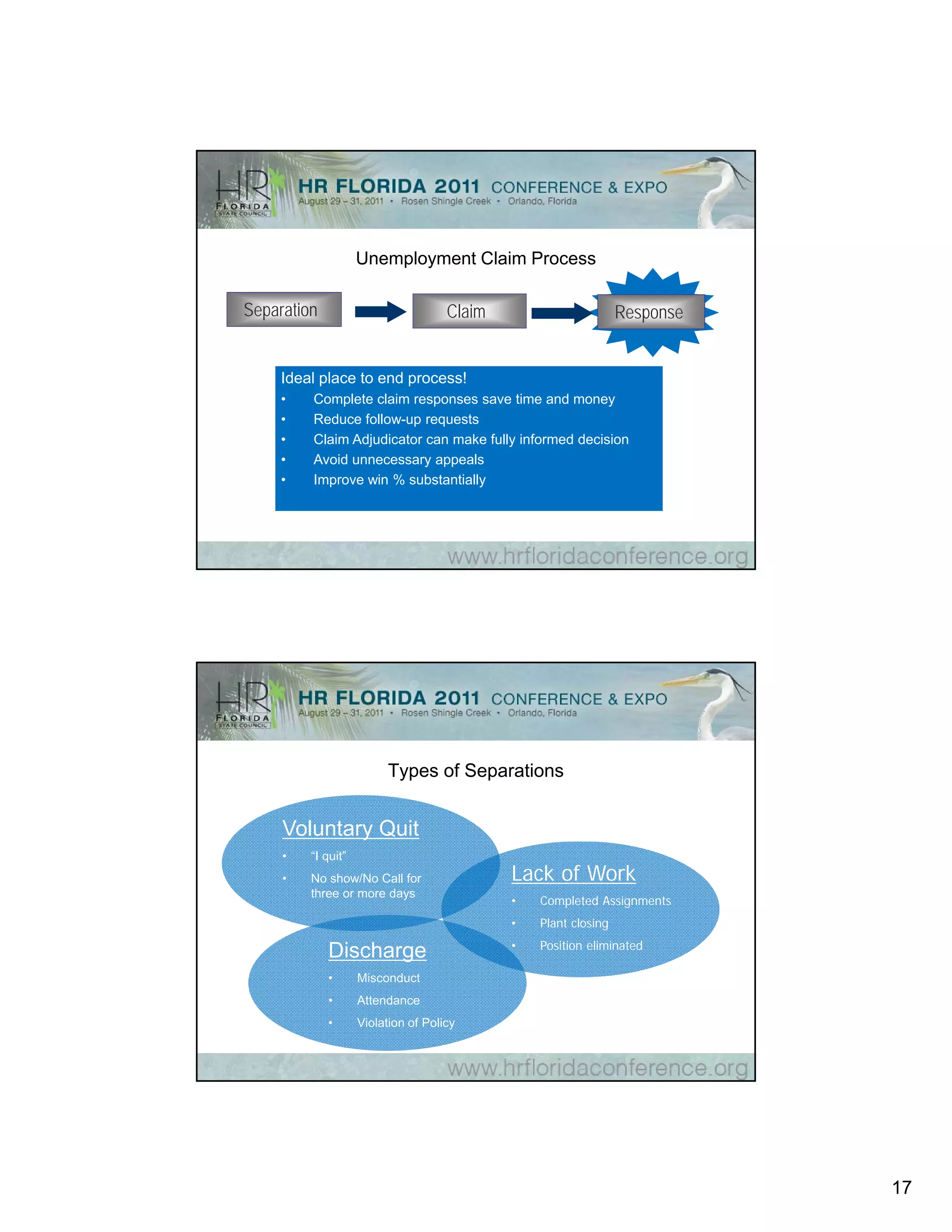

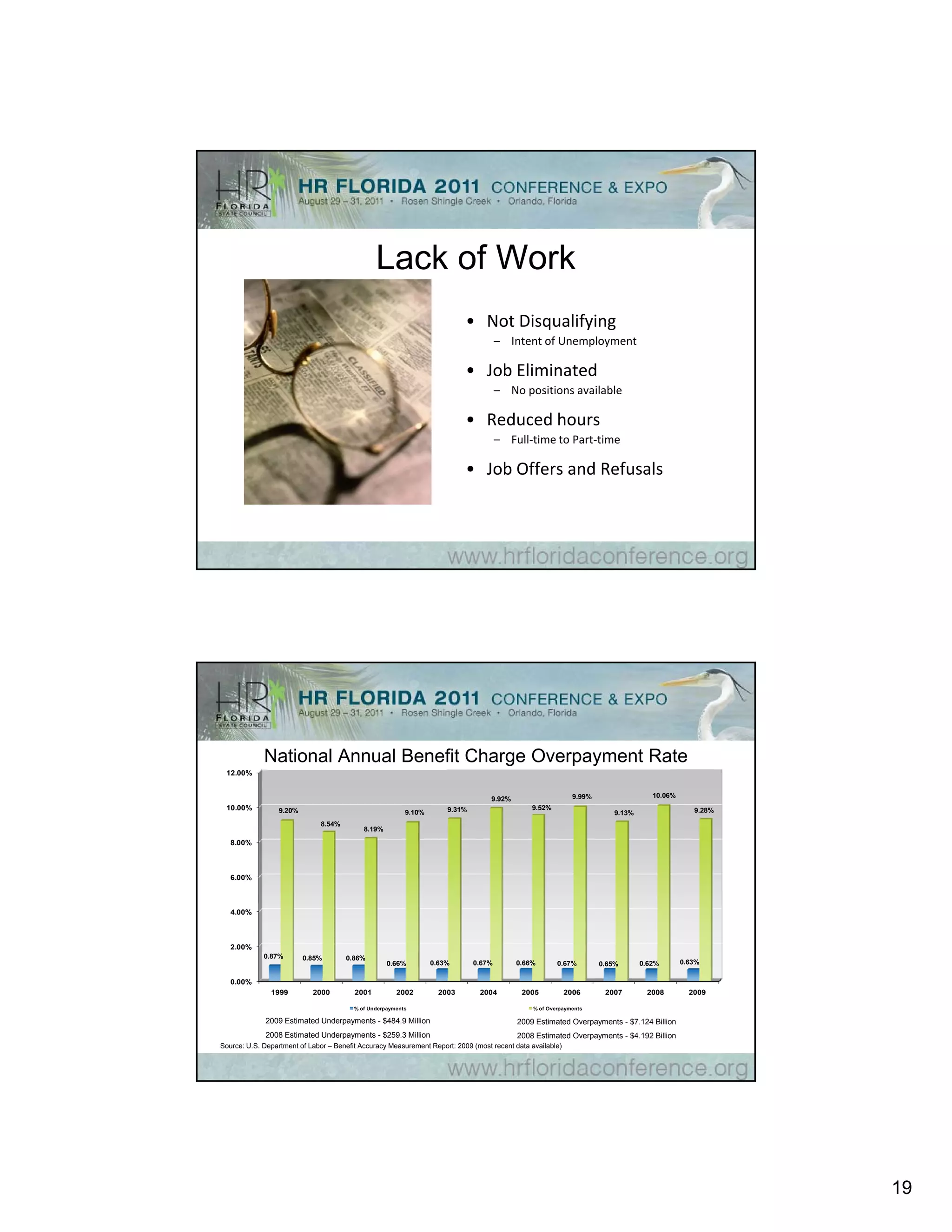

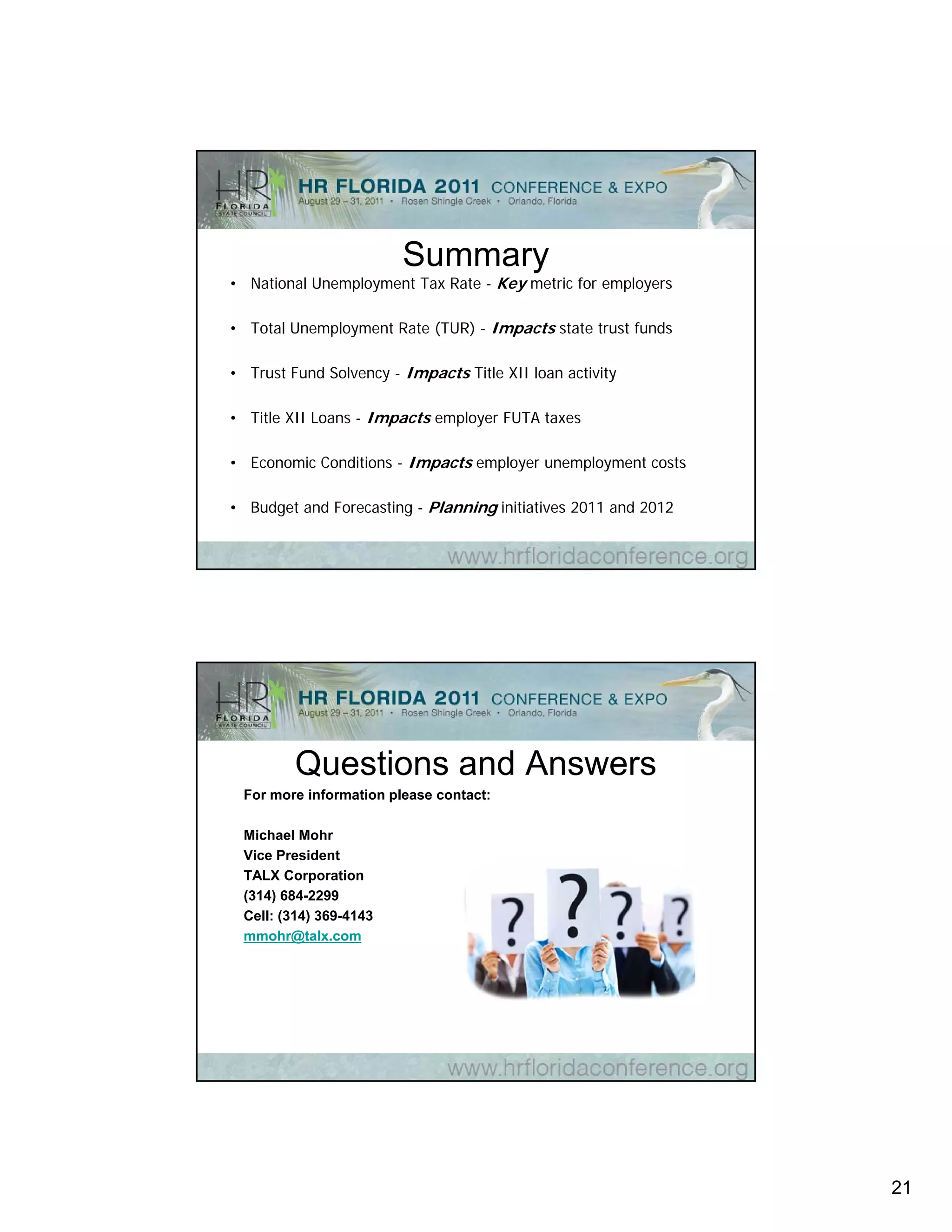

This document provides an overview and analysis of unemployment costs and systems in the United States in 2011. It discusses rising national unemployment rates and long-term unemployment. Many state unemployment trust funds are insolvent, requiring over $40 billion in federal loans. The document analyzes proposals to manage unemployment costs, including changes to the Federal Unemployment Tax Act that could increase taxes for employers in states with outstanding loan balances.