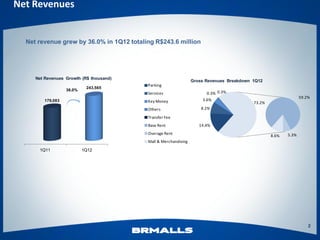

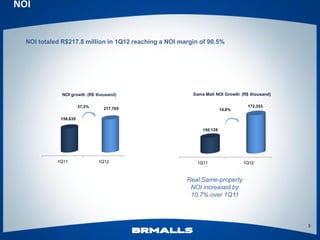

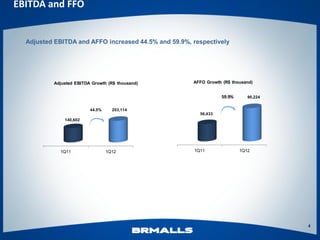

1) Net revenues for BRMALLS grew 36% to R$243.6 million in 1Q12, with NOI reaching R$217.8 million and a NOI margin of 90.5%. Adjusted EBITDA and AFFO increased 44.5% and 59.9% respectively.

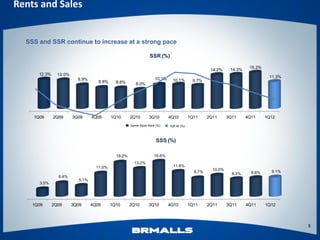

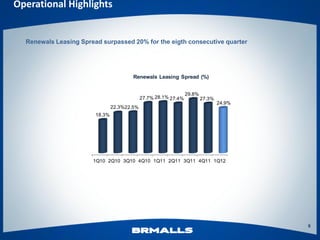

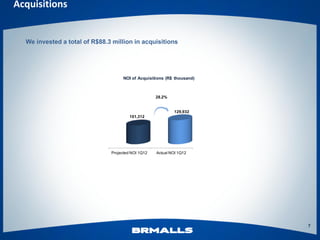

2) Same-store rents and sales continued to increase strongly, with renewals leasing spread above 20% for the eighth consecutive quarter. BRMALLS also invested R$88.3 million in acquisitions.

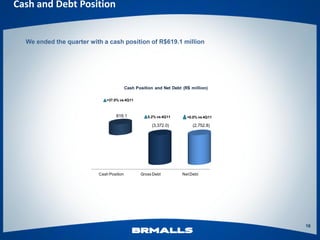

3) BRMALLS ended 1Q12 with R$619.1 million in cash and a diversified long-term debt profile. Development projects will