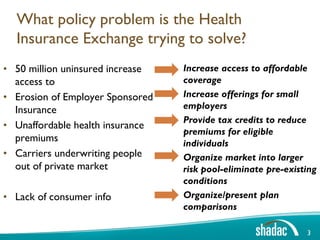

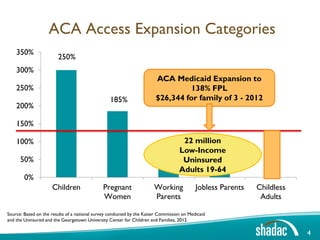

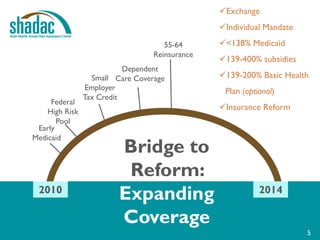

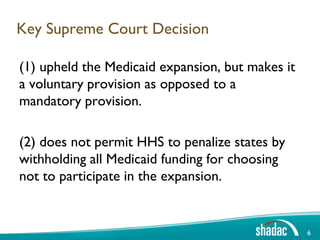

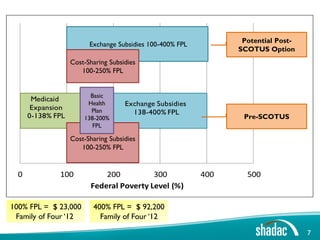

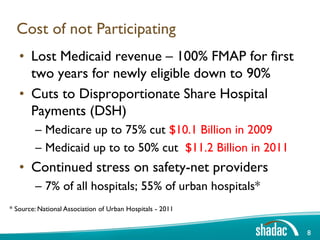

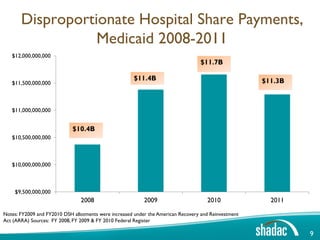

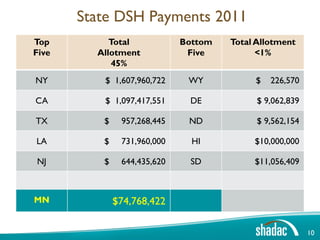

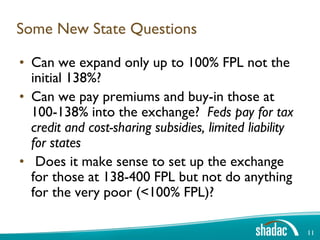

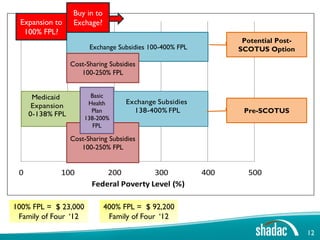

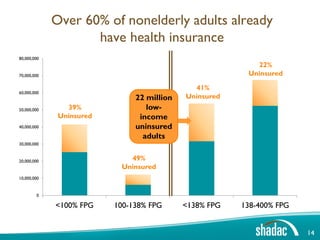

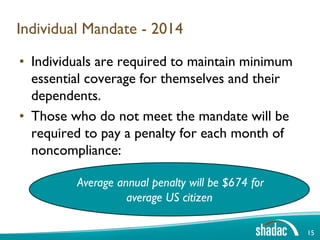

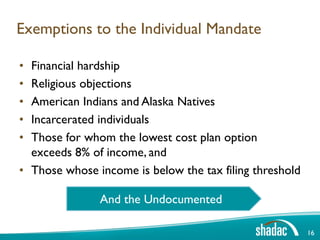

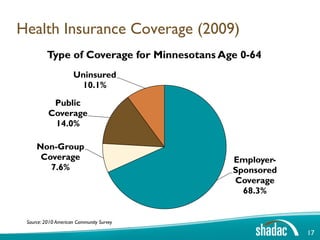

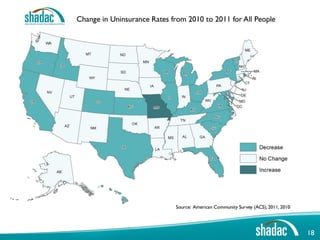

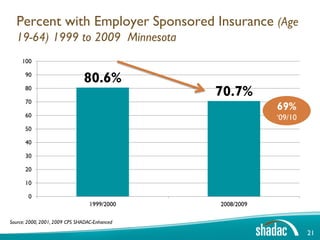

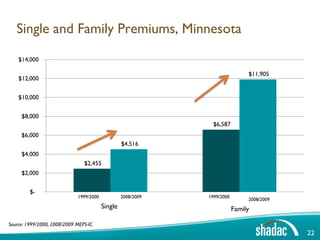

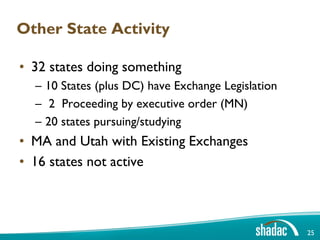

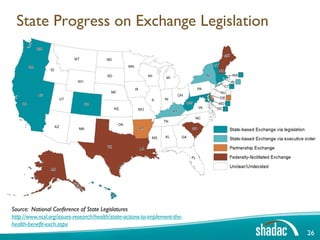

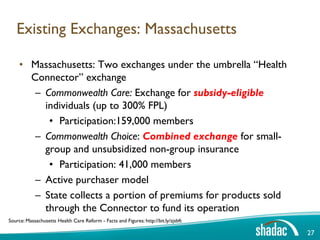

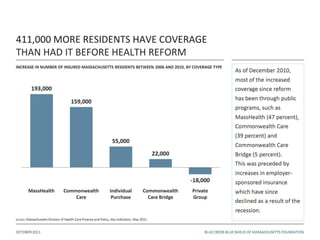

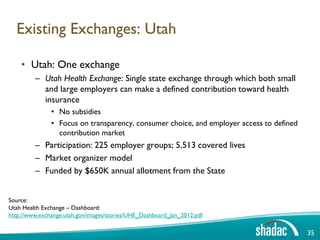

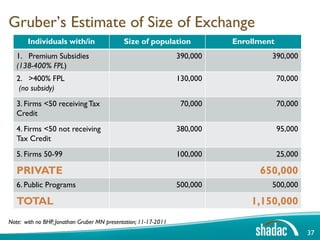

This document discusses key aspects of state health insurance exchanges and the Affordable Care Act. It provides an overview of how exchanges are meant to increase access to affordable health insurance coverage by organizing the market and providing subsidies. It also addresses the Supreme Court decision on Medicaid expansion, costs to states of not participating, and new questions states may consider around expanding coverage and subsidizing premiums. Data on current insurance coverage and estimated subsidy amounts by income level are presented.