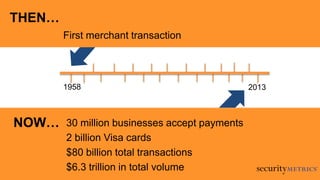

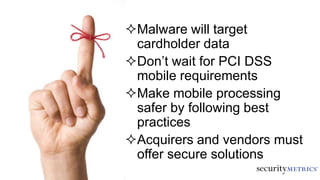

The document discusses the rapid growth of mobile payment processing and its vulnerabilities to data compromise, highlighting that 1 mobile device exists for every 5 people globally. It outlines security issues stemming from mobile malware, particularly through apps, and emphasizes the need for improved security practices in mobile processing. Key recommendations include encryption, regular updates, and employee training to enhance mobile payment security.