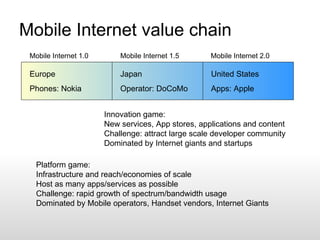

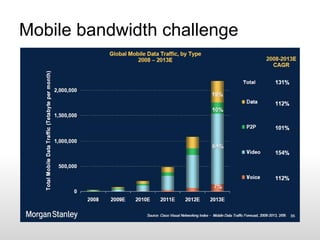

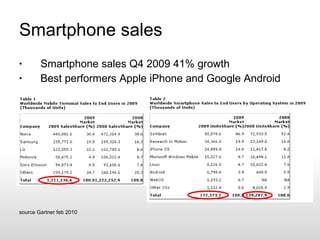

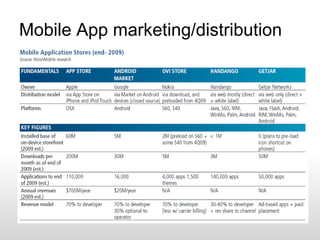

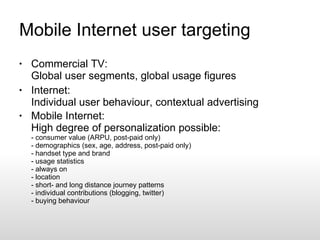

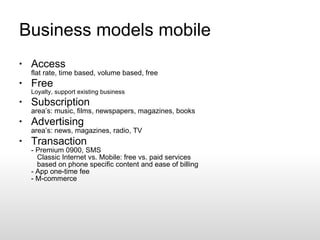

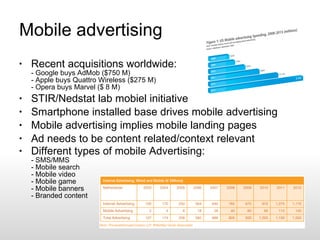

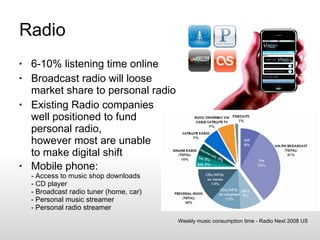

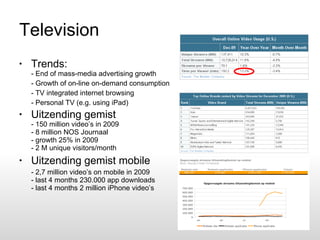

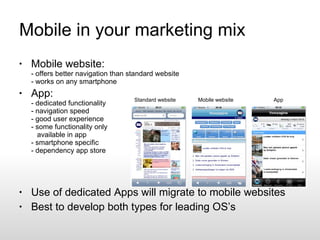

The document outlines the evolution of mobile internet from simple text-based services to today's complex systems featuring smartphones and app-based interactions. It discusses the value chain of mobile internet, the rise of mobile advertising, and the challenges faced by media industries as they transition from traditional models to digital and mobile platforms. The document highlights the need for content relevance in mobile advertising and emphasizes the importance of integrating mobile strategies into marketing mixes.