Building Financial Security

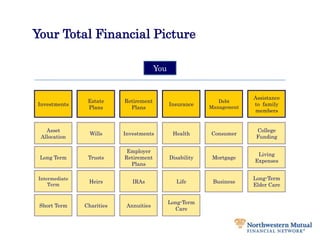

- 1. Your Total Financial Picture You Investments Retirement Plans Estate Plans Assistance to family members Debt Management Insurance Asset Allocation Wills College Funding Consumer Health Investments Long Term Trusts Living Expenses Mortgage Disability Employer Retirement Plans Intermediate Term Heirs Long-Term Elder Care Business Life IRAs Short Term Charities Long-Term Care Annuities

- 2. Building Financial Security WealthPreservation& Distribution WealthAccumulation RiskManagement

- 3. Building Financial Security Aggressive RISK Liability Insurance Health Insurance Disability Insurance Life Insurance Long-Term Care Insurance Little to No Risk Conservative RiskManagement

- 4. Building Financial Security Aggressive Home Equity RISK Money Market Funds Cash Value Life Insurance Cash Checking & Savings Accounts Certificates of Deposit Very Low Risk Conservative WealthAccumulation “Reserves”

- 5. Building Financial Security Aggressive Municipal Bonds RISK Government Bonds Corporate Bonds Moderate Risk Bond Mutual Funds Immediate Annuities Income Producing Real Estate Lower Risk Conservative WealthAccumulation “Income Generating”

- 6. Building Financial Security Aggressive Common Stock High Risk RISK Stock Mutual Funds Personal Business Variable Annuities Moderate Risk Variable Life Insurance ETF & Index Funds Conservative WealthAccumulation “Growth”

- 7. Building Financial Security Aggressive Very High Risk RISK Futures Options Collectibles Commodities Precious Metals Conservative WealthAccumulation “Speculative”

- 8. Building Financial Security Aggressive Wills & Trusts RISK Annuities Conservative Asset Allocation Income Producing Investments Dividends from Cash Value Life Insurance Long-Term Care Insurance Low Risk Conservative WealthPreservation& Distribution

- 9. Your Most Important AssetYour potential income to age 65 Annual Income

- 11. If I continue to save as I have in the past, how much money will I have in ten years?

- 12. Am I satisfied with my current level of savings?

- 13. Will I save systematically to reach my financial goals?When I say “saving systematically” I am really asking you to consider if you: ► Spend first and then save OR ► Save first and spend what is remaining

- 15. It’s disciplined – Dollar cost averaging takes the emotion out of investing and offers you the opportunity to take advantage of market highs and lows.

- 16. It’s sound – Dollar-cost averaging helps you avoid the pitfalls of market timing or investing based on guessing future market directions.

- 18. You take a long-term perspective with you investments

- 19. You can resist the temptation to withdraw assets or stop monthly investments when the market is fluctuating or volatileThis hypothetical example is for illustrative purposes only and is not intended to represent the performance of any particular Investment product or real investor. Past performance cannot guarantee comparable future results; current performance may be higher or lower.

- 20. The Price of Procrastination When it comes to saving money, time can be your best friend or your worst enemy. Procrastination can be expensive. The longer you wait to begin saving for retirement, the more you’ll have to save each month to build an adequate nest egg. As this chart illustrates, someone who starts saving at 25 may be able to accumulate $1 million at 65 by saving just $286 per month. However, someone who waits until 35 to begin saving will have to contribute more than twice that amount monthly to make up for lost time.

- 22. Build a solid financial foundation first – Risk Management

- 23. Asses your risks

- 24. Build your reserves

- 25. Commit to saving systematically – Wealth Accumulation

- 26. Save 10% to 20% of your annual income

- 27. Consider these points:

- 28. What is my tolerance for risk?

- 29. What are the impacts of taxes?

- 30. What is a reasonable or needed rate of return?

- 31. Build a solid retirement income strategy – Wealth Preservation & Distribution

- 32. Consider your estate planning needs – Wealth Preservation & DistributionWealthPreservation& Distribution AssetAccumulation RiskManagement

Editor's Notes

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.

- The planning process for qualified retirement plans mirrors the model designed for retail clients. You’re familiar with the financial security pyramid, which is applicable to the business retirement market as well.