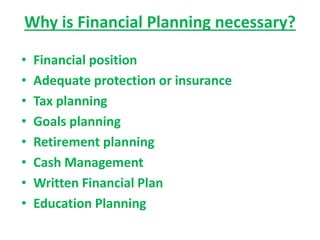

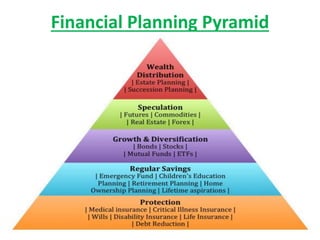

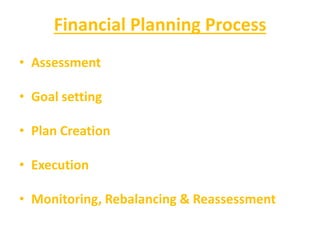

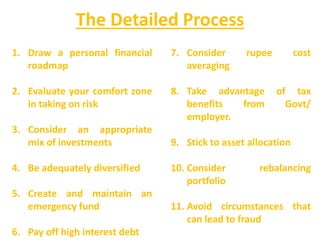

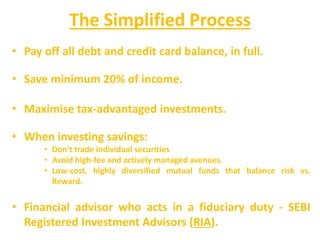

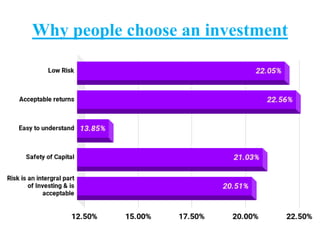

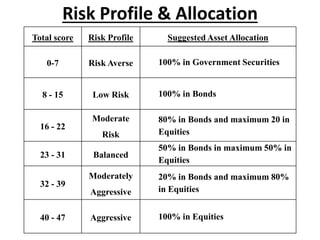

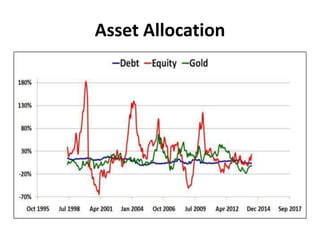

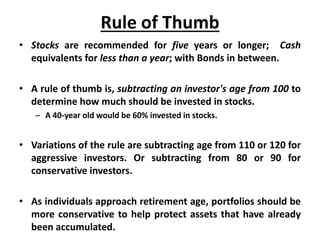

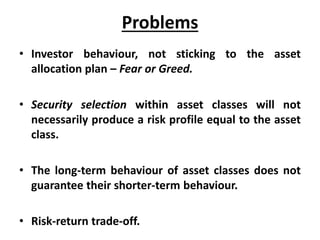

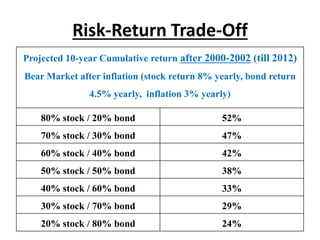

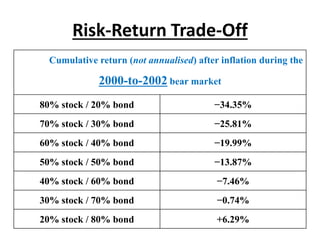

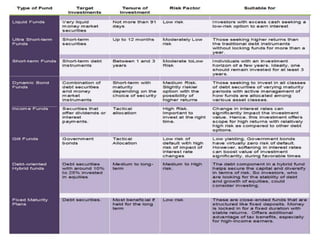

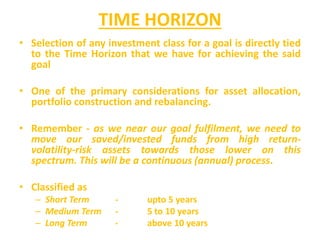

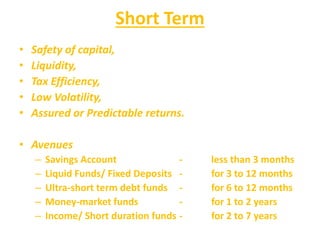

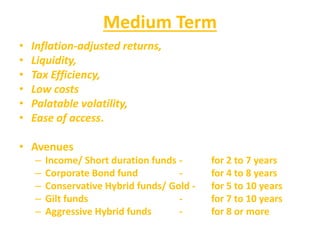

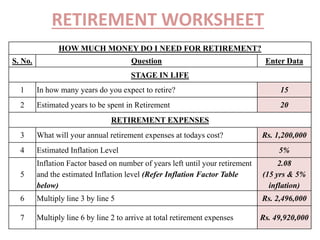

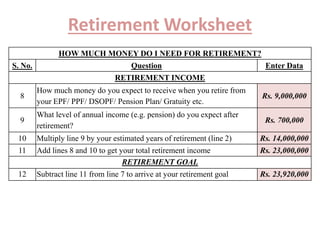

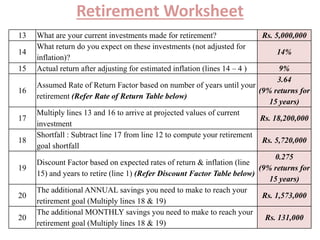

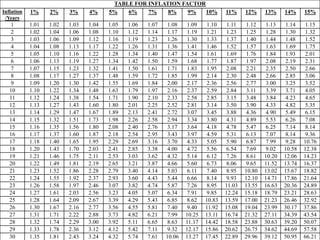

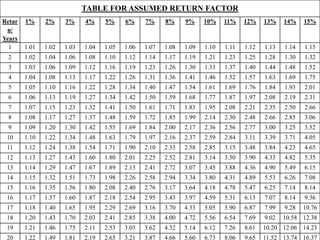

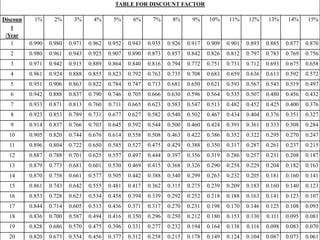

The document provides information on financial planning for do-it-yourself (DIY) investors. It discusses the basics of financial planning including assessing one's budgets, financial commitments, goals, and determining fund requirements. It covers various aspects of financial planning like risk assessment, asset allocation, portfolio management, and investment frameworks. The document emphasizes the importance of financial planning, diversification, low-cost investment avenues, and rebalancing portfolios. It provides worksheets to help estimate retirement expenses and income needs.