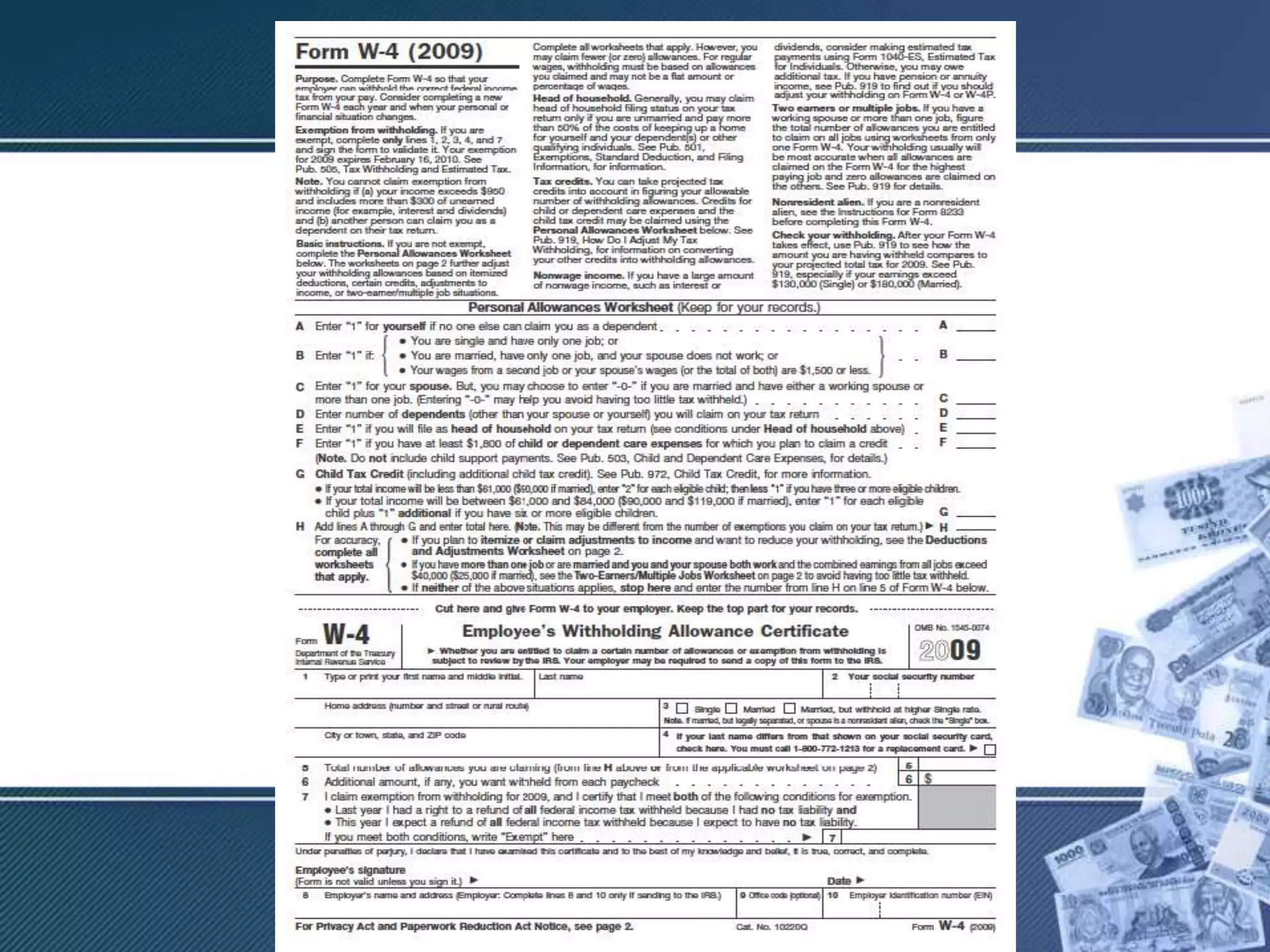

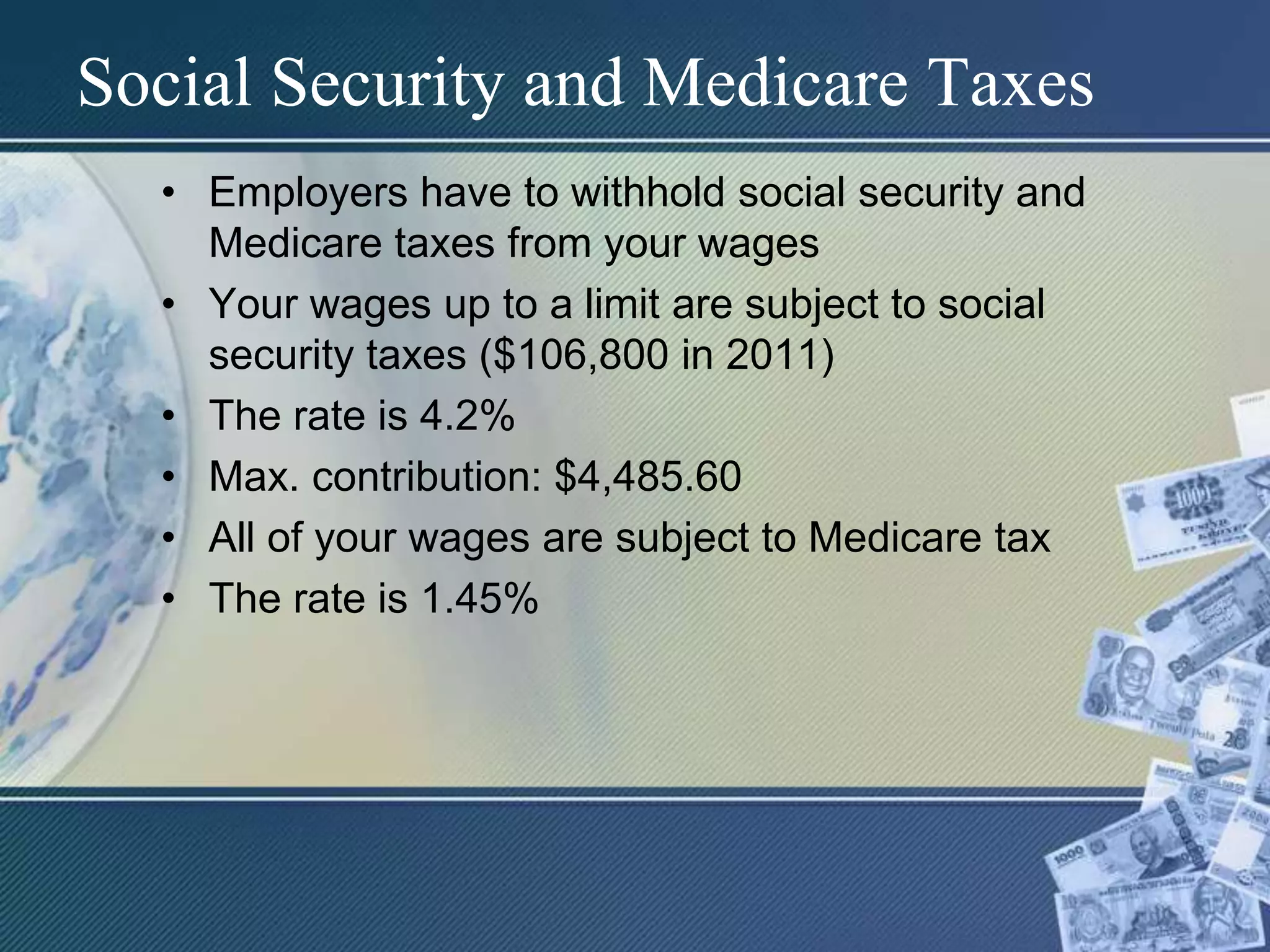

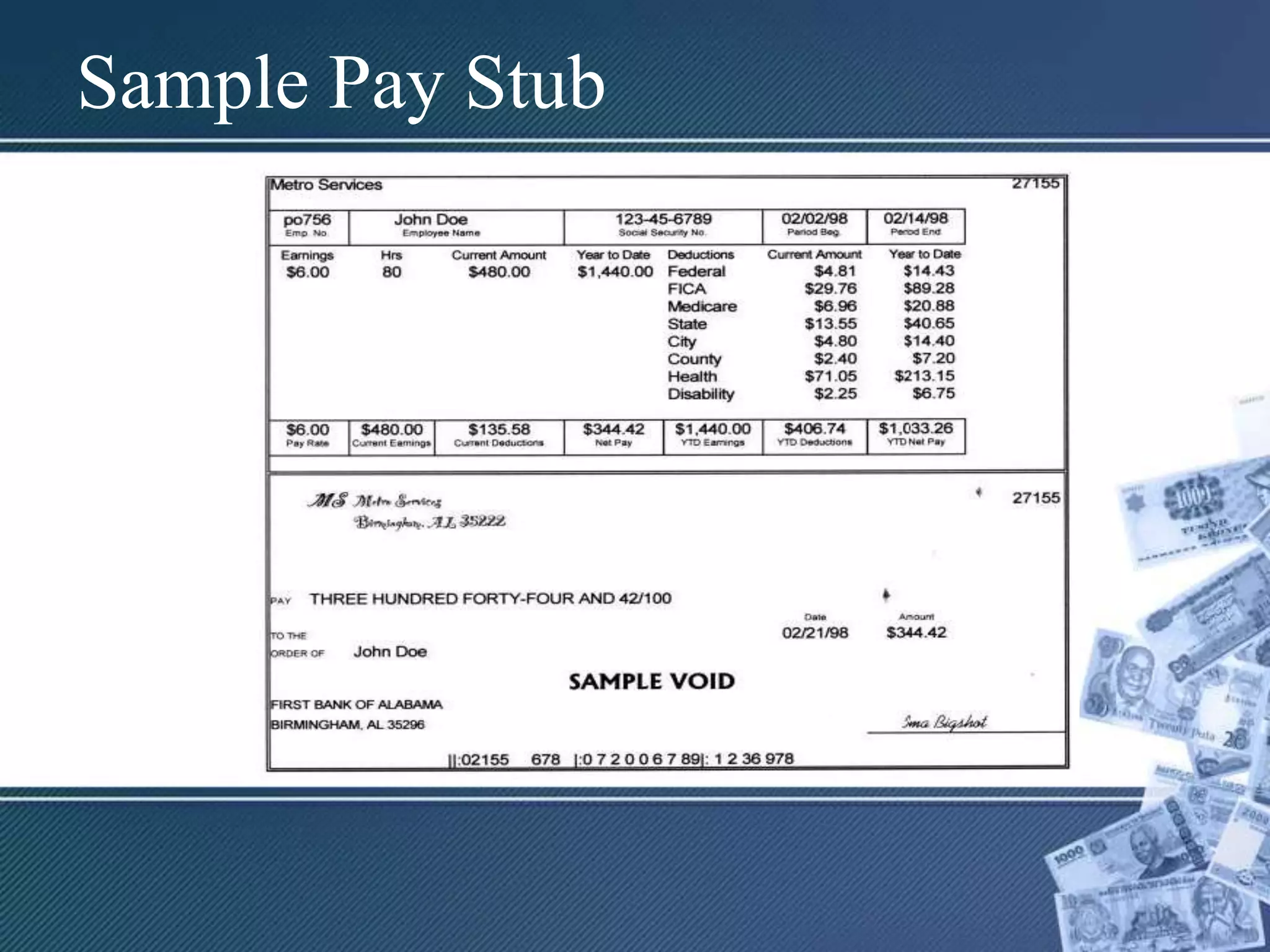

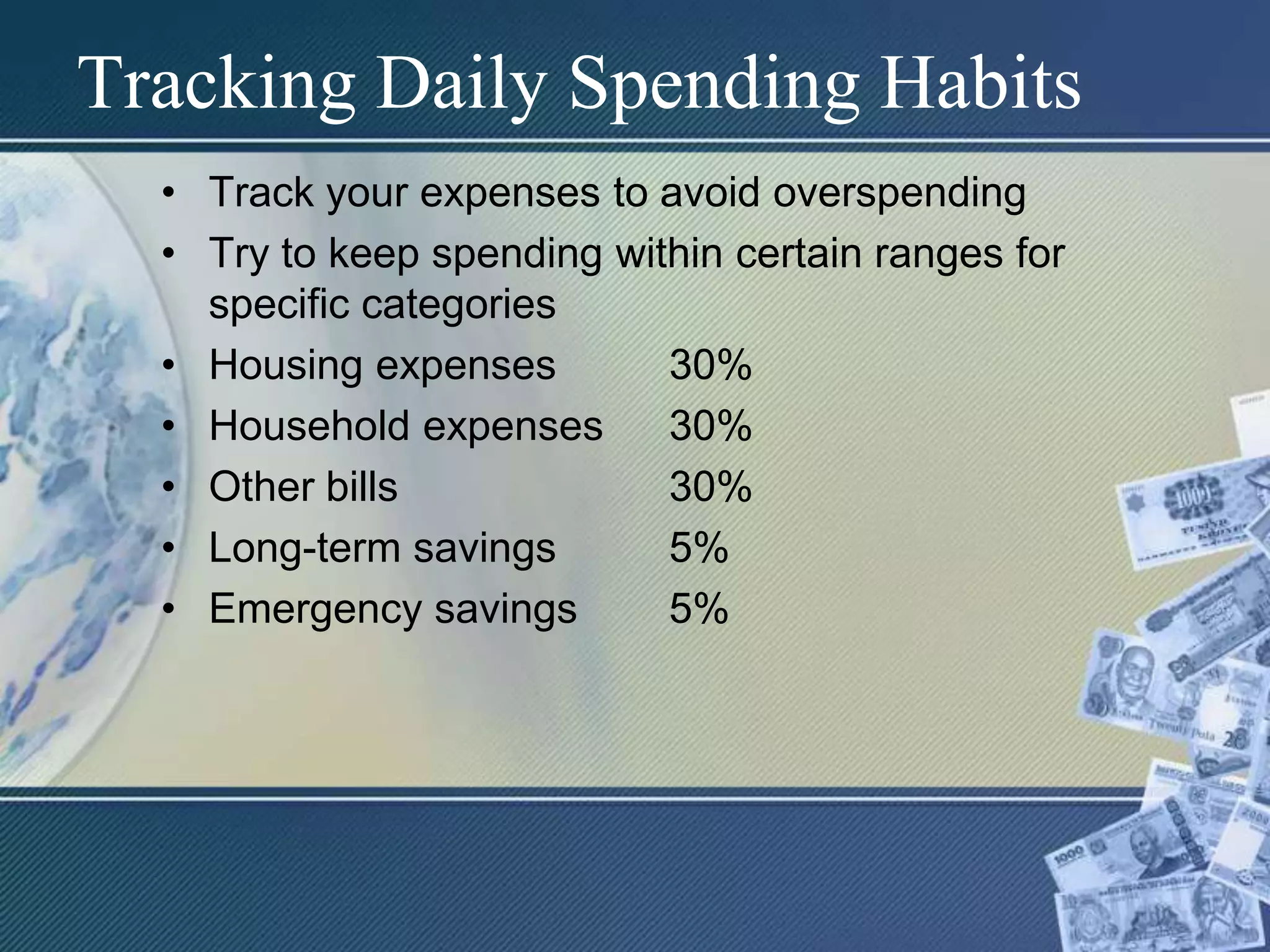

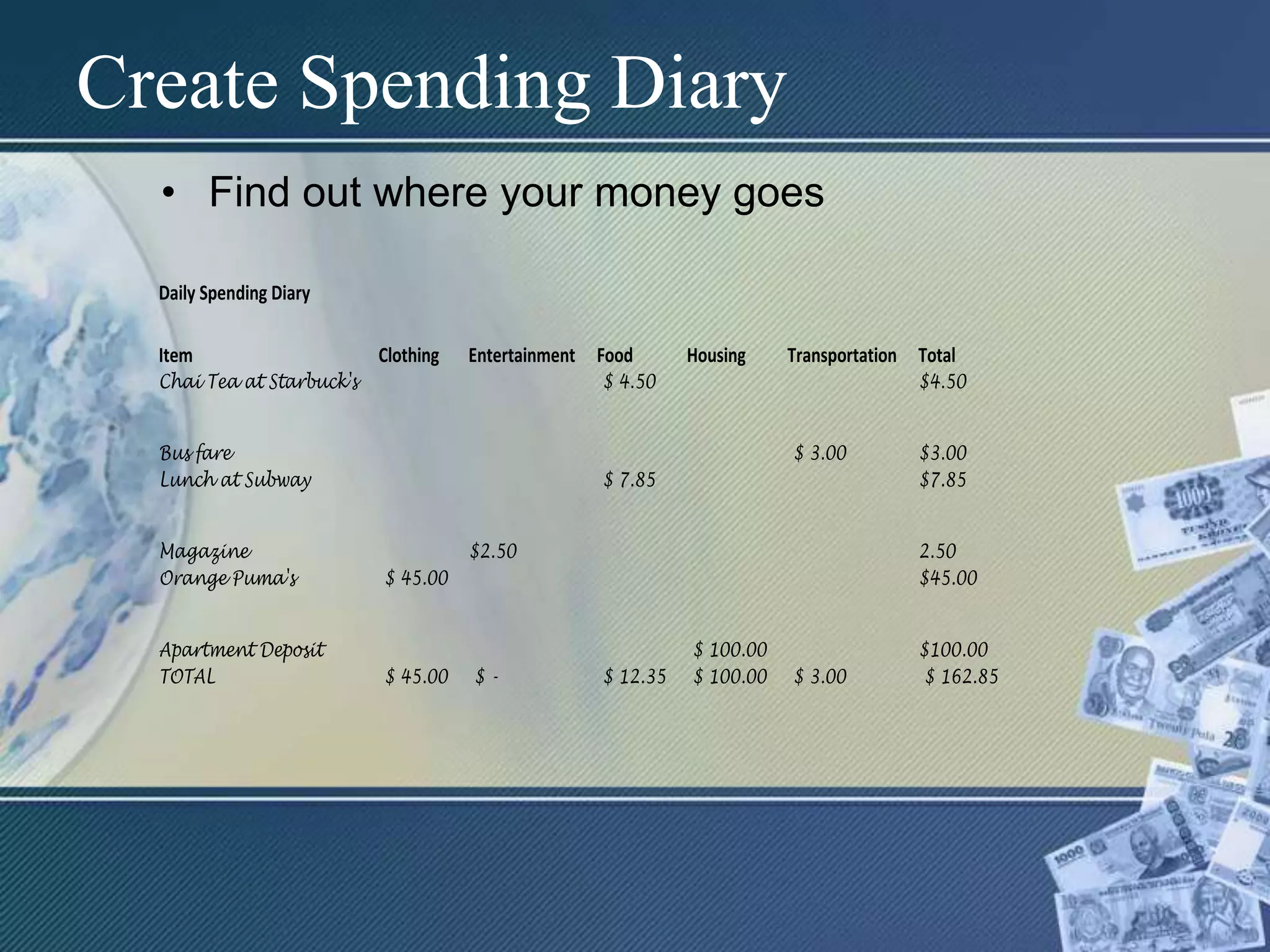

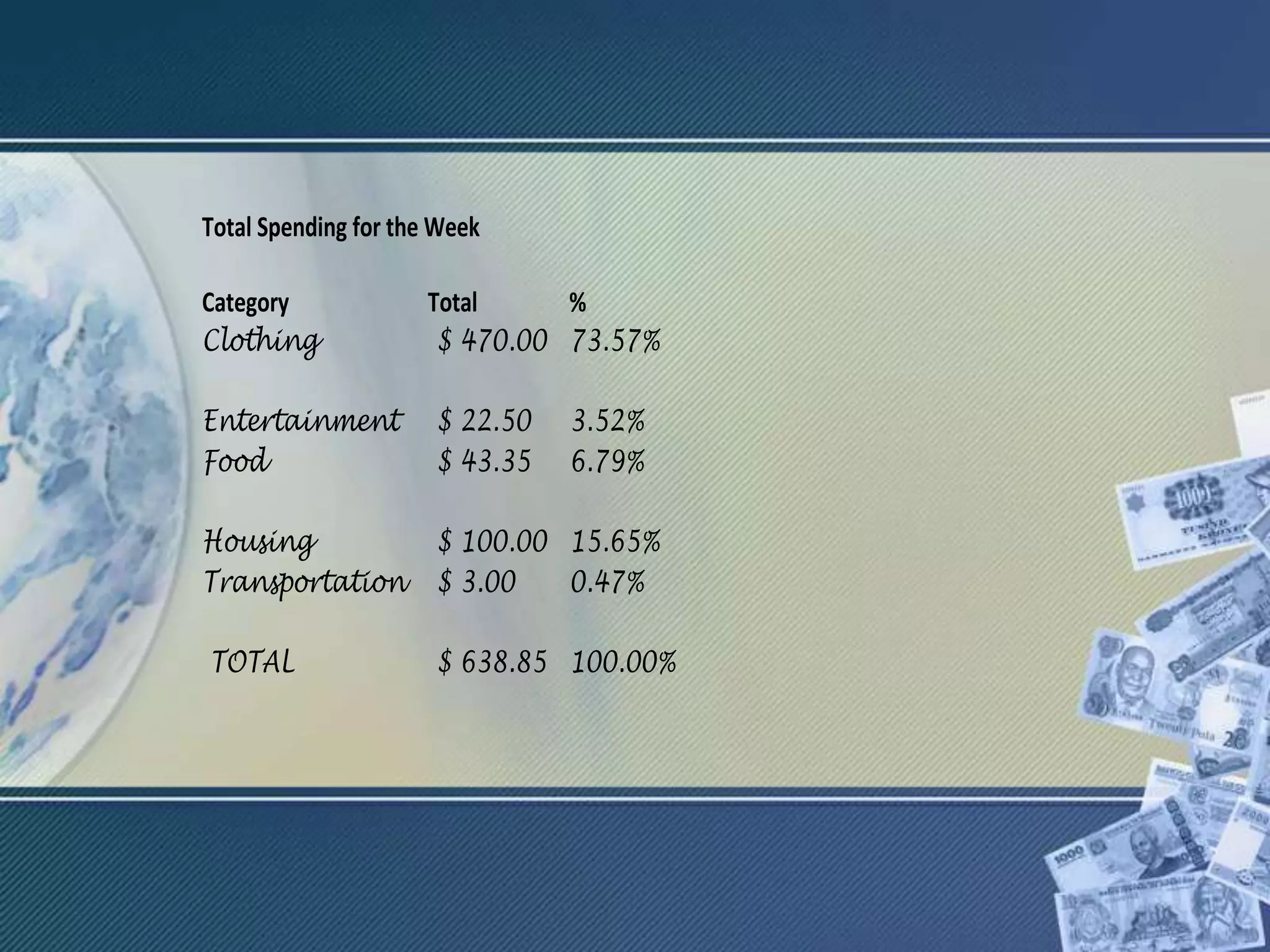

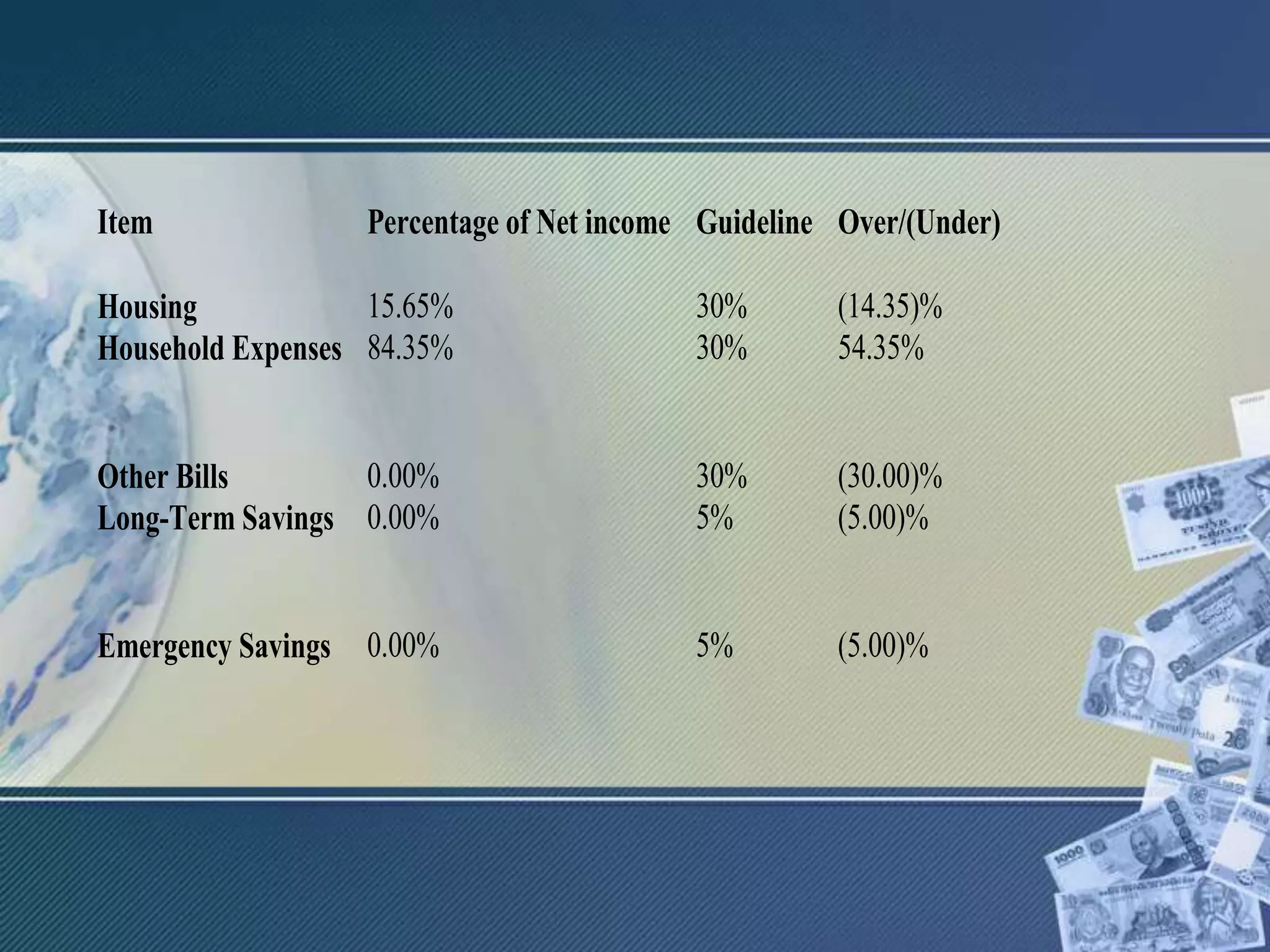

This document provides information on budgeting and financial goals. It discusses developing a personal budget by calculating monthly income, tracking daily spending habits, determining monthly expenses, and preparing a spending plan. The objectives are to learn how to manage money by setting financial goals, preparing a budget, and finding ways to decrease expenses and increase income. Key steps involve being realistic with goals, setting timeframes, considering constraints, and ensuring monthly income exceeds expenses. Tracking tools like spending diaries can help identify where money is going. Maintaining a positive net worth by paying bills and managing debt is also covered.