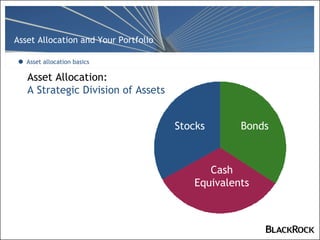

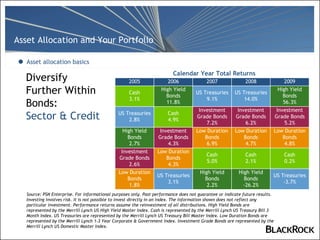

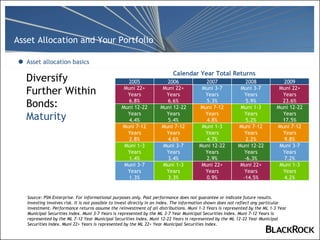

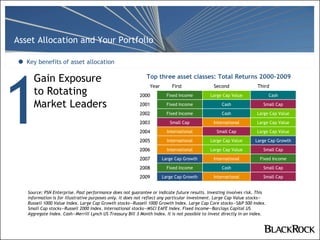

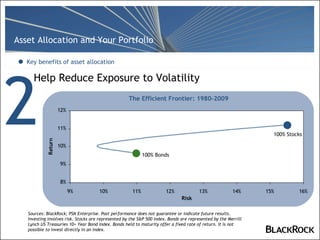

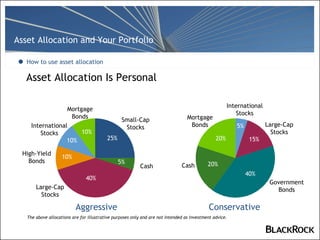

1) Asset allocation involves dividing investments among different asset classes like stocks, bonds, and cash equivalents to gain exposure to rotating market leaders and help reduce volatility.

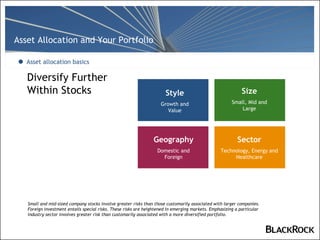

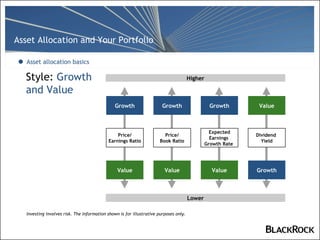

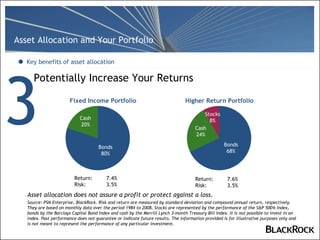

2) Maintaining a balanced mix of assets tailored to an individual's goals, time horizon, and risk tolerance can potentially increase returns compared to holding single assets.

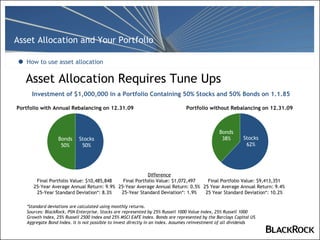

3) Asset allocation strategies need periodic rebalancing to maintain the intended risk level as market conditions and individual circumstances change over time.