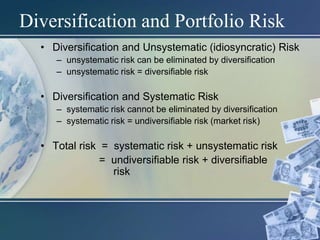

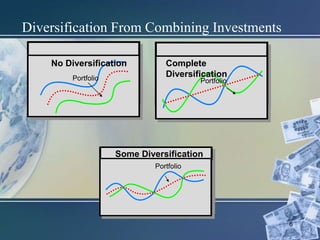

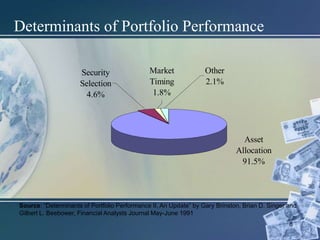

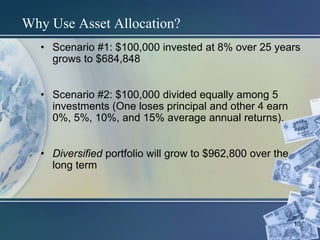

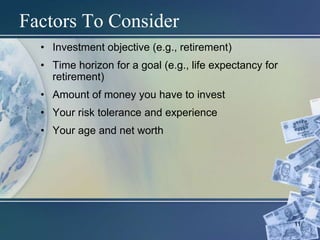

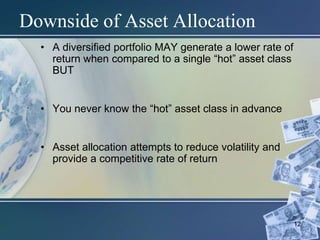

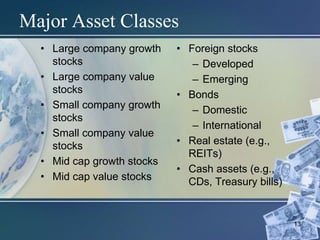

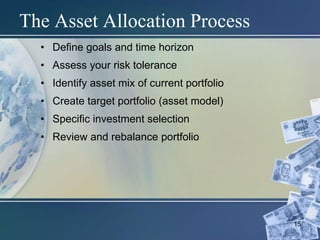

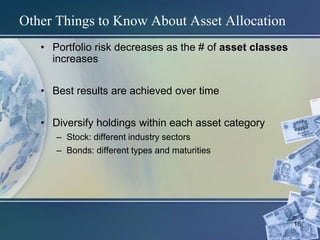

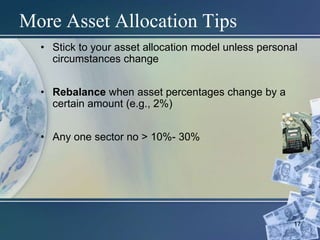

The document discusses the concept of diversification and asset allocation in investment portfolios, emphasizing that diversification can mitigate unsystematic risk while systematic risk remains. It highlights the importance of asset allocation, stating that it accounts for 90% of return variations in portfolios and provides guidelines for effective portfolio construction. The document also covers factors to consider in asset allocation and the downside of potentially lower returns in diversified investments compared to concentrated ones.