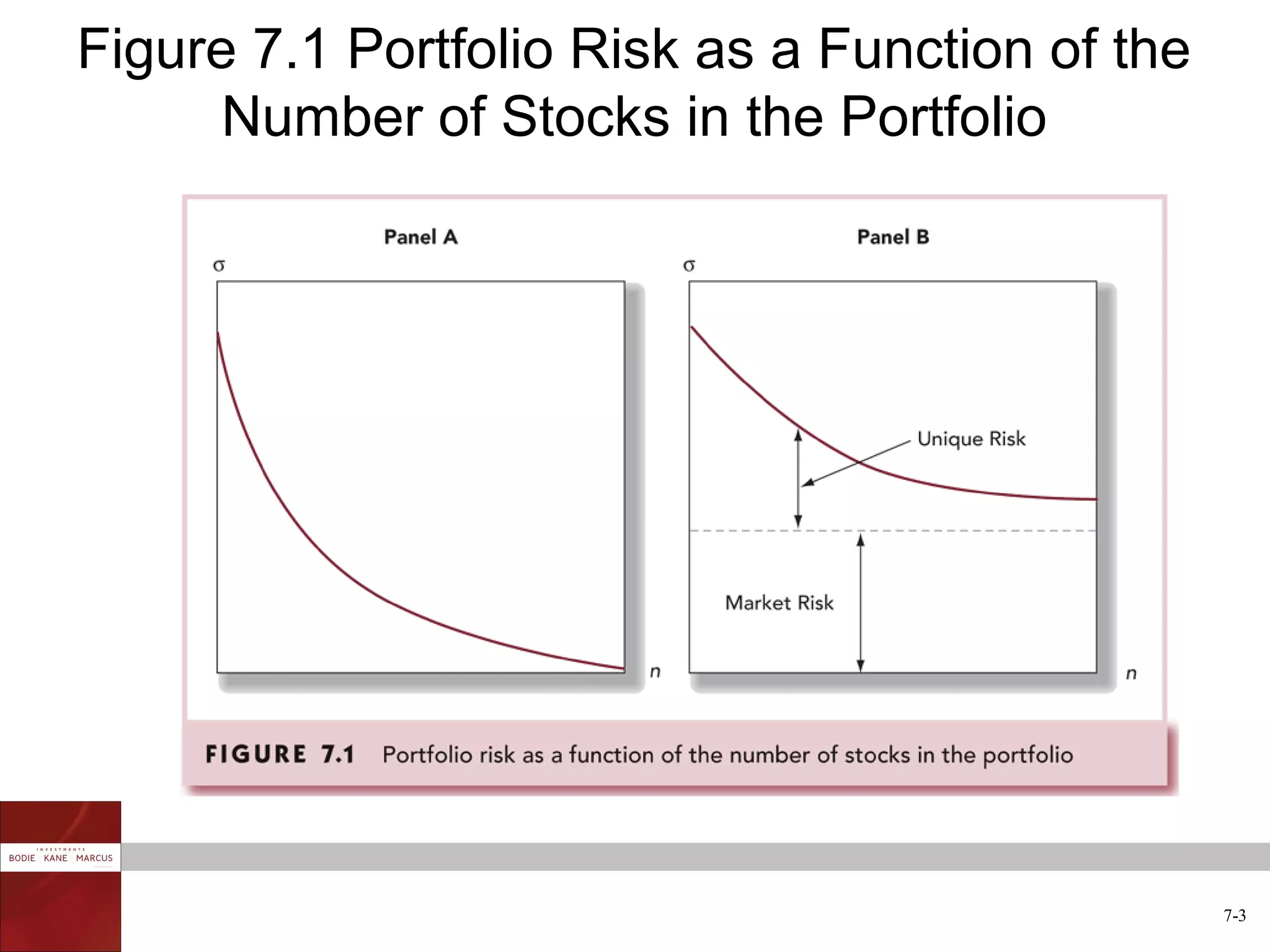

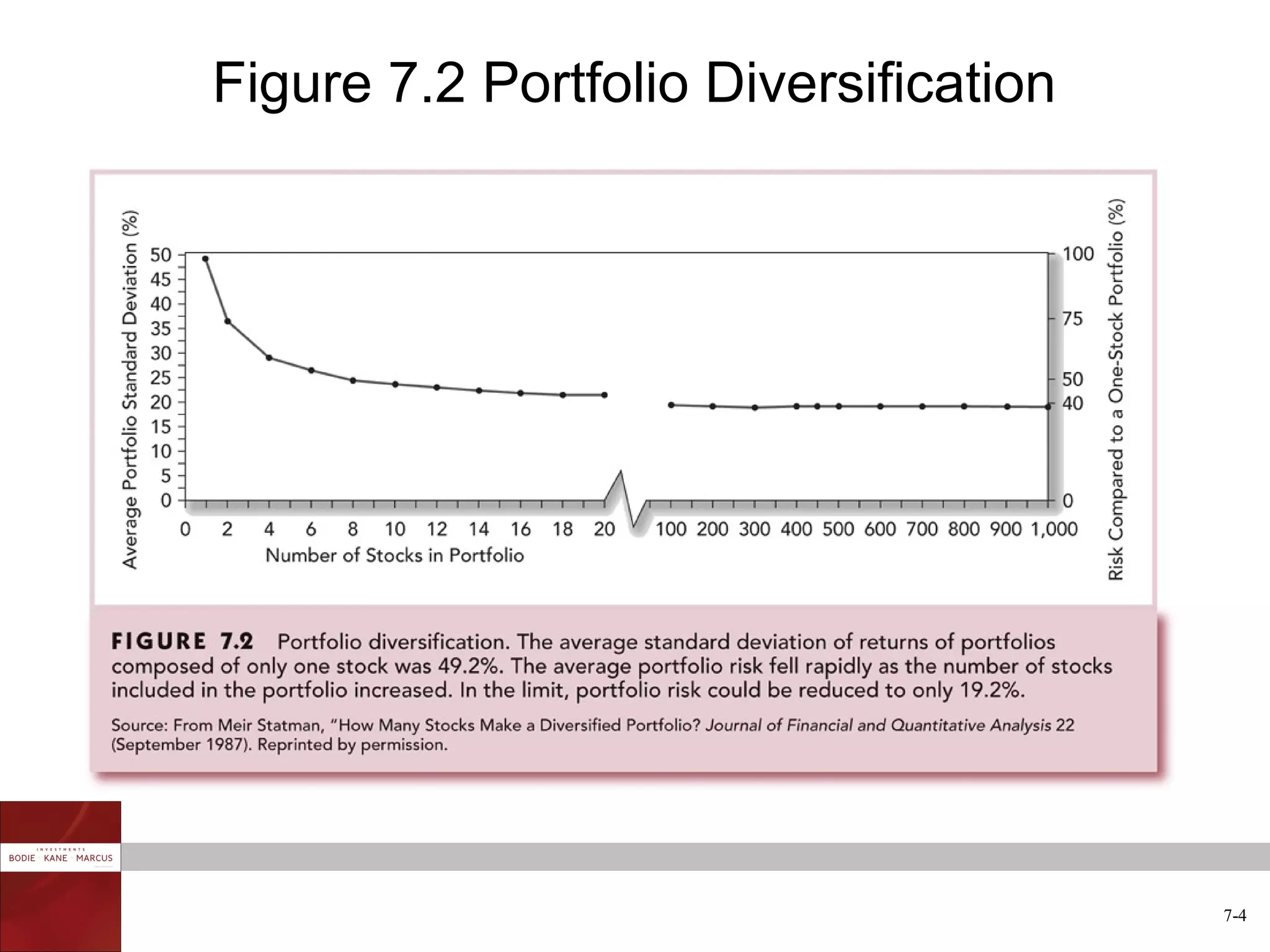

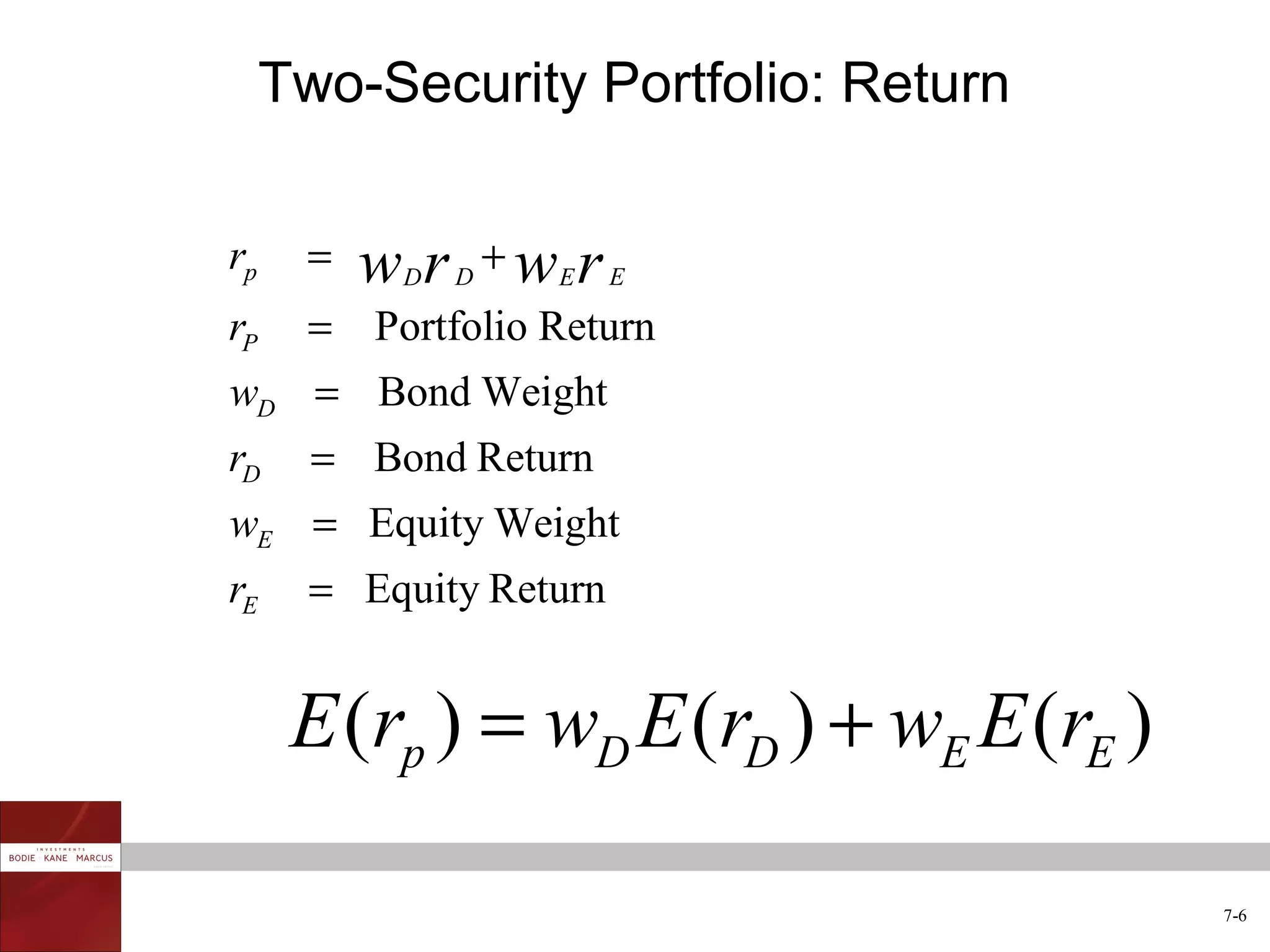

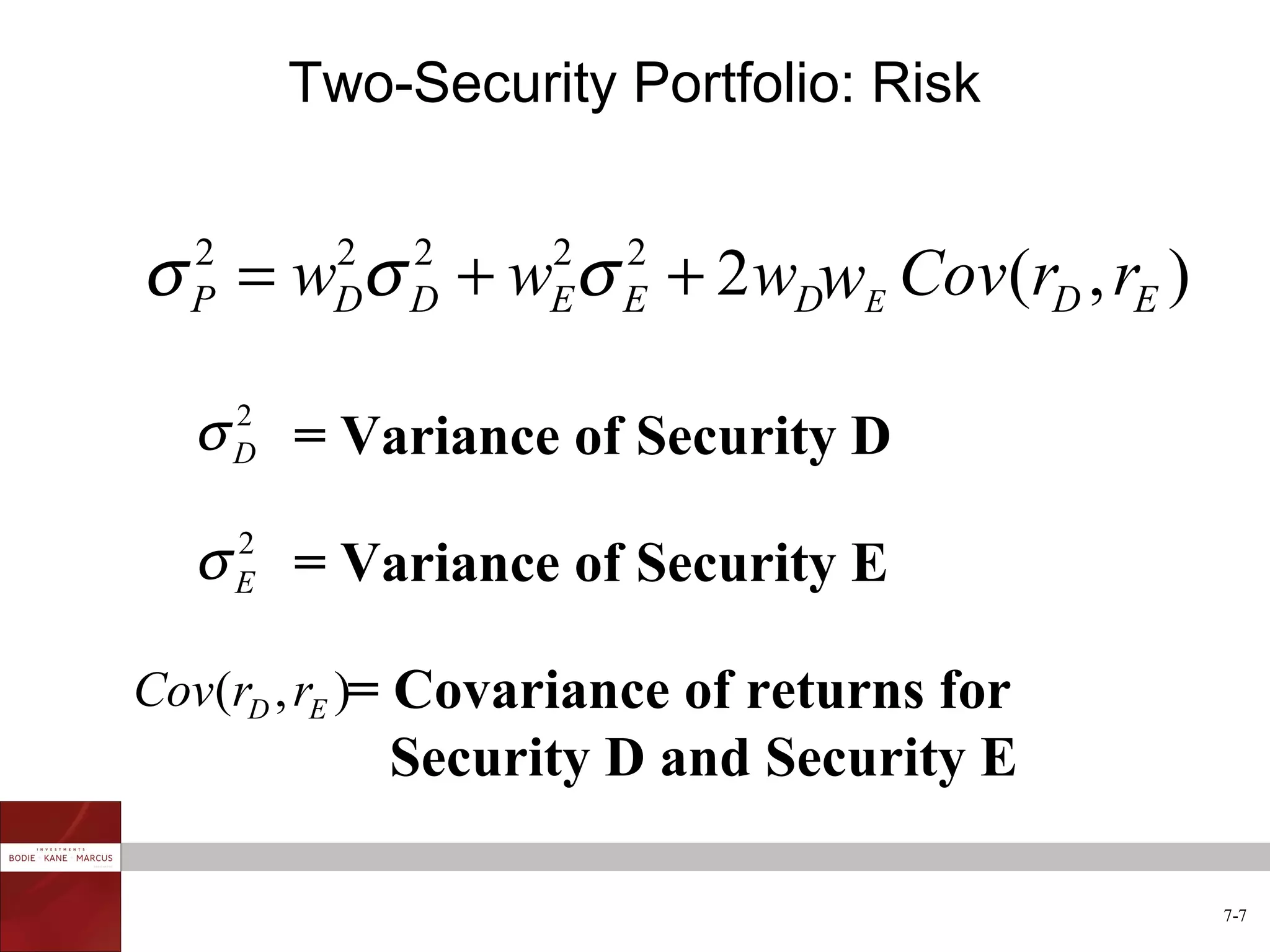

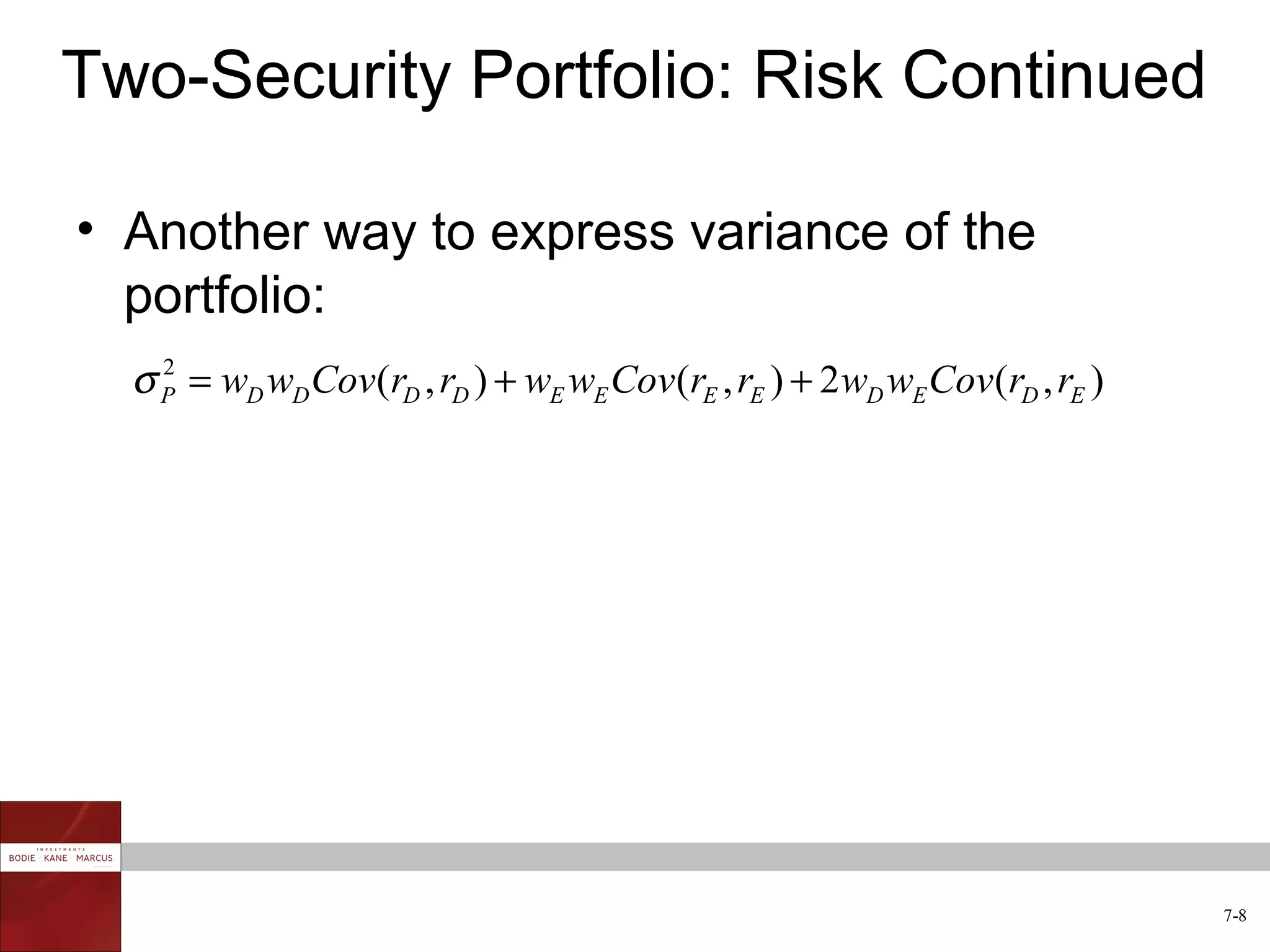

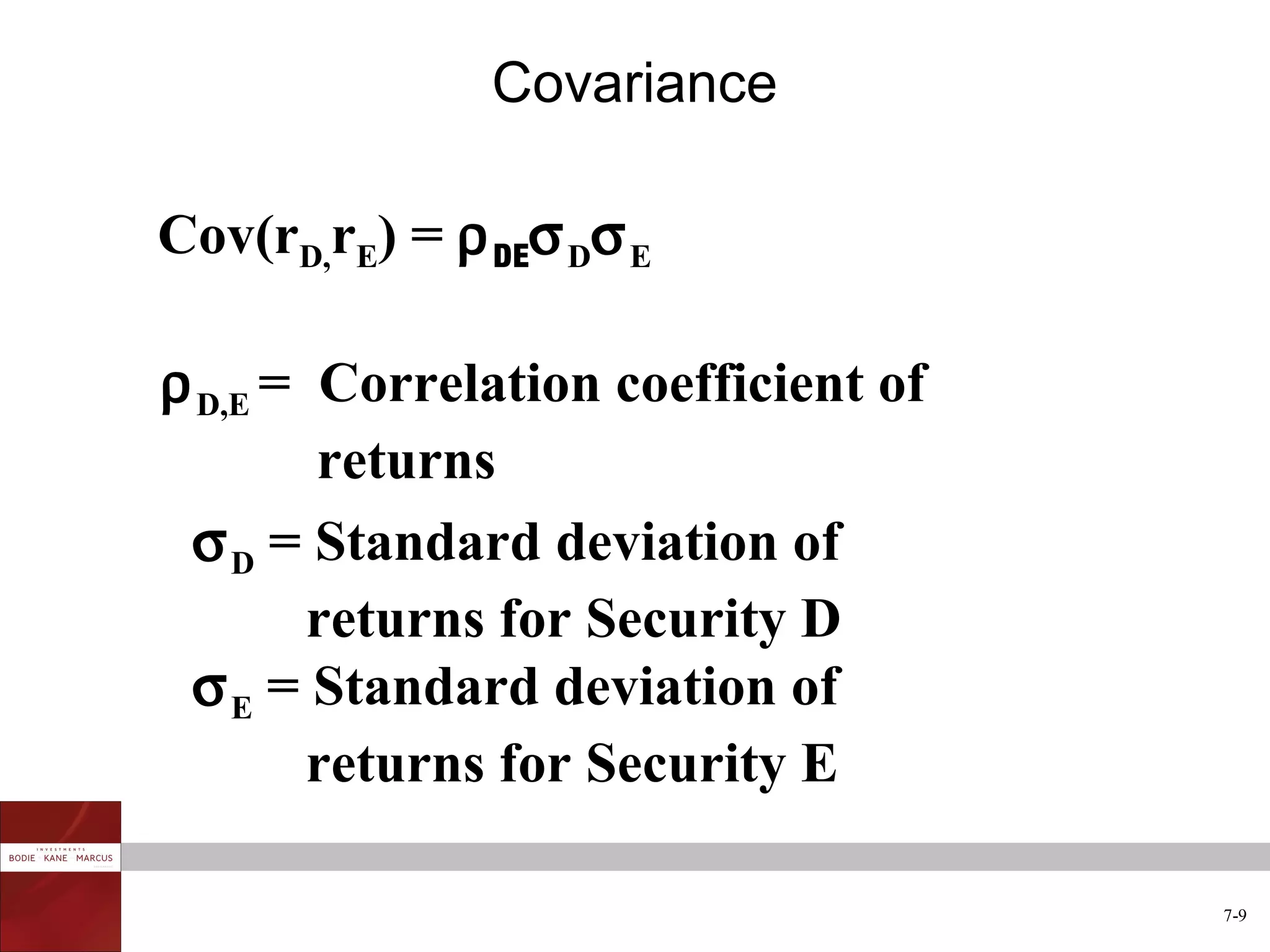

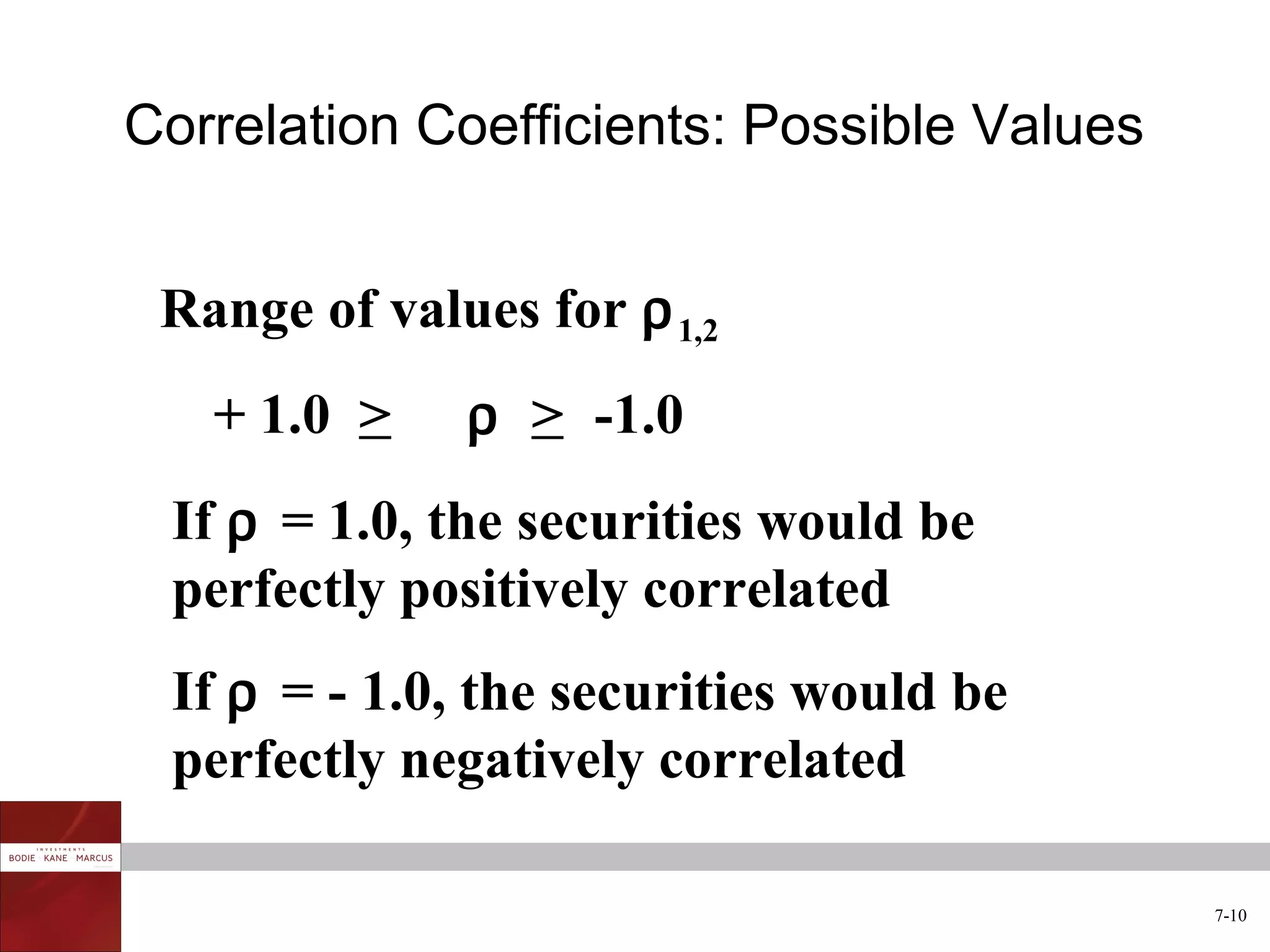

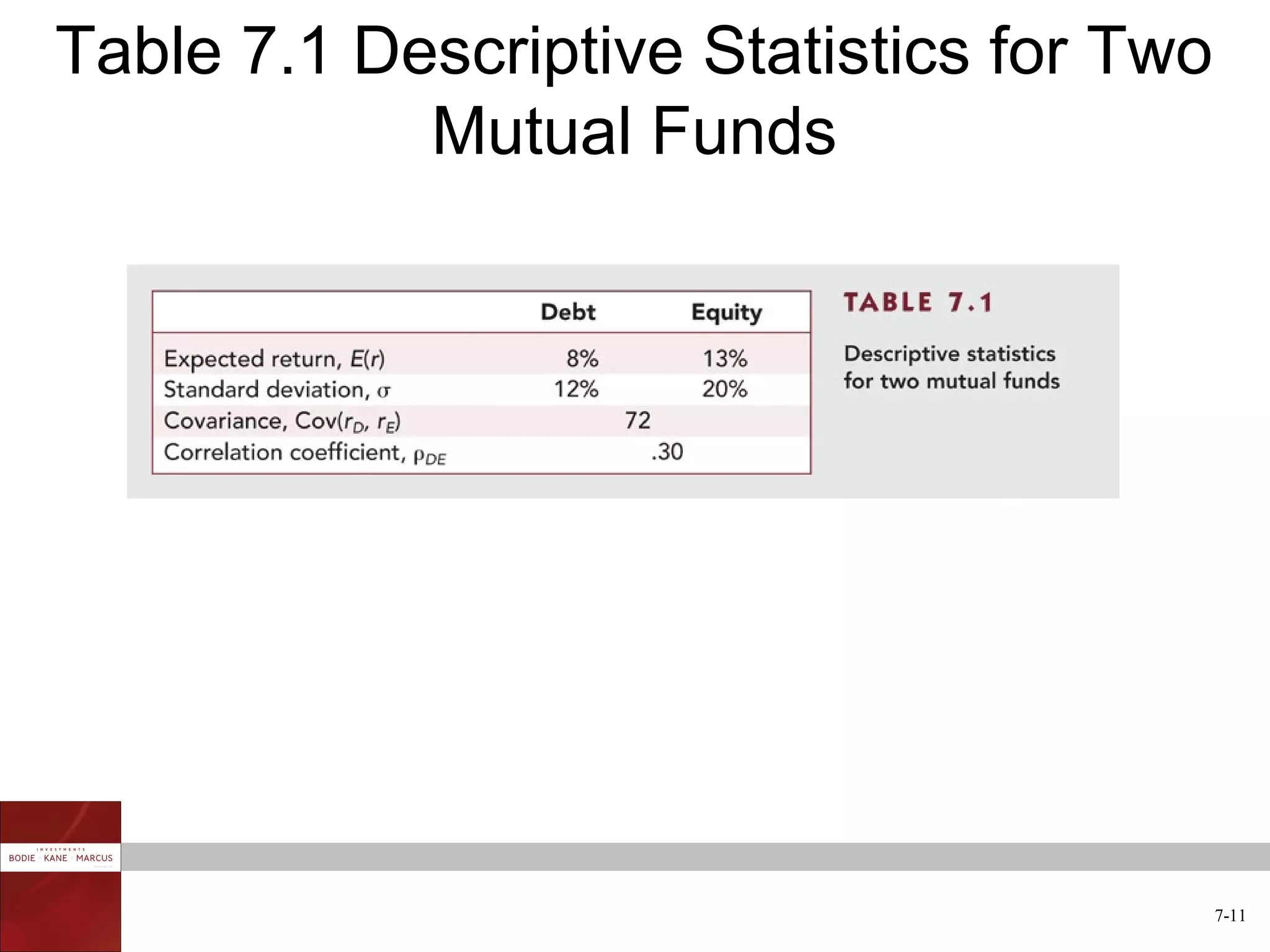

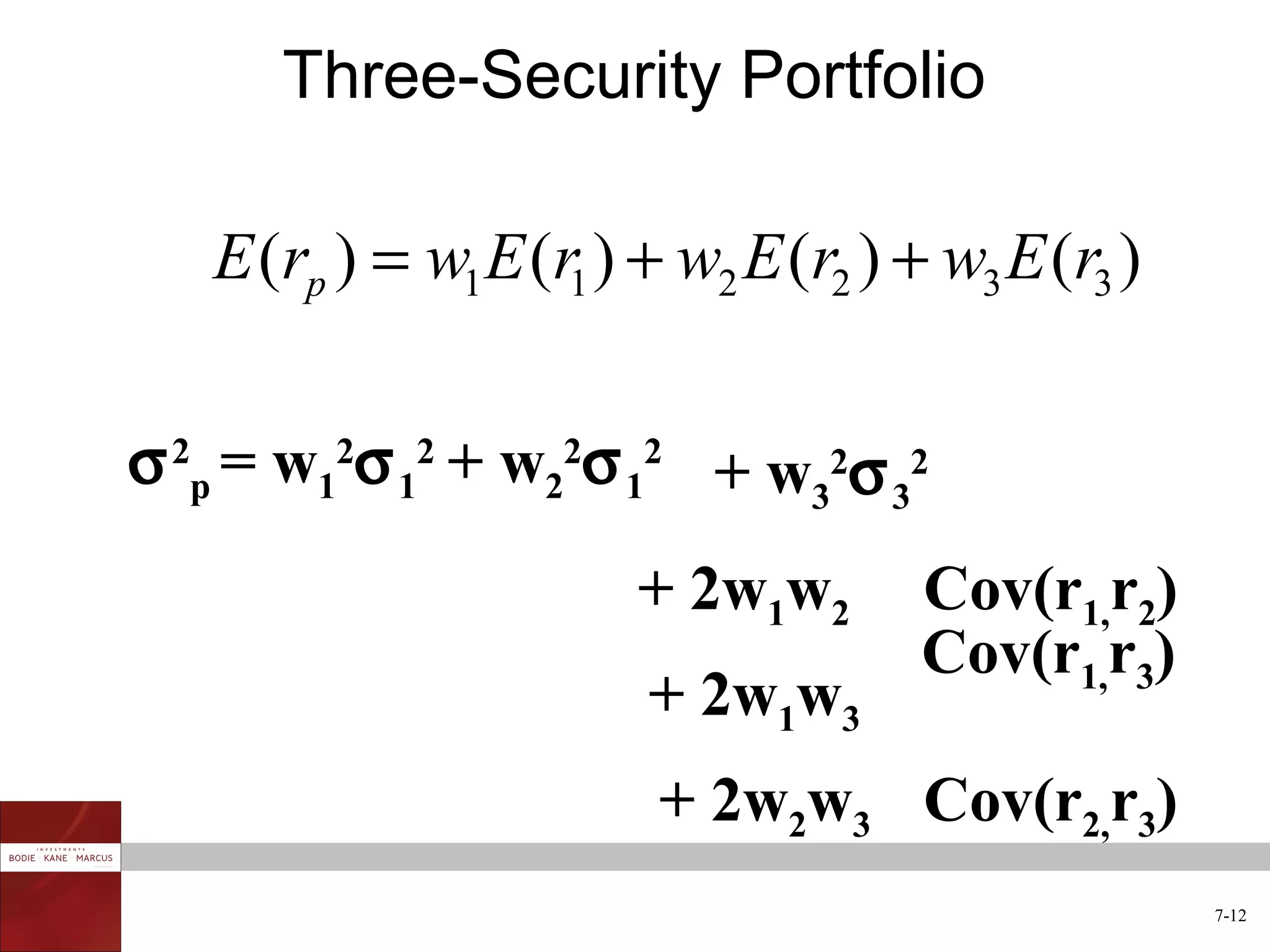

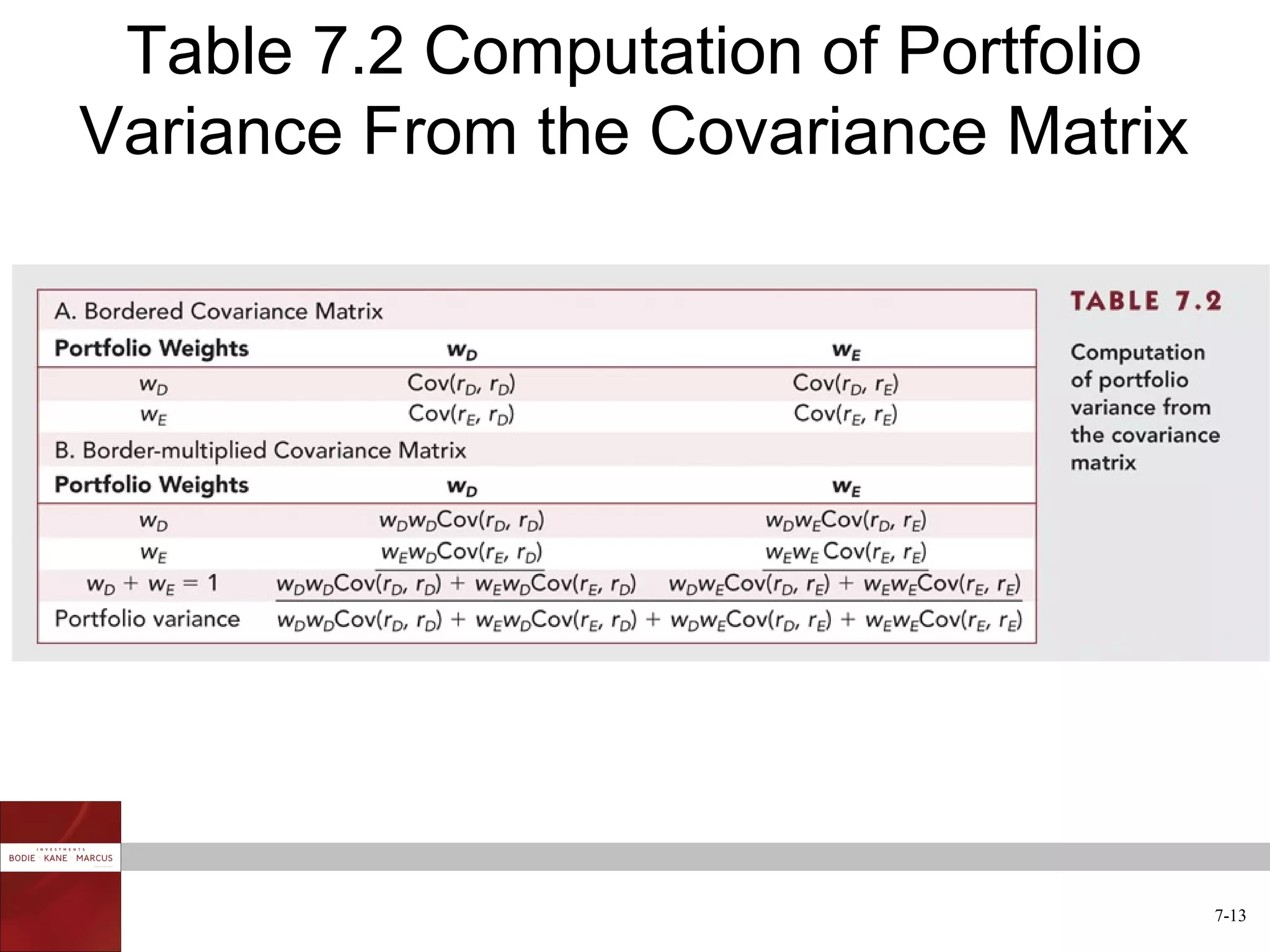

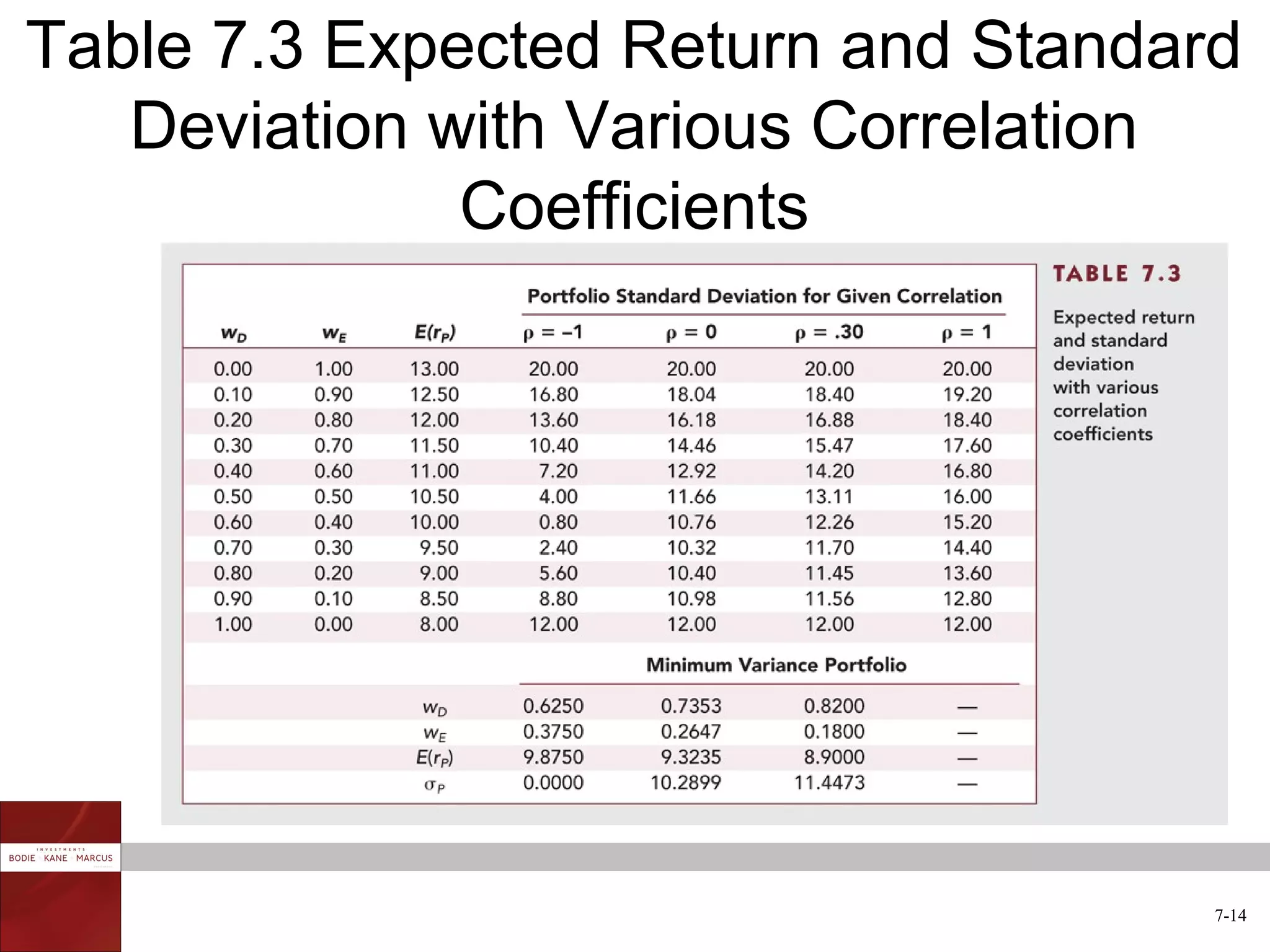

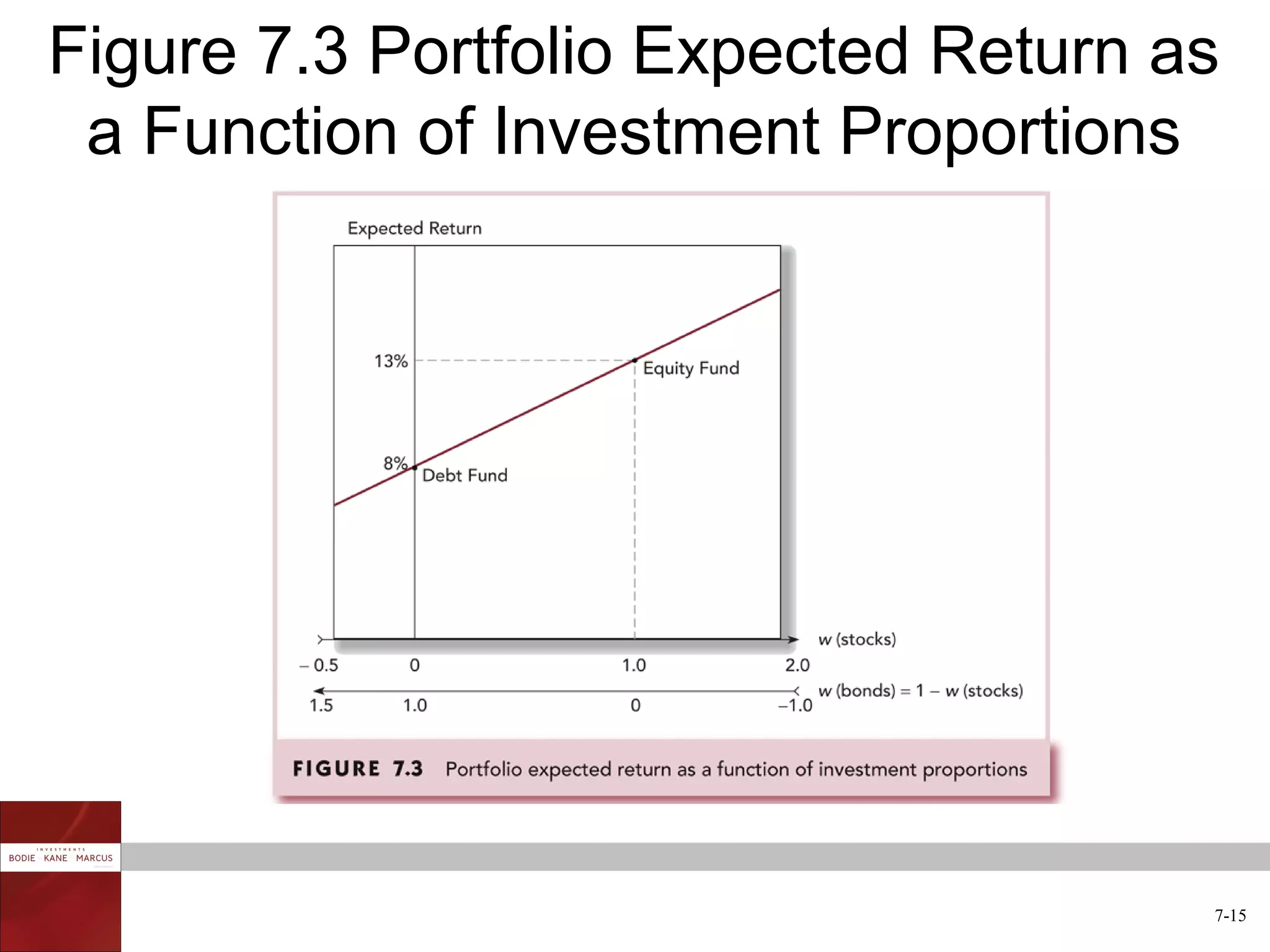

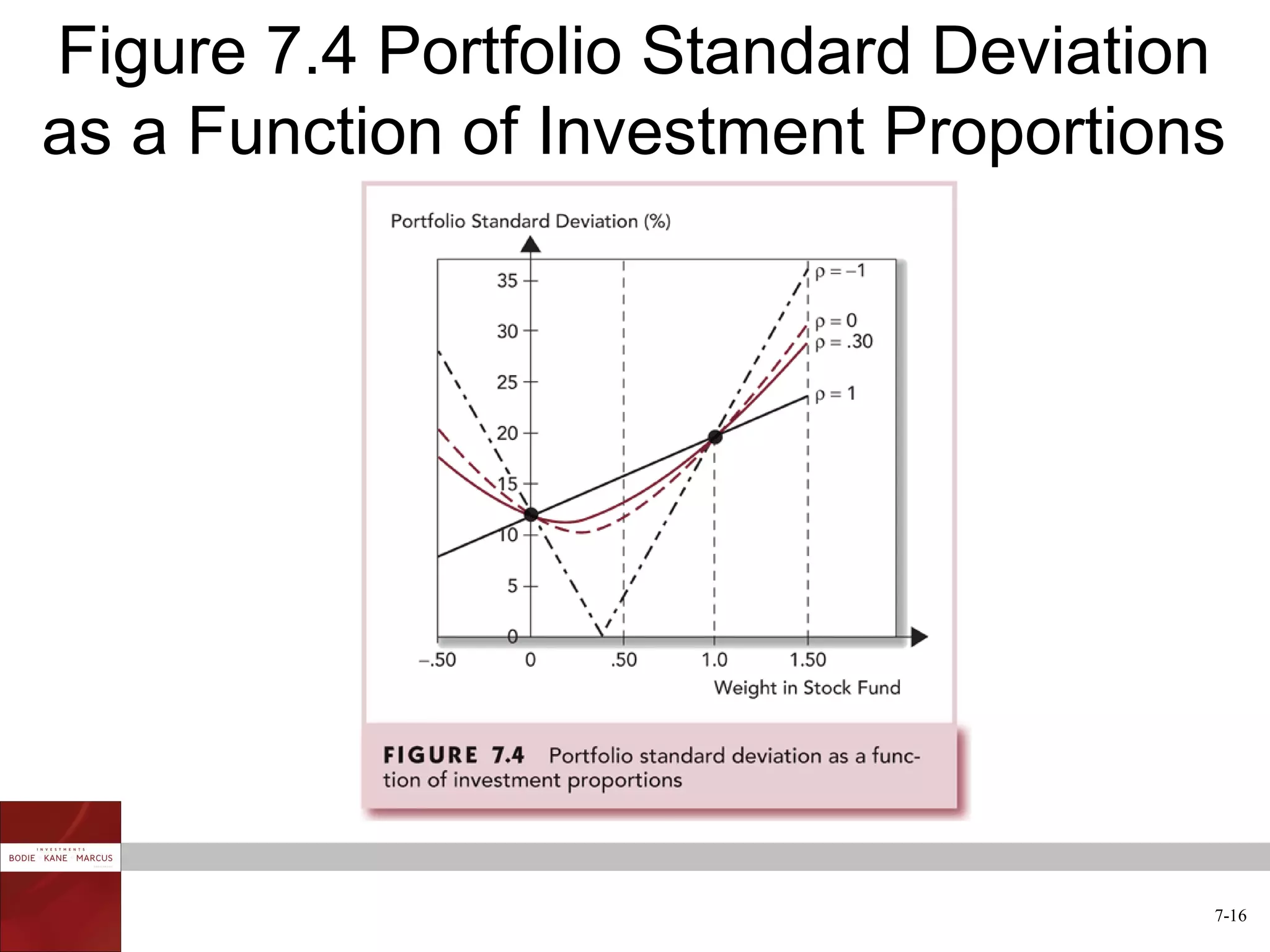

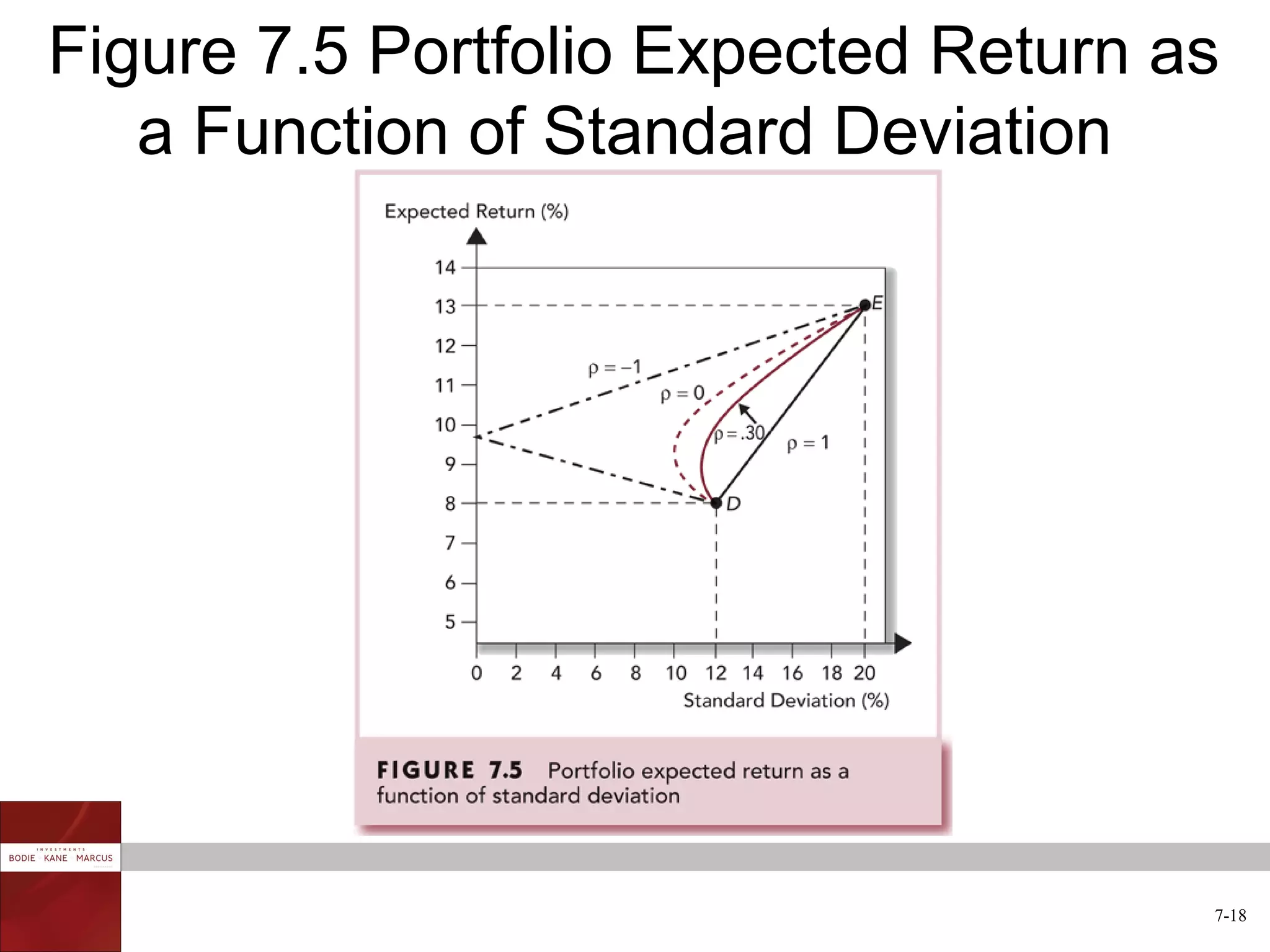

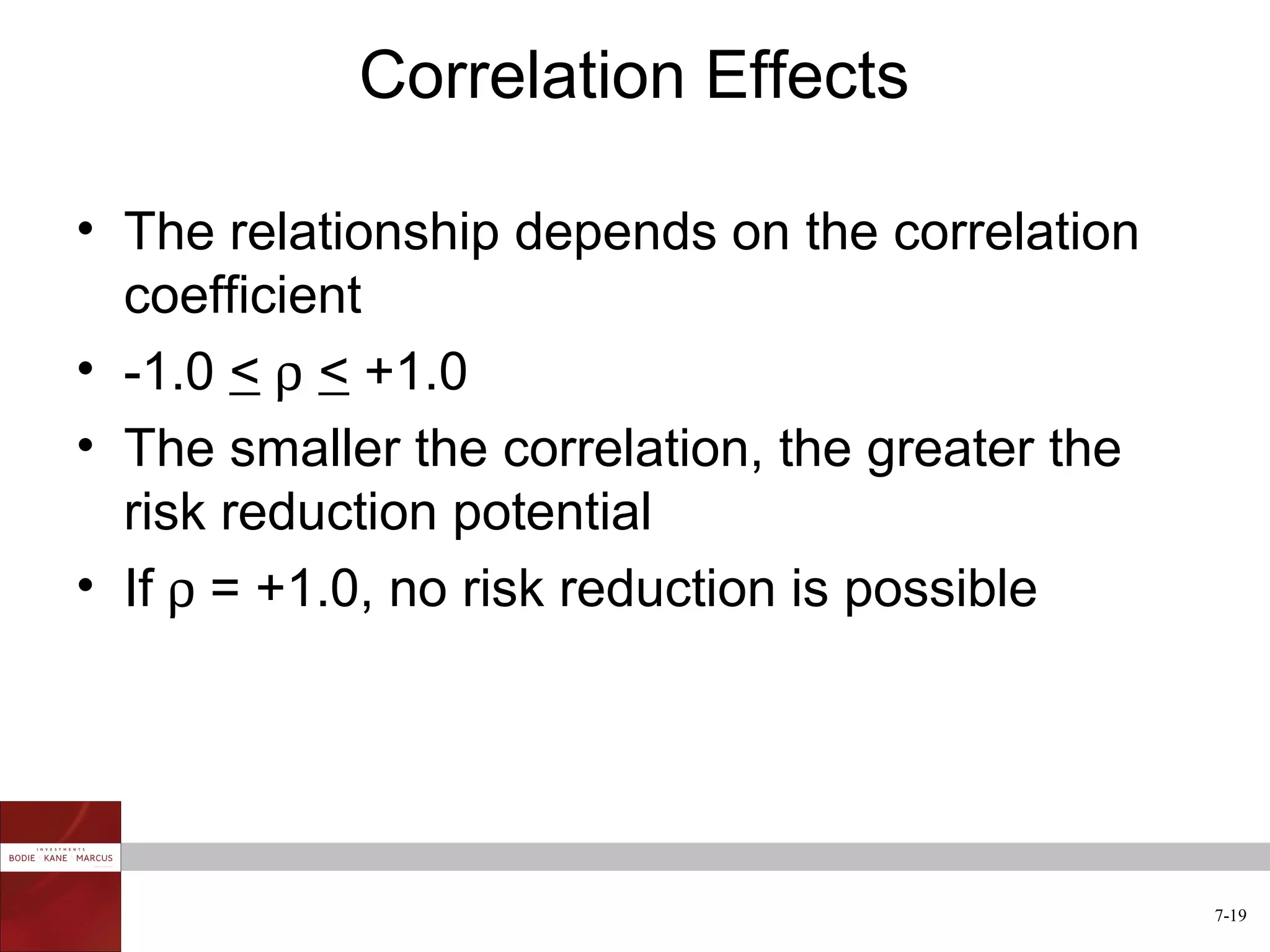

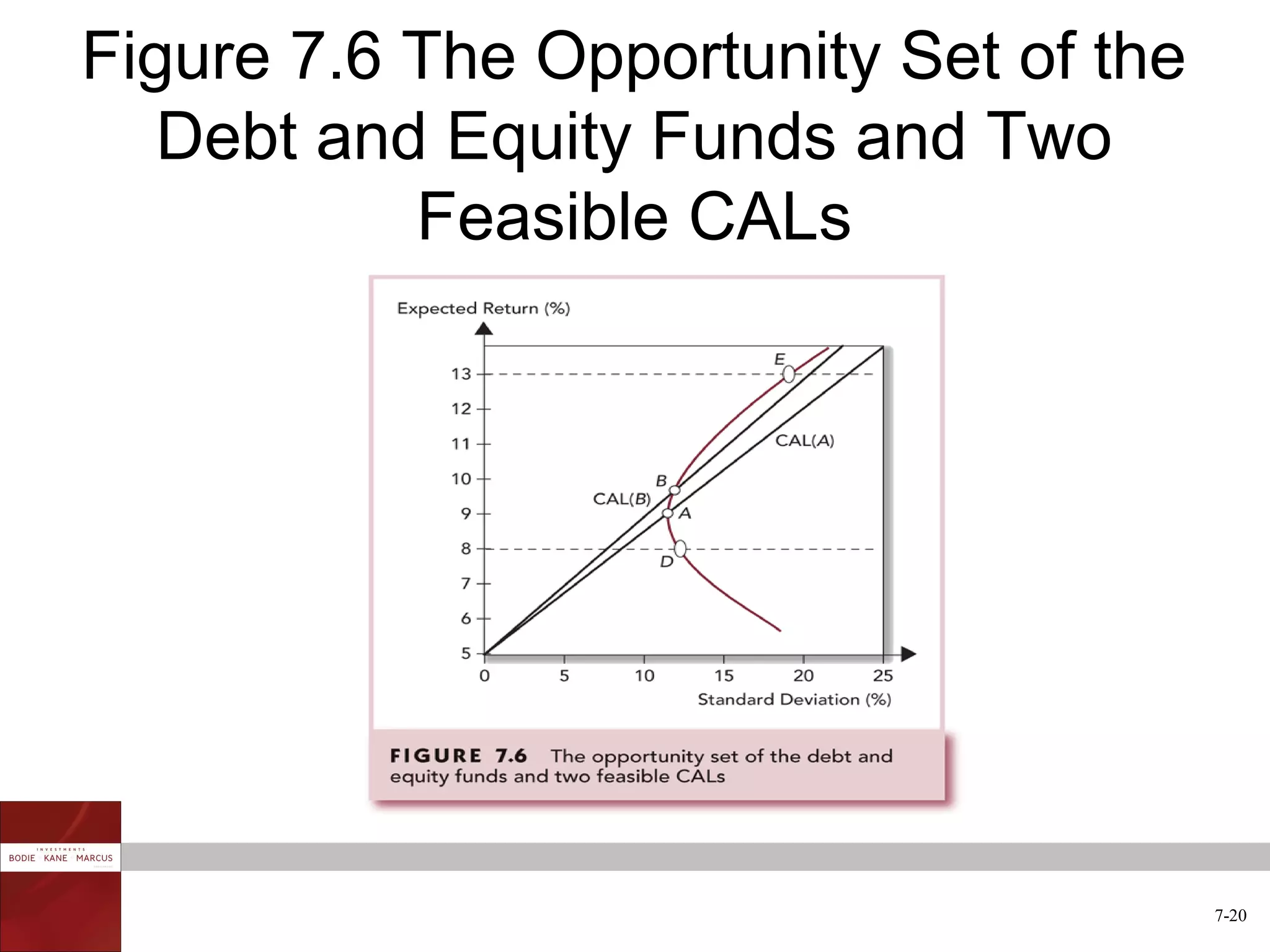

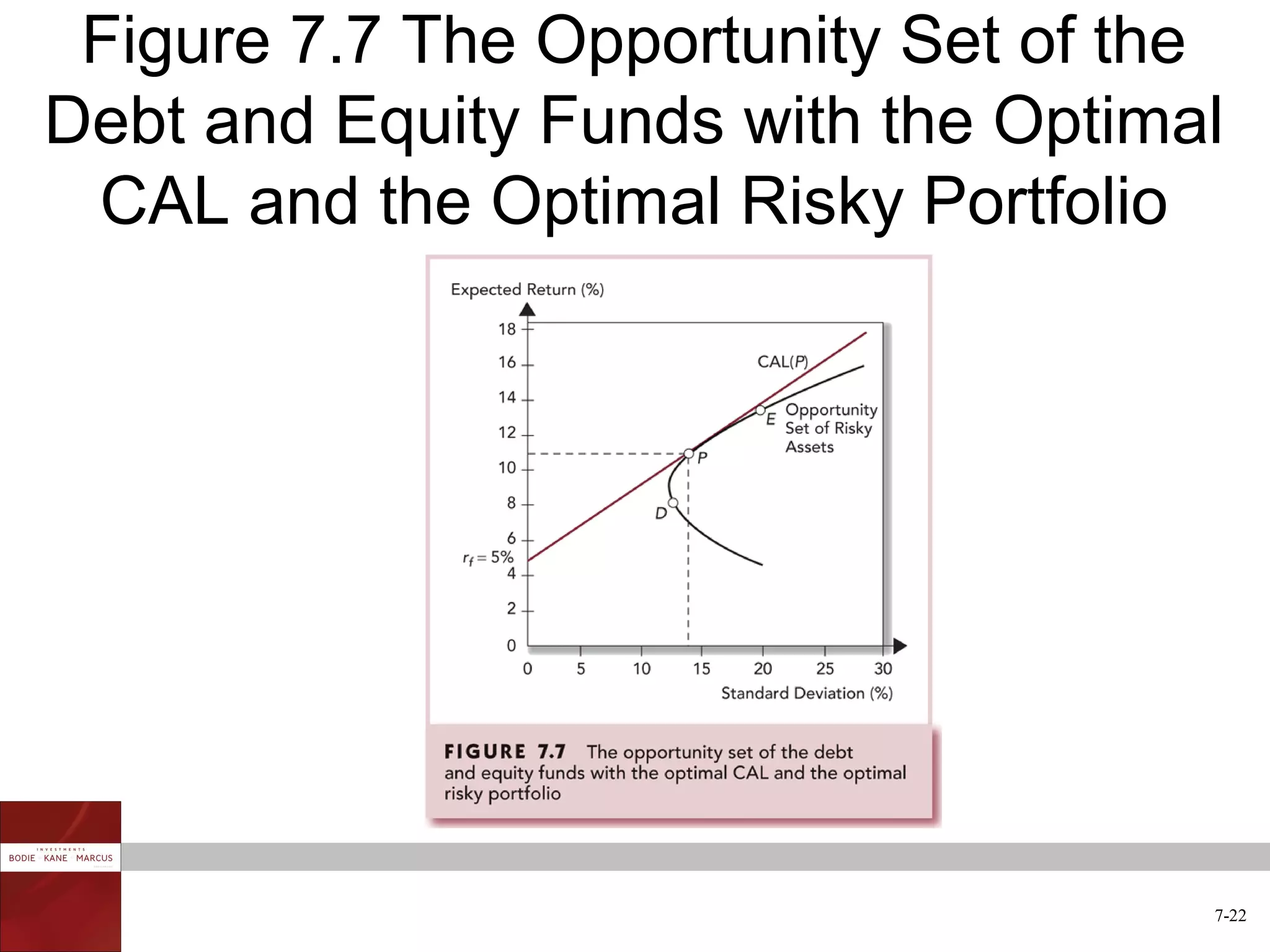

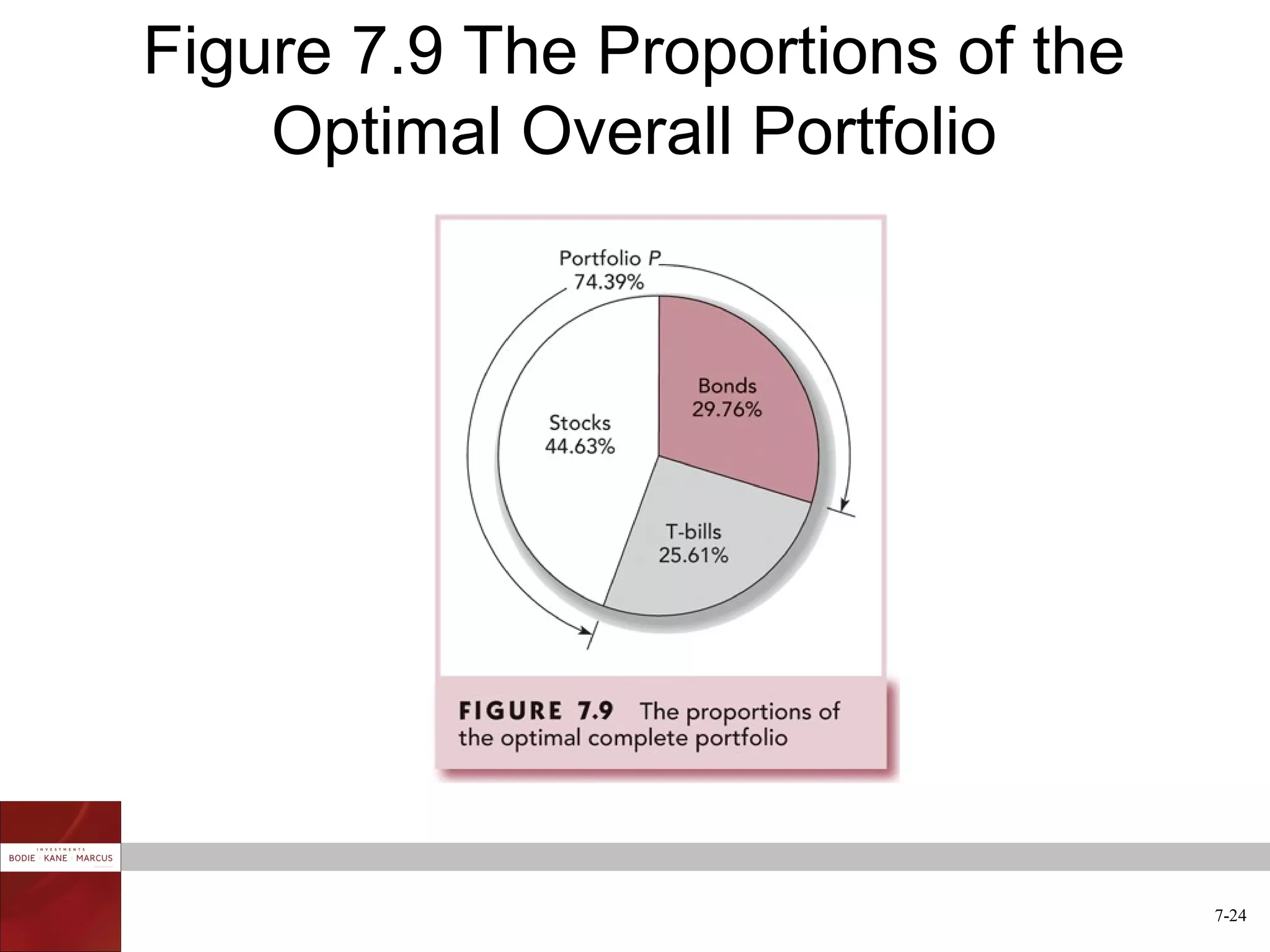

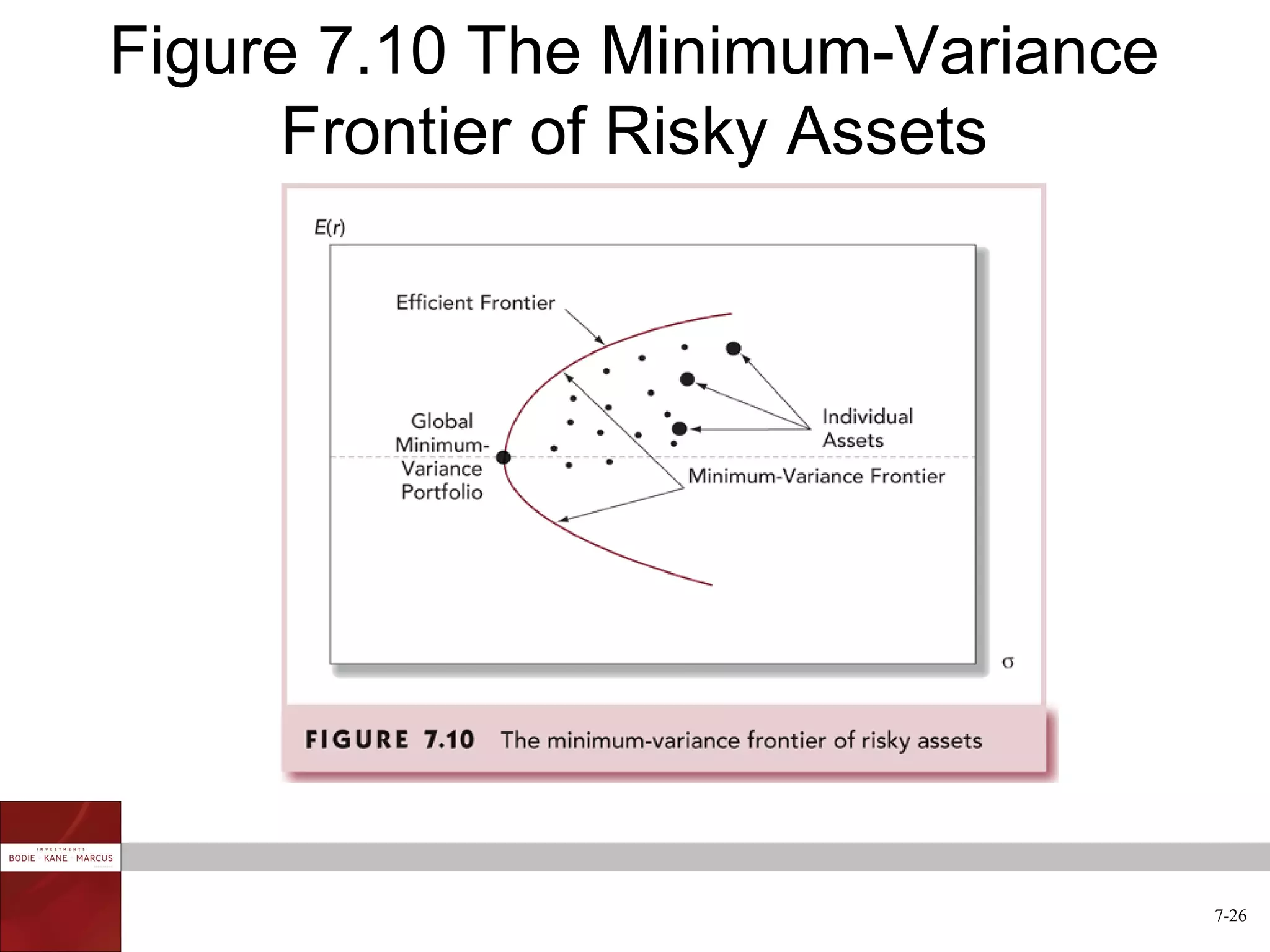

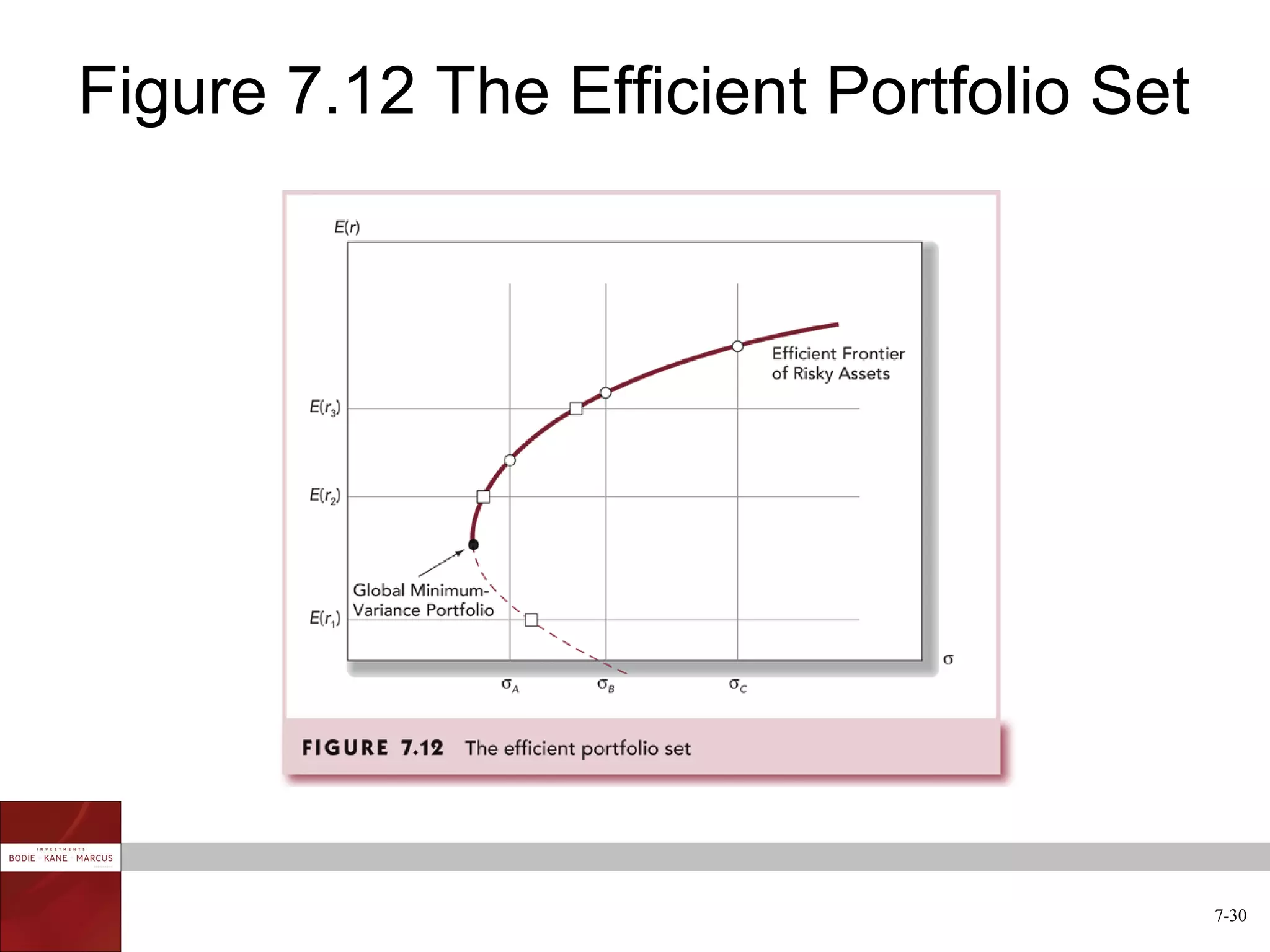

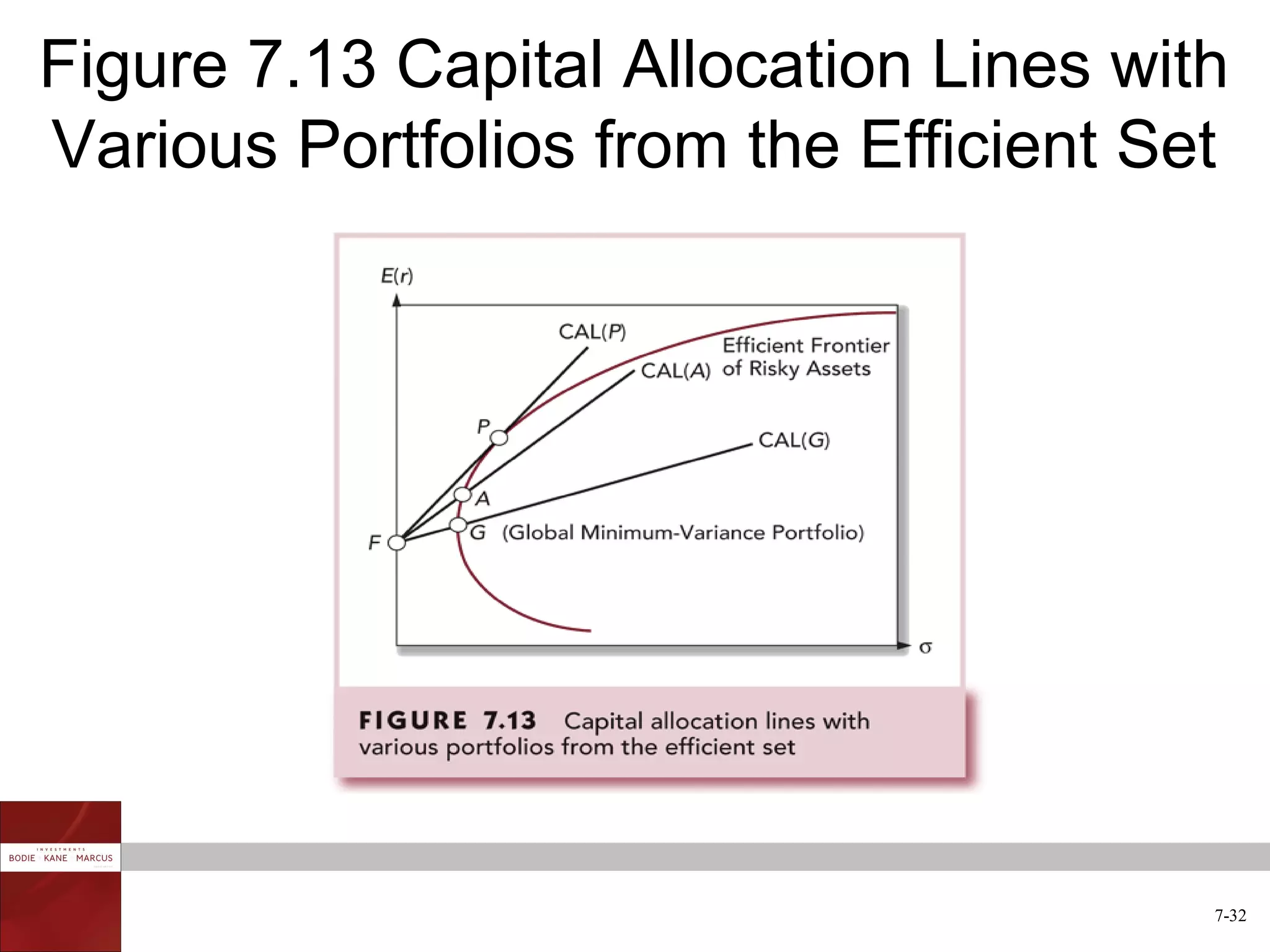

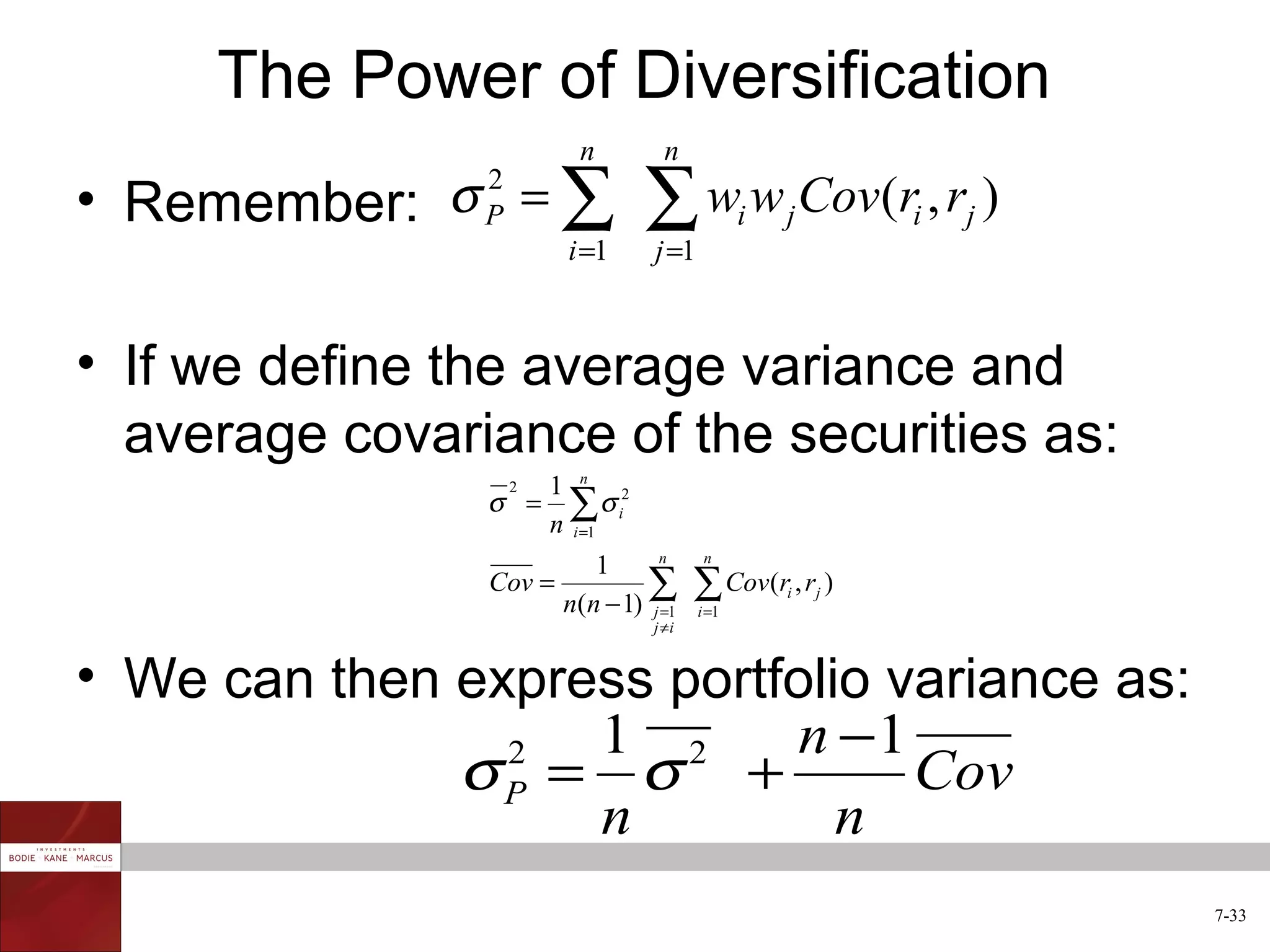

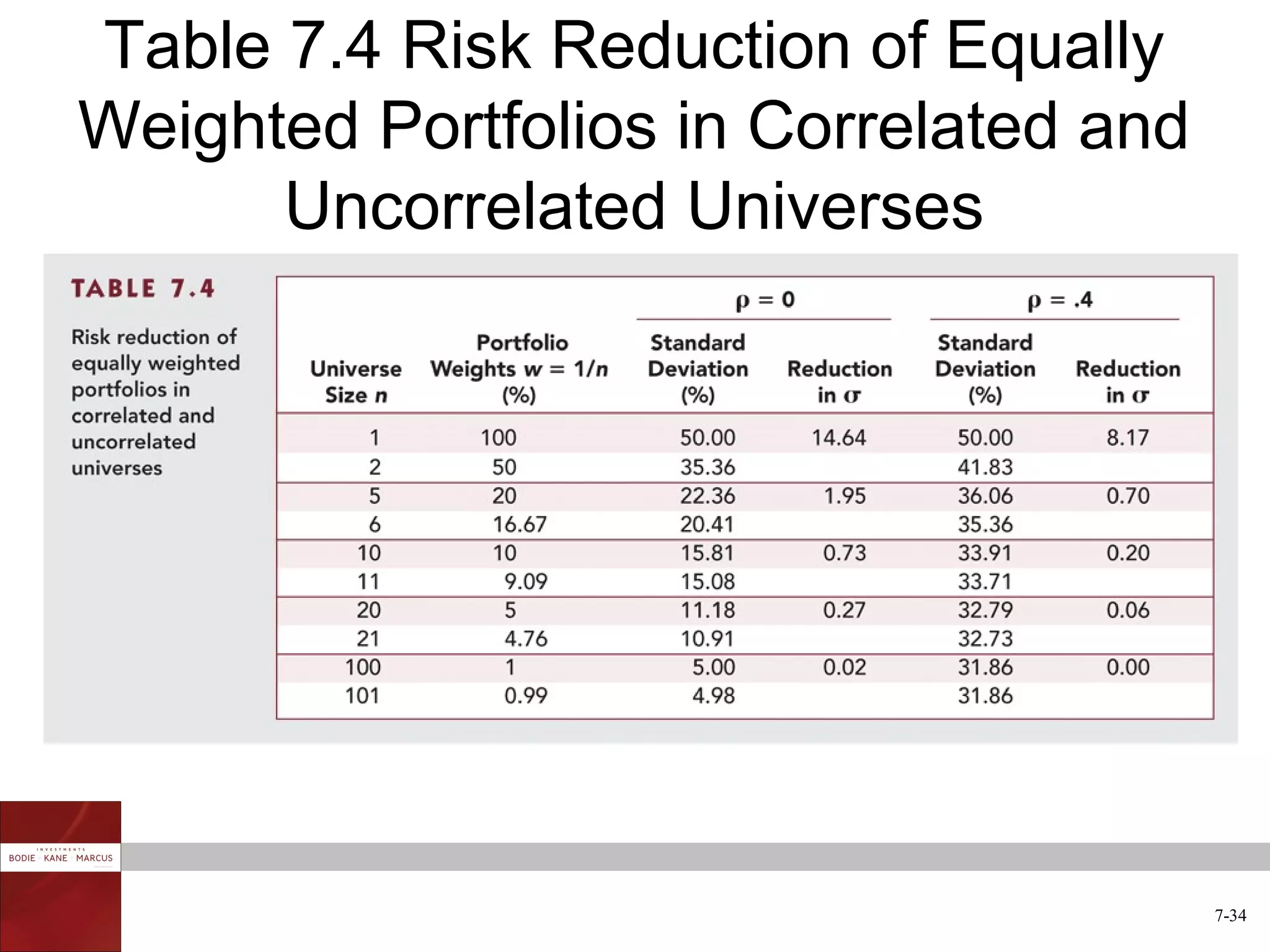

The document discusses optimal risky portfolios and diversification. It covers how portfolio risk depends on the correlation between asset returns, how to calculate portfolio variance and risk for two and three asset portfolios, the benefits of diversification in reducing risk, and how to construct efficient portfolios using the Markowitz model. The key benefits of diversification are reducing non-systematic risk and obtaining portfolios on the efficient frontier with higher risk-adjusted returns.