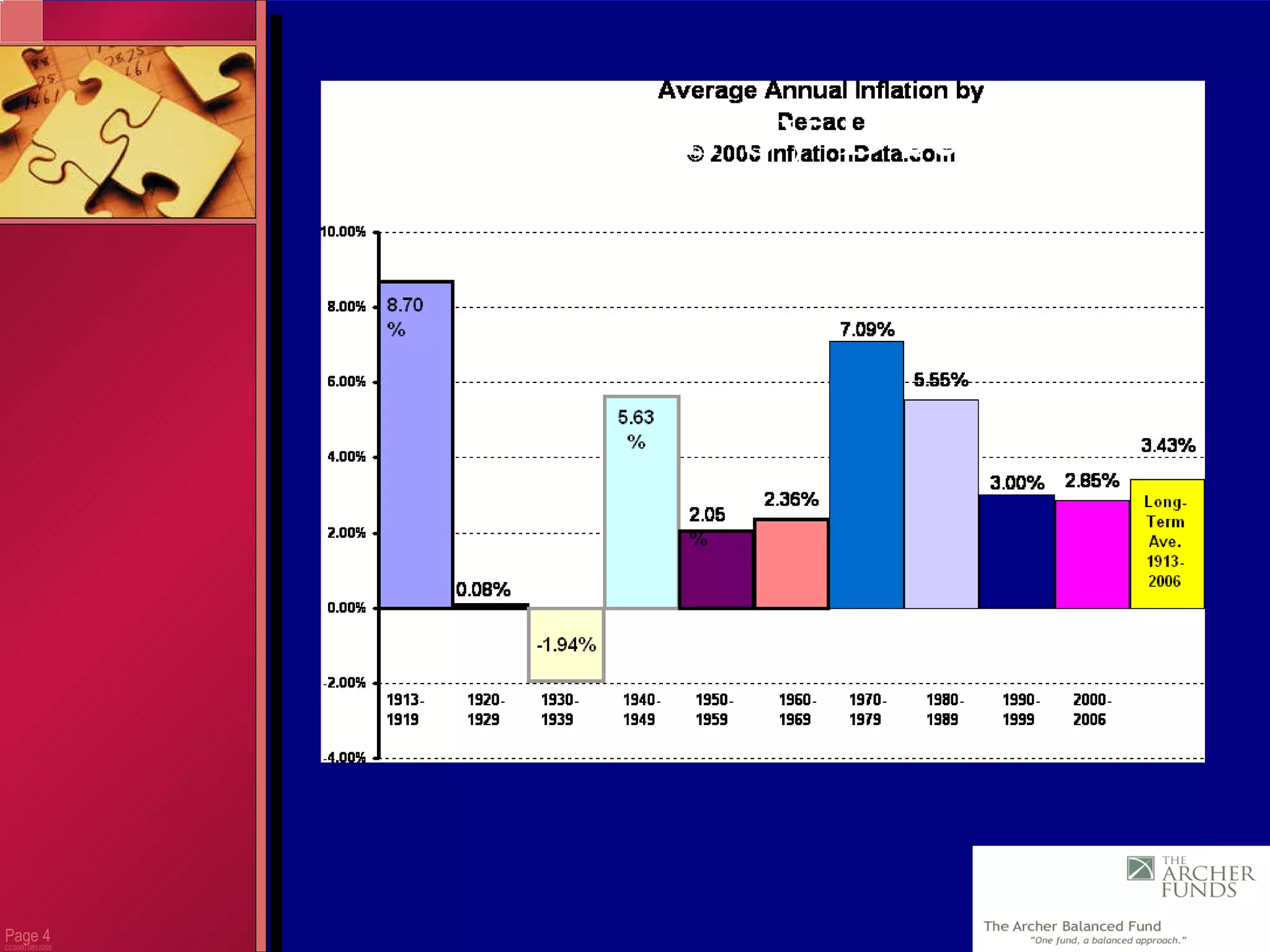

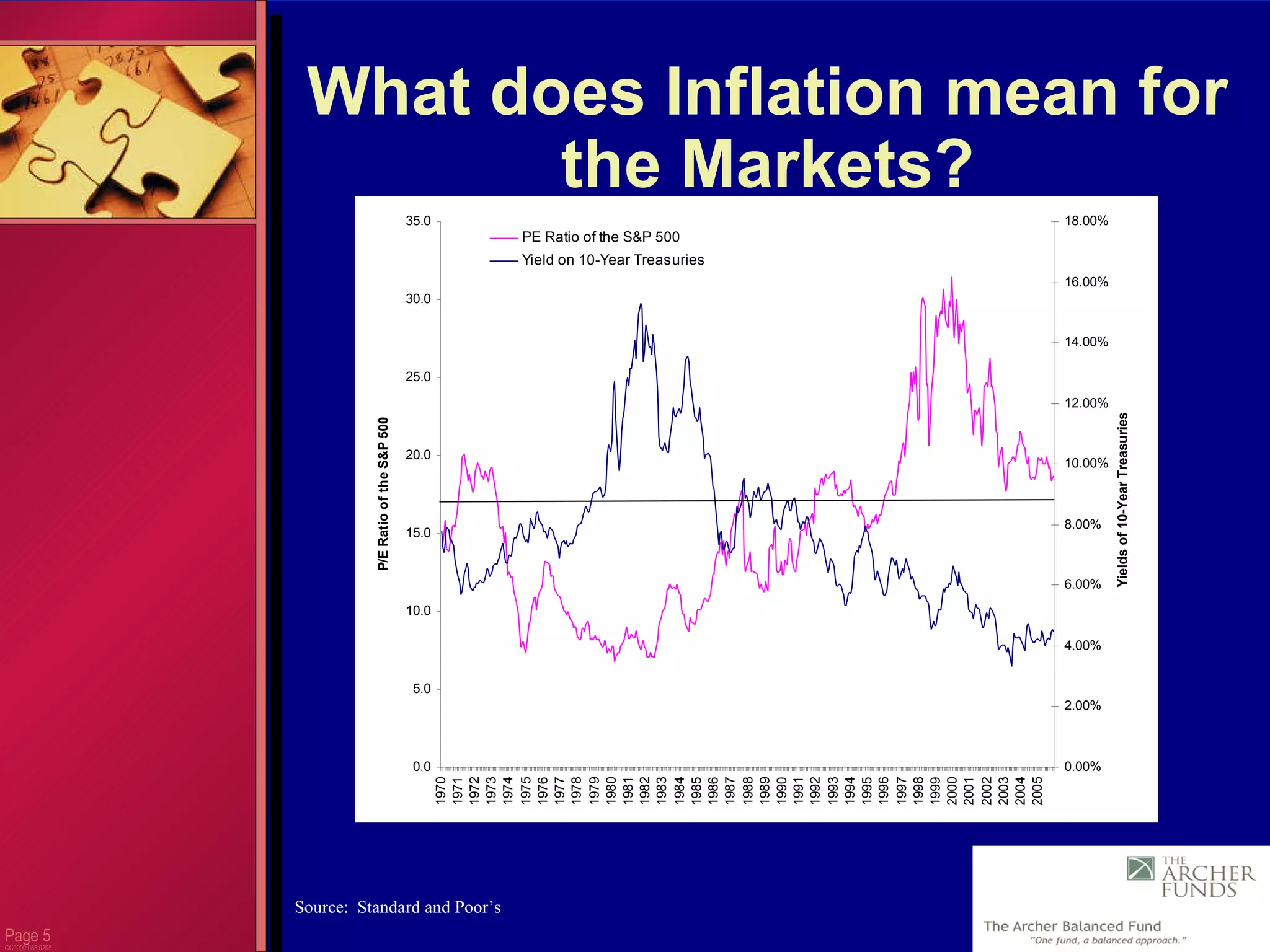

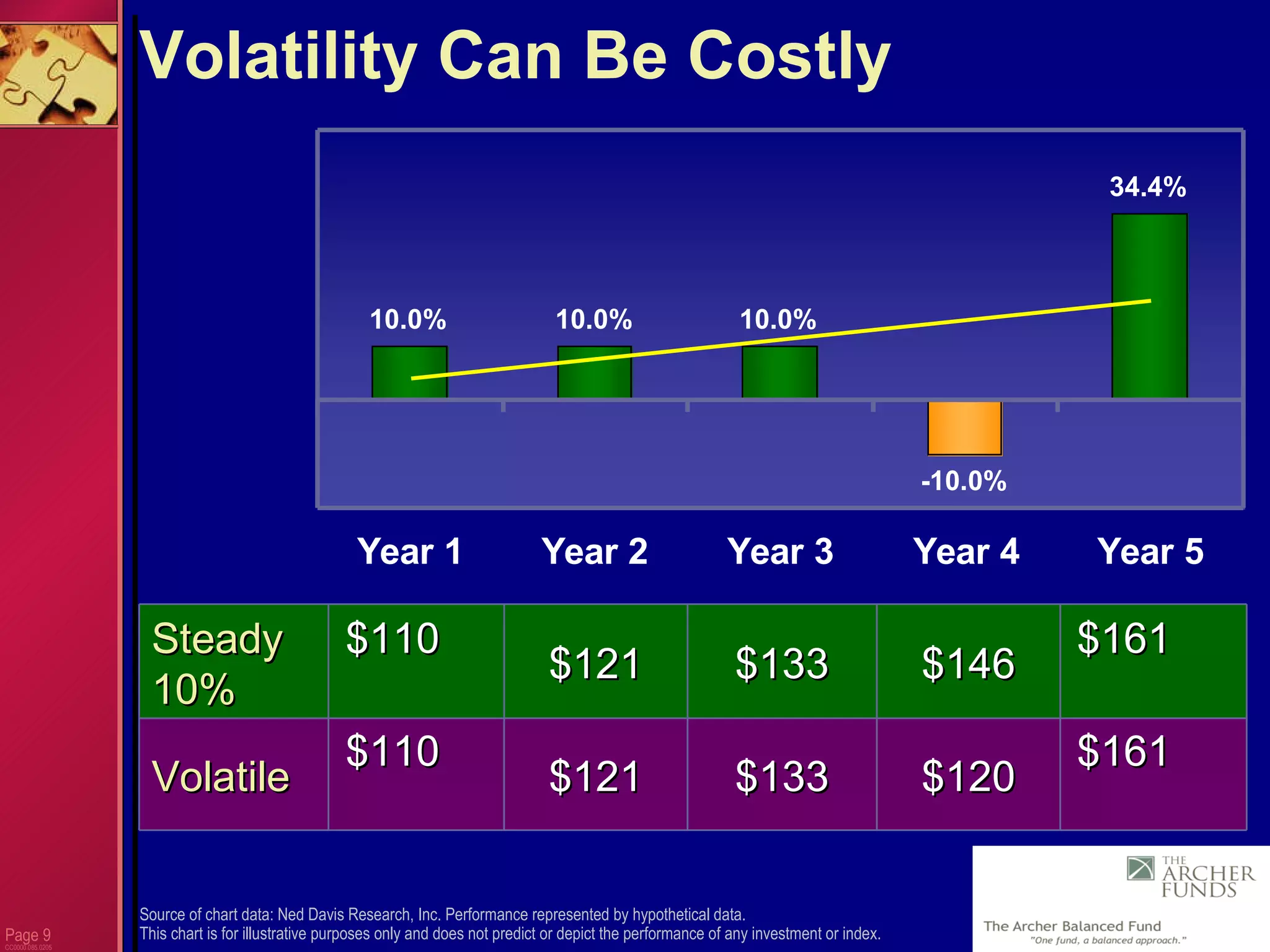

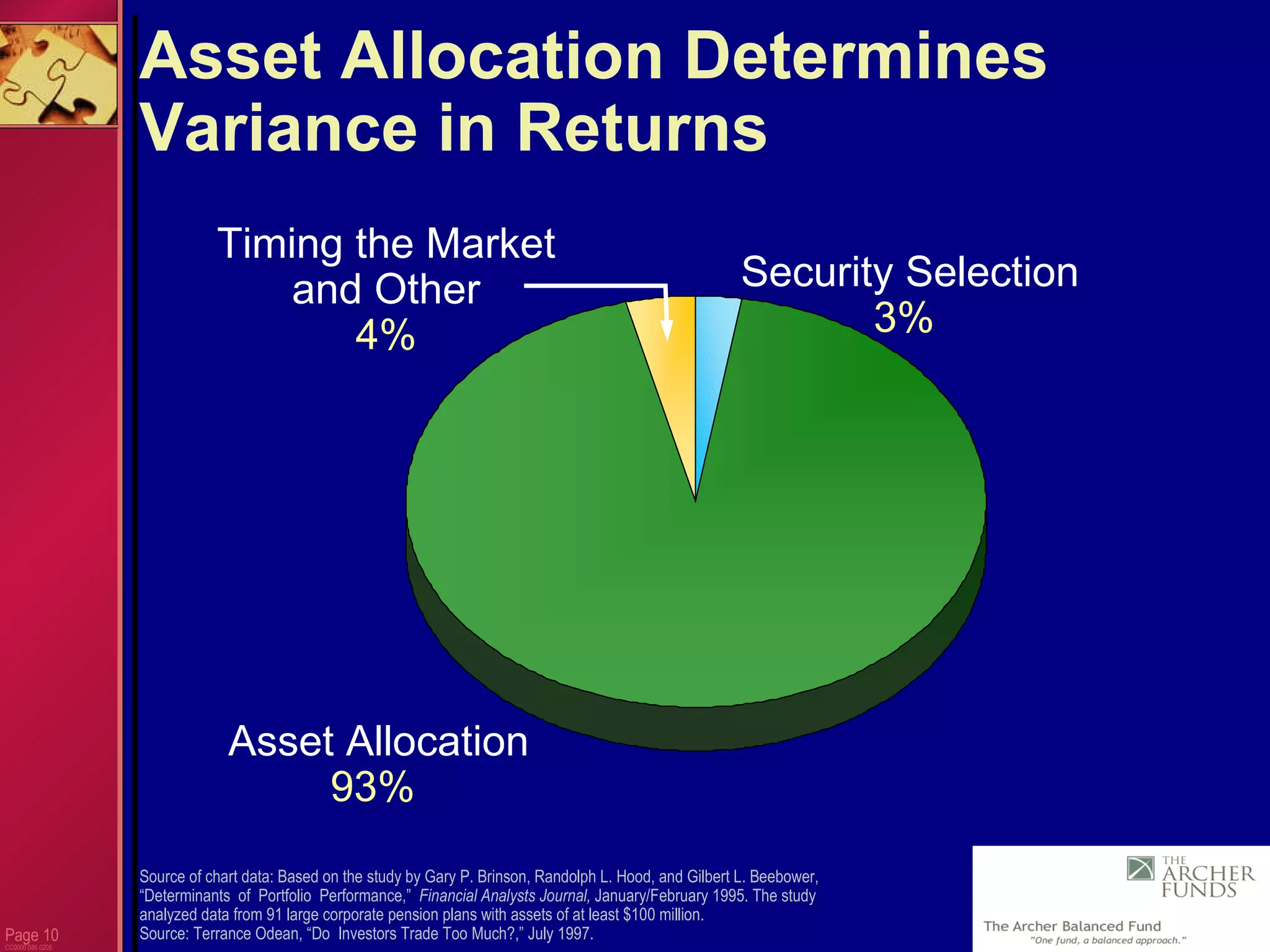

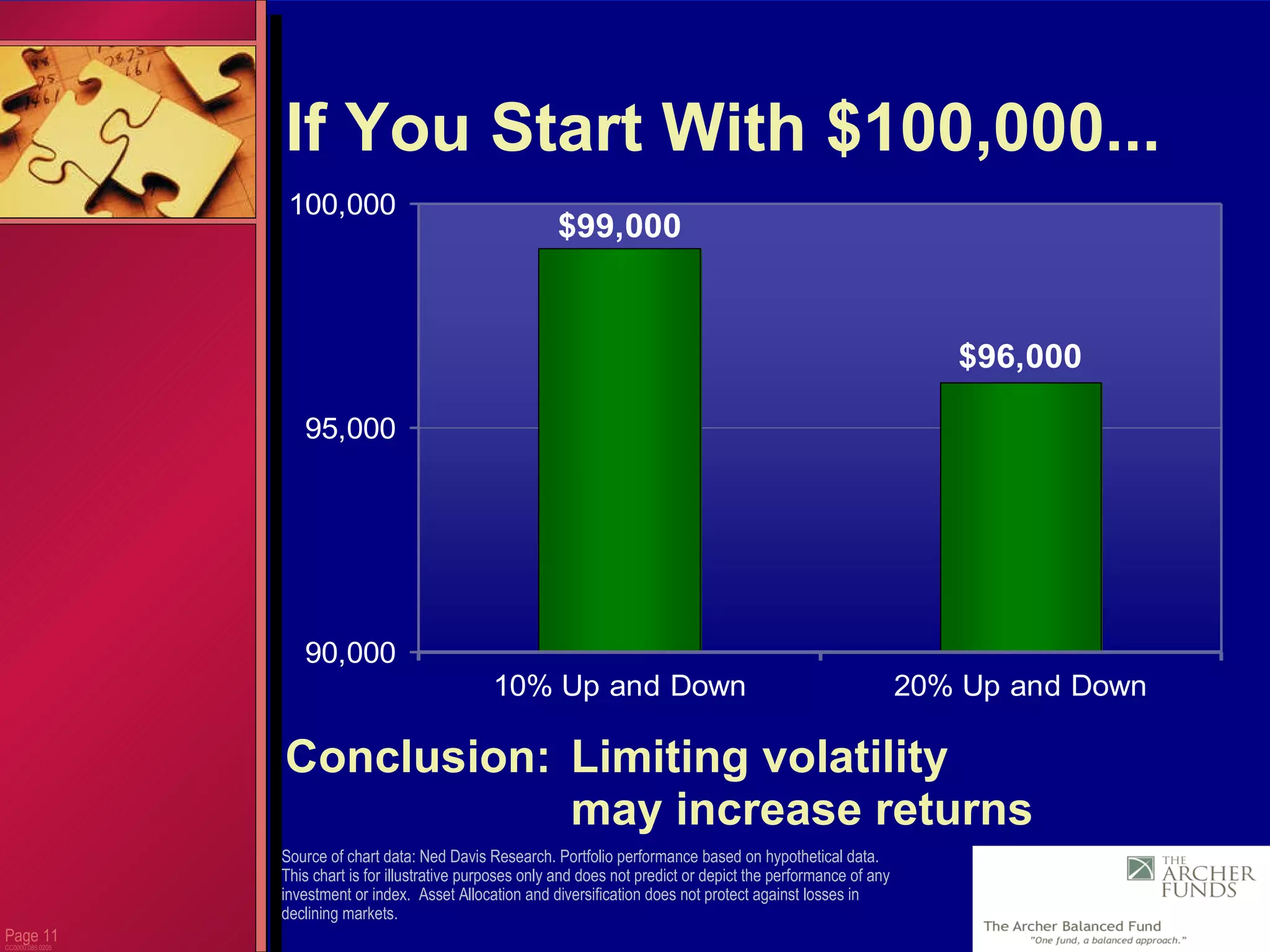

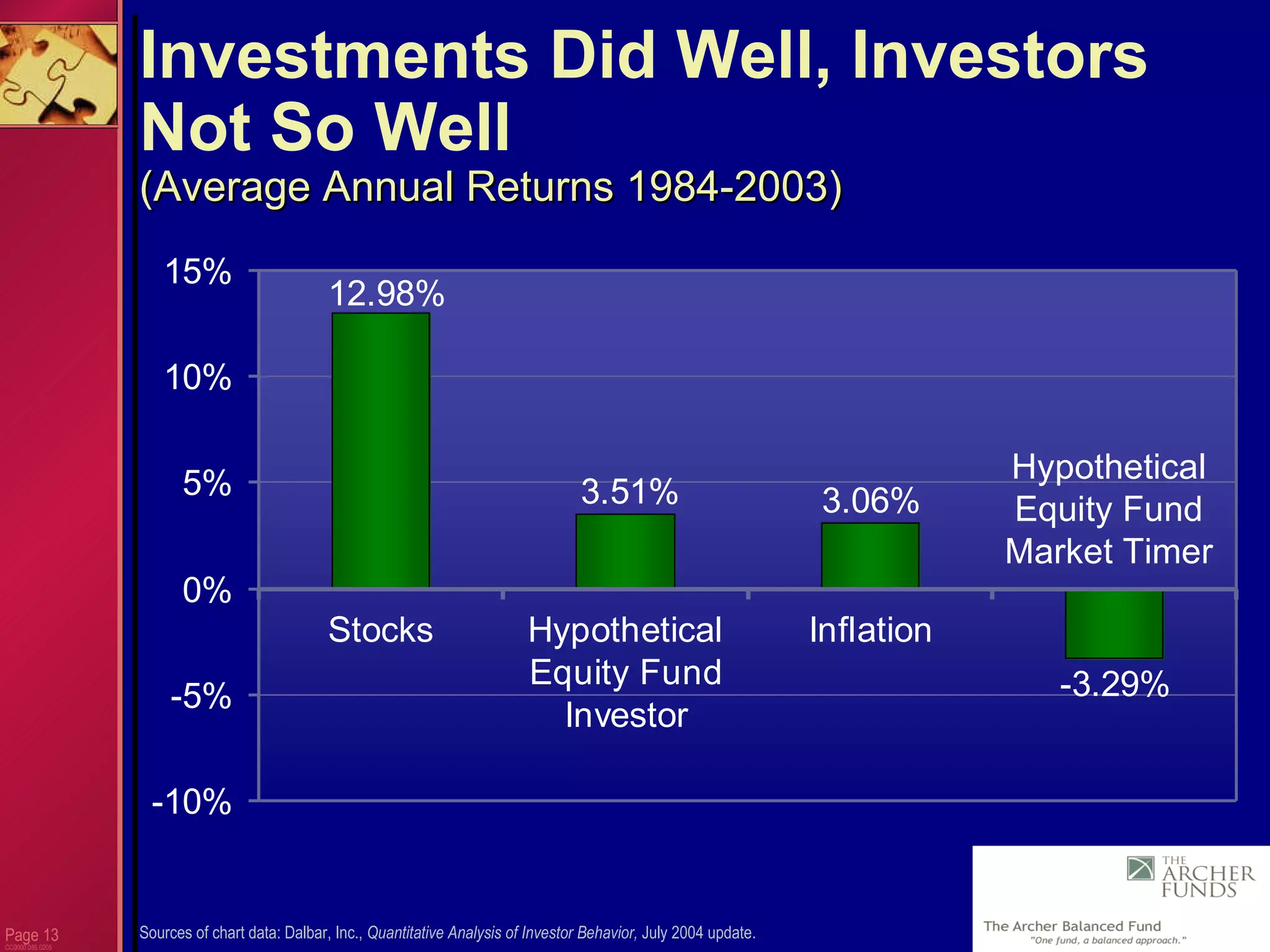

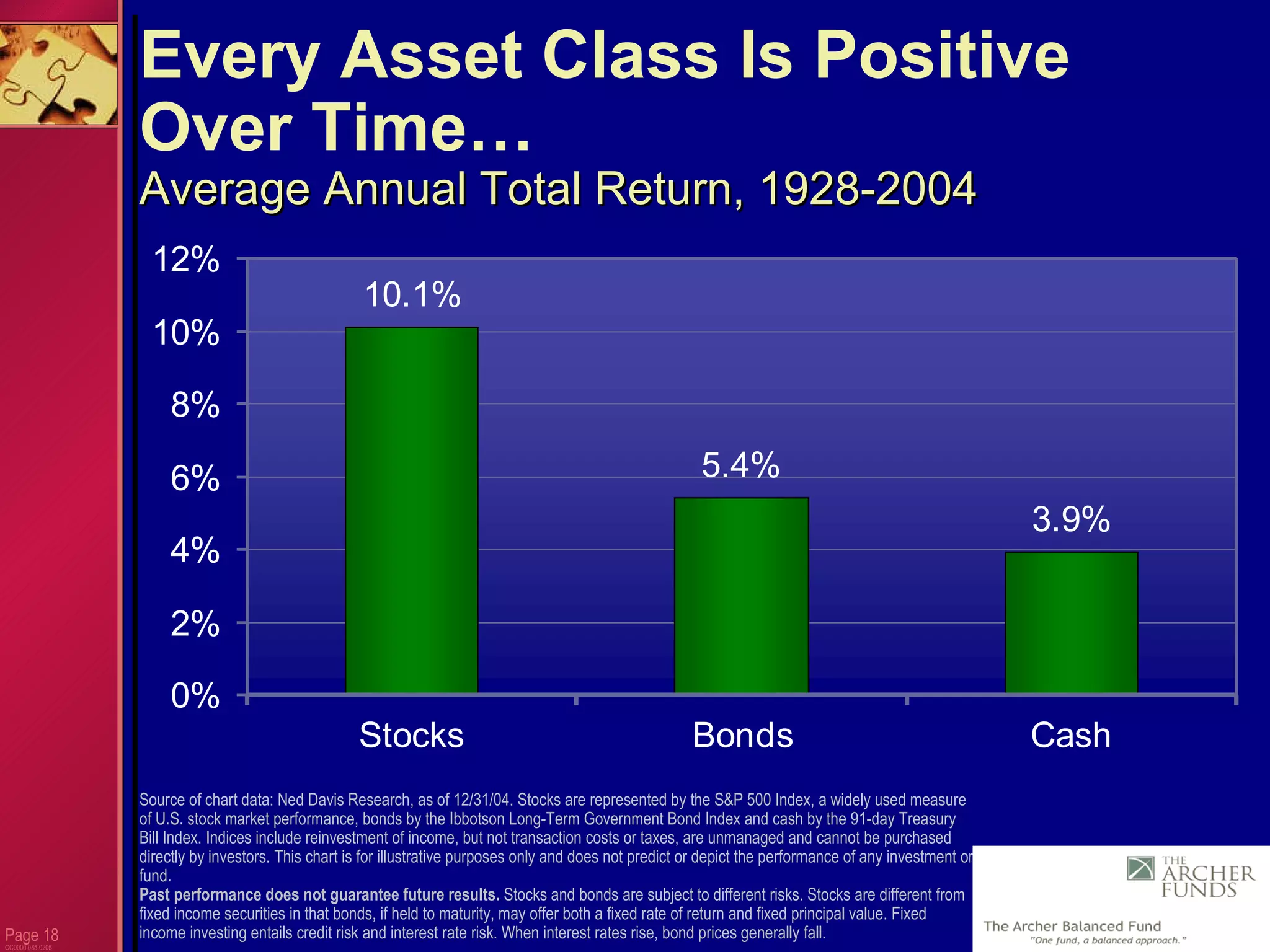

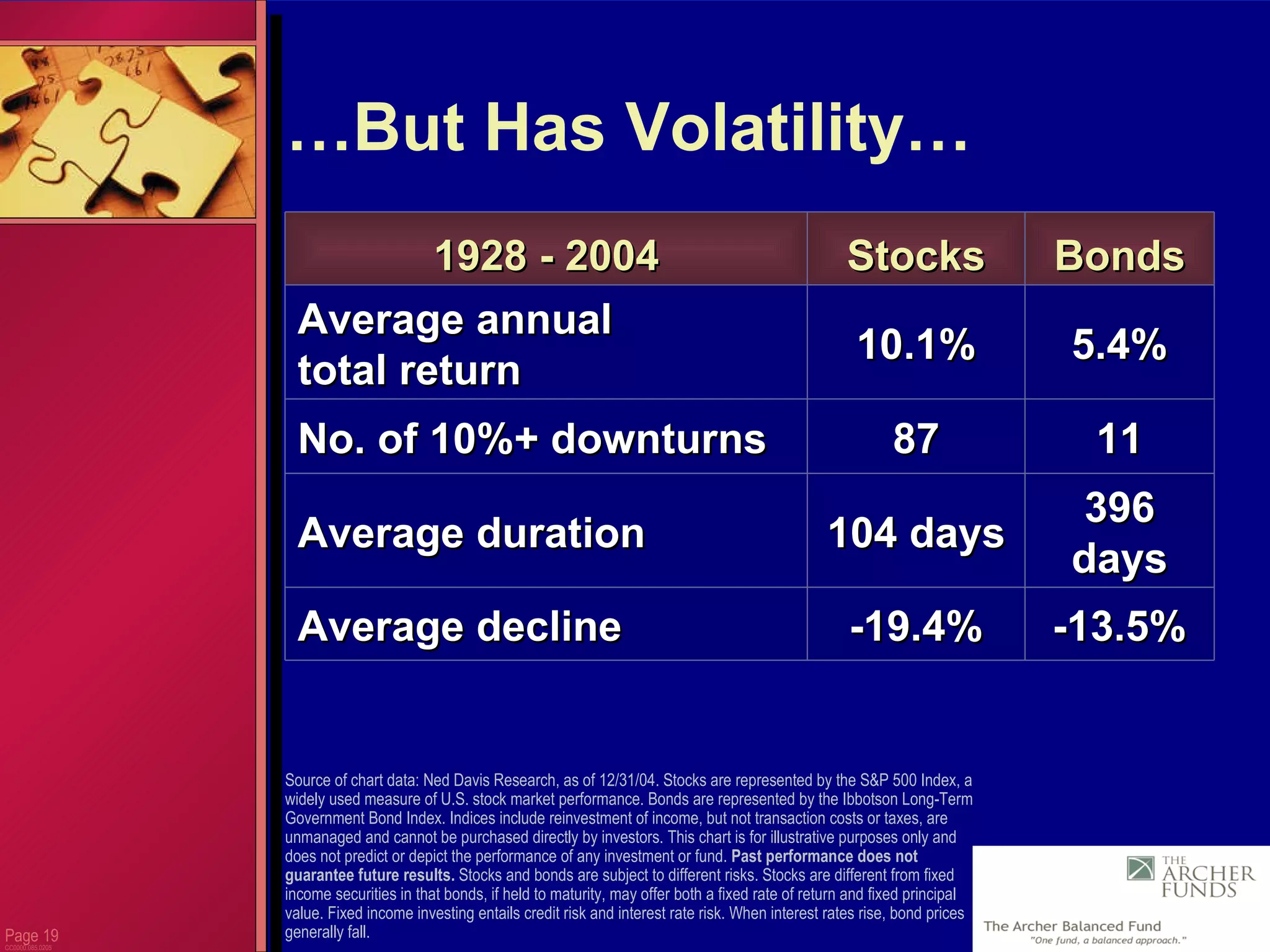

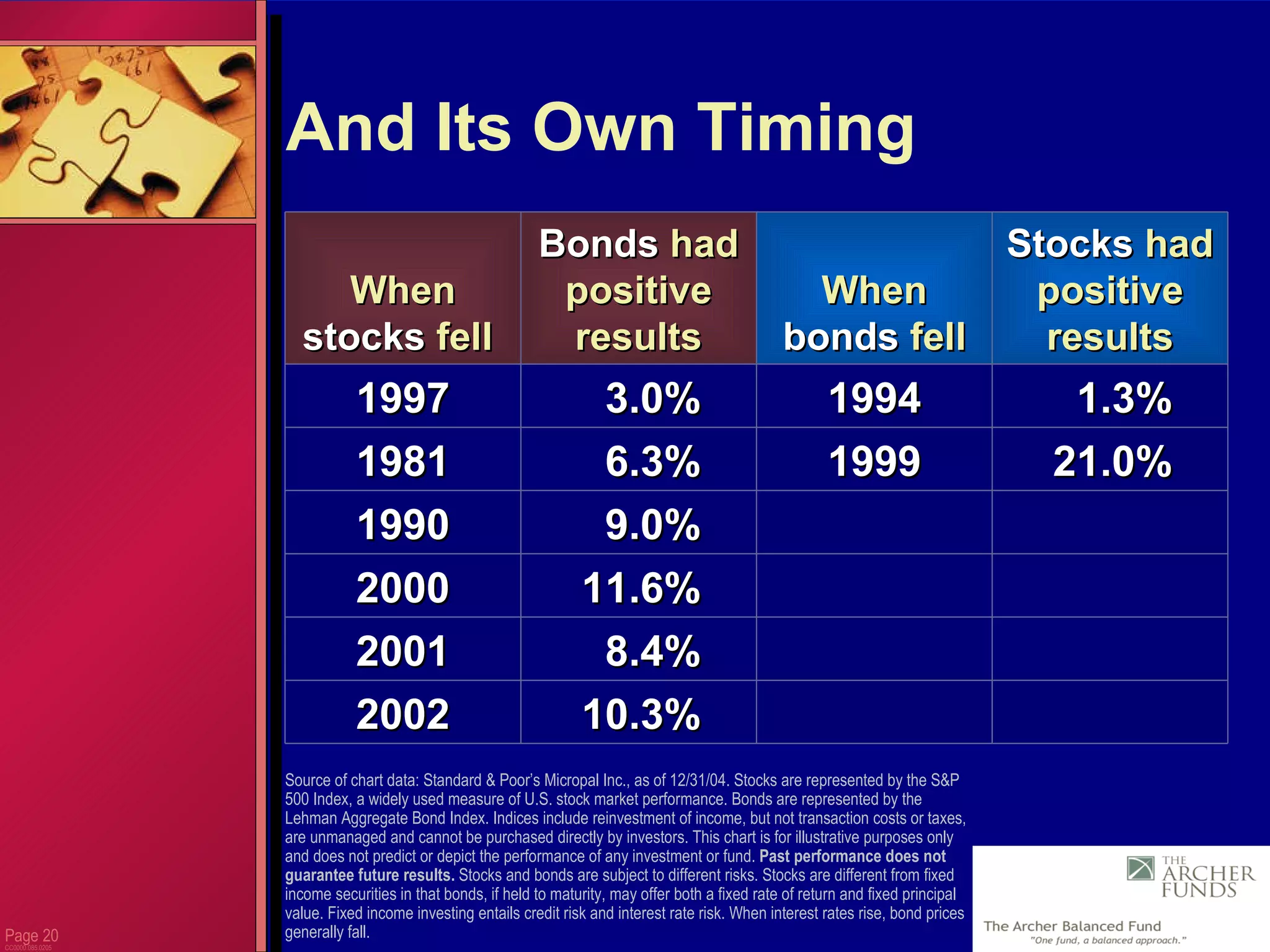

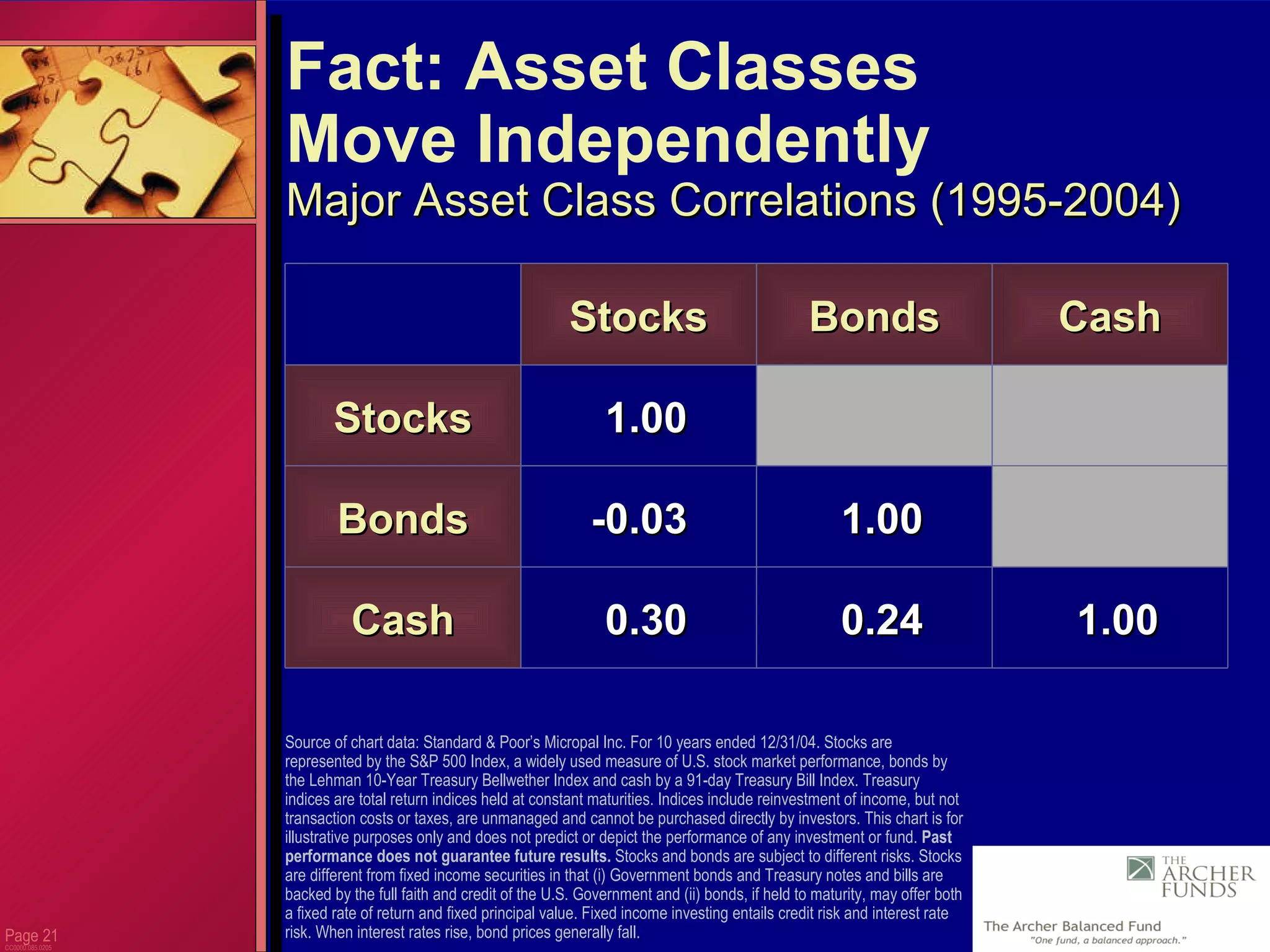

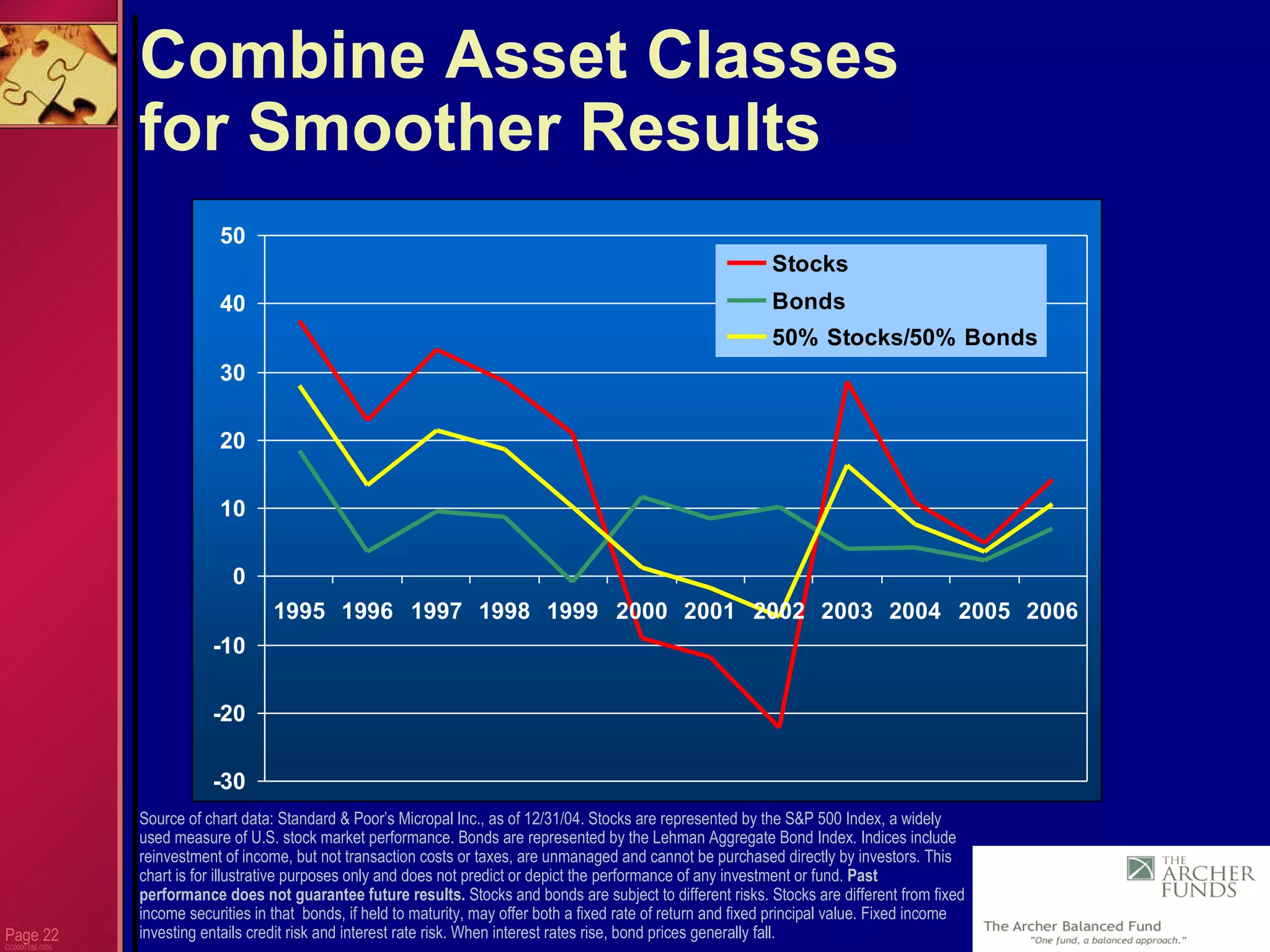

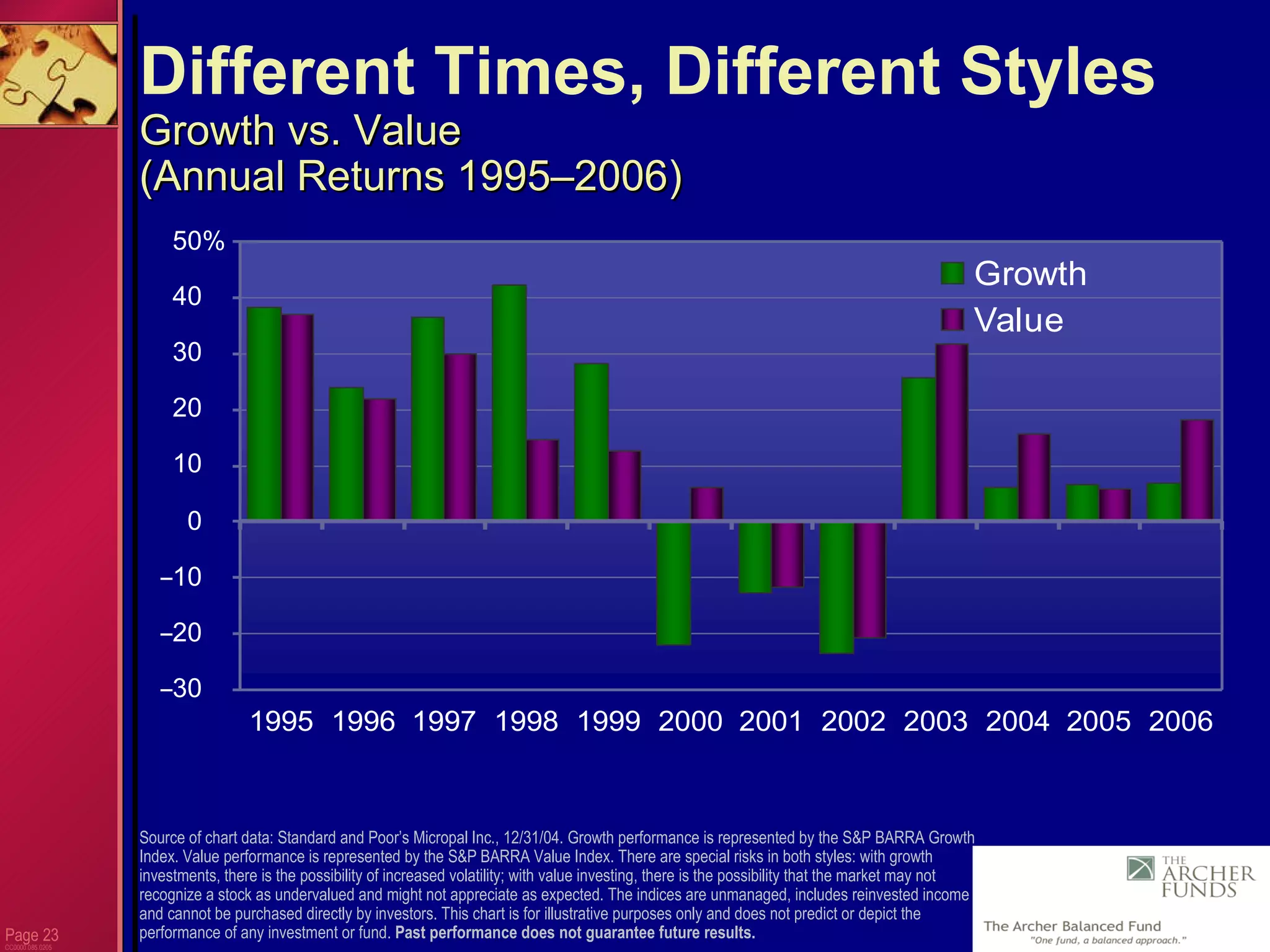

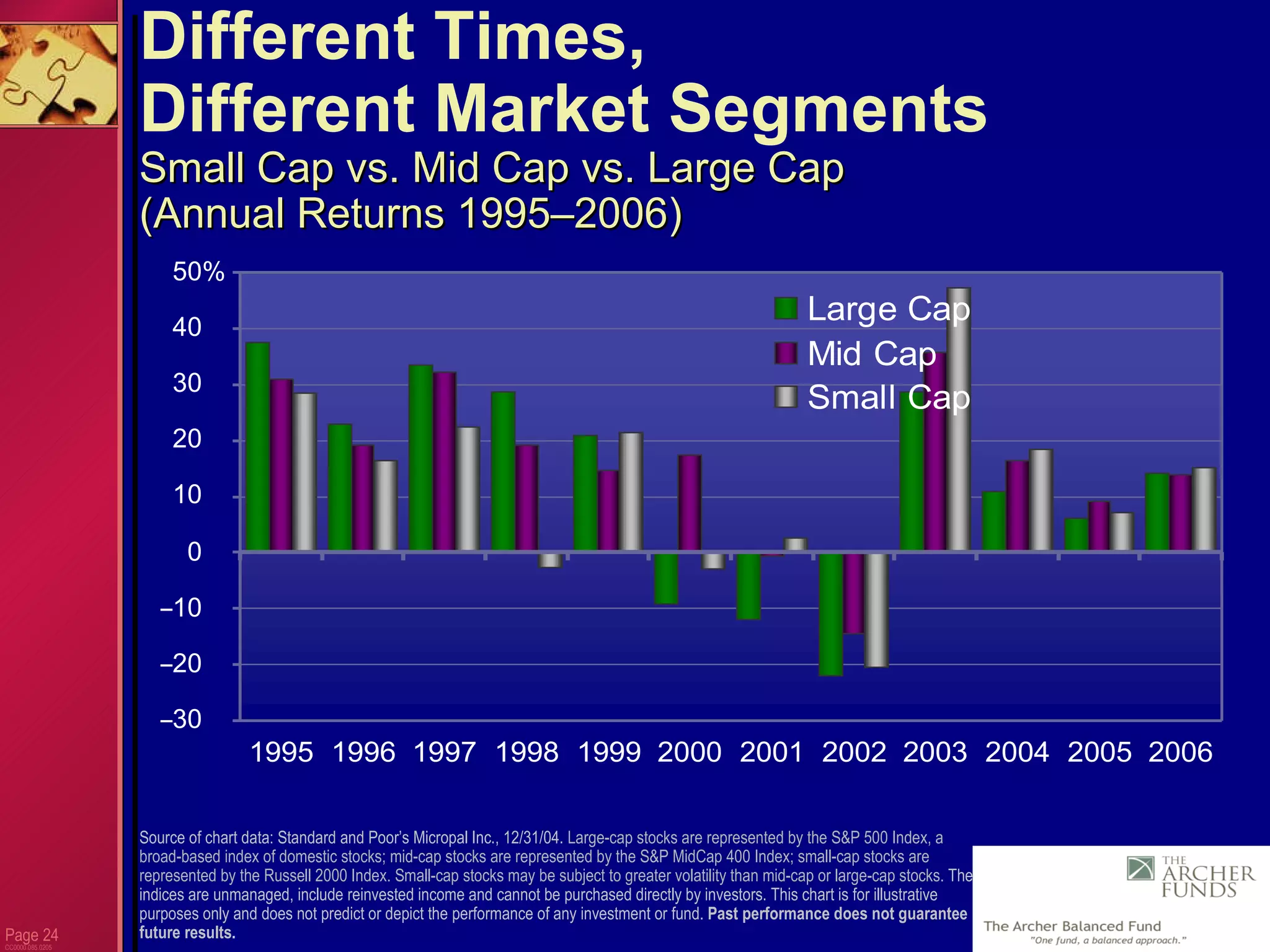

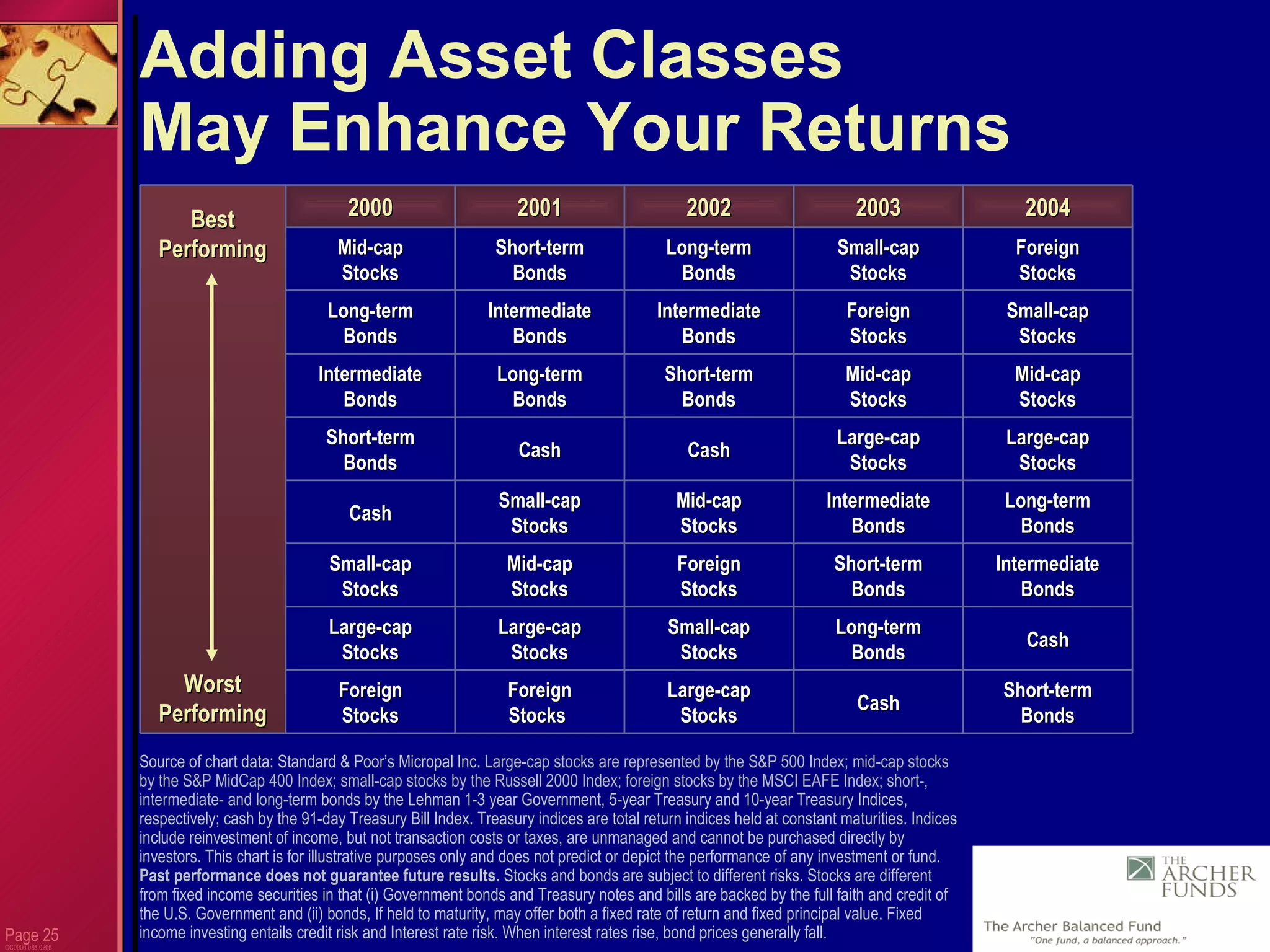

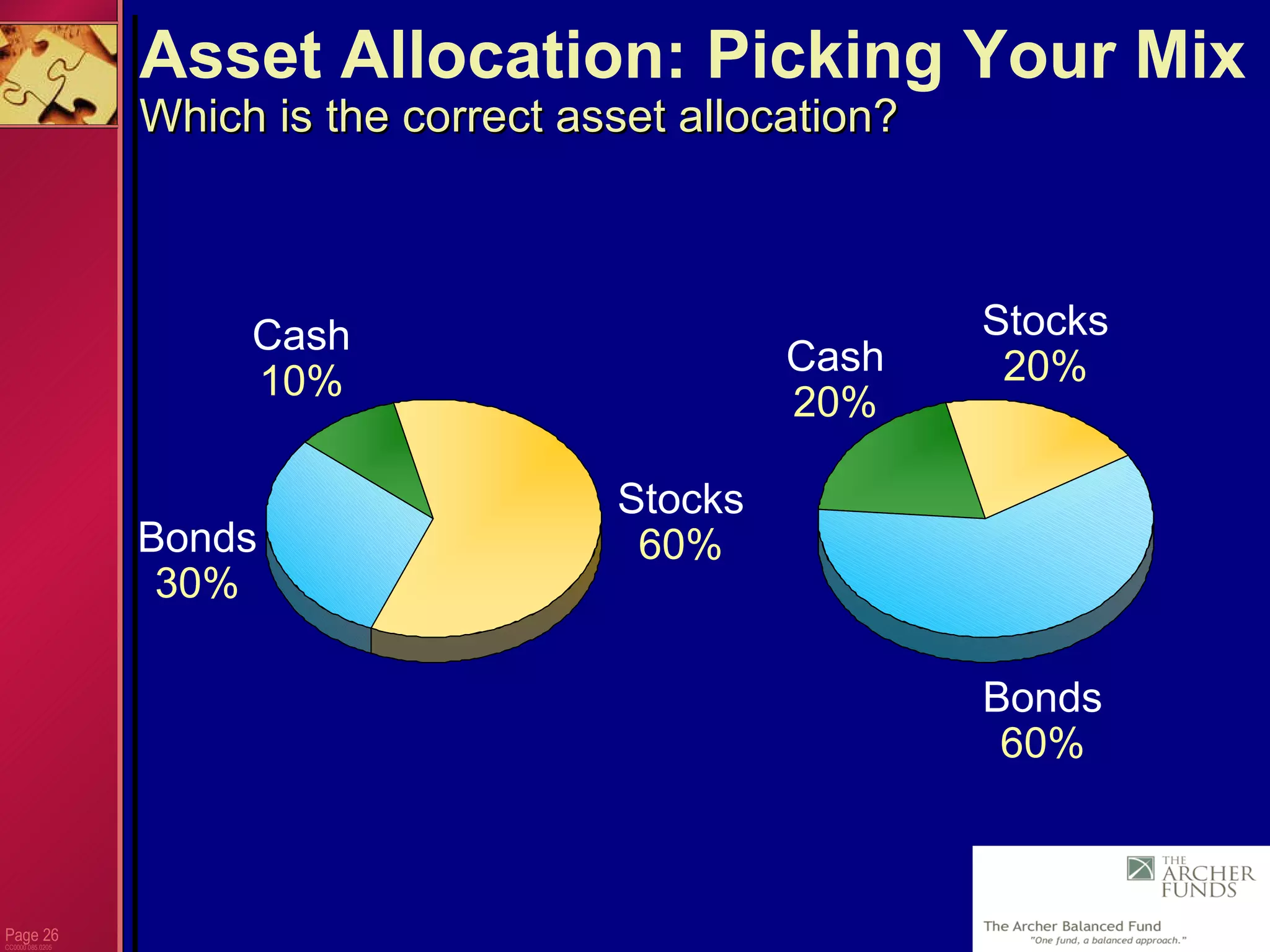

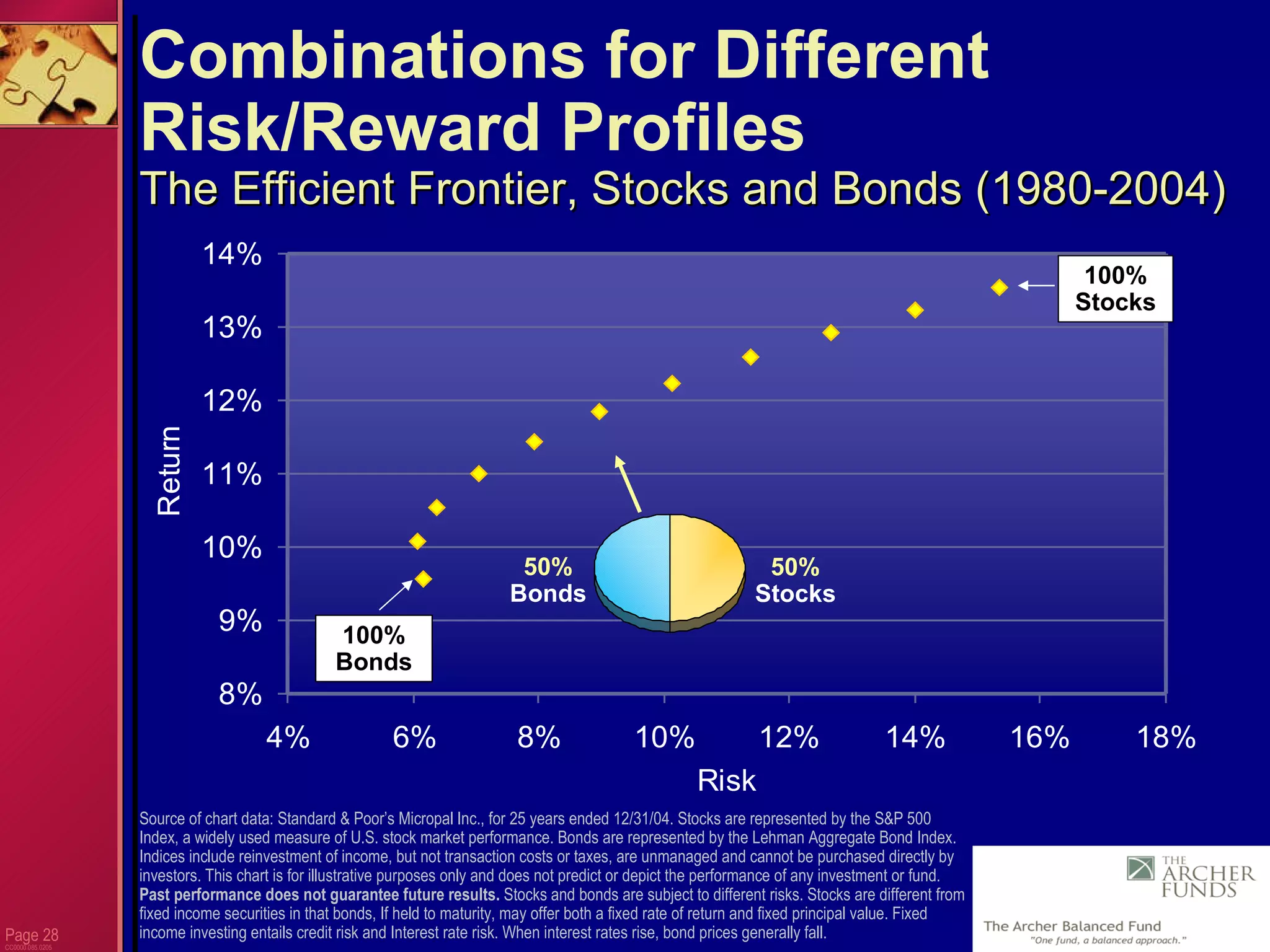

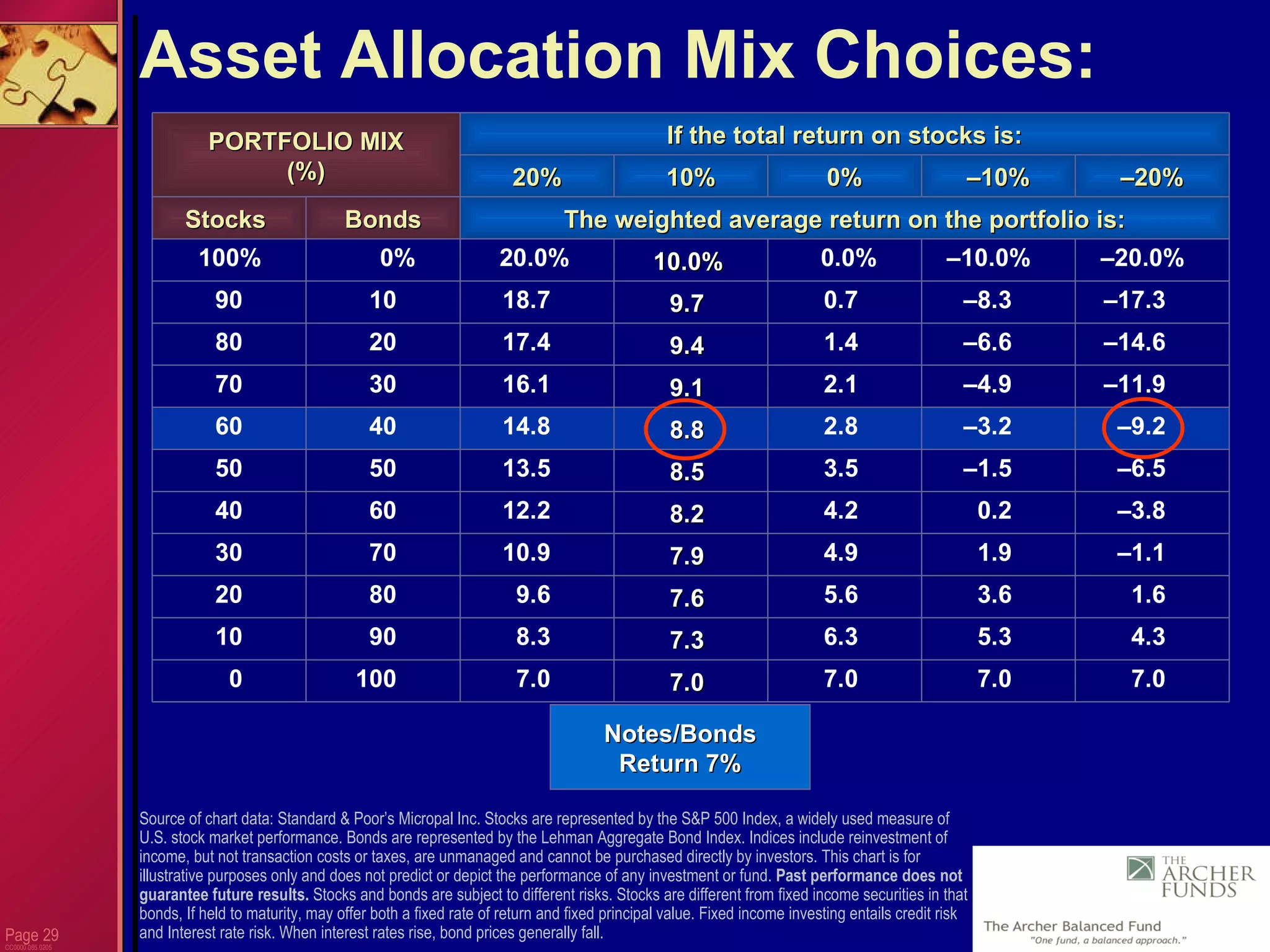

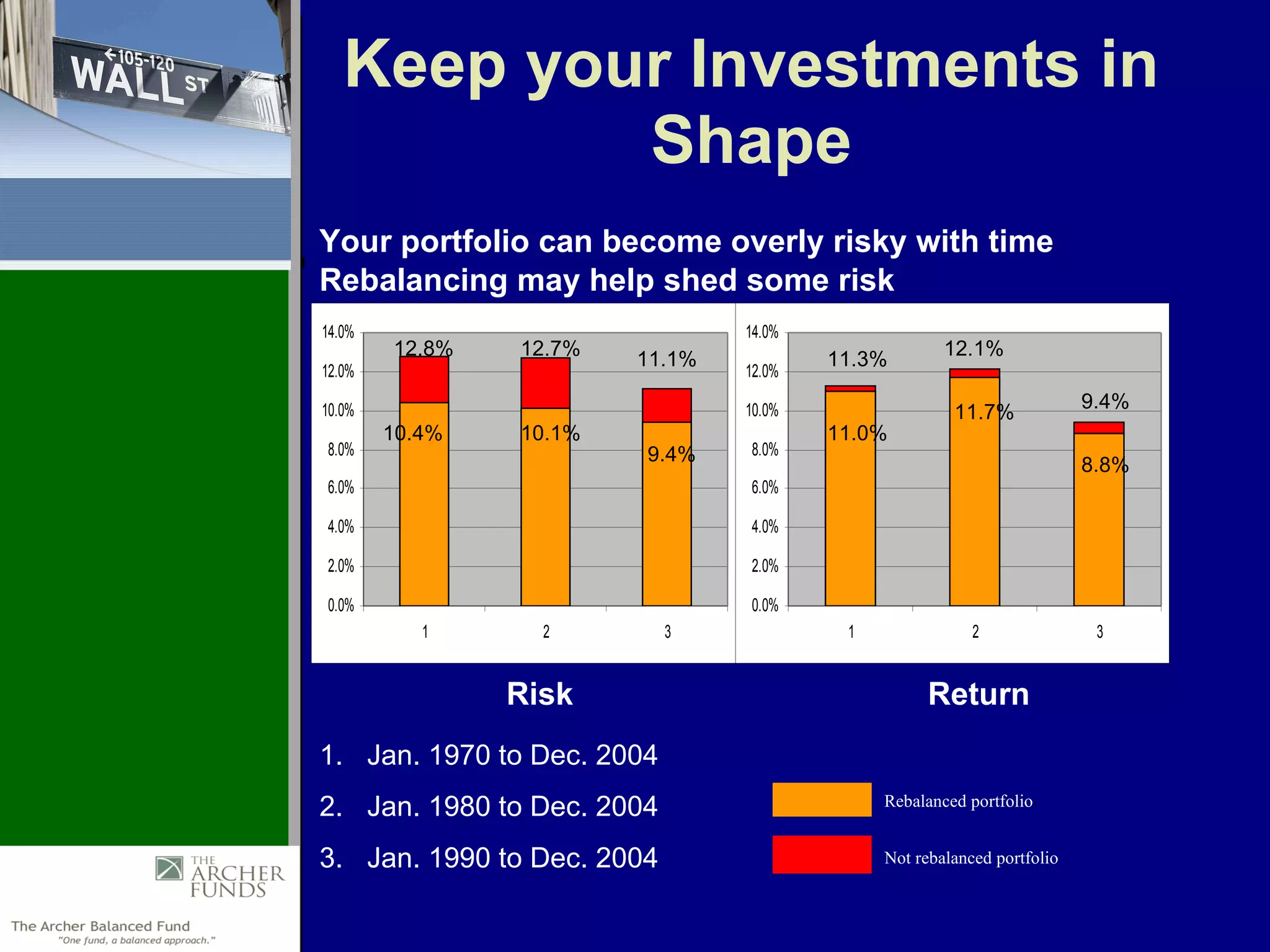

The document discusses asset allocation and how combining different asset classes such as stocks and bonds can help reduce risk for investors. It provides examples showing that a balanced portfolio with a mix of stocks and bonds experiences less volatility than an all-stock or all-bond portfolio. Additionally, the document discusses how factors like inflation, market timing, and investor behavior affect returns, and why asset allocation is an important tool for meeting investment objectives while managing risk.