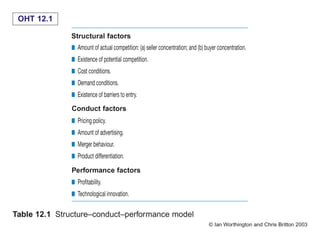

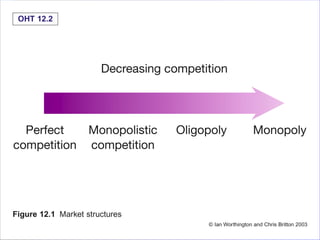

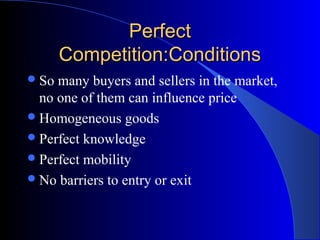

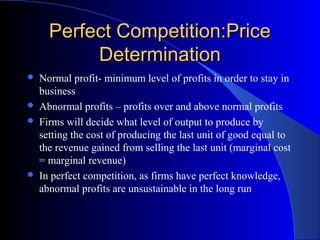

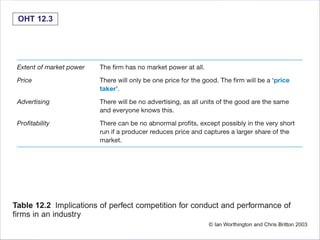

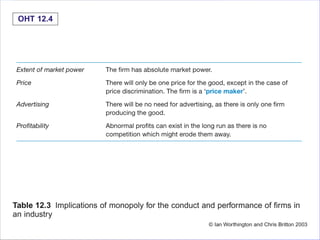

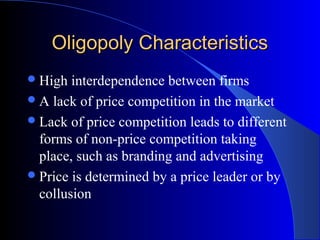

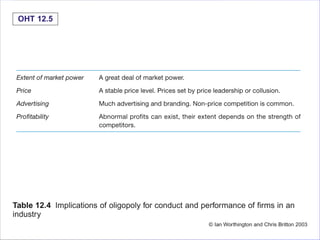

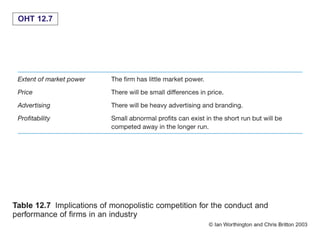

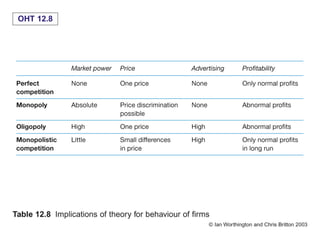

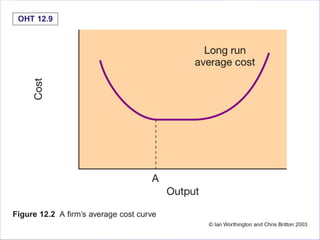

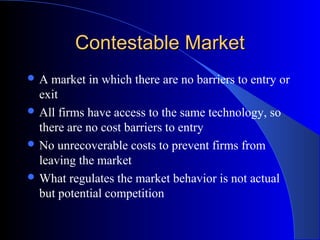

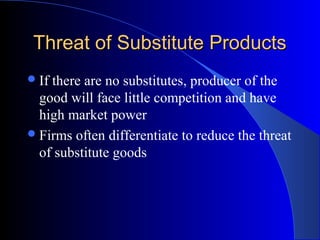

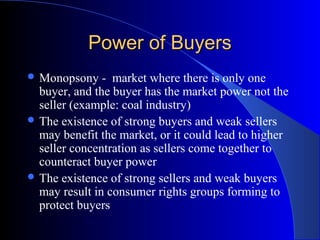

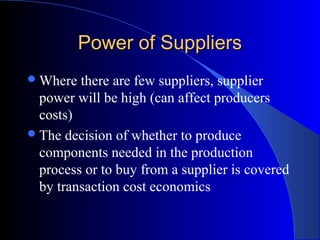

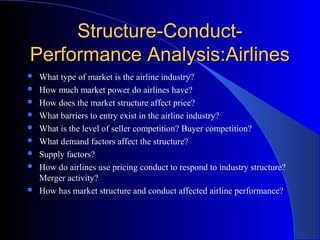

This document provides an overview of market structure and competition. It discusses the Structure-Conduct-Performance model and different market structures including perfect competition, monopoly, oligopoly, and monopolistic competition. It analyzes the characteristics and price determination processes for each structure. Porter's Five Forces model is also introduced to analyze industry competition. The document uses examples like airlines to demonstrate analyzing market structure, conduct, and performance. Homework is assigned to apply these concepts to analyze the structure-conduct-performance of another industry.