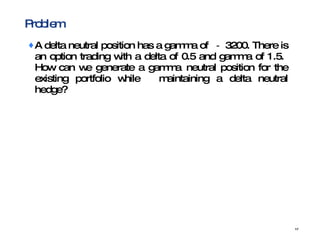

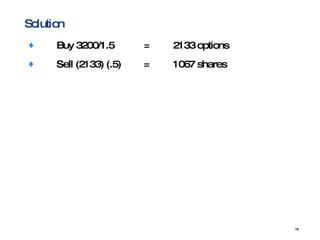

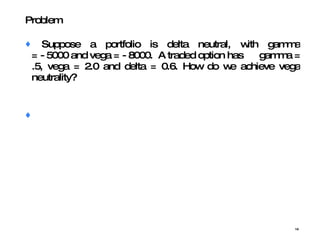

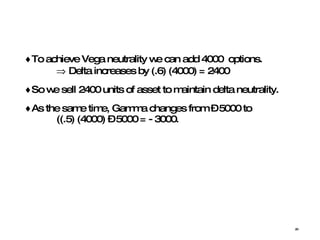

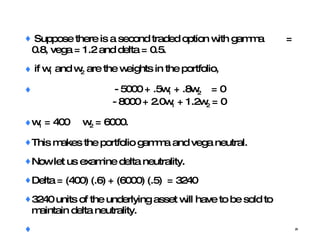

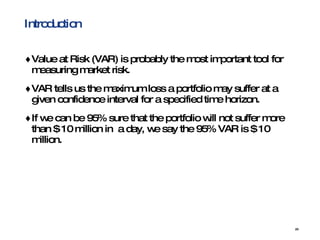

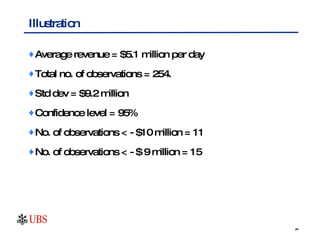

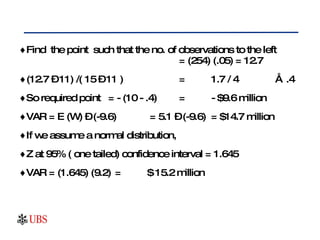

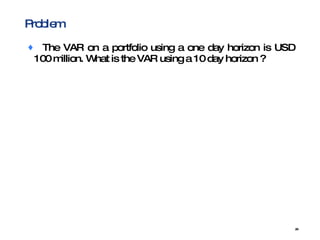

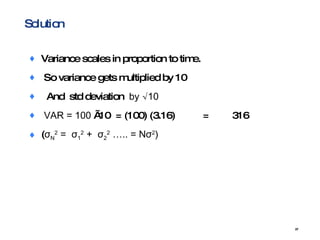

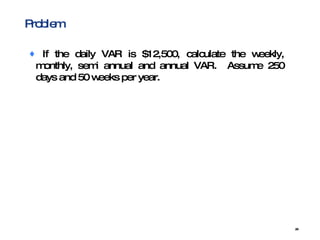

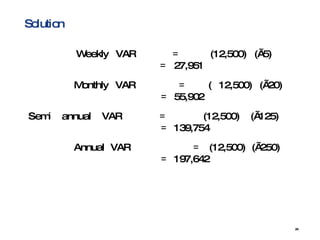

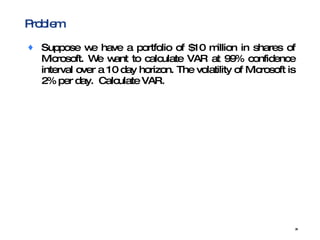

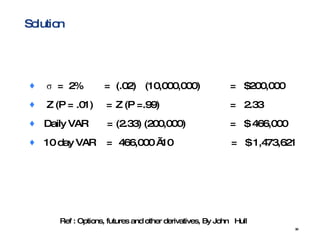

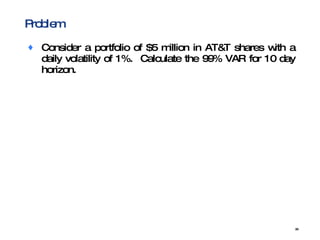

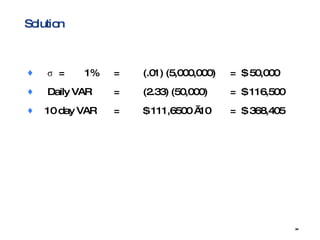

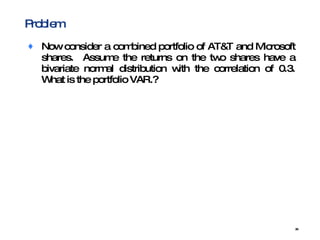

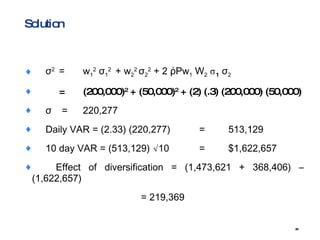

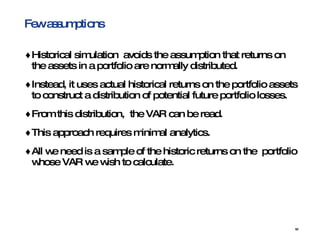

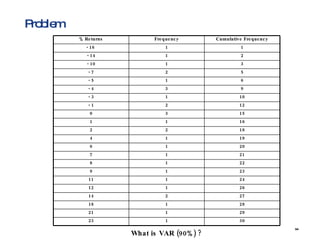

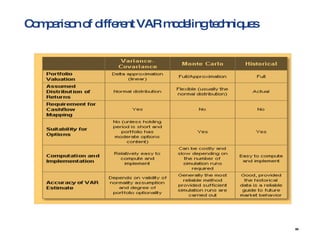

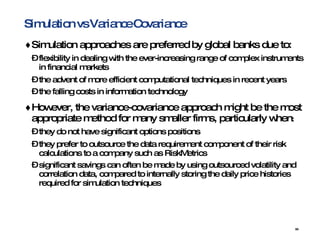

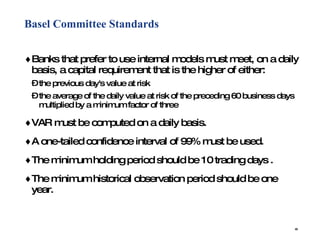

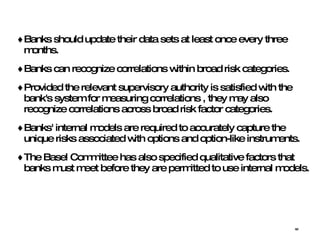

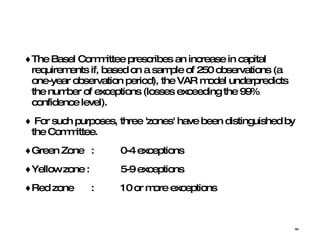

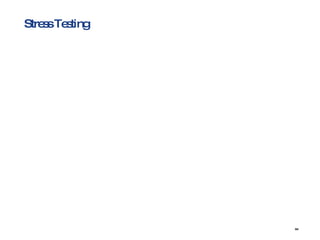

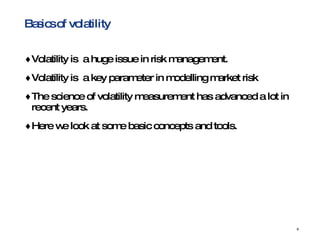

This document discusses various techniques for modeling market risk and estimating volatility, including calculating volatility, exponentially weighted moving average models, GARCH models, Greeks (delta, gamma, theta, vega, rho), value at risk using variance-covariance and Monte Carlo simulation methods, and historical simulation. Key concepts covered include estimating and updating volatility, incorporating mean reversion in models, hedging positions to achieve gamma and vega neutrality, and calculating value at risk over different time horizons using variance-covariance, Monte Carlo simulation, and historical simulation approaches.

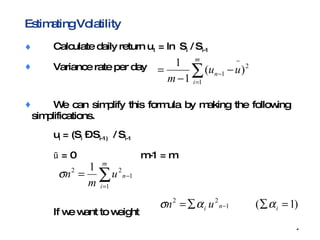

![Estimating Volatility Exponentially weighted moving average model means weights decrease exponentially as we go back in time. n 2 = 2 n-1 + (1 - ) u 2 n-1 = [ n-2 2 + (1- )u n-2 2 ] + (1- )u n-1 2 = (1- )[u n-1 2 + u n-2 2 ] + 2 n-2 2 = (1- ) [u n-1 2 + u 2 n-2 + 2 u n-3 2 ] + 3 2 n-3 If we apply GARCH model, n 2 = Y V L + u n-1 2 + 2 n-1 V L = Long run average variance rate Y + + = 1. If Y = 0, = 1- , = , it becomes exponentially weighted model. GARCH incorporates the property of mean reversion.](https://image.slidesharecdn.com/marketriskmodelling-100103003155-phpapp02/85/Market-Risk-Modelling-5-320.jpg)

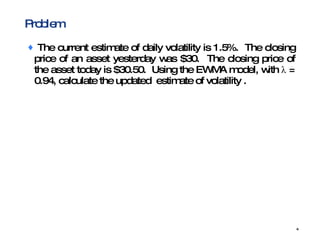

![Solution h t = λ σ 2 t-1 + ( 1 – λ ) r t-1 2 λ = .94 r t-1 = ln[(30.50 )/ 30] = .0165 h t = (.94) (.015) 2 + (1-.94) (.0165) 2 Volatility = .01509 = 1.509 %](https://image.slidesharecdn.com/marketriskmodelling-100103003155-phpapp02/85/Market-Risk-Modelling-7-320.jpg)