The document describes an ETRM reporting and market risk management solution including:

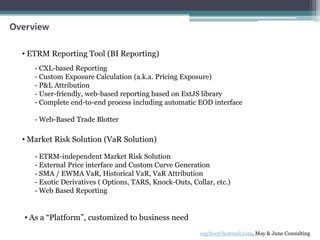

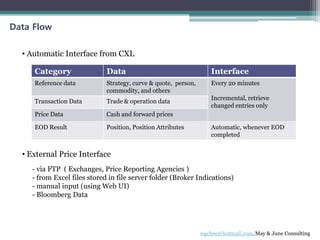

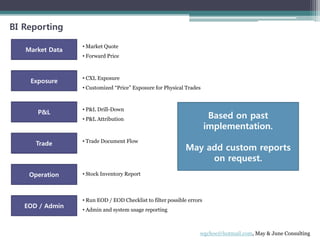

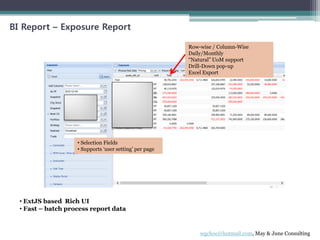

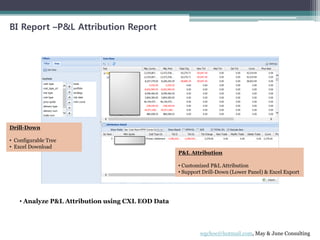

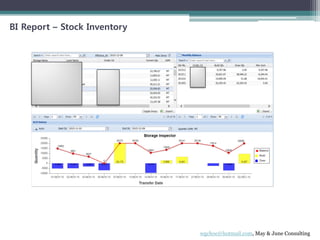

- A BI reporting tool for market data, exposures, P&L, trades, and operations from an ETRM system.

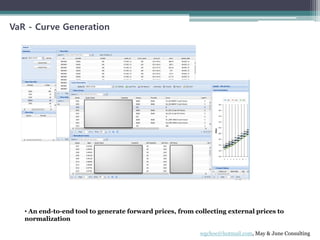

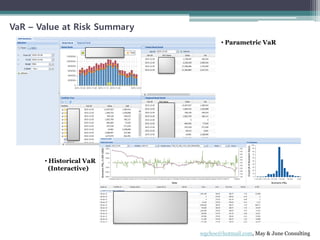

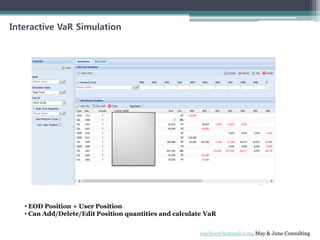

- A market risk solution for curve generation, VaR calculation, reporting, and structured derivative valuation.

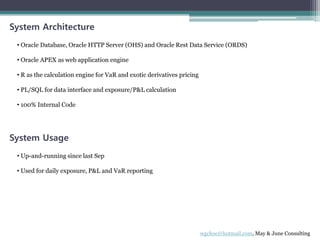

- The system architecture uses Oracle databases, HTTP server, and R for calculations, with a web interface for reporting, simulation, and risk management.

- It has been in use since September for daily exposure, P&L, and VaR reporting.