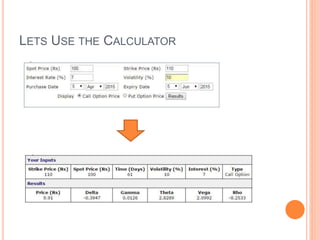

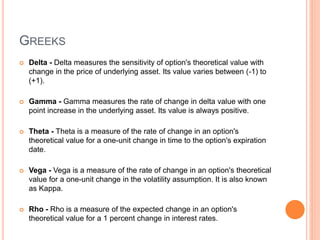

The document provides an overview of options, including calls and puts, strike prices, volatility, and Greeks. It defines an option as a contract that gives the buyer the right to buy or sell an asset by a certain date. Calls provide the right to buy and benefit from rising prices, while puts provide the right to sell and benefit from falling prices. The strike price is the price at which the underlying can be bought or sold. Options are in-the-money, out-of-the-money, or at-the-money depending on the relationship between the strike price and current underlying price. Volatility and Greeks like delta, gamma, theta, and vega are important factors in option pricing and the document provides definitions