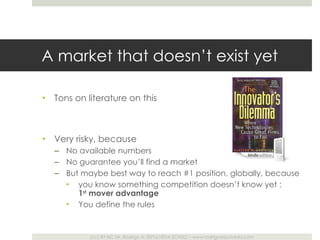

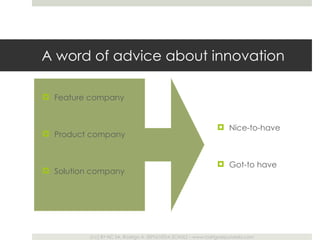

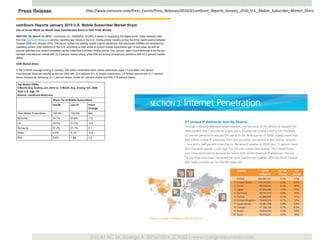

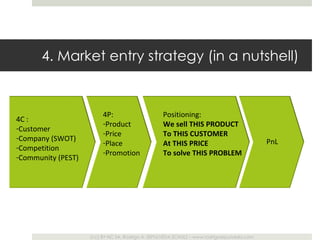

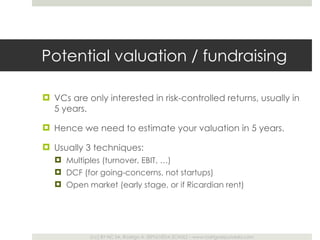

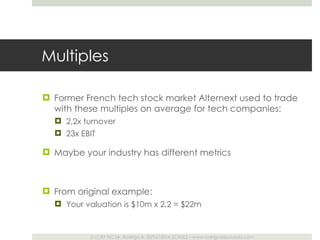

The document outlines the importance of understanding market size and type for assessing revenue potential and competitive positioning. It describes various strategies for estimating market size and entry, emphasizing the significance of targeting large markets and identifying unique opportunities. Additionally, it highlights the use of valuation techniques for fundraising endeavors and stresses the need for a comprehensive market entry strategy.

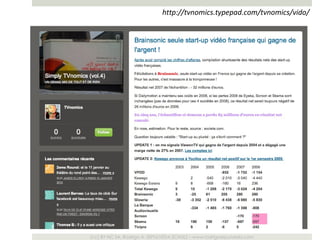

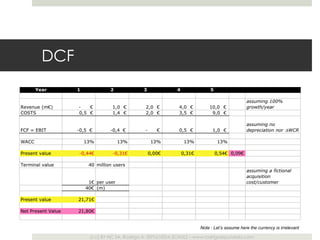

![VC ’s share Valuation bracket at exit = [$ 21,8-22,0m] If series A of $1,5m for 30% equity Then VC ’s value at exit is $22m x 30% = $6,6m That ’s a cash-on-cash return of : 6,6 / 1,5 = 4,4x (excluding tax impact) GREAT, but that ’s only $5,1m made for the VC in 5 years (too small !) cost of opportunity is too high Nota: if you ’re financing the company alone, then it’s a different story : $22m-$1,5m financing = $20,5m profit in 5 years = $4m/year](https://image.slidesharecdn.com/110308marketssfo-110308214615-phpapp02/85/Market-entry-strategy-presenter-deck-9-320.jpg)