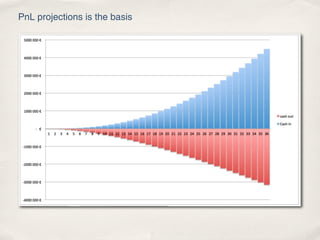

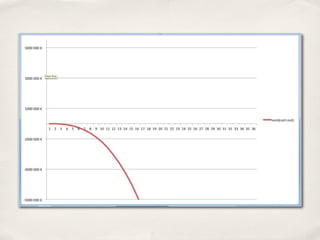

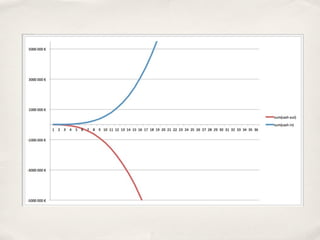

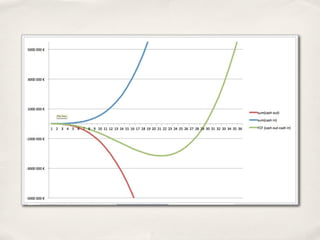

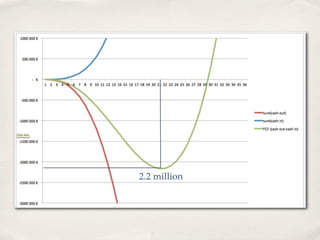

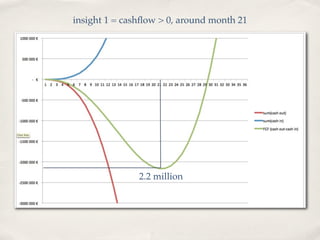

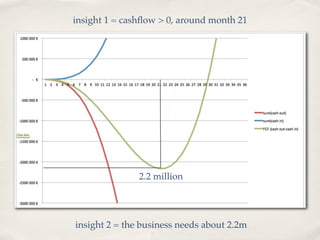

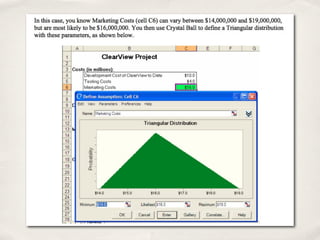

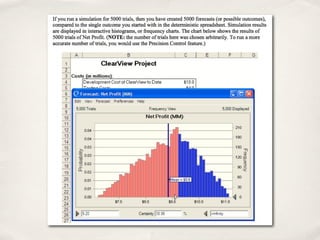

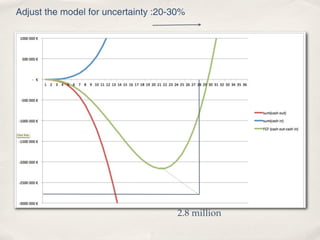

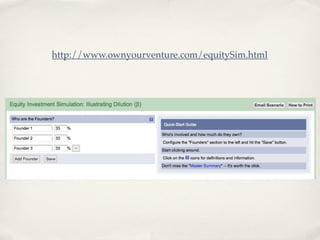

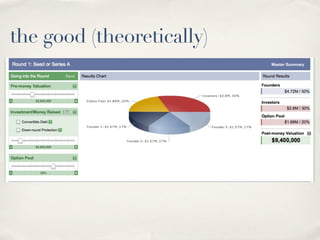

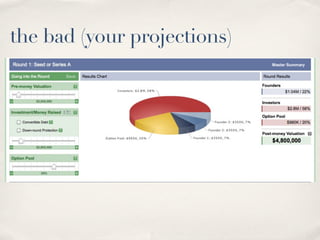

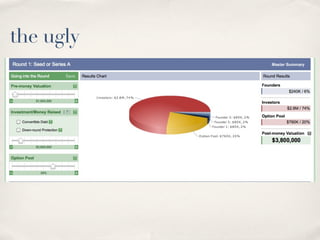

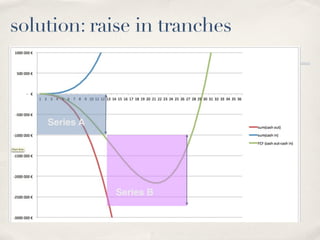

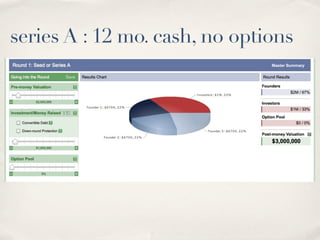

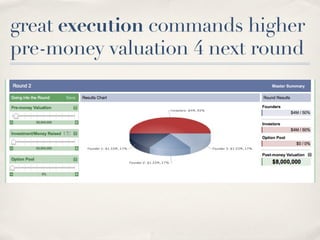

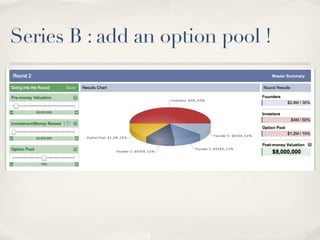

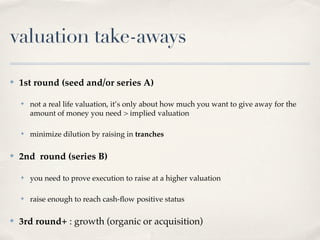

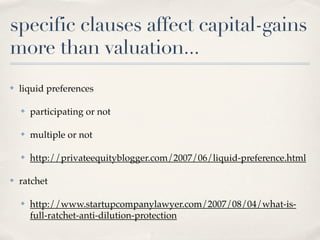

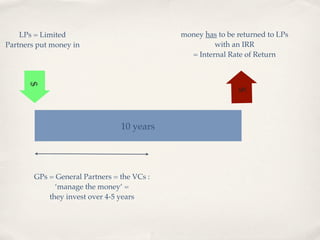

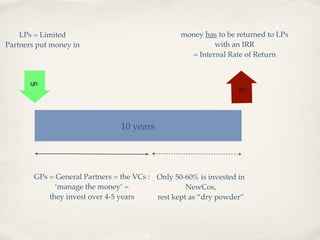

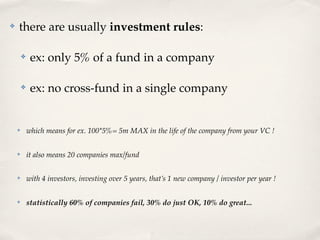

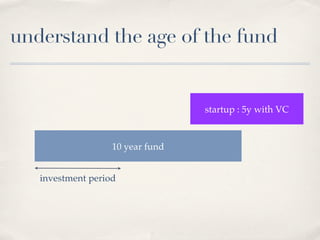

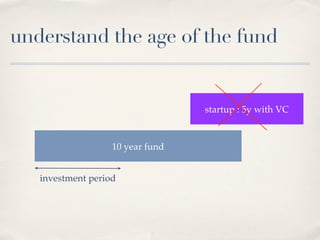

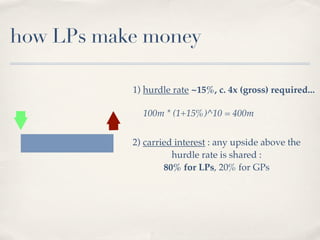

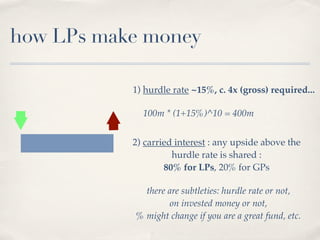

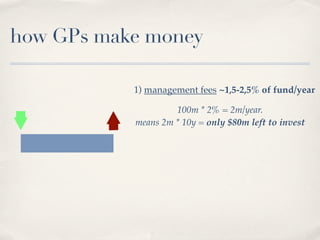

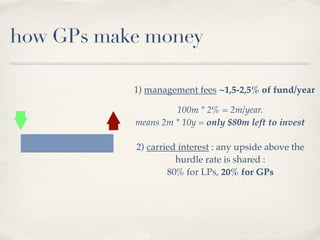

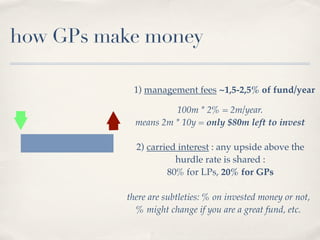

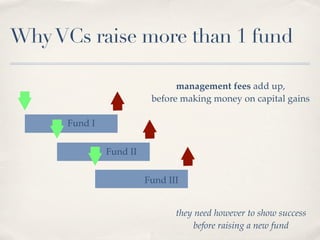

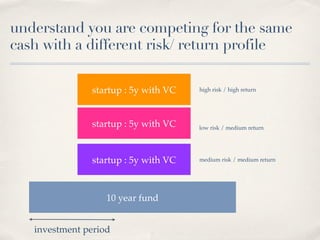

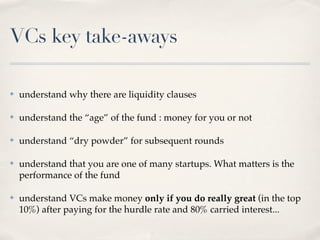

The document discusses key considerations for entrepreneurs regarding fundraising, including how much money to raise, valuation methods, and structuring fundraising in tranches. It also explains the mechanics of venture capital funds, including how they operate, what limited partners and general partners look for, and the importance of understanding risk management. Ultimately, it highlights the significance of careful financial planning and understanding the competitive landscape to secure successful investments.