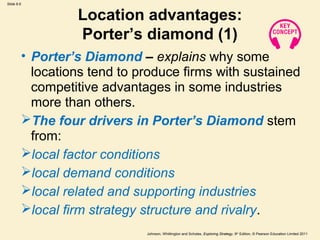

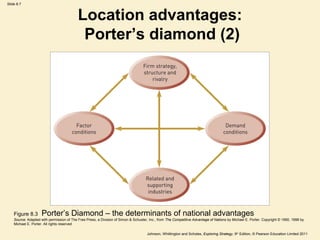

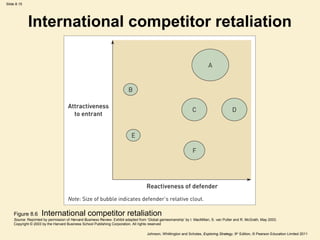

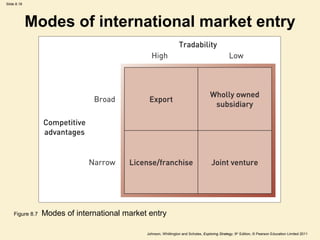

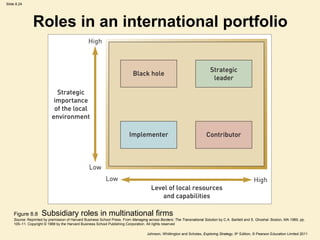

The document discusses international strategy and market entry. It outlines four types of international strategies ranging from simple export to globally coordinated strategies. It also discusses factors for evaluating foreign market attractiveness and potential such as Porter's Diamond framework. The document analyzes different modes of entering foreign markets including exporting, licensing, joint ventures, and foreign direct investment. It notes the relationship between internationalization and firm performance follows an inverted U-shape.