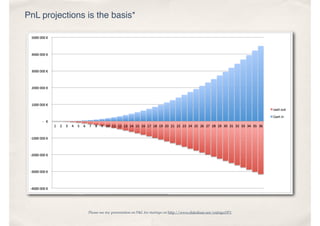

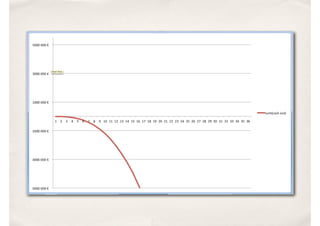

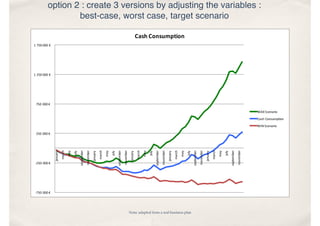

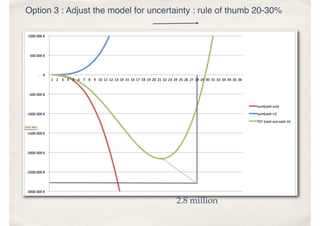

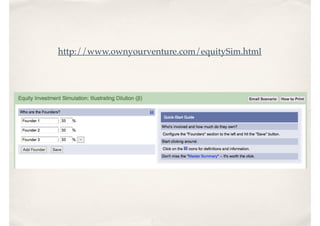

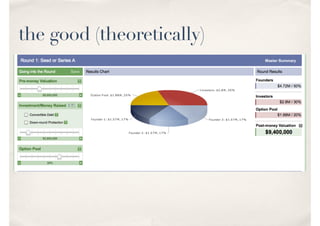

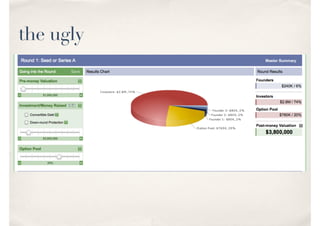

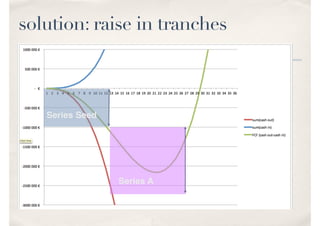

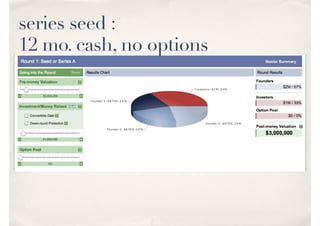

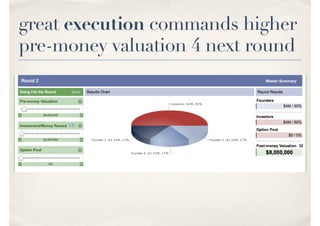

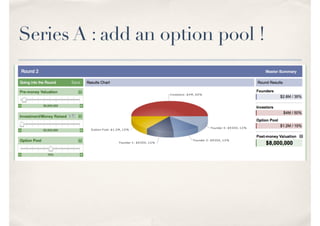

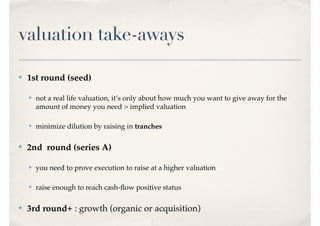

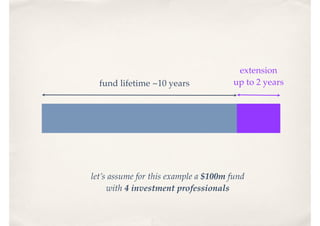

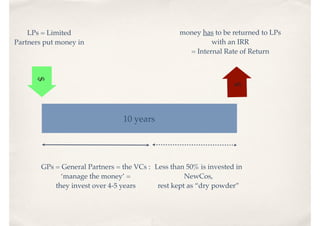

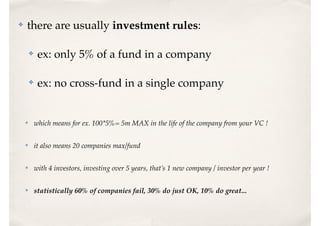

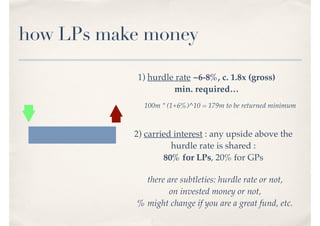

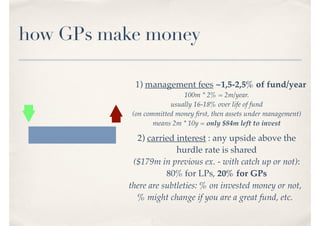

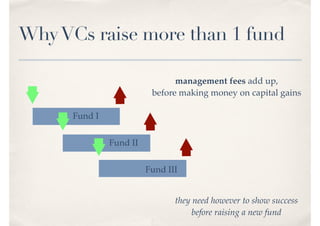

The document provides insights on fundraising for startups, covering how much to raise, valuation methods, fund mechanics, and risk management. Key takeaways include the importance of careful financial planning, raising in tranches to minimize dilution, and understanding VC fund operations. The author emphasizes the significance of risk assessment across various factors such as execution, market, and business model risks.