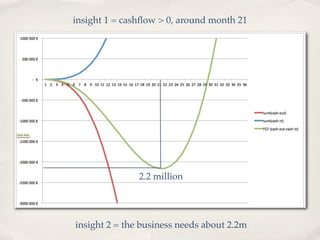

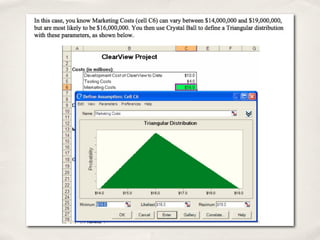

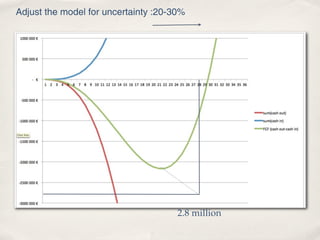

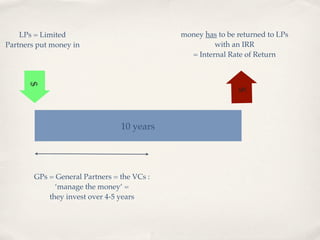

The document discusses key aspects of fundraising for startups, focusing on how much to raise, business valuation, and the workings of venture capital funds. It emphasizes the importance of careful financial planning, raising funds in tranches to minimize dilution, and understanding the criteria that venture capitalists (VCs) use for investments. Additionally, the document outlines risk management strategies, highlighting the need to minimize execution and market risks.