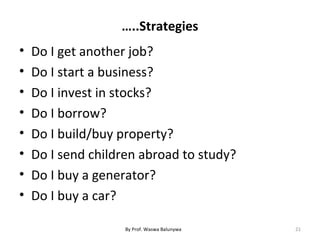

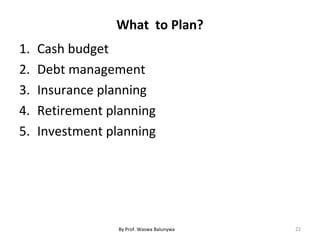

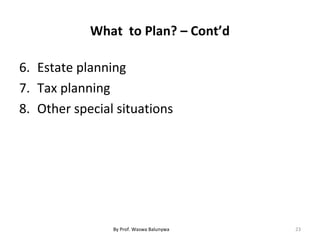

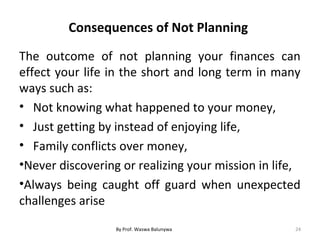

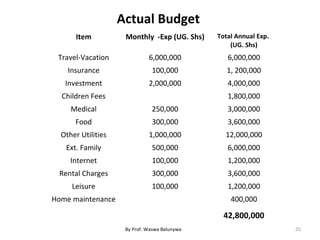

This document discusses personal finance planning and management. It begins by defining personal finance planning and outlining its objectives. It then describes the key steps in personal finance planning, which include assessing one's current financial position, determining goals, establishing sources of income and expenditures, and developing strategies. The document emphasizes the importance of planning and the consequences of not planning one's finances. It provides examples of assets, liabilities, income sources and expenditures to consider.