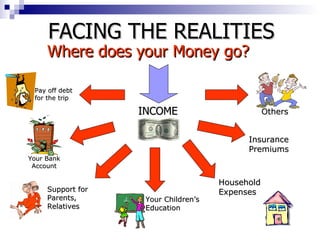

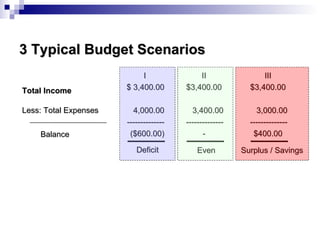

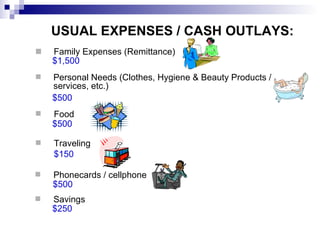

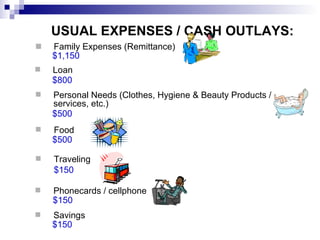

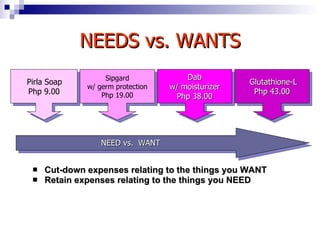

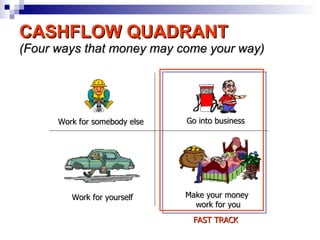

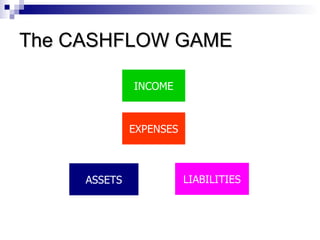

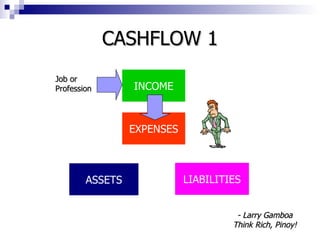

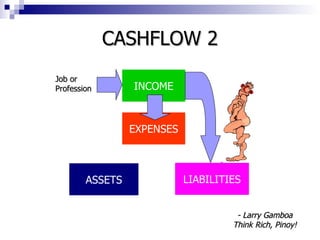

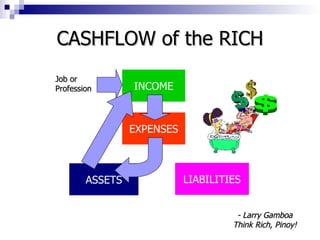

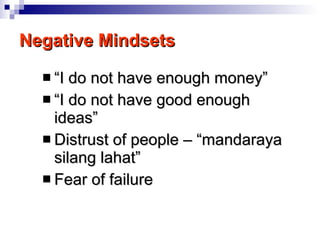

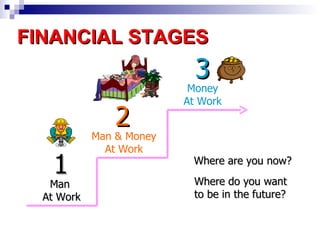

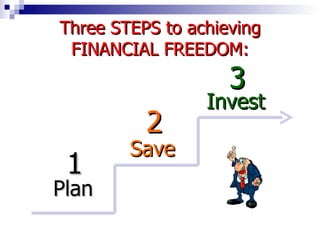

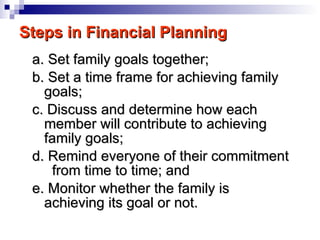

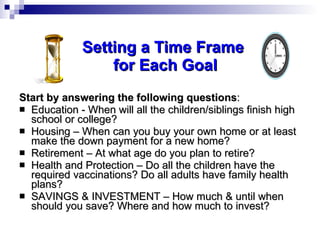

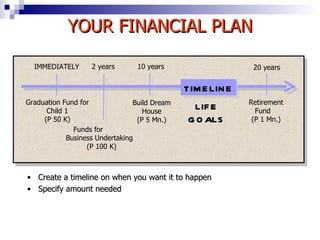

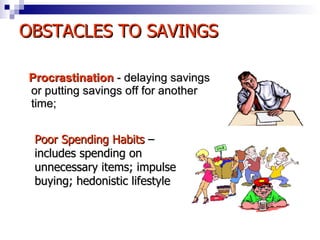

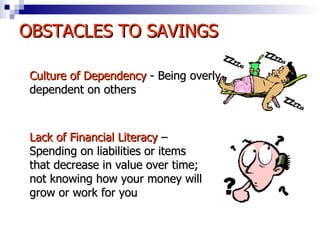

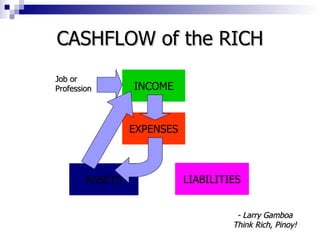

The document discusses financial literacy and its importance in building personal wealth, particularly for Overseas Filipino Workers (OFWs) who seek to support their families and invest in their future. It outlines budgeting scenarios, the distinction between needs and wants, and emphasizes the importance of savings and investment as key components to achieving financial freedom. It also highlights the need for proper financial planning to set and achieve family goals related to education, housing, health, retirement, and safeguarding against unforeseen events.