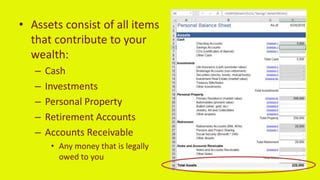

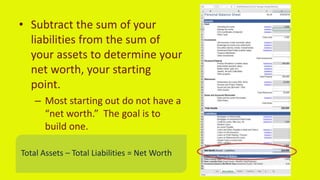

This document provides a 5-step guide to improving personal finances. Step 1 is to write a personal financial statement listing assets and liabilities to determine net worth. Step 2 is to establish financial goals like paying off debt or saving for large purchases. Step 3 is to create a plan of action, such as paying off debts from smallest to largest or focusing on highest interest rates first. Step 4 is to follow the plan by changing spending habits. Step 5 is to adjust the plan for life changes by reevaluating financial situation. The overall goal is to increase assets and decrease liabilities over time.