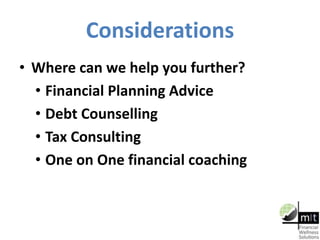

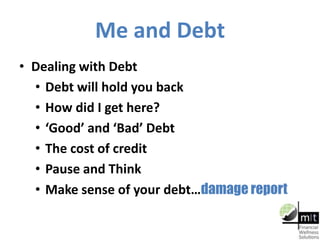

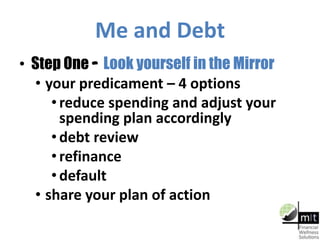

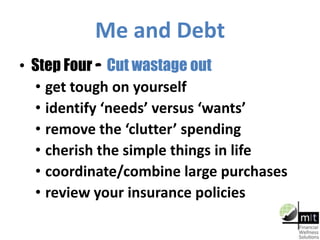

The document serves as an introduction to personal financial wellness, outlining key questions and a structured approach to managing personal finances. It covers topics such as budgeting, debt management, saving, investment strategies, and long-term financial planning. Various steps and considerations are provided to help individuals assess their financial situation, set goals, and seek necessary assistance.

![Me and Debt

• Step Six – Negotiate with the bank

• keep a record of all bank statements and

tally up the charges

• is the bank open to negotiation?

• challenge the facility costs and charges

• review what packages the bank offers |

shop around

• refinance | restructure options | Debt

Consolidation? [cost of credit]](https://image.slidesharecdn.com/presentation-lite-2hour-130420094738-phpapp02/85/Presentation-lite-2-hour-14-320.jpg)