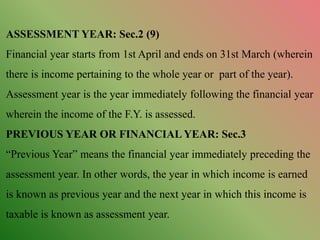

This document defines key terms related to income tax in India. It explains that the assessment year is the year following the financial year in which income is assessed. The previous year is the financial year in which income is earned. It defines who qualifies as a person, assessee, representative assessee, and deemed assessee for income tax purposes. It also explains how gross total income, total income, casual income, and agricultural income are defined and treated for income tax.

![PERSON: Sec. 2(31)

Income-tax is to be paid by every person. The term “person” as

defined under the Income-tax Act covers in its ambit natural as well

as artificial persons.

For the purpose of charging Income-tax, the term “person” includes

Individual, Hindu Undivided Families [HUFs], Association of

Persons [AOPs], Body of individuals [BOIs], Firms, LLPs,

Companies, Local authority and any artificial juridical person not

covered under any of the above. Thus, from the definition of the term

“person” it can be observed that, apart from a natural person, i.e., an

individual, any sort of artificial entity will also be liable to pay](https://image.slidesharecdn.com/incometaxbasicconcepts-200702071356/85/Income-tax-basic-concepts-4-320.jpg)