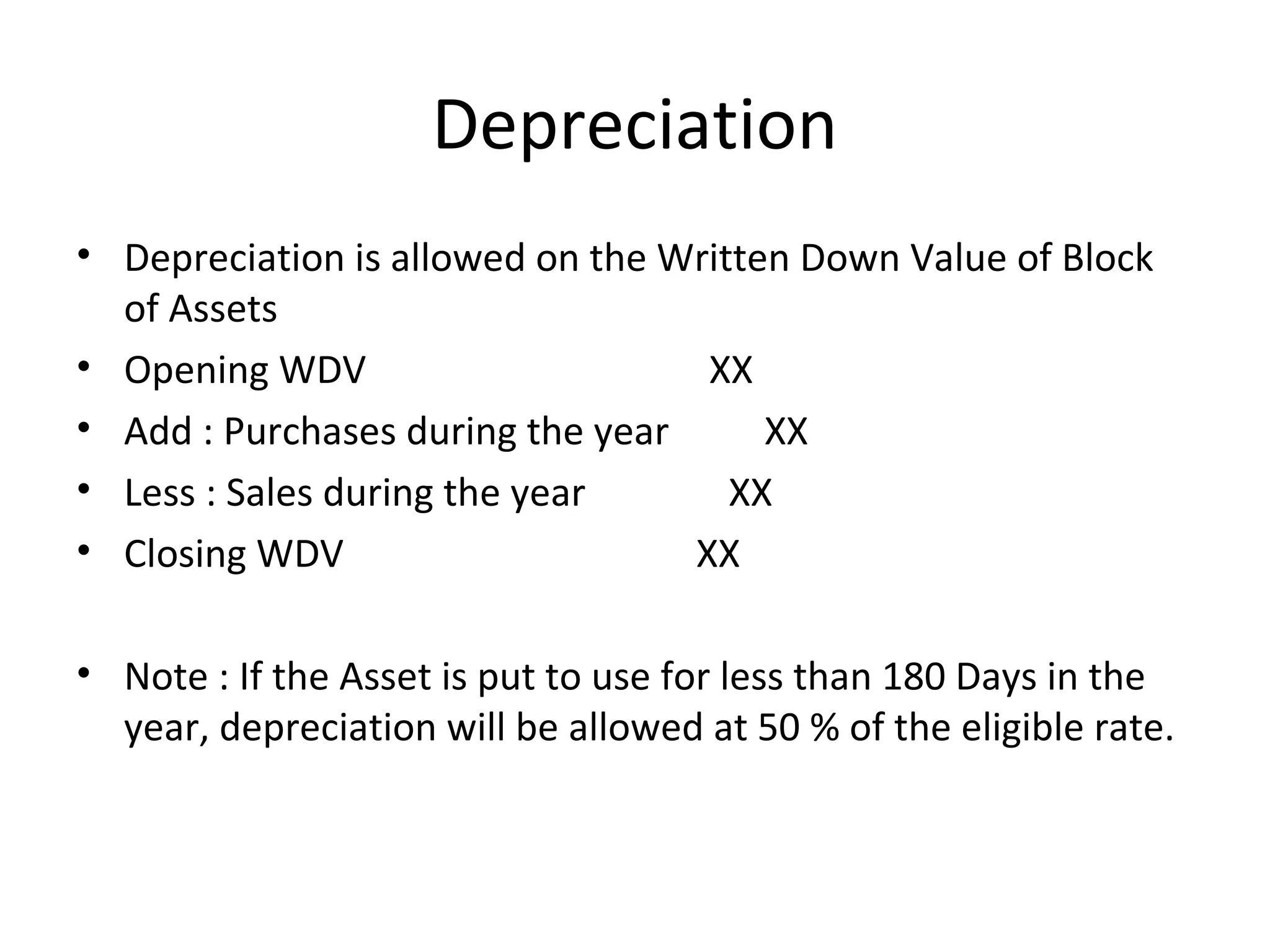

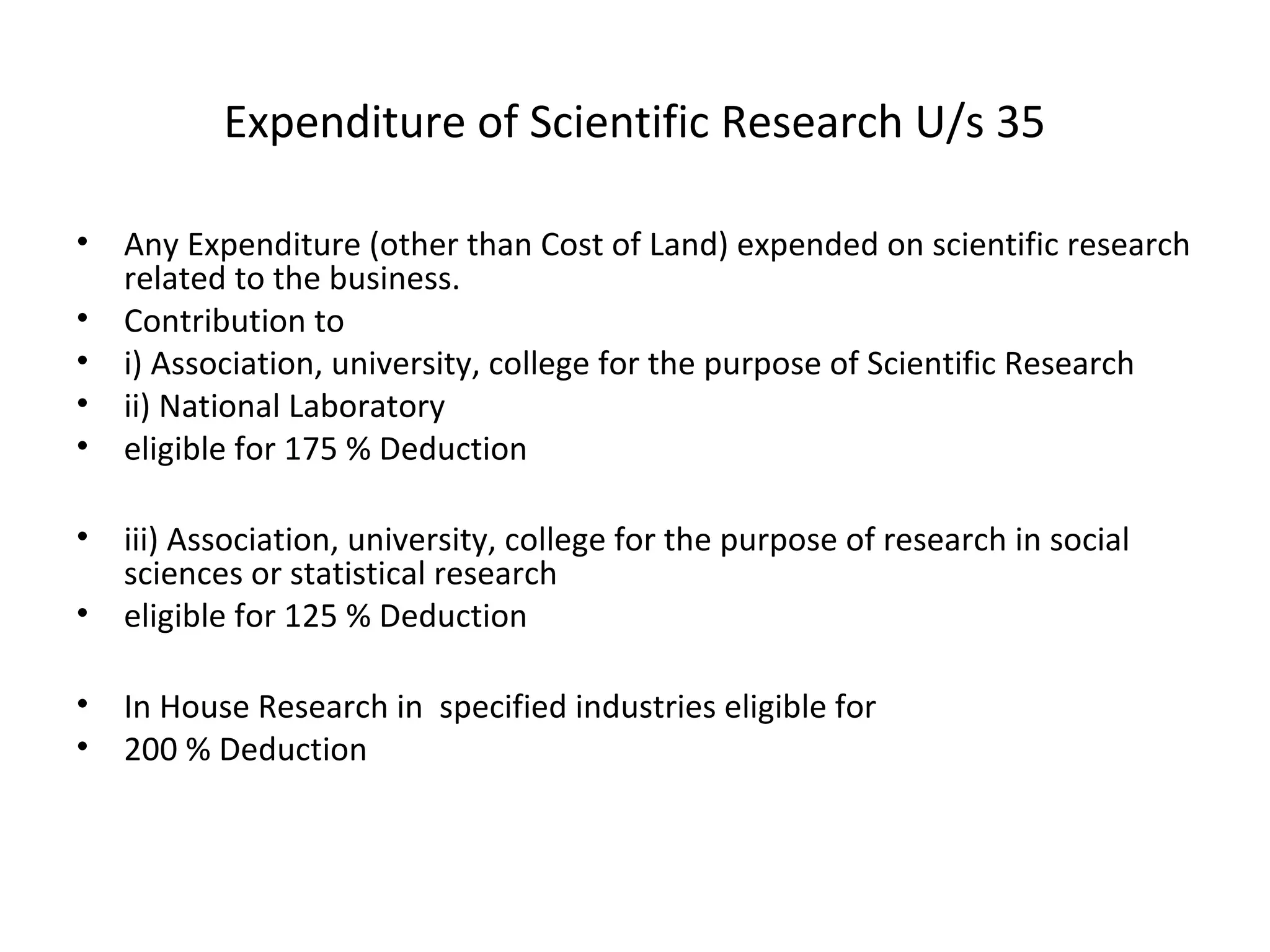

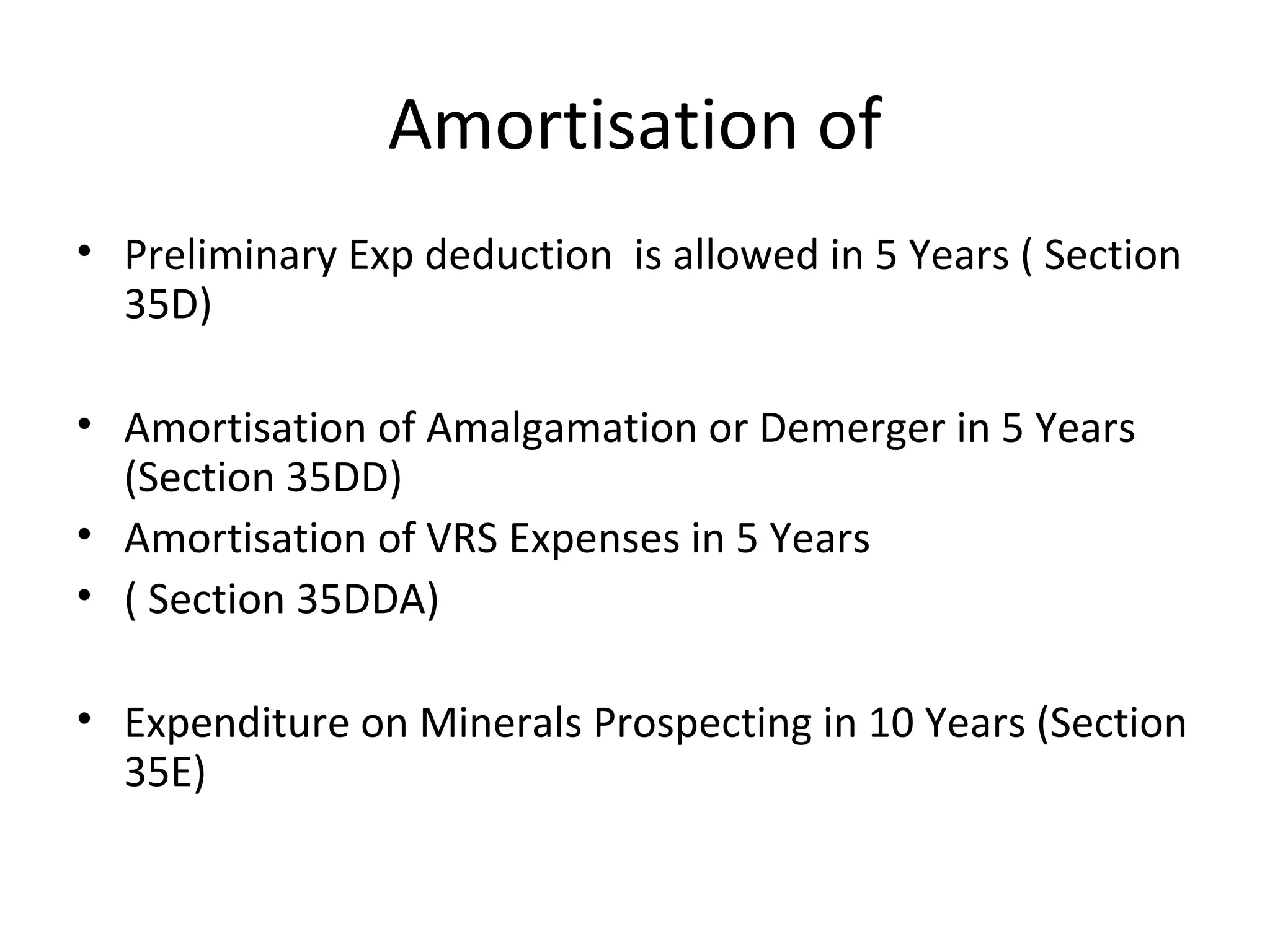

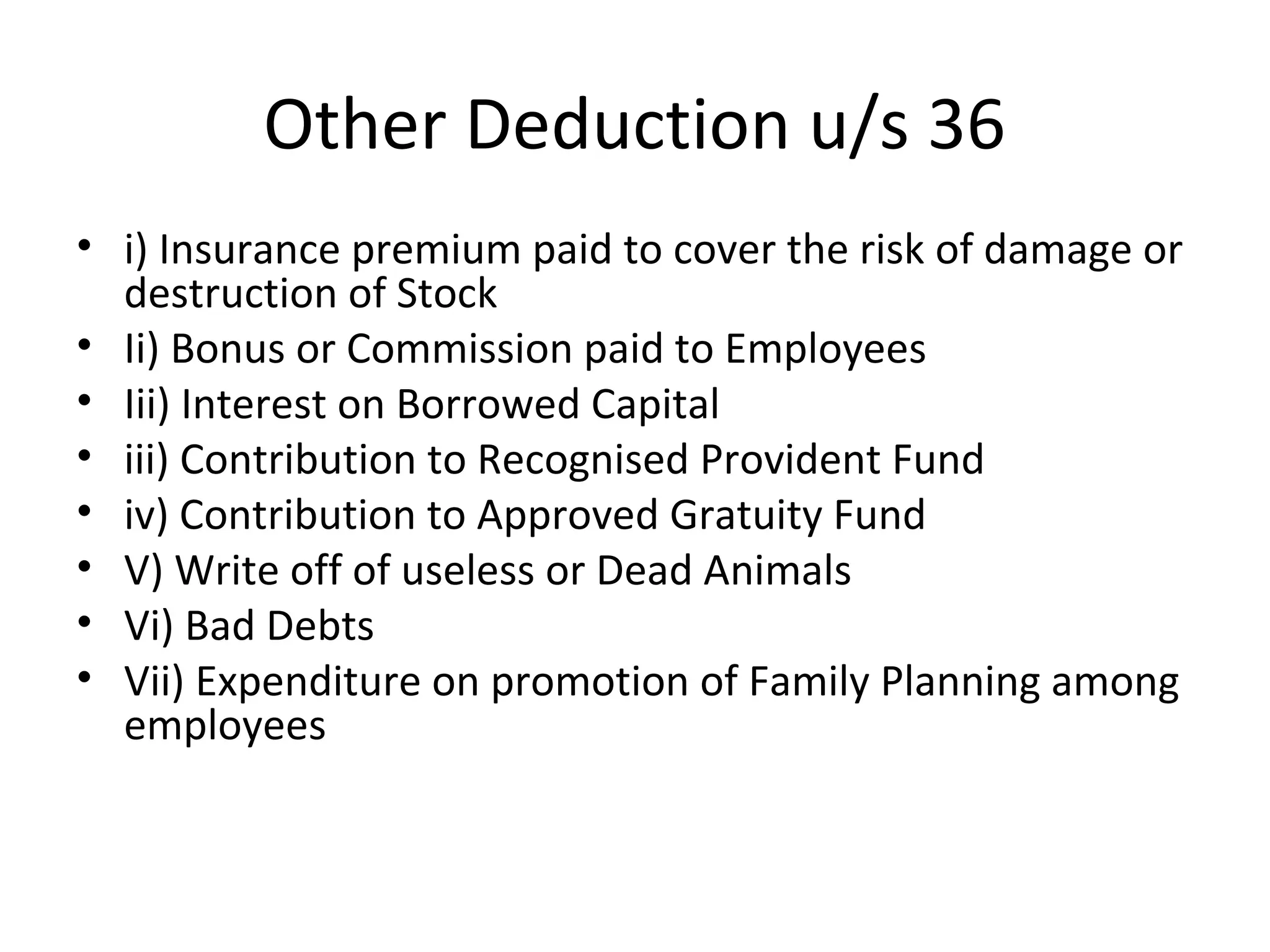

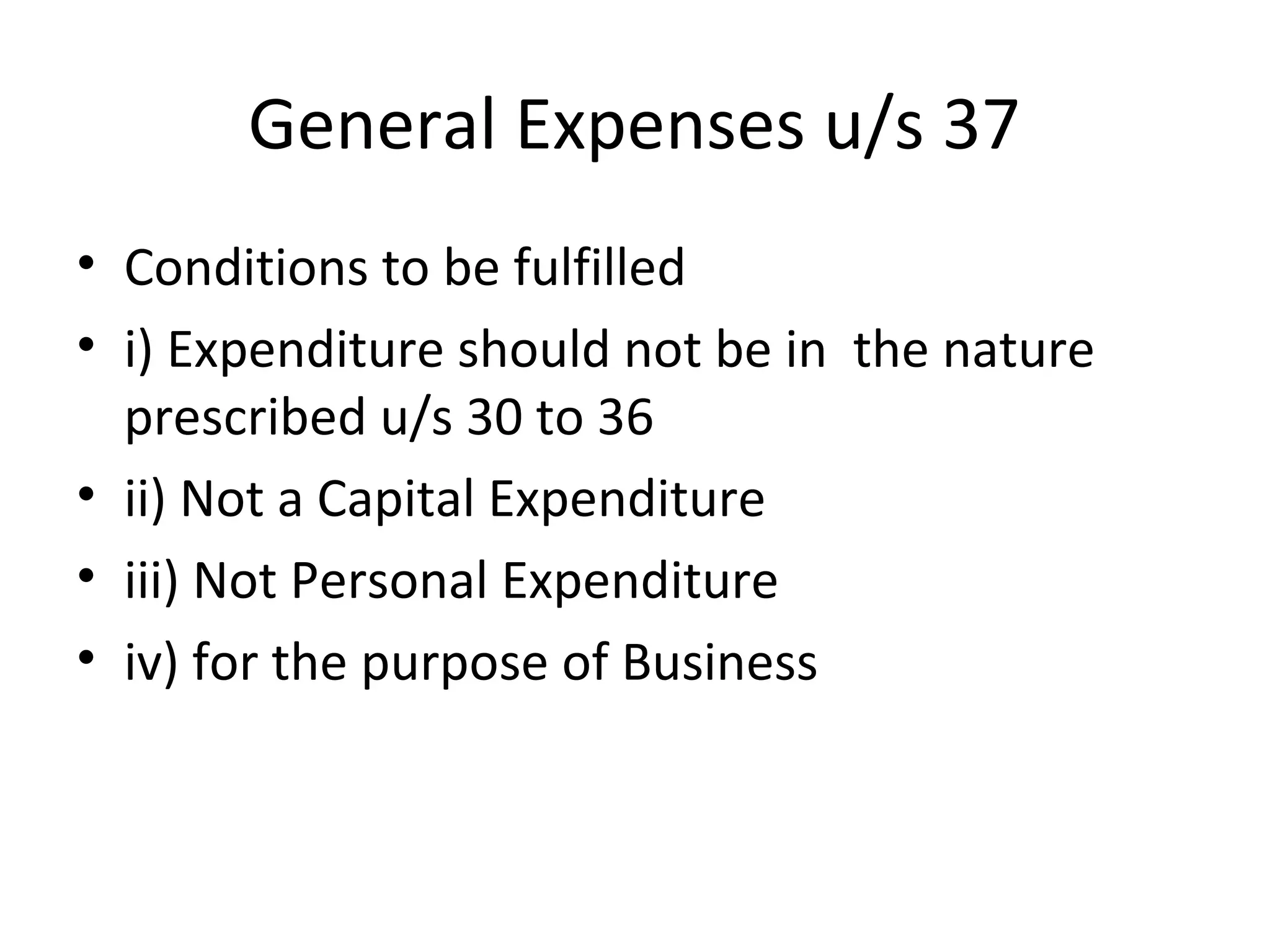

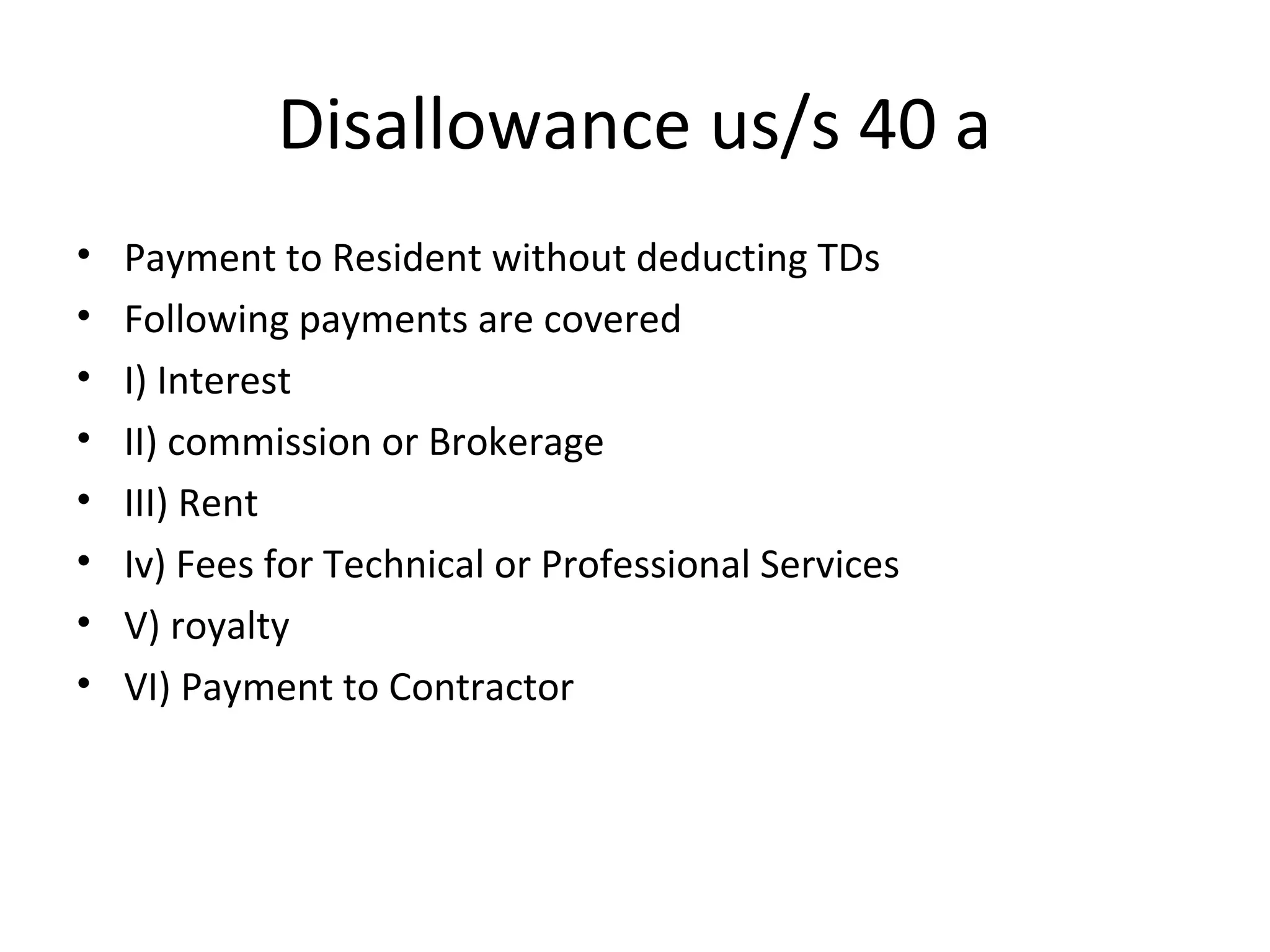

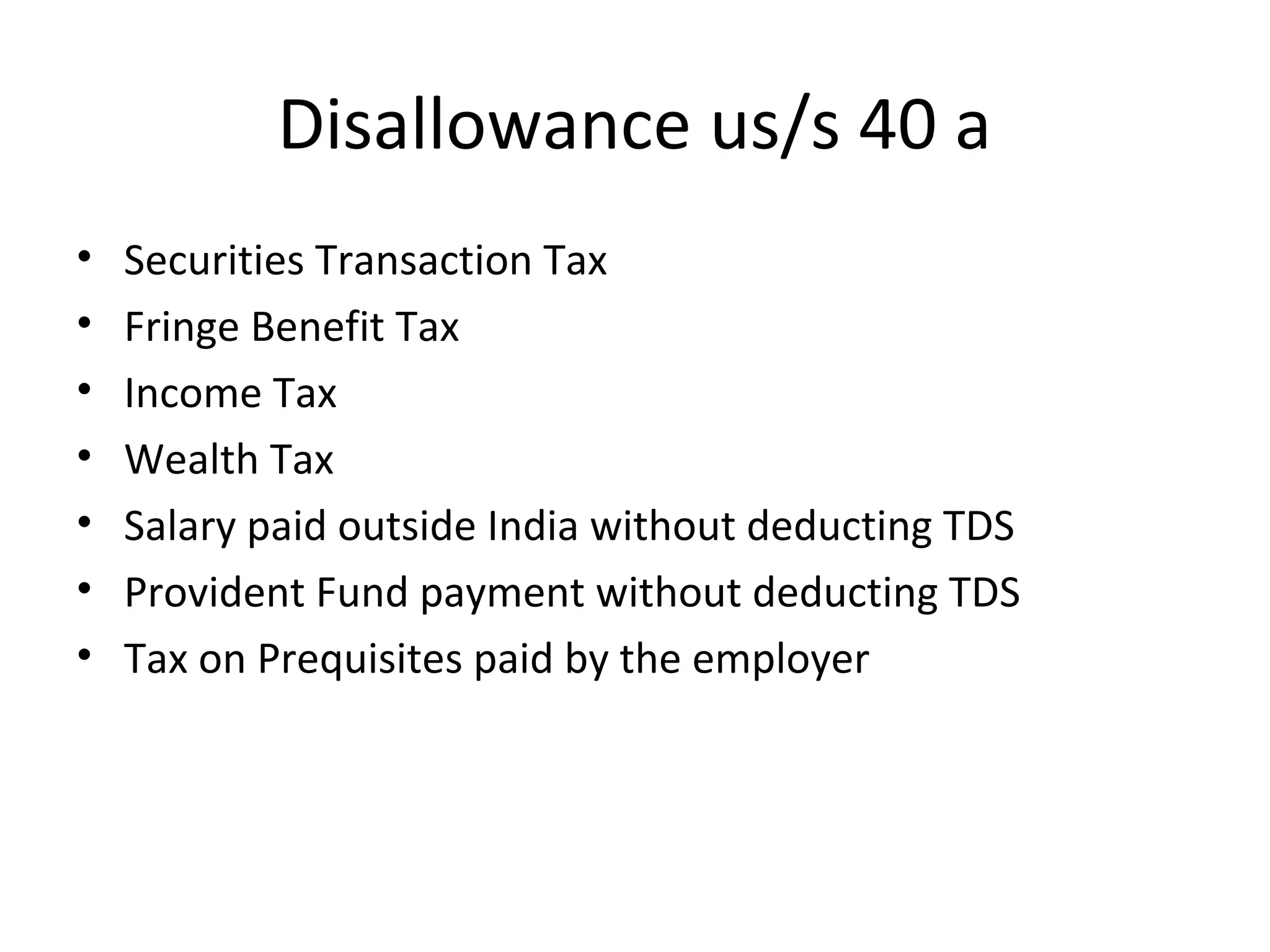

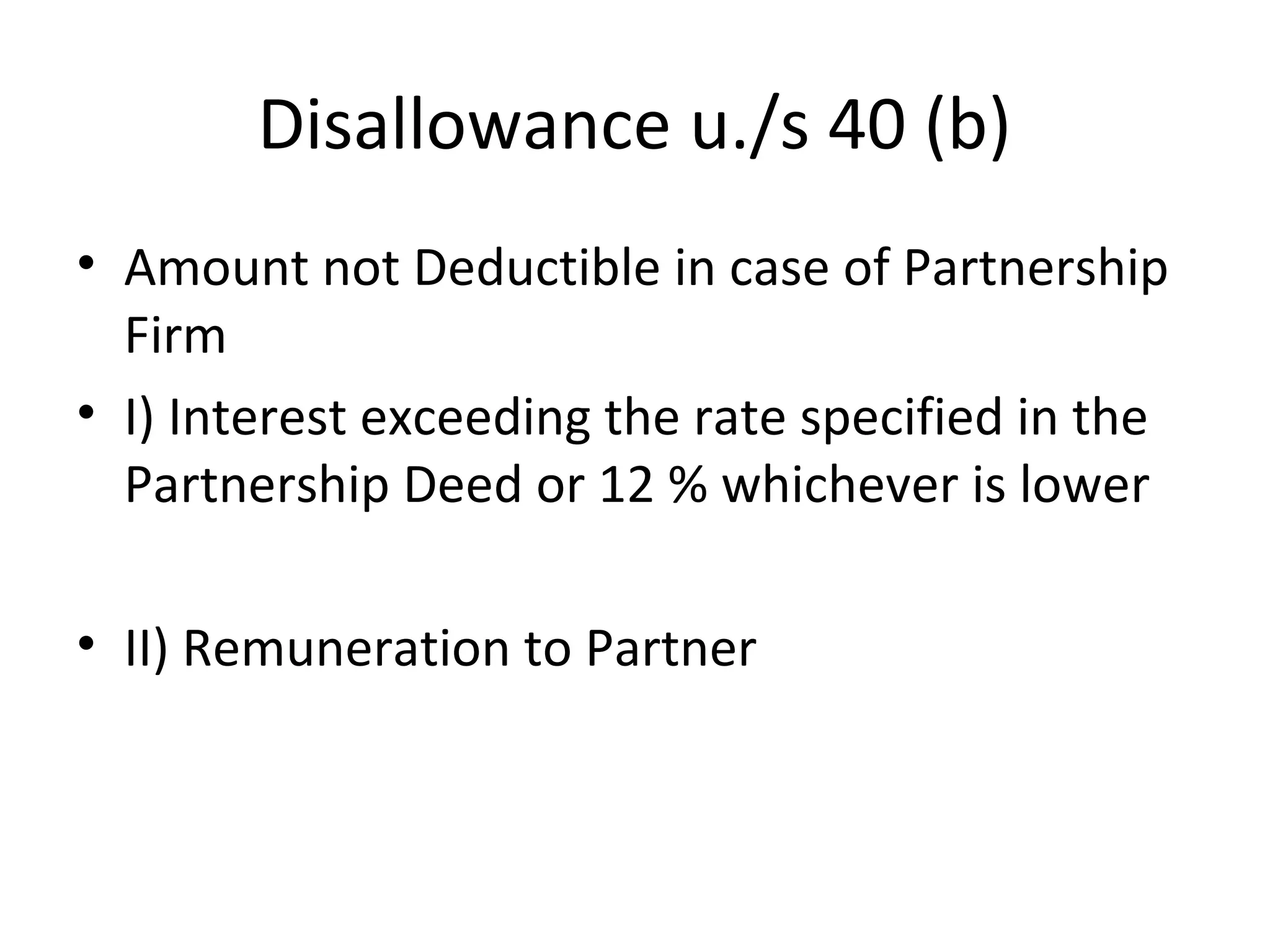

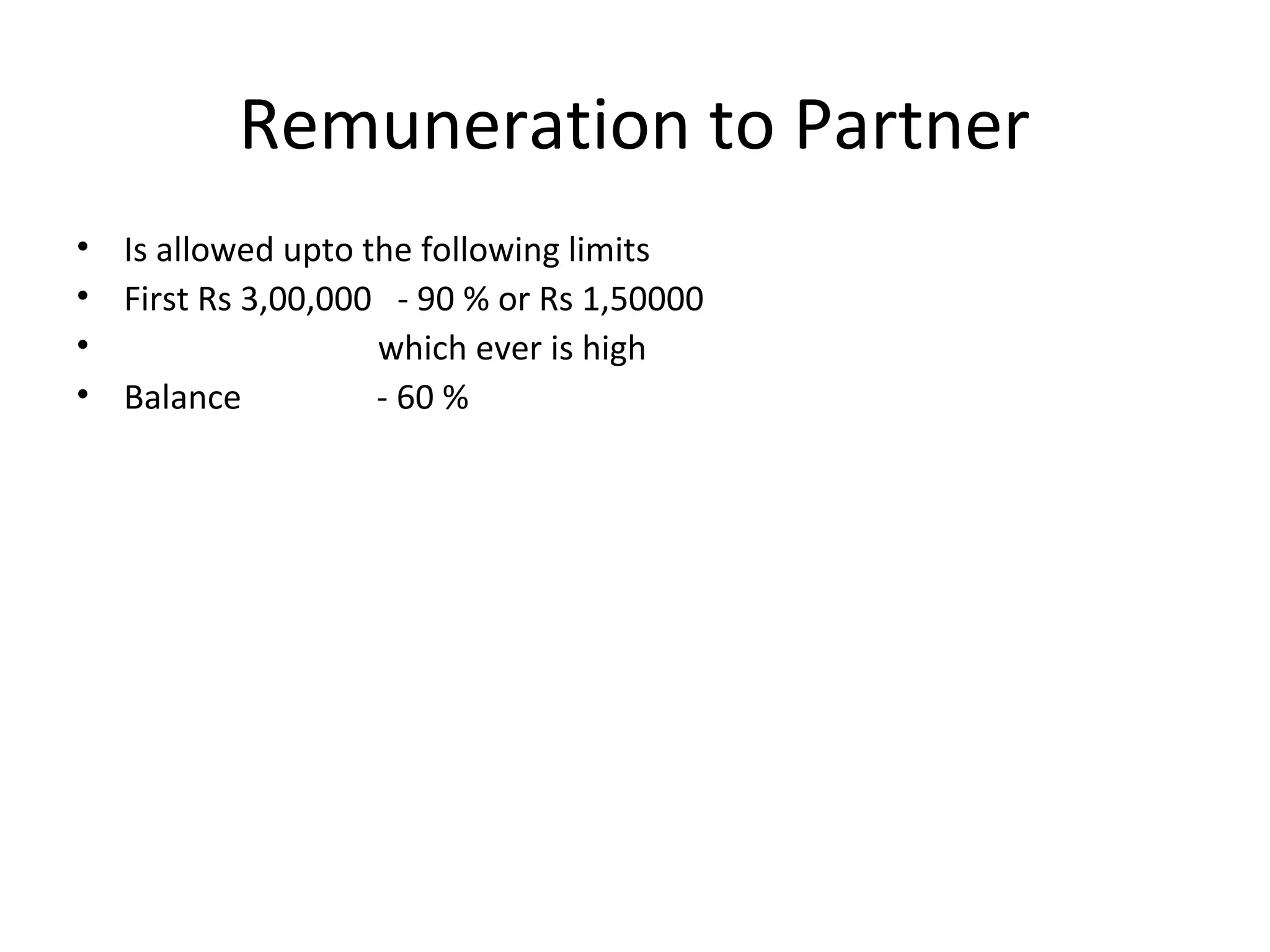

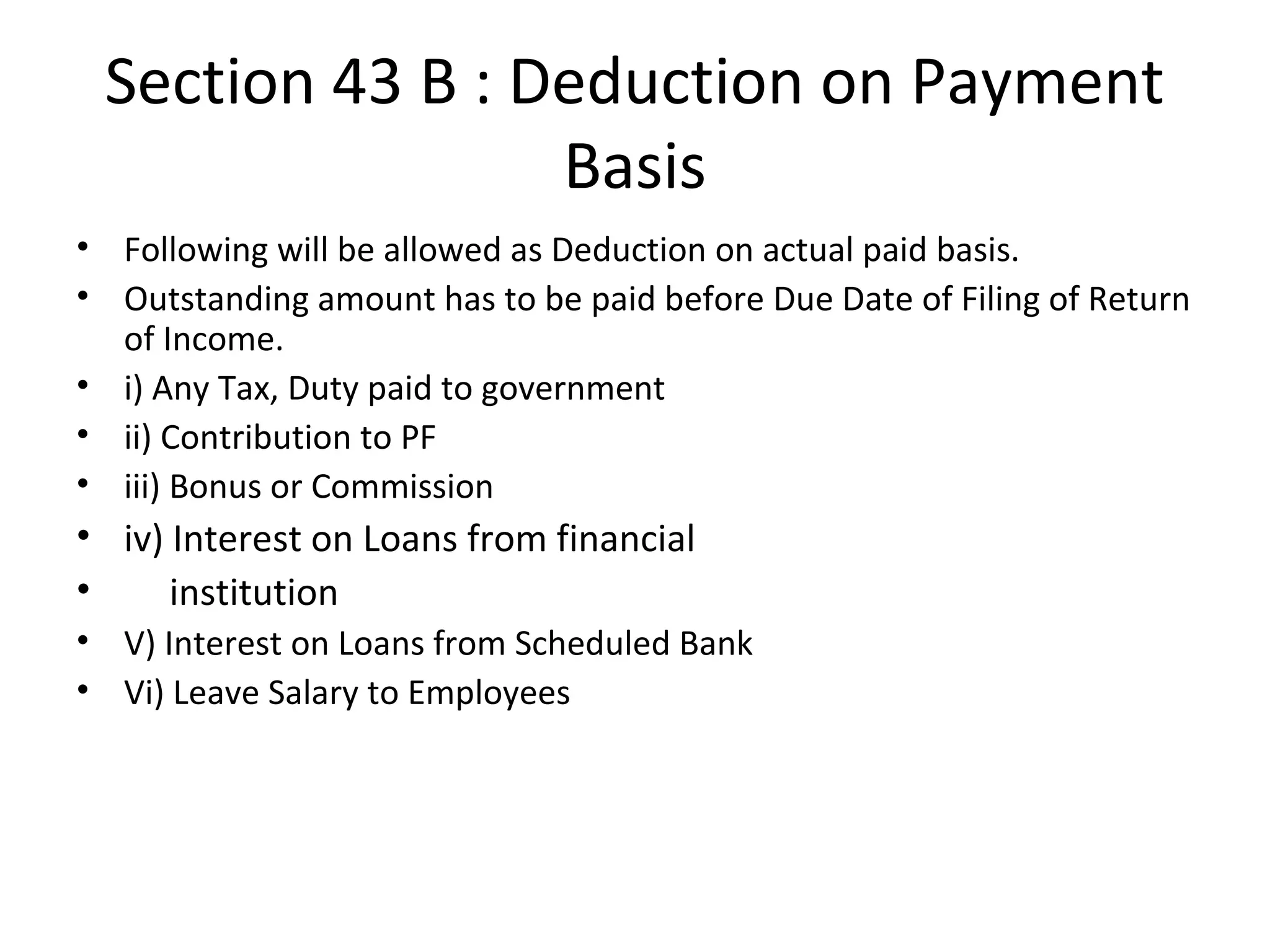

This document provides an overview of income from business and profession under the Income Tax Act. It discusses the various types of income that are taxed under this head, allowable deductions like rent, depreciation, scientific research expenditures, and disallowances. Key points include that income from any business, profession or vocation is taxed, various expenditures are deductible, depreciation is allowed on written down value of blocks of assets, and certain payments must be made by due date to claim deductions.