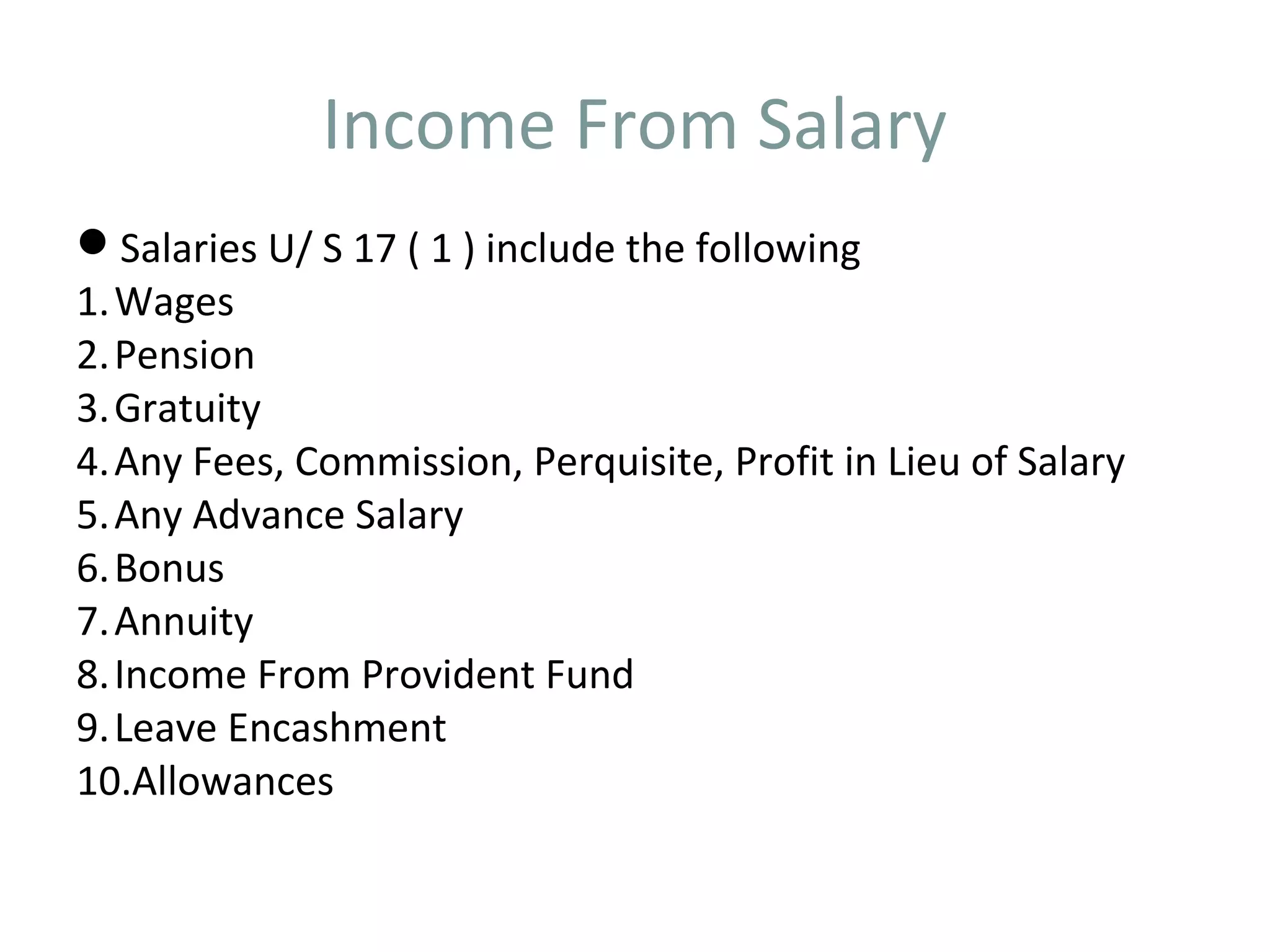

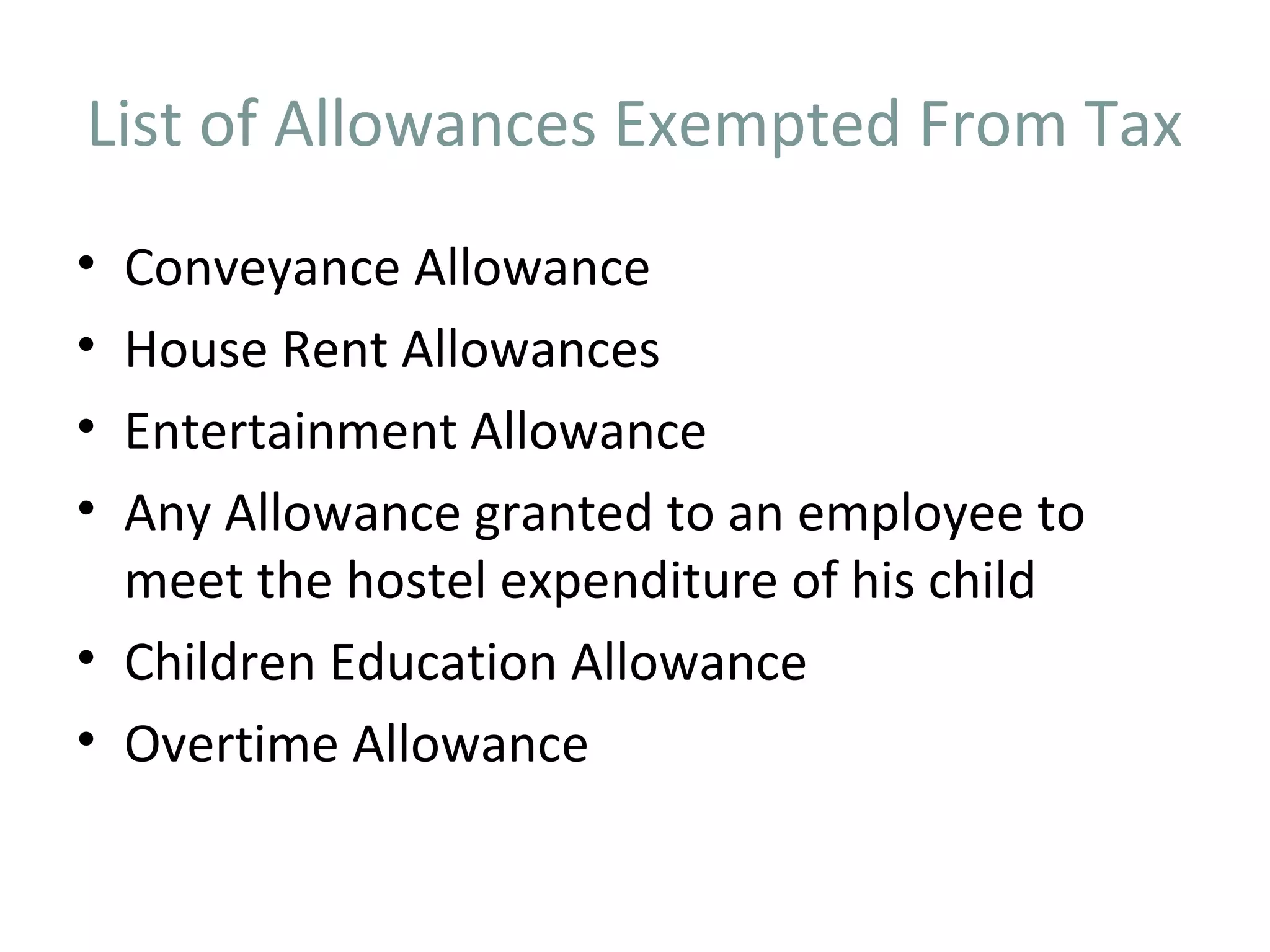

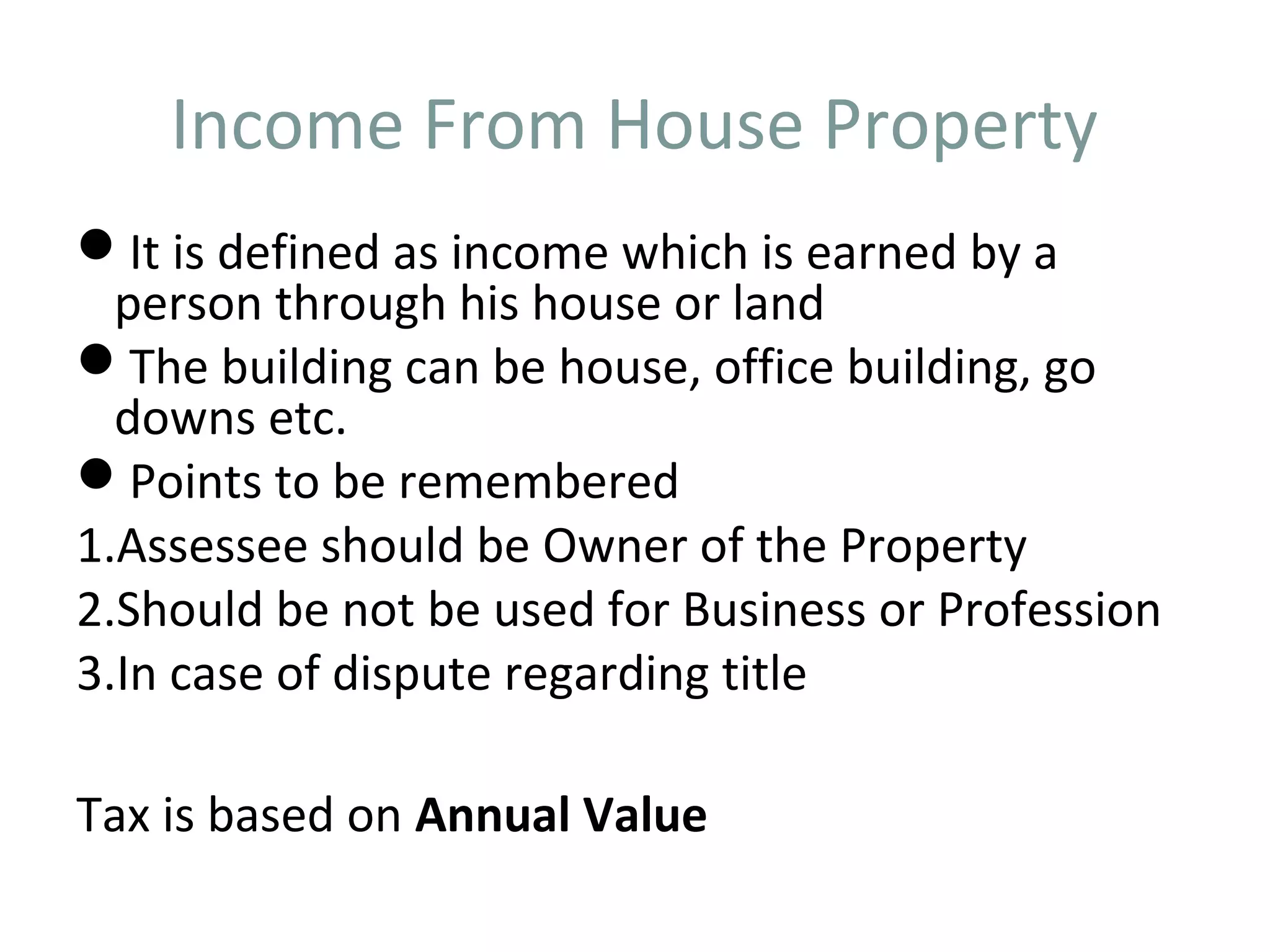

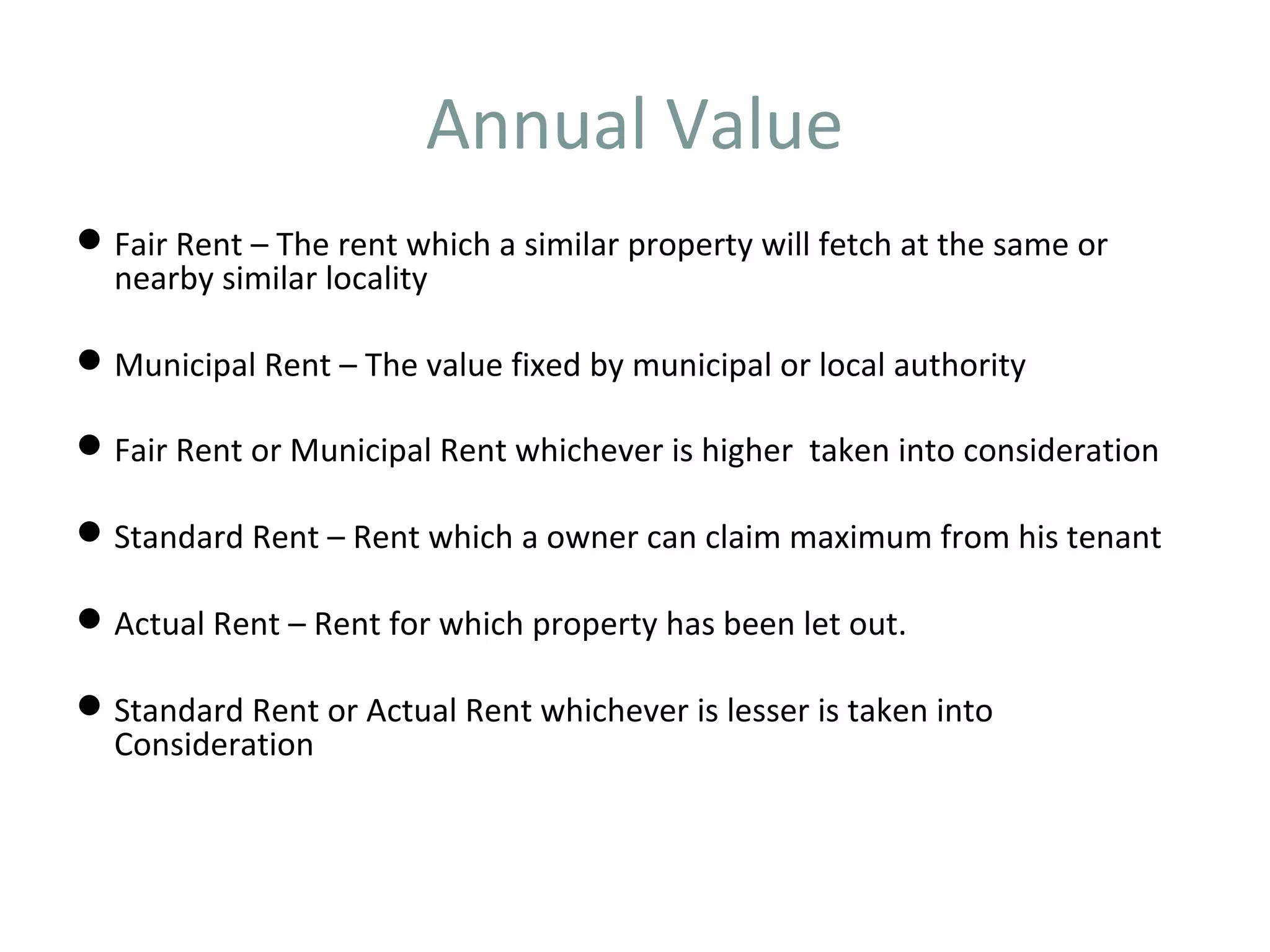

This document outlines the different heads of income under which a person's taxable income is classified and assessed in India. The key heads of income are: salary, house property, profits from business/profession, capital gains, and other sources. It provides details on what constitutes income from each of these heads, such as the types of allowances and deductions included in salary income or the conditions for business/profession income to be taxed.