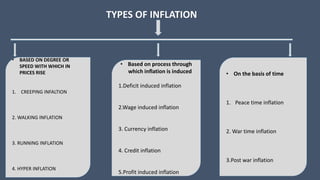

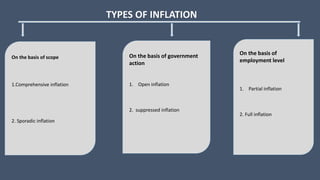

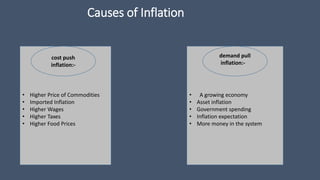

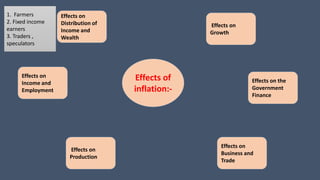

This document discusses various aspects of inflation including definitions, types, causes, effects, and measures to control inflation. It provides information on how inflation is measured using indices like the Consumer Price Index and Wholesale Price Index. Theories on inflation from Keynesian and Monetarist perspectives are presented. The impact of COVID-19 on inflation in India, with food inflation as a major contributing factor, is also summarized.