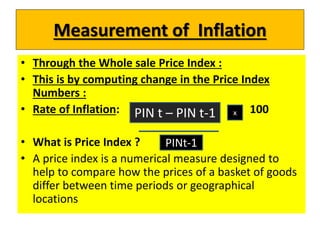

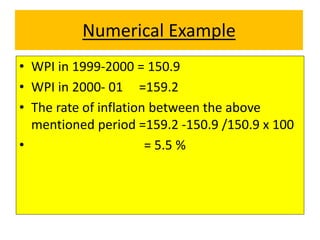

This document discusses inflation, defining it as a persistent increase in the general price level or decline in the real value of money. It categorizes inflation as either price inflation or money inflation and discusses various causes of inflation including increases in money supply, deficit financing, agricultural issues, and inadequate supply growth. It also covers measuring inflation using indexes like WPI and CPI, as well as the effects of inflation on different groups such as consumers, producers, debtors, creditors, wage earners and fixed income groups.