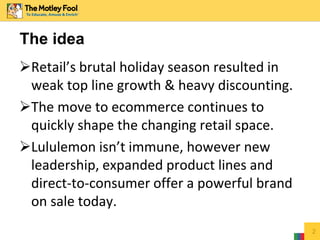

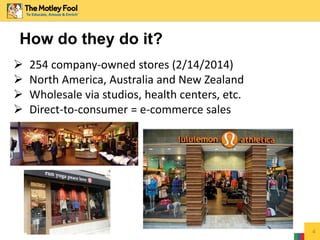

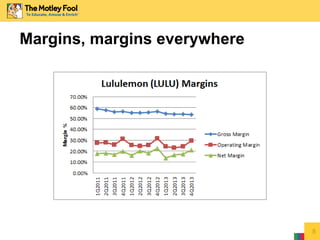

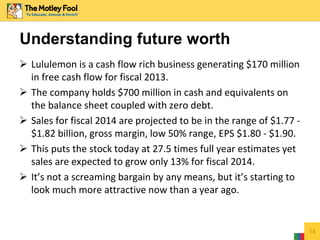

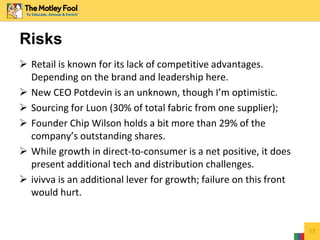

Lululemon faces challenges from a difficult holiday retail season and increasing competition from ecommerce retailers. However, new leadership, expanded product lines, and focus on direct-to-consumer sales provide opportunities for continued growth. The company aims to expand its store base and broaden its customer demographic while growing its ivivva brand. Lululemon has strong margins and cash flow, positioning it for long-term success if it can effectively address changing market conditions.

![18

Founder Chip Wilson is no stranger to controversy. Thankfully

for investors good old Chip decided to step down from the

board.

Risks

“Frankly some women’s bodies just actually don’t work for [wearing

Lululemon pants]… it’s really about the rubbing through the thighs, how

much pressure is there over a period of time, how much they use it,” –

Wilson’s response, when asked by a Bloomberg TV reporter about consumer

complaints related to “pilling” fabric in the yoga pants

“Mediocrity is doing an ‘okay job,’ having a relationship that ‘works,’ being

just ‘a little’ overweight, or having a job that ‘pays the bills.’ … Most people

live in a state of mediocrity. Mediocrity is as close to the bottom as it is the

top.” – Wilson writes in a blog post on Lululemon’s site

“The reason the Japanese liked [my former skateboard brand, ‘Homeless’] was because it had an L in it

and a Japanese marketing firm wouldn’t come up with a brand name with an L in it. L is not in their

vocabulary. It’s a tough pronunciation for them. So I thought, next time I have a company, I’ll make a name

with three Ls and see if I can get three times the money. It’s kind of exotic for them. I was playing with Ls

and I came up with Lululemon. It’s funny to watch them try to say it.” – Wilson in a 2004 interview with

National Post Business Magazine](https://image.slidesharecdn.com/lululemondeck-150108120642-conversion-gate01/85/Lululemon-Deck-18-320.jpg)