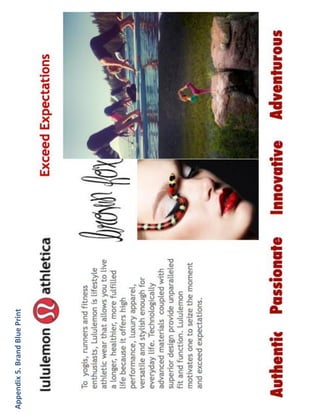

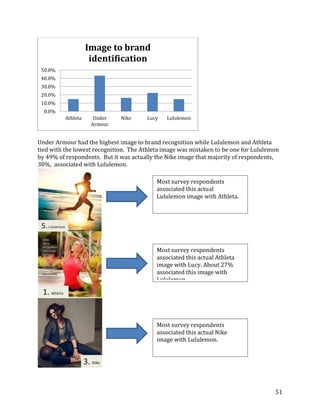

Lululemon is a brand known for high-quality yoga and athletic apparel. It differentiates itself from competitors by focusing on women as consumers and emphasizing community and wellness in its stores and marketing. Lululemon uses innovative fabrics and designs its products to be both stylish and high-performing. The brand communicates through minimal traditional advertising and focuses on interactive marketing like in-store classes and events. Word-of-mouth from ambassadors and customers is an important part of Lululemon's marketing strategy. The brand has been very successful financially and in building a loyal customer base around its focus on health, fitness and lifestyle.

![Brand Inventory

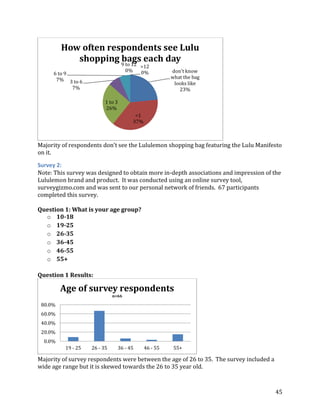

Company History

Lululemon Athletica [Lululemon] was

founded by Denis “Chip” Wilson in

1998, after he took a yoga class and was Figure 1. Brand Word Mark & Logo

swept away by the fitness high, but

disappointed by the ill-fitting cotton clothing people wore. Wilson recognized an

opportunity to change the status quo by using innovative design and athletic fabrics to

create a new offering for customers. Wilson started an underground yoga apparel

movement by offering clothing to instructors and relying on their feedback to grow his

business.1

Lululemon opened its first store location in

Vancouver, Canada in 2000, developing an

environment within the store where

consumers could learn, exchange ideas, and

contribute to a healthy living community

through their love of yoga. The company

soon took this idea of wellness education a

step further, training staff as educators not

only about product performance, but also

health and fitness in general.2 The

Figure 2. Lululemon Store Exterior, Walnut company has now expanded to over 201

Creek, CA locations, with stores in the United States,

Australia, and New Zealand and

showrooms in Hong Kong and Great Britain. The company’s huge success led it to go

public in July 20073.4

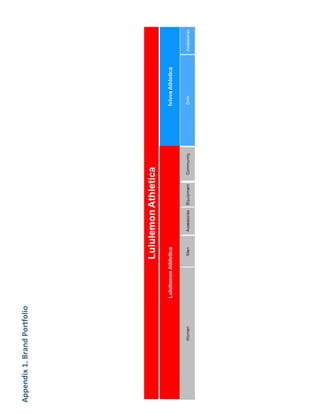

In the fall of 2009, the company expanded and launched

Ivivva Athletica, a subsidiary that targets a younger

female demographic - girls ages 6-12 years old. Ivivva

Athletica currently has 7 locations, which are located in

Canada and the United States.5

Brand Offering

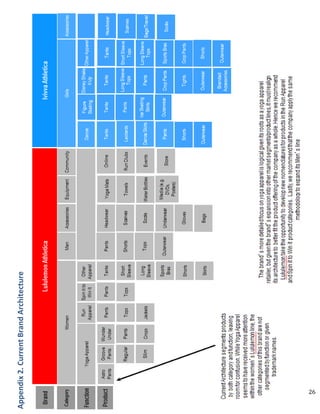

Since 1998, the company has expanded its product portfolio beyond its original niche

offering to include men’s apparel and products designed specifically for activities such as

1

our history | lululemon athletica. (n.d.). yoga clothes & running gear for sweaty workouts | lululemon athletica. Retrieved

October 25, 2012, from http://www.lululemon.com/about/history

2

ibid

3

Hutchinson, T. H. (2011, January 31). The World's Hottest Retail Stock Has Room to Run - NASDAQ.com. Home - NASDAQ

Community. Retrieved November 18, 2012, from http://community.nasdaq.com/News/2011-02/the-worlds-hottest-retail-

stock.aspx?storyid=55806#.UK0ZzkJ-jPo

4

"Dennis "Chip" Wilson, founder of Lululemon Athletica, presides over the opening bell". Nasdaq. Retrieved 2012-07-29.

5

Form 10-Q

4](https://image.slidesharecdn.com/lululemonfinalbrandaudit-130222172449-phpapp01/85/Lululemon-Brand-Audit-4-320.jpg)