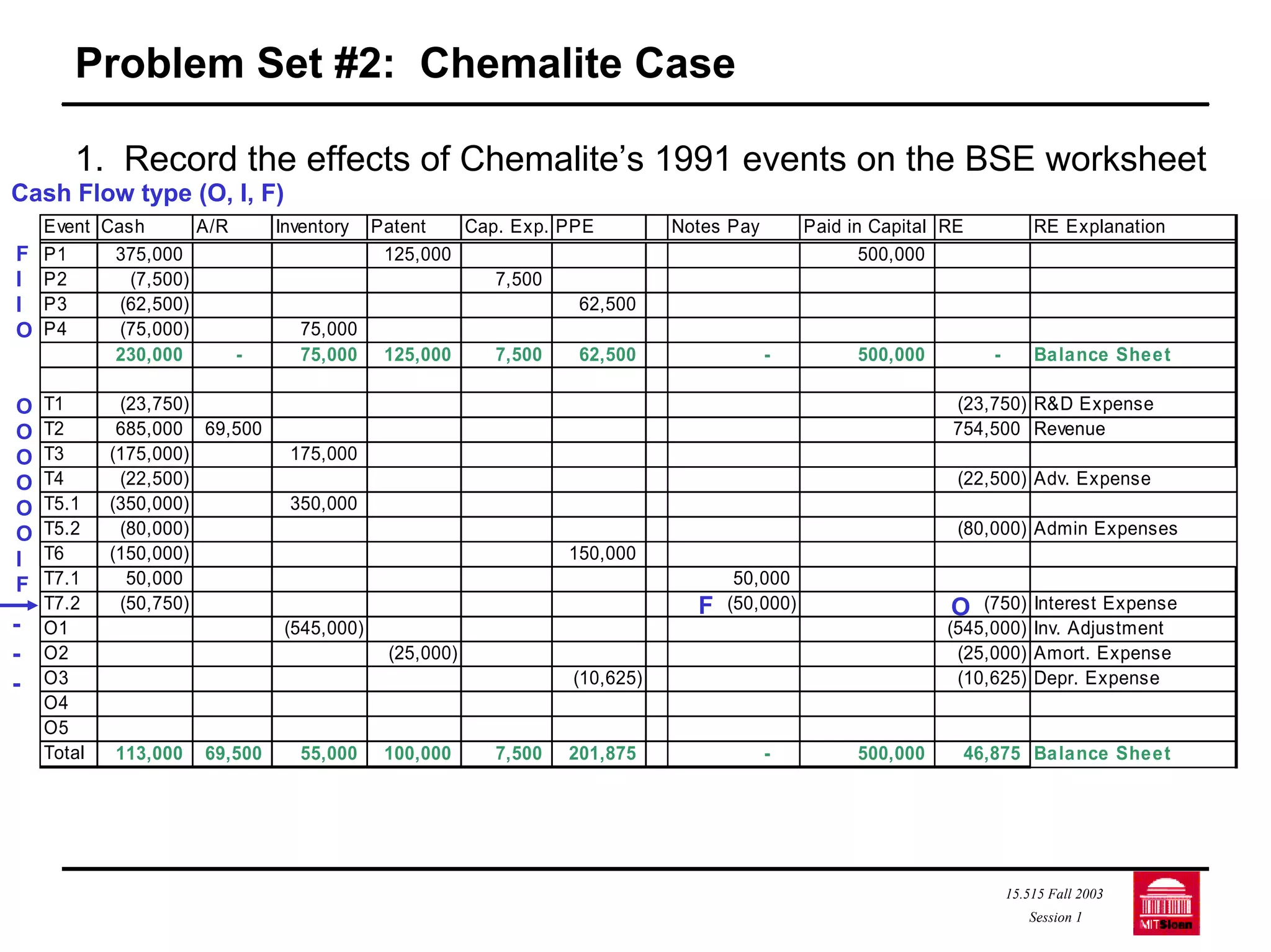

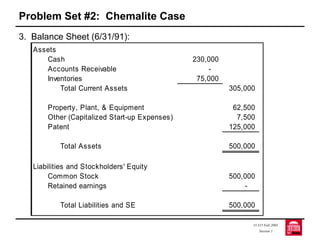

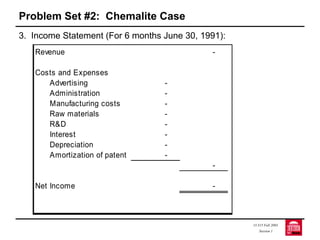

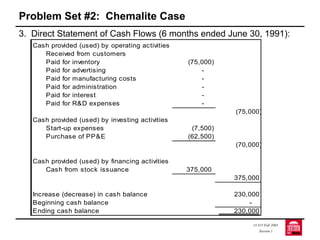

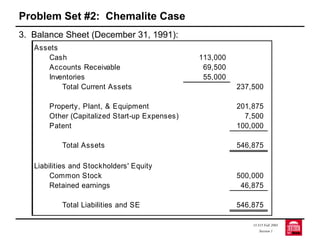

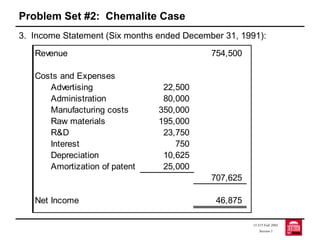

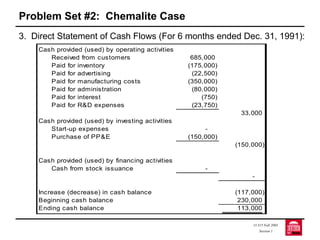

This document contains accounting information for Chemalite for 1991, including balance sheets, income statements, and statements of cash flows for the periods ended June 30, 1991 and December 31, 1991. It records various business transactions that affected Chemalite's assets, liabilities, equity, revenues and expenses. The ending balances on the December 31 statements show cash of $113,000, total assets of $546,875, total equity of $546,875, net income of $46,875 and ending cash balance of $113,000.