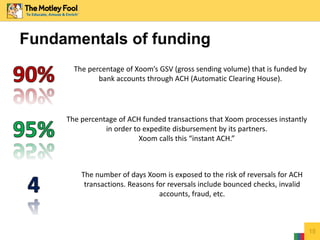

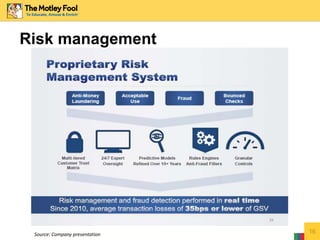

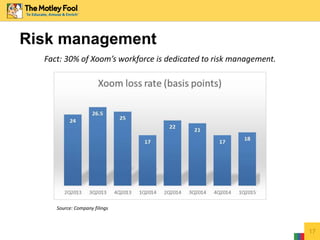

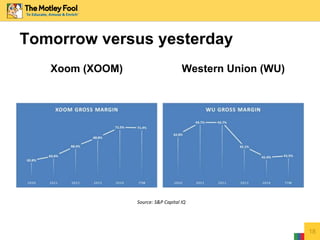

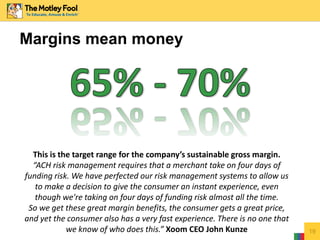

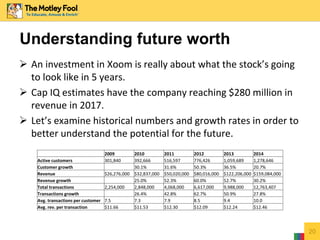

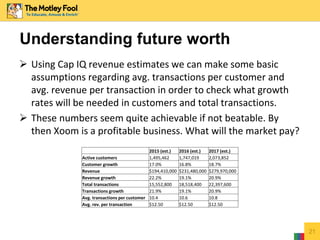

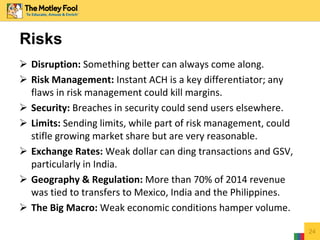

Xoom provides online money transfer services, focusing on transfers from the US to 33 other countries. It has a large market opportunity as the global remittance market was over $600 billion in 2014. Xoom's digital platform, capital light business model, and risk management system make it a compelling investment. Its ability to provide instant transfers while minimizing risk allows for strong margins between 50-60%. Growth has been significant in recent years and estimates have revenue reaching $280 million by 2017 if trends continue.