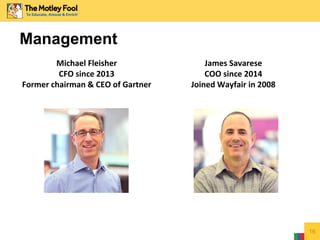

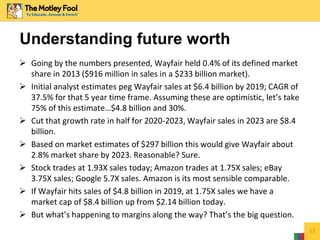

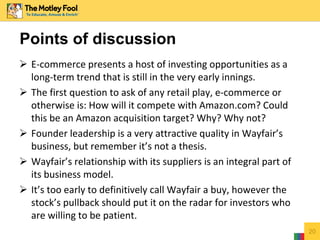

This document discusses Wayfair, an e-commerce company that sells home goods and furnishings online. It notes that Wayfair has a unique advantage as an e-commerce-only company in a growing market. The document outlines Wayfair's business model, metrics, management team, competition in the space, and risks facing the company. It concludes that while Wayfair faces challenges in competing against Amazon and sensitivity to economic conditions, its focus on e-commerce early on and founder leadership are attractive qualities for potential long-term investors.