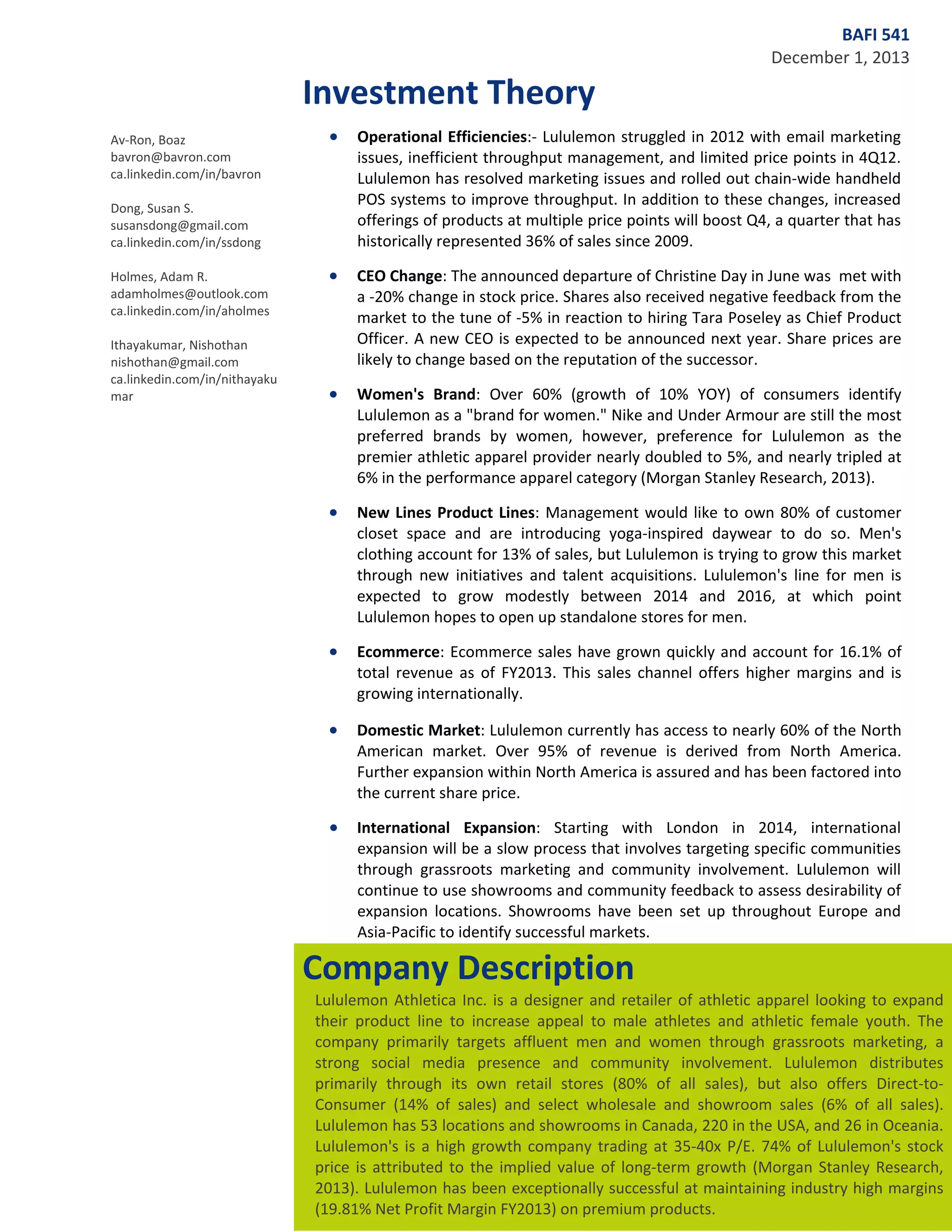

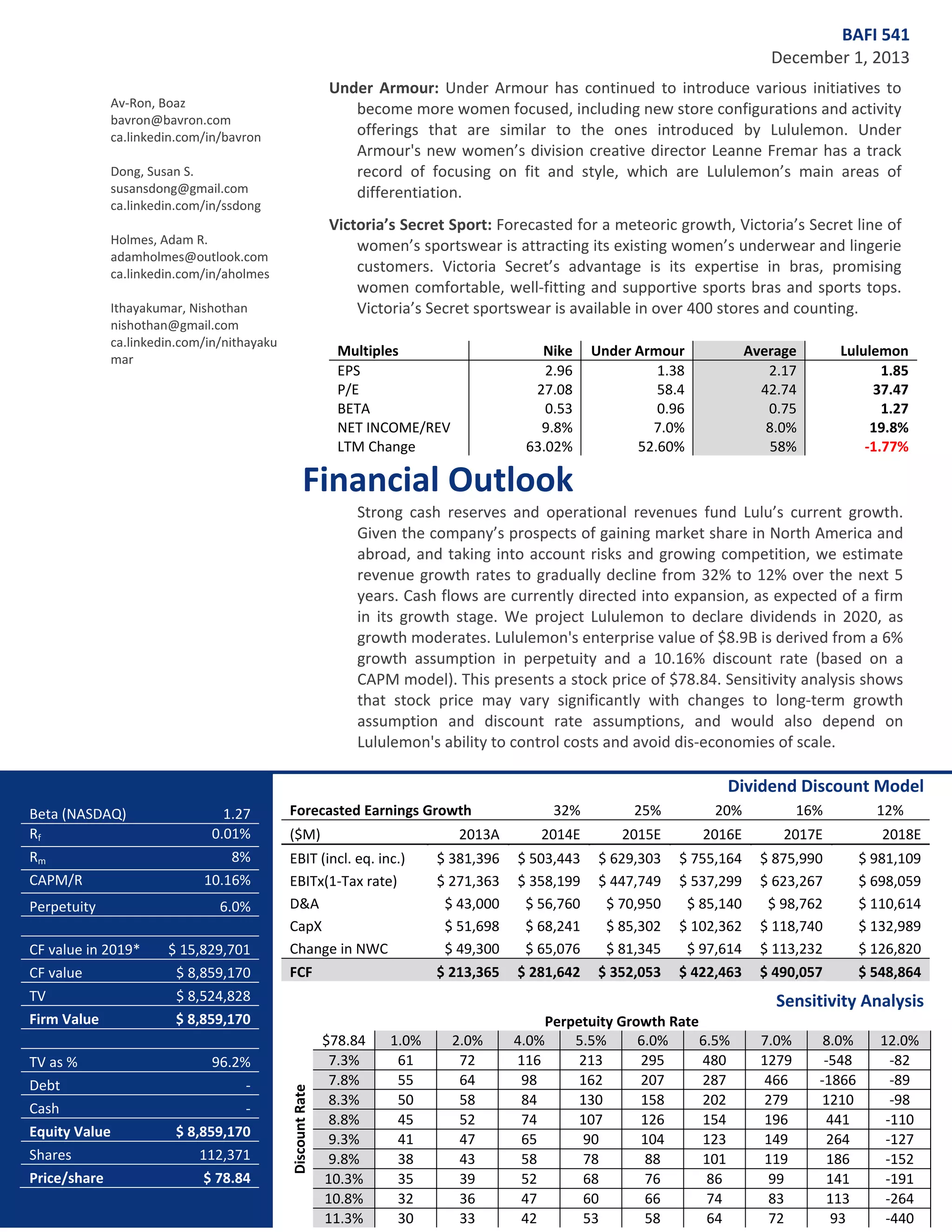

The document provides an analysis and rating for lululemon athletica inc. It initiates coverage with a BUY rating and a December 2014 price target of $78.84. It anticipates the company's valuation will return to higher levels in absence of further negative news in 2014 after controversies in 2013 depressed the stock price. Key points include Lululemon addressing challenges from 2013 and implementing strategies to increase same-store sales. International expansion and growth of the men's line are seen as growth catalysts, while financial performance is currently strong with high margins and sales per square foot. Risks include leadership uncertainty, quality issues, intensifying competition and limits to expanding brand identity.