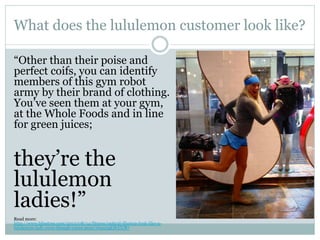

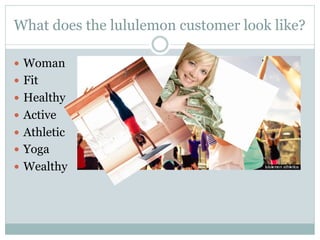

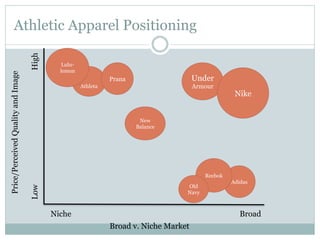

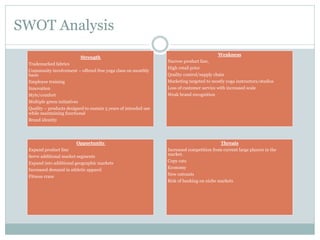

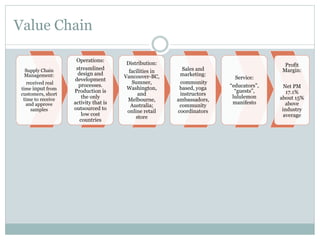

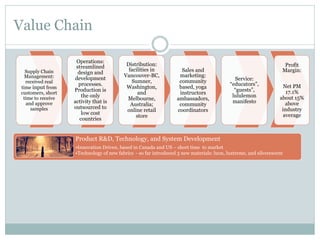

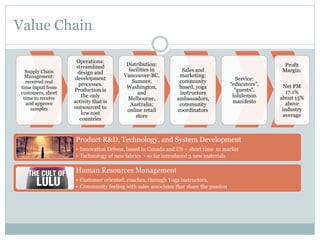

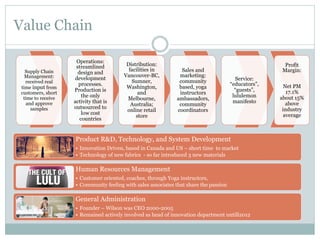

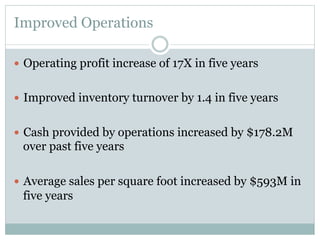

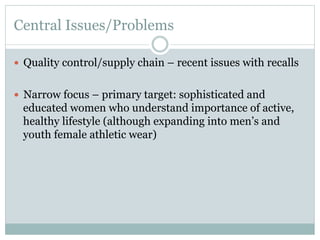

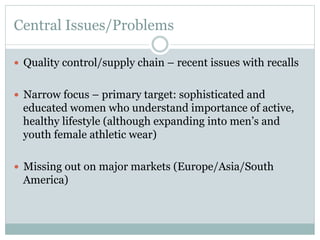

This document summarizes information about lululemon athletica, a designer and retailer of high-end yoga inspired athletic wear. It discusses that lululemon was founded in 1998 in Vancouver, British Columbia by Chip Wilson as a yoga studio and has since expanded to locations across North America and Australia. The typical lululemon customer is described as a wealthy, educated, fit, healthy, active woman who is interested in yoga. Competitive forces, SWOT analysis, value chain, and other strategic aspects of lululemon's business are also summarized.