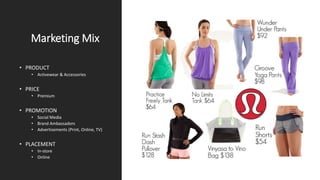

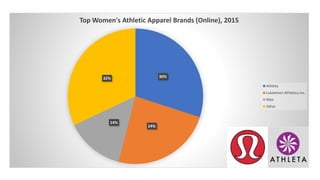

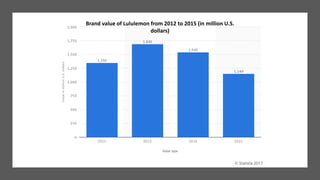

Lululemon, founded in 1998 by Chip Wilson, specializes in fashionable athleisure apparel aimed primarily at women, with growing focus on men and children. The company, which operates 350 stores globally and reported nearly $1 billion in profit in 2015, faces competition from major brands like Nike and Adidas while benefiting from trends in health consciousness and the casualization of fitness wear. Recommendations for growth include diversifying product lines, introducing a loyalty rewards program, and leveraging celebrity endorsements.