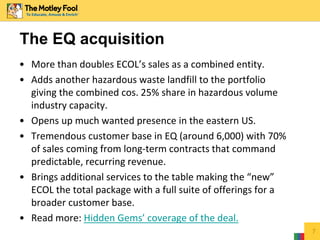

US Ecology provides hazardous, non-hazardous, and radioactive waste treatment, disposal, and recycling services. Its recent acquisition of The Environmental Quality Co. doubled its sales by adding assets like a hazardous waste landfill and expanding its customer base to over 6,000. The acquisition makes US Ecology a fully integrated environmental services provider with predictable recurring revenue from long-term contracts. The regulated nature of hazardous waste disposal in the US creates high barriers to entry and switching costs for customers.