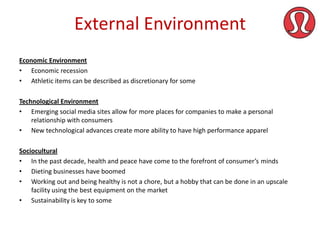

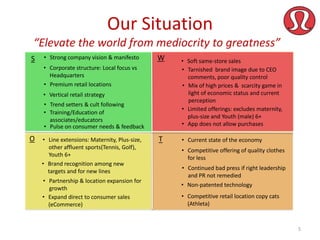

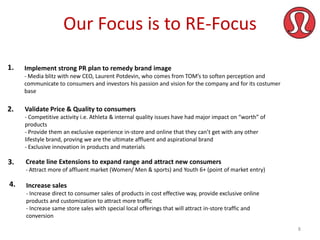

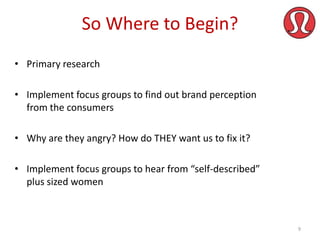

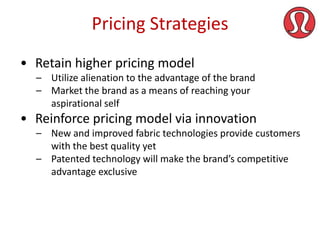

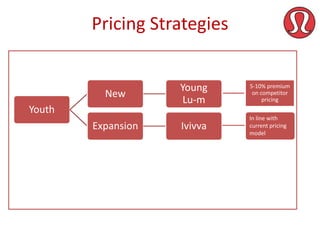

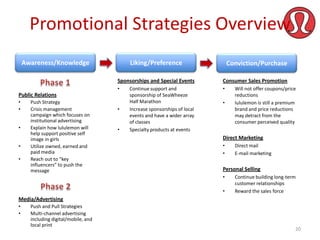

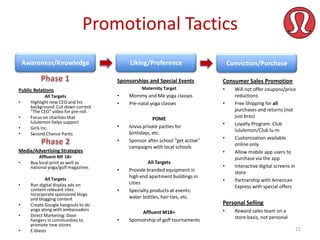

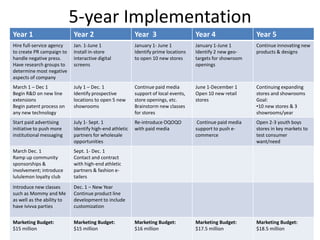

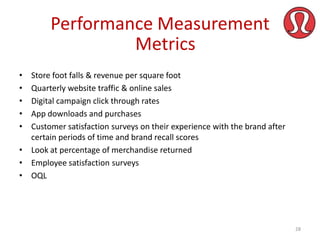

This marketing plan summary outlines Lululemon's situation, target markets, and marketing strategies. Lululemon aims to remedy its damaged brand image through PR initiatives and by validating its pricing and quality. Its target markets are affluent men and women ages 18+ who engage in active lifestyles. The plan proposes expanding product lines to include maternity, plus sizes, and youth apparel. Marketing strategies include sponsoring events, loyalty programs, store expansion, and growing e-commerce. Implementation will occur over 5 years through new product launches, advertising, partnerships, and performance measurement.

![At a Glance

•

Born out of a desire to provide high

quality and comfortable clothing to yogi's

with a manifesto (core values)

encouraging health, wellness, strength

and community

•

Heavily supports and empowers local

stores and employees to drive business

•

Only yoga-wear brand that has built its

brand image and profitable success

without sales/discounts & driving scarcity

•

Within the last year, foreseeable profit

and brand image nose dive due to bad

press and poor product execution

•

Leadership changes: Out with the old

CEO Christine Day, in with the

New, Laurent Potdevin

"Frankly some women's

bodies just don't actually

work for [the pants]."

3](https://image.slidesharecdn.com/lululemonmarketingplan-revised-140208075923-phpapp01/85/Lululemon-marketing-plan-revised-3-320.jpg)