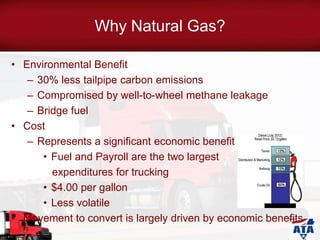

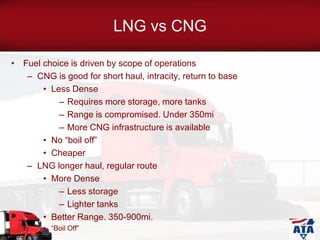

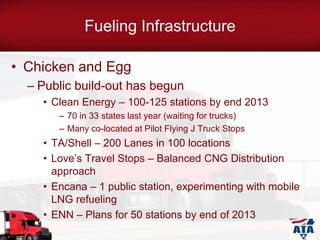

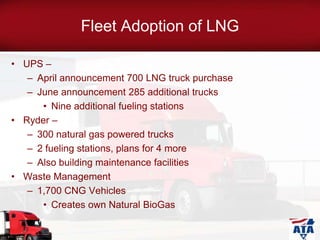

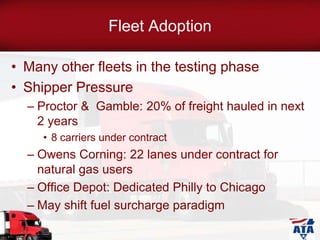

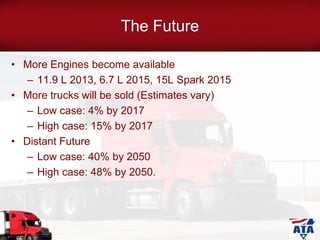

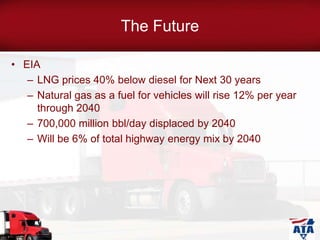

This document discusses the use of liquefied natural gas (LNG) as a fuel for trucks. It notes that LNG produces 30% fewer tailpipe carbon emissions than diesel fuel and represents a significant cost savings. While LNG is more dense than compressed natural gas (CNG), allowing for better vehicle range, it also requires more expensive infrastructure and vehicle modifications. The document outlines factors to consider when choosing between LNG and CNG, such as vehicle costs, engine types, weight and space requirements, and fuel availability. It predicts increasing adoption of LNG trucks and fueling stations in coming years, driven by economic benefits and pressure from shippers, with natural gas potentially displacing 12% of diesel fuel used for trucks