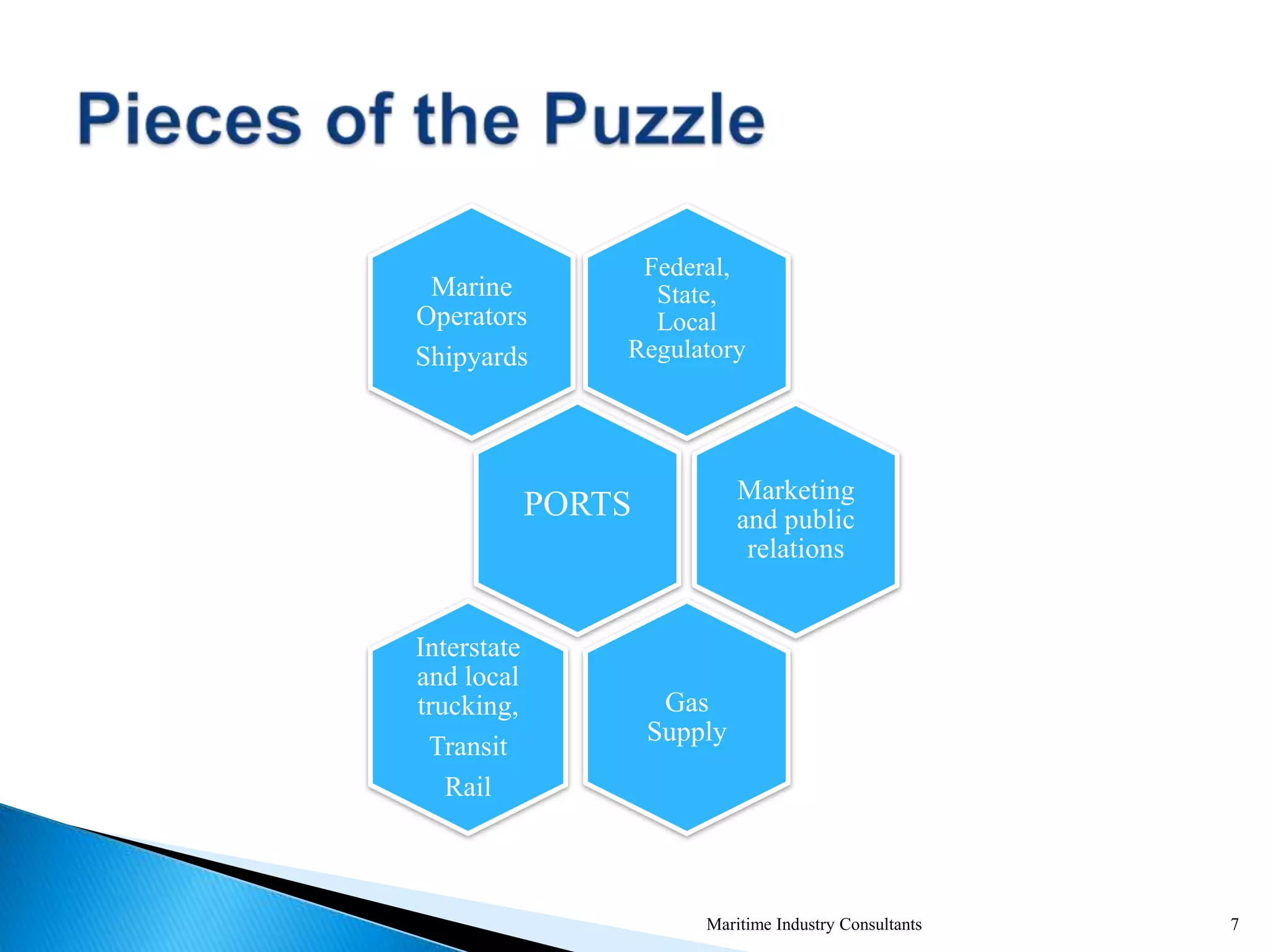

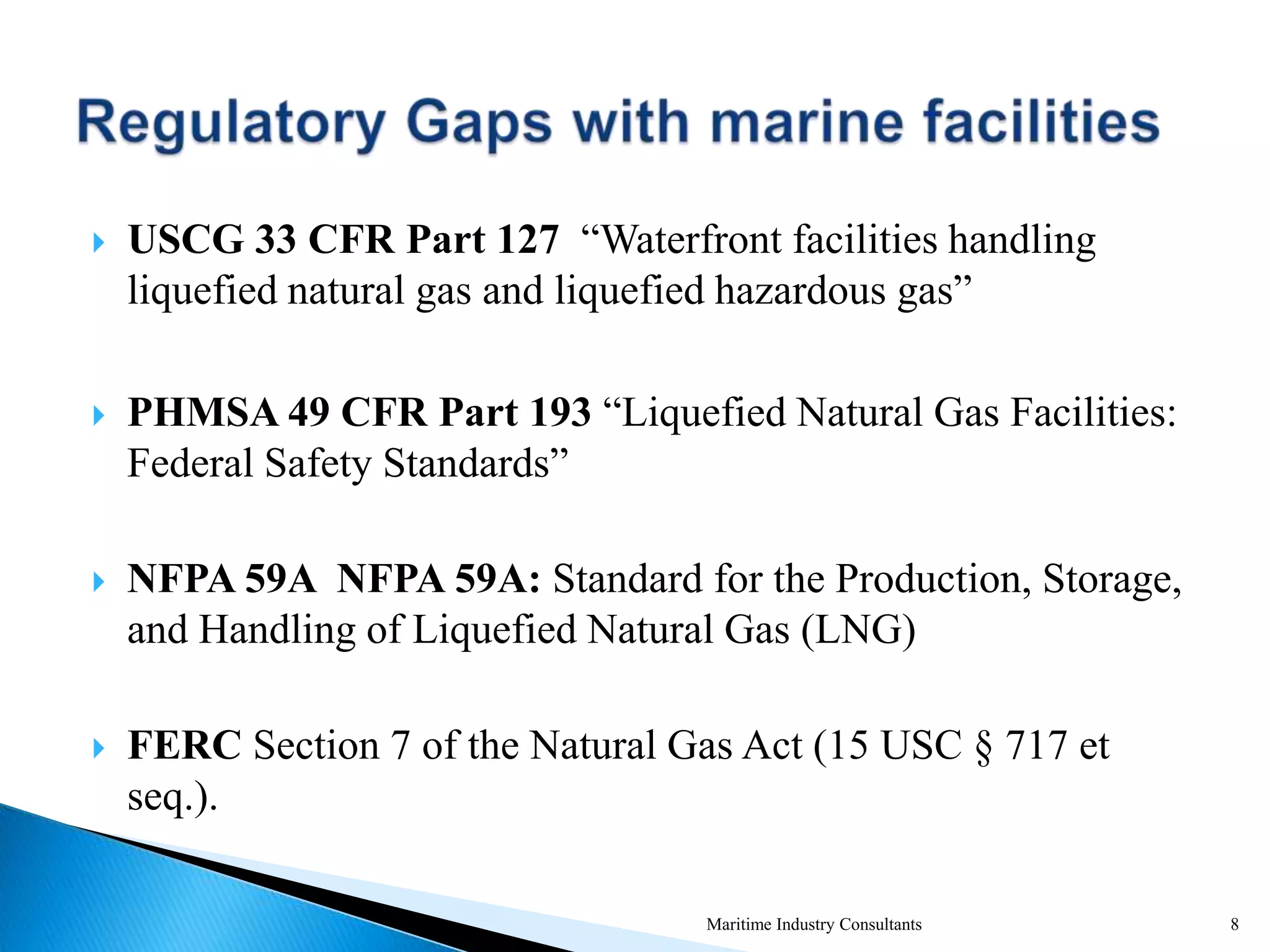

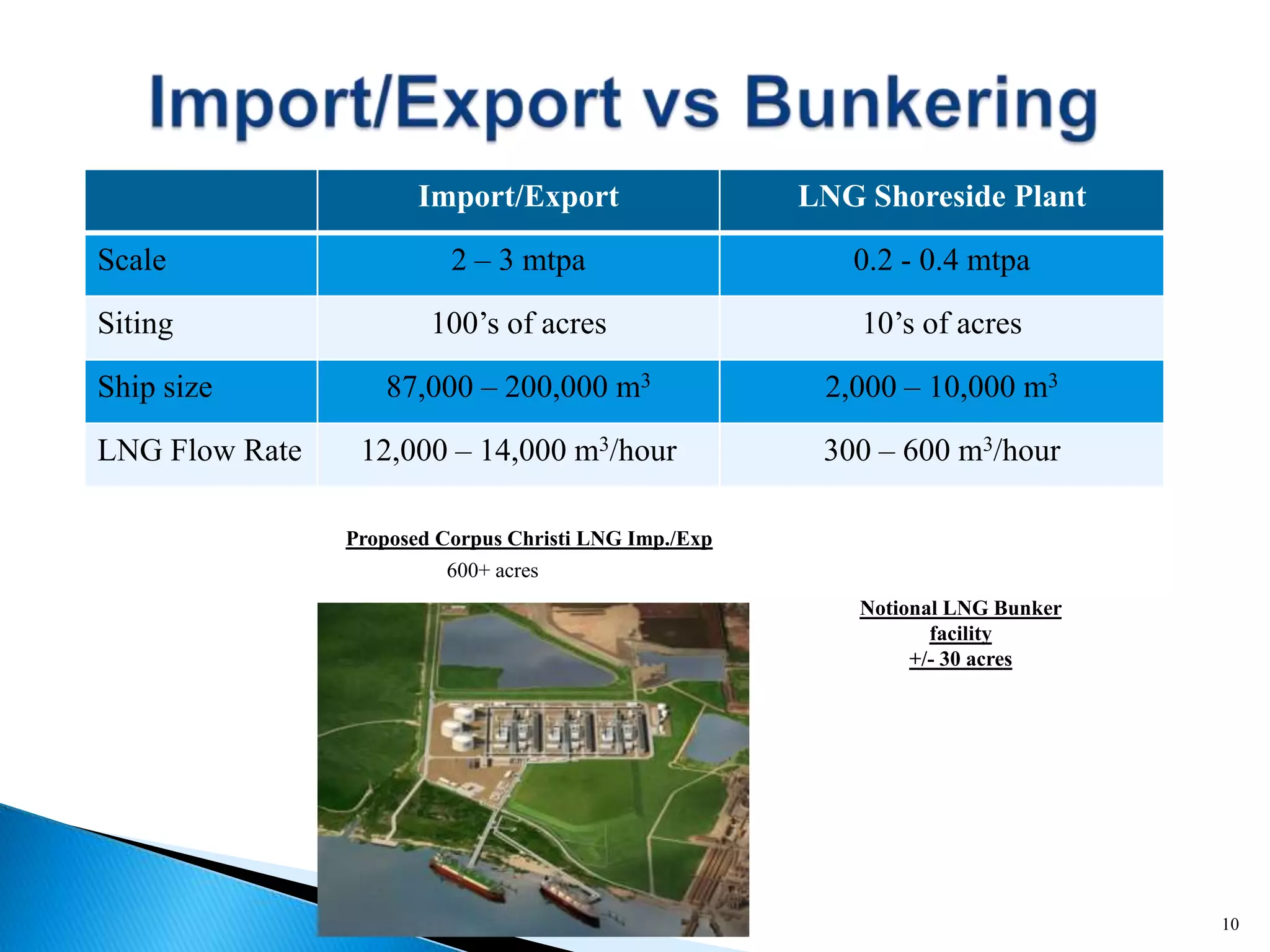

The document discusses the potential for liquefied natural gas (LNG) to become a common fuel for the maritime and transportation industries in the next five years. It outlines the benefits of LNG including lower costs compared to diesel, abundant domestic supplies, and ability to help meet emissions reductions goals. However, it also notes challenges including a lack of infrastructure and unclear regulations that create uncertainty. The document argues that ports are well positioned to help address these challenges and serve as anchors to broader deployment of LNG by working with stakeholders and regulators to build support and a framework for standardized safety procedures and development of small-scale LNG fuel terminals.