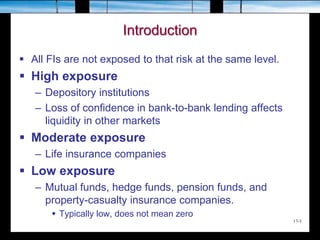

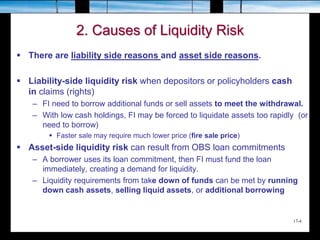

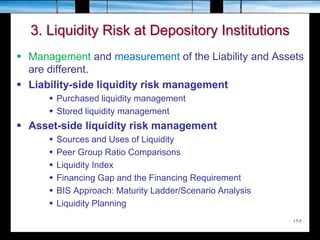

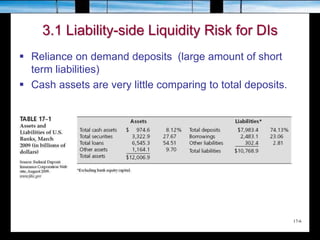

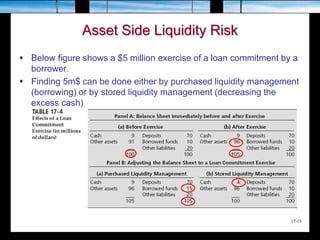

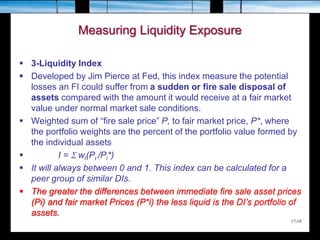

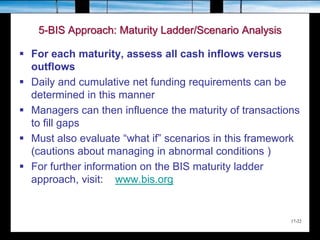

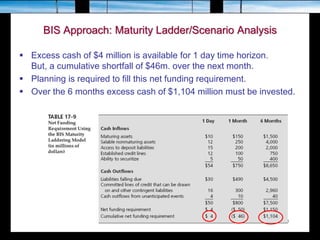

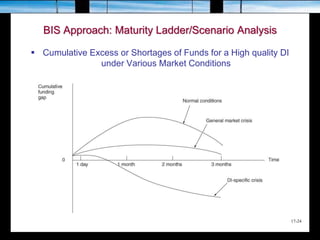

This document discusses liquidity risk faced by financial institutions. It begins by introducing the topic of liquidity risk and how it is a normal part of managing a financial institution. It then discusses various causes of liquidity risk, including risks from the liability and asset sides of an institution's balance sheet. Several methods for measuring and managing liquidity risk are covered, including liquidity ratios, indexes, maturity ladders, and scenario analysis. The document focuses on liquidity risk particularly for depository institutions and how they manage risks from both sides of their balance sheets.

![17-26

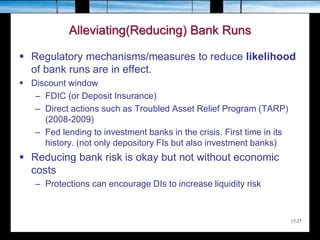

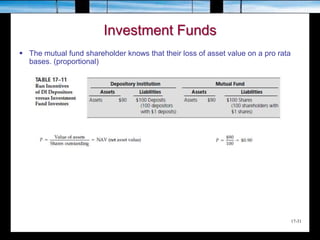

3.4 Liquidity Risk, Unexpected Deposit Drains,

Bank Runs

Anticipated needs are not unexpected deposit drains.

(summer, christmast, seasonal effects etc.)

Any sudden and unexpected surges in net deposit witdrawals

risk triggering a bank run that could eventually force a bank

into solvency.

Major liquidity problems can arise if deposit drains are

abnormally large and unexpected due to concern about:

– Bank solvency

– Failure of a related FI

– Sudden changes in investor preferences

Demand deposits are first come, first served

Bank panic: Systemic or contagious bank run [a sudden and

unexpected increase in deposit withdrawels from a DI]](https://image.slidesharecdn.com/3-chap017-edited041-230722155257-2d4cc725/85/3-_chap017-edited04-1-ppt-26-320.jpg)