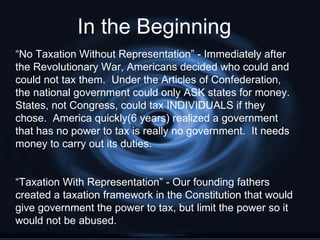

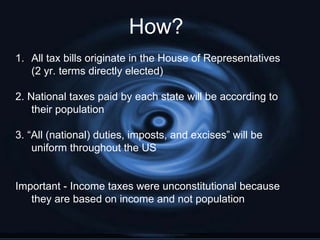

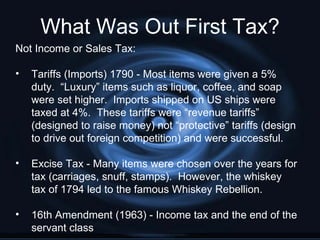

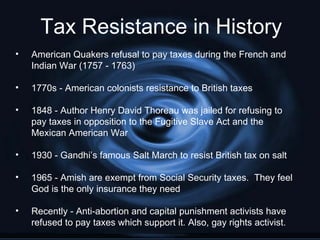

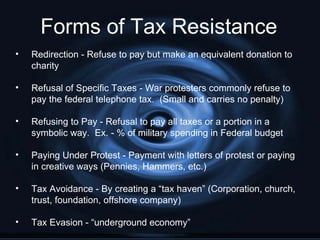

There are several types of taxes that governments use to raise revenue. The US Constitution gives the federal government the power to tax but limits this power to prevent abuse. Some of the earliest taxes in the US included tariffs on imports and excise taxes on goods like whiskey. Some groups and individuals have historically resisted certain taxes as a form of protest against government policies. Methods of tax resistance include refusing to pay, redirection of funds to charities, and paying taxes under protest.